The Federal Reserve will extend their Operation Twist past the June 2012 deadline and downgraded the economic outlook. Originally Operation Twist was $400 billion in Treasuries that were maturity dates of 3 years of less turned into T-bills with maturity dates of 6 to 30 years.

The Federal Reserve will extend their Operation Twist past the June 2012 deadline and downgraded the economic outlook. Originally Operation Twist was $400 billion in Treasuries that were maturity dates of 3 years of less turned into T-bills with maturity dates of 6 to 30 years.

Here is the twist details from the NY Fed:

On June 20, 2012, the Federal Open Market Committee (FOMC) directed the Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York to continue through the end of the year its program to extend the average maturity of the Federal Reserve’s holdings of Treasury securities. Specifically, the Desk was directed to purchase Treasury securities with remaining maturities of 6 years to 30 years and to sell or redeem an equal par value of Treasury securities with remaining maturities of approximately 3 years or less. The continuation of the maturity extension program will proceed at the current pace and result in the purchase, as well as the sale and redemption, of about $267 billion in Treasury securities by the end of 2012.

The FOMC also directed the Desk to continue reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities (MBS) in agency MBS, and to suspend, for the duration of the maturity extension program, rolling over maturing Treasury securities into new issues at auction.

Purchases of Treasury securities for the maturity extension program will be distributed across five sectors using the same approximate weights that have been used in the purchases to date:

Nominal Coupon Securities by Remaining Maturity* TIPS**

6 – 8 Years

8 – 10 Years

10 – 20 Years

20 – 30 Years

6 – 30 Years

32%

32%

4% 29% 3% *The on-the-run 10-year note will be considered part of the 8- to 10-year sector.

**TIPS weights are based on unadjusted par amounts.This distribution could be altered if market conditions warrant.

A combination of sales and redemptions of Treasury securities will be conducted to match the amount of purchases over the program. Sales of Treasury securities will take place in securities maturing between January 2013 and January 2016. Securities maturing in the second half of 2012 will be redeemed—that is, allowed to mature without reinvestment—since redeeming maturing Treasury securities has a nearly identical effect on the portfolio as selling securities that are approaching maturity. Once the maturity extension program is completed, the Federal Reserve will hold almost no securities maturing through January 2016.

Operation Twist supposedly lowers the yield curve, but we've seen what uber-low interest rates do, not a lot. Another theory of operation twist is to push investors into the private sector bonds, corporation bonds, but translating that to consumer lending, it's unclear. Bottom line people don't need more debt, they need income.

You can bet money, as Wall Street did earlier this week, the Operation Twist extension was approved due to, finally, gas prices dropping and overall inflation abating. That said, core inflation has been around the Fed's target for months. Core inflation is not deflationary. On the other hand, the Operation Twist extension is basically half of the original, so inflationary effects shouldn't be that significant. Question is, did the Fed simply throw Wall Street a bone?

The real problem here is while Wall Street loves the twist, Main Street just gets trampled on anyway. Hiring is pathetic and it's clear we have a long term, never ending jobs crisis. Clearly operation twist has not caused employers to start hiring.

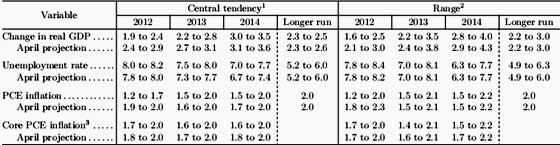

To wit, the real news is the beyond belief downgrade of the economy by the FOMC.

The thing to note is the FOMC just knocked off a good half a percentage point from GDP projections and raised unemployment projections. In other words, we are going to be in economic purgatory through 2014!

During Bernanke's press conference, he implied quantitative easing didn't work too well to reduce unemployment and boost real GDP. The Fed Chair still denied the Fed is out of ammunition to help the economy. Monetary policy still has capacity to strengthen the economy by easing financial conditions according to Ben.

Bernanke claimed quantitative easing did effect asset prices, but as a counter measure to deflation. The Fed implied low interest rates have caused many people to buy homes, really? We are BROKE, you cannot buy a home on fumes, at least not since 2007. The claims indirect effects spur investment and economic demand, are trickle upon and we've seen over and over again, Banks are not lending money to consumers and small businesses for homes and more importantly, to start businesses. We need constraints, requirements on credit, hiring, tax breaks for jobs, dictated by Congress, to form more of a bottom up direct stimulus to America's working class. You need to force Wall Street to give a shit about Main Street for clearly they are operating in a financial bubble that is fluttering above the real production economy and working America.

Bernanke quotes the housing sector as being a huge drag on the economy as well as government contractions, especially on jobs. To see what Bernanke implied this administration and Congress need to do, see this article.

Going forward, the Fed is looking at labor data, asking the question is the labor market sustainable? It is just a bummer the Fed only controls monetary policy at this point. Lord knows it is our Congress and this administration who needs to move on jobs and lord knows they will not. Instead we get policies that hurt workers, U.S. labor markets such as more bad trade deals, or ridiculous tax cuts for the rich. We even have fictitious claims austerity would create jobs, which is simply, theoretically wrong. The problem is with hemorrhaging Main Street. Main street is just crumbling into the poverty dust heap and these corrupt DC jokers refuse to even throw a bone to working America at this point,. Even when the results of treating workers like disposable diapers destroys the entire U.S. economy due to weaker and weaker demand, these corrupt politicians will not act based on sane economic principles.

Only corporations, not regular people, can get Congress to act as a general rule. Wouldn't it be nice if the Fed could lay out very specifics and almost lobby Congress? Yeah, sure we all hate the Fed, but at this point, don't you hate Congress and politicians more? At least the Federal Reserve runs spreadsheets and can add.

By the way, the Federal Reserve will not be buying European sovereign debt, so proclaims Bernanke during the press conference.

Comments

Home Sales Increasing

Despite my own bearish disposition I can say with some certainty that home sales in the mid-west and east coast are 'peppy' (As in homes are actually being sold). 30 year mortgages below 4% are the likely culprit. The lower rates go, the more people are qualified to hold the loans. I talked with someone who managed a rental property and he was losing several long time renters to recent home purchases.

So on the surface (and it's been a long time coming), twist has worked to at least temporarily stabilize housing. Still a person without a job cannot afford any housing.