HVS: Q1 2024 Homeownership and Vacancy Rates

The Census Bureau released the Residential Vacancies and Homeownership report for Q1 2024 today.

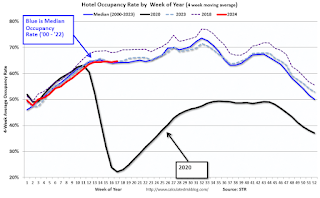

The results of this survey were significantly distorted by the pandemic in 2020.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

Click on graph for larger image.

Click on graph for larger image.

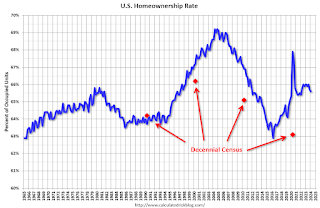

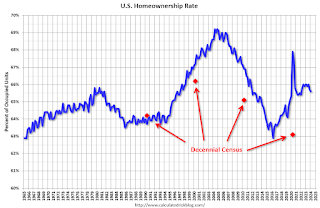

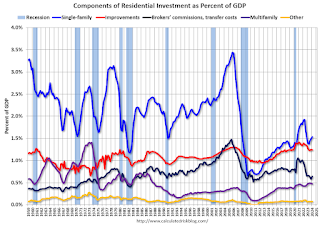

The Red dots are the decennial Census homeownership rates for April 1st, 1990, 2000, 2010, and 2020.

The HVS homeownership rate decreased to 65.6% in Q1, from 65.7% in Q4.

The results in Q2 and Q3 2020 were distorted by the pandemic and should be ignored.

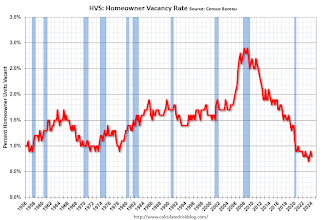

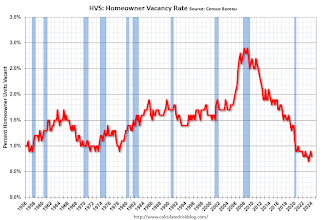

The HVS homeowner vacancy decreased to 0.8% in Q1 from 0.9% in Q4.

The HVS homeowner vacancy decreased to 0.8% in Q1 from 0.9% in Q4.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The homeowner vacancy rate declined sharply during the pandemic and includes homes that are vacant and for sale (so this mirrors the low levels of existing home inventory).

The rental vacancy rate was unchanged at 6.6% in Q1 from 6.6% in Q4. This is up from the low of 5.6% in 2021 and 2022.

The rental vacancy rate was unchanged at 6.6% in Q1 from 6.6% in Q4. This is up from the low of 5.6% in 2021 and 2022.

The quarterly HVS is the timeliest survey on households, but there are many questions about the accuracy of this survey.

The results of this survey were significantly distorted by the pandemic in 2020.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. Analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

National vacancy rates in the first quarter 2024 were 6.6 percent for rental housing and 0.8 percent for homeowner housing. The rental vacancy rate was not statistically different from the rate in the first quarter 2023 (6.4 percent) and virtually the same as the rate in the fourth quarter 2023 (6.6 percent).

The homeowner vacancy rate of 0.8 percent was virtually the same as the rate in the first quarter 2023 (0.8 percent) and not statistically different from the rate in the fourth quarter 2023 (0.9 percent).

The homeownership rate of 65.6 percent was not statistically different from the rate in the first quarter 2023 (66.0 percent) and not statistically different from the rate in the fourth quarter 2023 (65.7 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The Red dots are the decennial Census homeownership rates for April 1st, 1990, 2000, 2010, and 2020.

The HVS homeownership rate decreased to 65.6% in Q1, from 65.7% in Q4.

The results in Q2 and Q3 2020 were distorted by the pandemic and should be ignored.

The HVS homeowner vacancy decreased to 0.8% in Q1 from 0.9% in Q4.

The HVS homeowner vacancy decreased to 0.8% in Q1 from 0.9% in Q4. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The homeowner vacancy rate declined sharply during the pandemic and includes homes that are vacant and for sale (so this mirrors the low levels of existing home inventory).

The rental vacancy rate was unchanged at 6.6% in Q1 from 6.6% in Q4. This is up from the low of 5.6% in 2021 and 2022.

The rental vacancy rate was unchanged at 6.6% in Q1 from 6.6% in Q4. This is up from the low of 5.6% in 2021 and 2022.The quarterly HVS is the timeliest survey on households, but there are many questions about the accuracy of this survey.

Recent comments