November Retail Sales Rise 0.7% on Autos

A key economic release of recent weeks was the Advance Report on Retail and Food Service Sales for November (pdf) from the Census Bureau, which estimated that seasonally adjusted retail sales were at $432.3 billion in November, an increase of 0.7 percent (±0.5%) from October, and 4.7 percent (±0.7%) above sales of last November. October's seasonally adjusted sales were revised to $429.4 billion, an increase of 0.6% (±0.3%) over September's further revised $426.8 billion, which was up from the originally reported month over month gain of 0.4% (±0.5%), with the ± parenthesis in each estimate representing the 90% confidence range. Total unadjusted November sales were estimated to be at $434,119 million, up from October's revised $422,953 million and unadjusted revised sales of $403,043 million in September. The table below from the census report breaks out the monthly and annual seasonally adjusted percentage change in retail sales by business type; the first column shows the percentage change in sales from October to November, while the second column shows the year over year sales percentage change as of this report, while in the third and fourth columns, we have those same metrics for October's report based on the revisions to it from this month.

As you can see by the above table, a 1.8% increase in sales at auto and other motor vehicle dealers again drove the overall increase, as those sales did in October. Sales at motor vehicle & parts dealers rose to a seasonally adjusted $83,287 million in November from $81,779 million in October and accounted for 19.3% of November sales; without these automotive businesses, retail sales rose just 0.4%. We should note that unadjusted vehicle & parts sales, extrapolated from a small sampling of dealer reports, reportedly fell from $79,298 million in October to $75,871 in November, so the increase seen here was only in the seasonal adjustment. Other businesses seeing greater than 1% seasonal increases in November sales included non-store retailers (which are mostly online sellers), where monthly sales rose 2.2% from $38,172 million to $39,011 million, building material and garden supply stores, where adjusted sales rose 1.8%, from $25,933 million in October to $26,391 million in November, restaurants and bars, where normalized sales rose 1.3% from $46,699 million to $47,283 million, furniture stores, where seasonality adjusted sales of $8,895 were 1.2% above October's sales of $8,792 million, and electronic and appliance stores, where adjusted sales rose 1.1% from $8,894 million to $8,989 million. The only retail businesses that saw sales decline in November were gasoline stations, where sales fell 1.1% to $44,752 million from $45,271 million on lower gas prices, grocery stores, where sales fell 0.3% from $48,594 million in October to $48,450 million, dragging the food & beverage retailing group down 0.1% to $54,555 million, and the small grouping of miscellaneous stores where sales fell 1.3% to $10,530 million.

There were also some substantial revisions made to the delayed advance retail sales data which we reviewed 4 weeks ago; which are included in the 3rd column of the above table. Although the increase in overall sales for October has been revised from 0.4% to 0.6%, sales at auto and other motor vehicle dealers, originally reported to have increased 1.4% in October, are now seen to have increased by just 1.1%; that meant October sales excluding the automotive group rose 0.5% rather than the 0.2% originally reported. This was due to rather large revisions in the September to October sales change for several retail categories: sales at electronics & appliance stores, originally reported up 1.4%, were revised to an increase of 2.6%; the increase in sales at furniture stores was revised from 1.0% to 1.8%. October sales at clothing stores, first reported as up 1.4%, are now seen to be up 2.6%; non store retailers saw a 0.8% increase rather than the 0.4% increase first reported, and sales at restaurants and bars were revised from a gain of 1.0% to one of 1.4%. In addition, the 1.9% decrease in sales at building material and garden supply stores was reduced to a decrease of 1.5%, and the sales change at miscellaneous stores went from a decrease of 0.1% to an increase of 0.4%...

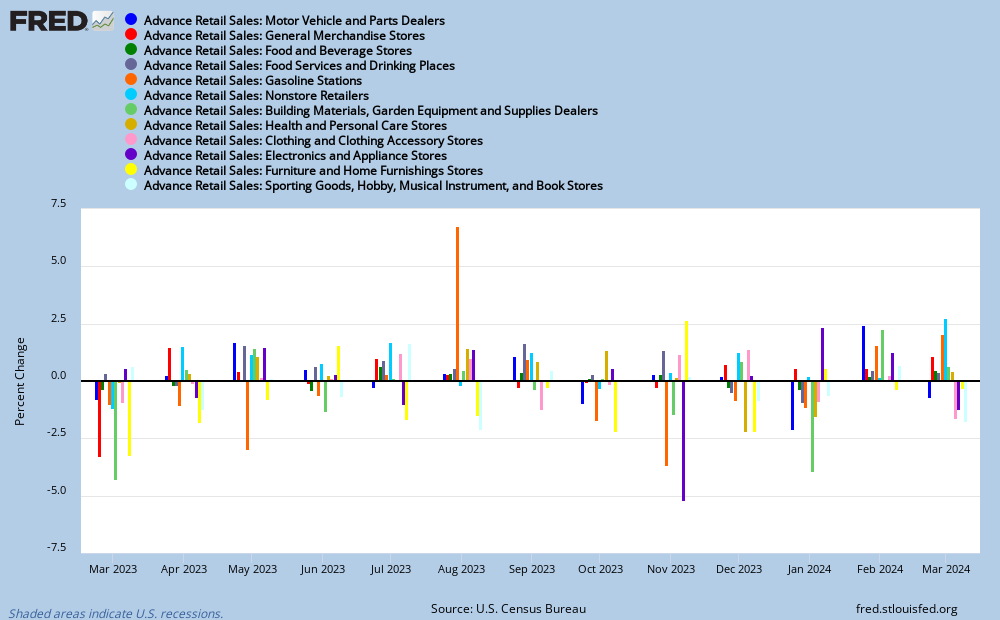

Our FRED bar graph below shows the monthly percentage sales change for each of the 12 major retail sales categories since last November. Each of the past 13 months is represented by a grouping of 12 bars, with the percentage change in each type of retail sales represented by its own color code within each bar group, wherein a monthly increase in sales for that business appears above the ‘0’ line and a decrease below it. From left to right in each group is a dark blue bar representing the percentage change in motor vehicles and parts sales, a red bar indicating the change at general merchandise stores, followed by the percentage change at food and beverage stores in green, the sales change restaurants and bars in mauve, the change at gas stations in orange, the change non-store or online retailers in sky blue, the change at building and garden supply stores in light green, the percentage change at drug stores in mustard, the change in sales at clothing stores in pink , the change at electronics and appliance stores in purple, the change at furniture stores in yellow, and the percentage change in sales at stores specializing in sporting goods, books or music in pale blue…(click to enlarge)

If you recall, we computed real retail sales for the advance October report at ~.75 by adjusting each of the retail groups for inflation with their respective CPI component. We got a confirmation of the accuracy of our method when the Incomes and Outlays report for October showed that real durable goods personal consumption expenditures were up 0.8% and real non-durable personal consumption expenditures were up 0.7%...(see full pdf, table 7) Without undergoing such an involved computation this time, we'd estimate that these revisions to October suggest a real retail sales gain on the order of ~.95%, which is close to an annualized increase in real sales of 12%. We expect October PCE to be revised accordingly to reflect the revisions to October retail sales.

November Consumer Prices Unchanged as Rent Increases are Offset by Lower Energy Costs

Next, we're going to take a look at consumer prices for November, because we're going to want to use that data to adjust the retail sales report we just covered, which didn't account for changes in price, for those changes. We do that because inflation and seasonally adjusted sales for the month will give us an insight into how those sales will contribute to personal consumption expenditures in 4th quarter GDP figures, which as we well know, are the largest component of GDP overall.

The Consumer Price Index for November from the Bureau of Labor Statistics again showed no increase in prices overall due to lower energy costs. The seasonally adjusted energy price index, which accounts for 9.6% of the CPI, fell 1.0% for the month, offsetting modest price increases in rent and other services, leaving the seasonally adjusted Consumer Price Index for All Urban Consumers (CPI-U) unchanged for the month. The unadjusted index, based on 1982-84 prices = 100, was at 233.069, down fractionally from 233.546 in October and up just 1.2% from the 230.221 reading of a year earlier. Driving the decline in energy prices were gasoline prices that were 1.6% lower than in October, and now 5.8% lower than a year ago. Fuel oil, down 0.6% in October, rose 0.4% in November, and the composite for other fuel commodities, including kerosene, propane and firewood, also rose 0.3%. But energy services were down 0.2% in November as prices for natural gas fell 1.8%, which was only partially offset by a 0.3% increase in the cost of electricity. After October's energy price index decline of 1.7%, November's data left energy prices 2.4% lower than they were a year earlier.

Increases in food prices were also modest, as the food index rose 0.1% in November, the same increase as in October. However, all of that was due to a 0.3% increase in prices for food away from home, as both fast food outlets and full service restaurants saw prices rise 0.2% while food at work sites and schools rose 0.6%. Meanwhile, seasonally adjusted prices for food at home were statistically unchanged, as the unadjusted food price index fell from 234.418 to 233.639 in November, which was only 0.6% higher than the 232.295 index reading of a year earlier. Of the major food groups, only dairy products, which increased 0.4%, saw prices higher in November, as prices for milk rose 2.0% and cheese prices were 0.9% higher. Prices for cereals and bakery products were statistically unchanged, as a 2.6% increase in bread prices was offset by 1.5% lower prices for biscuits, rolls, muffins, 0.9% lower prices for rice, pasta and cornmeal, and 0.4% lower prices for flour and mixes. Seasonally adjusted prices in the meat group were down 0.2% in November, as chicken prices fell 1.5%, pork prices fells 0.8%, seafood prices fell 0.3%, while beef prices rose 0.5% and egg prices were 1.1% higher. Fruit and vegetable prices were also lower, by 0.7%, as fresh vegetable prices were 2.0% lower on 4.0% lower lettuce prices and potatoes that were 1.5% cheaper, and fresh fruits prices slipped 0.1% as apples were up 0.7% while oranges were 1.2% less, while processed fruits and vegetables rose 0.5%. Beverage prices were 0.2% lower as frozen juices fell 0.5%, roast coffee fell 0.6% while carbonated drinks were unchanged. In addition, prices for the catch all grouping of 'other foods at home' were up 0.5% as the spices, seasonings, condiments, sauces index rose 2.2%, margarine prices were up 1.3%, while snacks fell 1.7% sugar & sweets fell 0.5%, and fats and oils also fell 0.5%...

Excluding price changes for food and energy, the so-called core CPI was up 0.2%, the most since July core prices rose by the same percentage. The unadjusted core index was little changed, however, as it rose from 235.162 in October to 235.243 in November, which was 1.7% above the year earlier reading of 231.263. The shelter index, which accounts for 31.8% of the CPI by itself, drove the increase as it was up 0.3%, with rents up 0.2%, homeowner's equivalent rent up 0.3% and prices for lodging away from home up 2.9%. In contrast, the apparel price index fell 0.4% in November, as prices for men's clothing fell 1.5%, women's wear prices fell 0.2%, footware fell 0.4%, & toddlers' apparel rose 1.9%. In addition, the index for medical care was unchanged in November, with both medical care commodities and medical care services also unchanged, as a 0.2% increase in prescription drug prices was offset by a 1.1% decrease in medical equipment and supplies prices, while a 0.2% increase in physicians services was offset by a decrease of 0.4% in hospital charges. Prices for transportation commodities less energy were unchanged as used car prices rose 0.1% and new car prices were down 0.1%, while the transportation services index rose 0.3%, due mostly to another 2.6% jump in airfares. Meanwhile, the recreation price index was up 0.2%, as recreation services were up 0.3% as cable and satellite TV costs and veterinary services both rose 0.5%, while recreation commodity prices were unchanged, as sporting good prices rose 0.5% and TV prices fell 0.5%. Finally, the last major price index, which combines education and communication, also saw 0.2% higher prices as education and communication commodities rose 0.1% as a 2.3% increase in telephone hardware prices more than offset a 1.6% decrease in computer software and accessories prices, while education and communication services rose 0.2% on a 0.6% increase in tuitions....

Our FRED graph below shows the relative price change in each of these major components of the CPI-U since January 2000, with all the indexes reset to 100 as of that date to allow for a comparison between indexes with different BLS origination date. In blue, we have the track of the change in the price index for food and beverages, which tracks pretty close to the track of the CPI-U, which is shown in black; in red, we have the change in the price index for housing, which includes rent and equivalents, utilities, repairs and other homeowners costs like insurance and which at 41% of the CPI also tracks close to the CPI. In violet, we have the price index for apparel, which has been the only index to show a net price decline over the decade. The transportation index, in brown, shows the impact of volatile gas prices on the cost of transportation, while the price index for medical care in orange has obviously risen the most over the entire period. In addition, education and communication prices are tracked in dark green, and the track of the recreation price index is shown in light green.. (click to enlarge)

We Find Real Retail Sales Rose ~.91% in November

Now that we have the November prices changes for all items sold at retail, we can now go back to last week's retail sales report and compute real retail sales, which adjusts what was sold at retail for inflation. We do this by adding the appropriate percentage to nominal sales when the prices declines (because that means more of the items were produced and purchased) and subtracting from real sales when the price increases. We then compare that to the previous month's sales to determine the actual or real change in unit sales for the month. Understand that the sales numbers we generate no more represent actual current dollar sales for the month than do seasonally adjusted numbers; both are generated from the actual data as a means of comparing growth from one month to the other...

So; first, we further adjust the seasonally adjusted $76,168 million in November motor vehicle sales with the weighted price changes for new cars (down 0.1%) and used cars (up 0.1%) and find that would add $26 million to real vehicle sales. Then we adjust the $9,099 million in sales of auto parts, accessories. & tires with the 0.1% decrease in the vehicle parts and equipment price index and add another $9 million to real retail sales from that adjustment. Next, we'll adjust the $8,895 million in furniture sales with the 0.5% decline in prices for furnishings and supplies, which will add another $44 million to real sales. Then, adjusting $8,989 million in electronics & appliance sales with appropriately weighted indices for video and audio products, which was unchanged, appliance prices, which were down 0.5%, and information tech commodities which were off 0.3%, gives us a addition to real sales of $24 million. In addition, adjusting $26,391 million in building material & garden supplies sales with the price index for tools, hardware, outdoor equipment which was off 0.5% adds another $131 million to our real sales number. However, while there were $54,555 million in food & beverage sales, the food at home price index was unchanged, so there will be no change accruing to real sales from this business group. Similarly, there were $24,305 million in drug store sales but the medical care commodities index was also unchanged so real drug store sales will also be unchanged. Adjusting $44,752 million in gas stations sales with the 1.6% decline in the price of gasoline will add $716 million to our computed real sales figure. While this may seem excessive, we have to remember that the $44,752 million gas station sales figure represents November sales that were down 1.1% in nominal dollars, and that what we're doing here is restoring that to represent the increase in real gallons of gasoline in November sold at October's price, which is what we must do if we want a comparable real unit sales change figure. Next, adjusting $21,218 million in clothing stores sales for the 0.4% price decline in the apparel price index gives us will add another $85 million, while they'll be no real sales adjustment for the $7,676 million in sales at sporting goods, hobby, book & music stores when adjusted with the unchanged recreational commodity index. Adjusting $60,292 million in sales at general merchandise stores with the index for retail commodities less food and energy prices, which was off 0.1%, adds another $60 million to real sales, while adjusting the $10,094 of miscellaneous store sales with the same index adds another $10 million. Based on the top internet sales items, we'll adjust the $40,053 million in sales by nonstore retailers with a weighted combination of software and book prices, which were down 0.5%, consumer electronics, which saw no price change, and apparel, for which prices dropped 0.4%, which will add $86 million to real sales, while adjusting $43,074 million in food services & drinking places with the 0.3% price rise in food away from home subtracts $129 million from real retail sales.

Finally, adding all these adjustments together, we find that the total dollar adjustment to convert November sales to their October price equivalents would be $1,002 million, which we then add to seasonally adjusted November sales in order to compute the month over month change in real retail sales, which we find is an increase of .91%, instead of the .68% increase in retail sales as reported by the census without adjusting for lower prices. In PCE or GDP terms, that is growth in personal consumption of goods at a 11.5% annual rate for November. Note that even without the increase in unit sales of gasoline, all other real retail sales would have been up .86%, which is still growth in real consumer retail spending at a double digit annual rate. We have now seen back to back months wherein the annualized gain in real consumption of durable and non-durable goods reached double digits. Since these retail sales represent roughly a third of PCE, or 23% of GDP, this report suggests that most early estimates of 4th quarter GDP will need to be revised upward.

(crossposted from MarketWatch 666)

Comments

chained October dollars

while it may seem odd that we adjust November retail sales for prices changes to October dollar values, that's a just what the BEA does when it computes real PCE and GDP based on chained 2009 dollars...since we are interested in knowing only the month over month change in real retail sales, we're using a shorter term adjustment which we could call "chained October dollars"

rjs

Price deflators

You might be able to do a reality check by digging into the BEA for price deflators and NIPA inputs into consumer spending to see if you are right.

You mean Q4 GDP will be higher than "many economists" are currently estimating for it has not been released yet.

Interesting.

half right

yes, i probably should have said "forecasts of 4th quarter GDP" rather than estimates...most i've seen suggest that there will be an inventory pullback and hence a growth rate around 2%...real retail sales suggest that inventory is moving off the shelves; industrial production shows production of consumer goods up 1.5% MoM, replacing what's sold..

i wanted to post this before i saw this morning's PCE so i could use the PCE deflators (or inflators) to check my thinking...as i expected, October's real PCE growth was revised to +0.4%, with goods up 0.9%...October real durable goods were up 1.2% (was + 0.8% in the first estimate) and non durables were up 0.8%, which is a bit of surprise since auto sales were revised down, so i expected the revision to boost non-durables PCE..

but i missed by a bunch on November, as they have real goods up 0.7% with PCE up 0.5%...it was all durables; up 2.2% while non-durables were unchanged..

BEA has three deflators for PCE; PCE excluding food and energy, which was up 0.1%, food, which was down 0.1%, and energy goods and services, which was down by 1.0%...so they are in effect, using a deflator that includes electricity and piped gas to deflate gasoline sales...since i used the CPI gasoline index, which was down 1.6%, to deflate (inflate) gas station sales, i just overrefined it a bit...there is further breakdown of non-durables in GDP, i'll have to check how they do that...

rjs

doing PCE overview right now, hold on

Got a PCE "at least", GDP estimate for Q4 in the overview. I get even if there is zero growth in consumer spending, PCE would be 2.8 percentage points contribution to real Q4 GDP. The odds of that happening are next to nil, so I'd say we're looking at a 4.0 percentage point contribution to PCE if the strong spending maintains in December. Post is up at top of front, right at the the moment. Supposedly retail sales are strong for Xmas, we'll see, they always hype growth in retail sales claims during their biggest consumer driven holiday on the planet.

Christmas sales way down, impact Dec. retail sales

ShopperTrak is reporting 21% less traffic in stores, sales down 3.1% and for three weeks Christmas sales are way down from last year.

MarketWatch has some figures.

That said, we'll see with online, which has been growing dramatically and after Xmas sales. I think the typical shopper has wised up and isn't buying so many ugly sweaters and slippers no one will wear this year.

Still real time reports doesn't bode well for retail sales and consumer spending might be impacted, although so much more goes into PCE.

cars?

if they're tracking big box stores, that's not where the strength has been in retail; autos, which is 20% of retail, has carried the group; ex-auto, ex-online, sales of everything else have been very normal...of course we saw that in November real PCE, with durables up 2.2%...

if it's lousy compared to other christmases, though, seasonal adjustments will write it down big time..

rjs

yes indeedy, autos rule retail sales that said....

But if you put all of other retail sales together it might be an impact. I have a pie graph, not updated since 9./13, which shows retail sales by volume.

If one takes GM, online (I thought online exceeded), and some of the other where foot traffic would matter, say Liquor stores, it could counteract the growth in auto sales. But the auto industry is doing their Xmas marketing thing as well, so, TBD.

I believe people are smarter shoppers and wages, income are still flat, repressed, the unemployed group static, millions and millions not counted who need a job, i.e. middle class tapped out.

Wall street forgets there are limits on credit cards. ;)

snow

just remember what happened; a deep low developed in Oklahoma and came right up the Mississippi/Ohio valley and into the Northeast over that weekend; watching the storm track, i'd guess states from Missouri & Illinois to the Northeast all got smacked with 8 inches or more that weekend, with a foot or more in the Northeast...it was too deep to shovel here; i had my driveway plowed both saturday the 14th and sunday the 15th...

rjs