The November 2011 unemployment report showed 120,000 new payroll type jobs were added. Additionally, September job growth was revised from +158,000 to +210,000. October nonfarm payrolls was also revised up, from +80,000 to +100,000.

The payrolls survey is different from the household survey, which showed people dropped out of the labor force count.

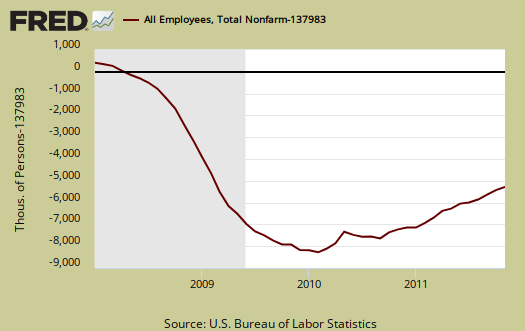

Graphed below are the total number of nonfarm payroll jobs lost since December 2007, seasonally adjusted and does not take into account increased population. Since the start of the great recession the United States has officially lost 6.275 million jobs.

So far, 2011 has added 1.448 million payroll jobs. For the last three months,the United States has added 430,000 nonfarm employee type jobs. Payrolls includes both part-time and full-time jobs.

In looking over table B1 we can get a little more detail on what kind of jobs were created (and lost) on the permanent jobs front.

- Financial: +8,000

- Information: -4,000

- Construction: -12,000

- Manufacturing: +2,000

- Mining & Logging: +4,000

- Health and Education: +27,000

- Leisure and Hospitality: +22,000

- Professional & Business Services: +33,000

- Temporary: +22,300

- Trade, Transportation, Utilities: +58,000

- Retail Trade: +49,800

- Government: -20,000

- Postal Workers: -5,100

- State Government: -5,000

- Local Government: -11,000

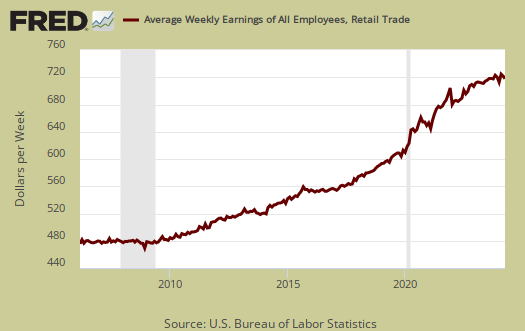

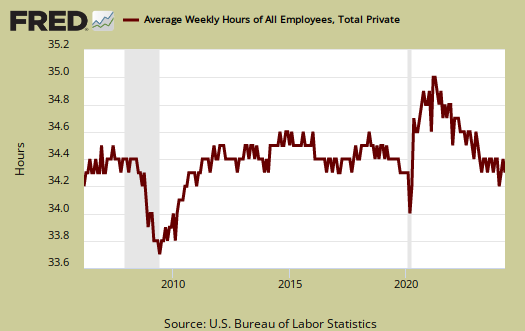

What we see is really not so great. Retail trade are notoriously low paying, no benefits, types of jobs. The average weekly earnings for all retail trade sector workers is beyond pathetic, it's right below $500/wk or $26k a year. But this assumes paid two weeks of vacation and full time and that's fairly rare for retail sales clerks. The average weekly hours for all retail trade workers is 31.4, clearly not full-time.

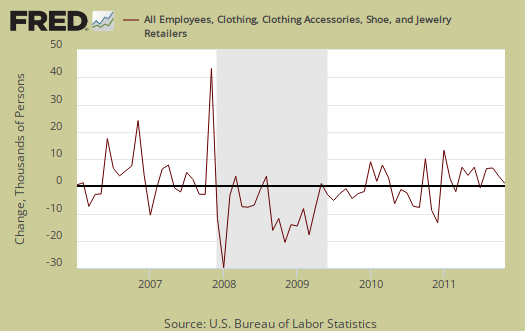

While these numbers are seasonally adjusted, thus one assumes temporary Christmas workers are already adjusted for, the jump in retail trade jobs are astounding. One must wonder how many of these jobs are really permanent? Graphed below are clothing retail jobs a subset of retail trade jobs. We see 26,700 jobs gained in November 2011. In November 2007, 28,000 jobs were added, yet by February 2008, 30,900 jobs were lost. The question becomes will we see a similar drop in clothing store jobs by February 2011?

Leisure and Hospitality are also typically low paying jobs. There are now 13,310,000 jobs in this category, or 10.1% of all payroll jobs. The average hourly wage for non-supervisory workers, $11.36/hr. The arts is included in this figure but the majority of jobs are in restaurants and bars.

Good jobs, like manufacturing jobs are clearly disappearing. All one needs to do is look at the manufacturing job declines. Note how the graph slope correlates to the China trade agreement of 2000 and the increase of offshore outsourcing at the same time.

In November, goods producing jobs declined by -6,000, whereas services types of jobs, which includes both retail trade and leisure/hospitality, increased 146,000. Serving up fries and taking care of the sick is no way to rebuild an economy.

Professional services are adding temporary jobs, through third parties who offer no benefits and take a large cut of worker's wages. In November 2011, 2,333,100 jobs were temporary. More importantly the percentage of temporary professional services jobs, many which supposedly which require a college degree,has increased. In 1990 temporary jobs were 10.7%. Now they are 13.4% of professional services job. In turn professional services are 13.2% of all payroll jobs. Additionally, since the Great Recession, professional services are still down 687,000 jobs.

Seems the sick and dying is the new growth industry for the United States. Since December 2007, health care has added 1.114 million jobs and for 2011, a total of 295,100 jobs. Health care is now 10.8% of all payroll type jobs, whereas in the start of the great recession, health care was 9.3% of all jobs.

Government jobs continued it's decline with 20,000 more jobs lost this month. Post Office workers accounted for -5,100 of those 20,000 jobs lost in government. Government has been shedding jobs all year and the below graph is the total number of government jobs, Federal, State, Local since December 2007. Think what you will about government jobs, but they usually pay enough and have enough benefits to make rent and support a family.

The average work week remained the same, 34.3 hours. Average earnings (drum roll please), decreased 2¢ to $23.18/hr. Take a look at how many industry sections are below full time hours. When the number of hours per worker is below full time, beyond the labor implications, there also is a common practice among employers to keep workers part-time, in order to deny them benefits. Manufacturing hours are one of the few full-time, now at 40.3 hours per week.

What's the bottom line? While any job growth is better than none, what we're getting are Walmart type jobs and that is not good. One cannot even pay for health insurance, never mind a family on the typical wages paid in these jobs.

Recent comments