90% of the drop in the labor force since the Great Recession is attributed to young prime-age workers going on Social Security disability. OMG!!! Can this be true? Would the new CBO lie? Hasn't the Congressional Budget Office always been touted as a "non-partisan" body of the U.S. Government, and can always be wholly trusted to provide our political leaders with unbiased facts, free and clear of any ideological spin?

Evidently, not any more.

The Republicans have already launched a first strike on disability — and they have also been recruiting new players to advance their game plan.

Incoming Republican leaders in Congress didn’t reappoint Doug Elmendorf to another term as head of the Congressional Budget Office. The move came after a campaign from conservative lawmakers, who wanted to change the way the CBO calculates the costs of government. Incoming House Budget Committee Chairman Tom Price (R-Ga) wanted a new director who would introduce so-called dynamic scoring to CBO analysis. Dynamic scoring is the idea that policy changes can induce significant macroeconomic effects, such as tax cuts partially paying for themselves.

One economist, Mark Thoma, writes at his blog: "Another worry [about dynamic scoring] is the politicization of the CBO. See here and here. Also see here and here on the application of dynamic scoring to things such as Head Start and infrastructure spending."

Republicans recently named Keith Hall as head of the Congressional Budget Office, installing a conservative Bush administration economist atop an agency charged with determining how much lawmakers’ bills would cost. Hall, who served on George W. Bush’s Council of Economic Advisers, is a critic of the Affordable Care Act, and shares Republican skepticism of government spending and regulation. He has criticized proposals to raise the minimum wage, expand regulation and boost anti-poverty programs. Last month, House Republicans formally adopted the controversial budgeting rules known as “dynamic scoring” — which aims to account for the macroeconomic effects of legislation. (The House Budget Committee Chairman Tom Price praises the new CBO boss, while diplomatically complimenting the old boss).

Republicans hope the combination of a new CBO director and the dynamic scoring rules, will make it much easier to cut taxes. But revenue estimates are actually the job of a different office: The Joint Committee on Taxation (JCT). The twin budget offices divvy up the scorekeeping responsibilities, with JCT focused on taxes and CBO handling spending, deficits and economic forecasts. Here are the latest proposals for taxation at the Joint Committee on Taxation. (And guess who's in charge there? Paul Ryan is the Chair and Orrin Hatch is the co-Chair. A perfect storm for those on disability.)

New York Times (By N. GREGORY MANKIW) A Slippery New Rule for Gauging Fiscal Policy: Dynamic Scoring Is Defensible, but Has Drawbacks

"In the coming years, will these Congresses respond quickly to the revenue shortfall, or will they let budget deficits fester? When they act to close the budget gap, will they increase taxes, or will they cut spending? If they cut spending, will it be on consumption items, such as health care for the elderly, or on growth-promoting investments, such as education for the young?" (We know very well what the GOP will do. Right now the Republican leaders are trying to cut disability, for Democratic and Republican disabled voters alike.)

And the new head of the CBO is also not above making false and exaggerated claims about Social Security disability. The GOP will cut spending, and most probably on all Social programs that benefit everybody else but the top one percent. To pay for tax cuts, cuts in social programs will most likely occur — sort of like PAYGO — but in reverse. Some call it "starving the beast".

Or maybe we can call the GOP's proposed budget and tax plans part of their overall strategy of "Starving the Least" — as in, starving the least fortunate, the least connected, the least financially secure, the least able, the least paid, the least healthy and the least wealthy. And now the GOP's plan is in full swing.

But whatever we call it, with a GOP-controlled Congress, with Rep. Paul Ryan as the chair of the Way and Means and chair of the Joint Committee on Taxation, and with Keith Hall as the head of the Congressional Budget Office, be afraid. Be very afraid, because Keith Hall was specifically picked by the new GOP Congress to replace Douglas Elmendorf so that the GOP would use “dynamic scoring” when going over new tax proposals by the Joint Committee on Taxation.

Last year Keith Hall claimed that "90 percent of the labor force decline for those who were in their prime working ages [25 to 54] for the entire six-year span [from 2007 to 2013] was from disability." (The full text is at the end of this post, if the web page is ever removed).

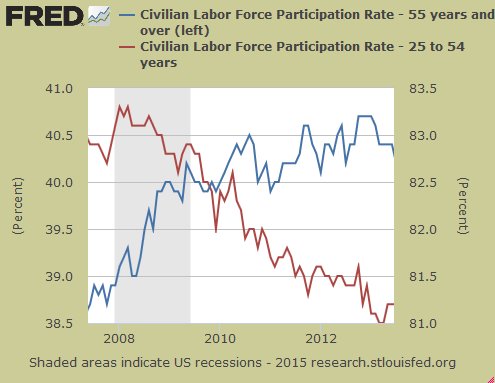

That is a totally preposterous claim by our new head of the CBO. Below is a graph from the St. Louis Federal Reserve for the participation rates of prime-age workers and older workers from June 2009 to June 2003 — the period that Mister Hall refers to. Yes, there was a huge decline for prime-age workers; but was it because the vast majority of young workers went on disability? Simple answer. Hell no! But if you need some convincing, then read on.

Keith Hall claims: "Today, [July 2014] after six years of recession and weak recovery, labor force participation by this group [25 to 54] has plummeted. Nearly five million out of the 125 million of them dropped out of the labor force."

I assume that when he says "125 million of them" he was speaking of the civilian labor force was, although, that's wrong. According the BLS, as of June 2007, the civilian labor force was 154,313,000 -- and as of June 2013, it was 155,761,000 — for a net gain of 1,448,000. Also, 5 million workers didn't drop out of the labor force during the time period he refers to. It was over 11 million, as I document later on in this post.)

Keith Hall also claims that of those five million, those "between 55 and 60 years old — about 2.4 million dropped out of the labor force" — and that of those, "about 70 percent moved into retirement. The rest exited the labor force due to disability."

70% of 2.4 million is 1,680,000 who he says had retired — which would mean the other 30% (who are "between 55 and 60 years old") would equate to be 720,000 who "exited the labor force due to disability." Math would also indicate that when he says "the rest", it is 2.6 million. But according to the Social Security database, as of June 2007 there were 6,923,999 "disabled workers" in payment status for disability. As of June 2013 there were 8,892,515 — for a net gain of only 1,968,516 (for all age groups) over that 6-year period that Keith Hall refers to. But he says "the rest" (2.6 million) "exited the labor force due to disability." (Remember these numbers for future reference, because he is totally wrong about, both the number on disability, and the number of retirees.)

Keith Hall also claimed the rise in the disability rate "hit a record 5.2 percent in 2013". This is only partially true, if one were using the number who are disabled and assigning it an equivalent percentage to those who are in the labor force (155,047,000 in the civilian labor force and 8,942,584 in payment status for disability in 2013). Yes, as a percentage of those we count in the labor force (the "employed" and the "unemployed"), a greater share is on disability today. (In 1967 there were 1,193,559 on disability — or 1.52% of a labor force of 78,491,000 as an equivalent percentage). But that increase is also taken out of context, because as a percentage, overall there also more people NOT in the labor force for many other reasons as well (retirement, discourage workers, etc.)

A combination of many different factors can also be attributed to the increase of those disability (as a percent to the labor force), such as an aging work force (e.g. the Baby Boomers) — and because of many other factors that effects the overall labor force in general, which has kept the labor force from growing in direct proportion to the population as a whole: factors such as off shoring, computers, automation, immigration, guestworker visas (etc.), all of which requires less workers (from a larger pool of workers) to produce the previous equivalents of GDP output; and that's another reason why we have a declining labor force (a lack of enough jobs to employee everyone who wants one.) For Keith Hall to simply claim the decline in the labor force is because of young people dropping out to go on disability, is at best, ignorant — and in the worse case, very disingenuous.

Also during that same period of time that Keith Hall stipulates, according to the Bureau of Labor Statistics (BLS), as of June 2007 there were 77,460,000 Americans (16 and over) not in the labor force. By June 2013 there were 88,463,000 — for a net gain of 11,003,000 more not in the labor at the end of that 6-year period that Keith Hall refers to. Not just 5 million as he had claimed.

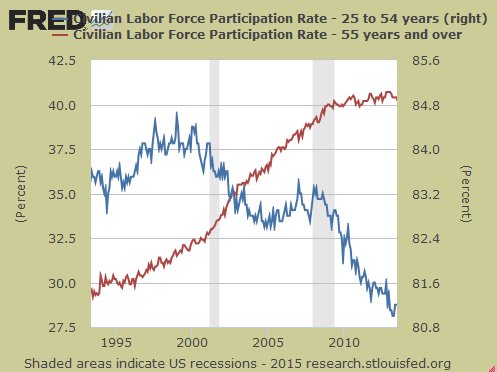

Keith Hall claims: "For those aged 55 and above, the participation rate was below 30 percent just 20 years ago — yet for the past five years, it has been higher than 40 percent." (Yes, this is the one point he makes that is totally true, as verified by FRED (which also helps to dispel the myth that it's mostly Baby Boomers retiring that's driving down the labor force participation rate.)

But then, on almost everything else, Keith Hall gets it all very wrong. He claims: "For those who remain in their prime working years — now between 31 and 54 years old — the story is different. As with the older workers, the decline in participation has been significant — over 2.5 million have dropped out of the labor force. But while some moved into retirement, a shocking nine out of 10 individuals of the younger group report that they exited the labor force due to a disability."

I reiterate: he's said that 5 million dropped out of the labor force during the time frame of June 2007 to June 2013, which is dead wrong. As was previously noted, we've had over 11 million more — over double than what he claims.

Also, very few people younger than 54 (in their prime age years) can afford to retire, nor do they retire, even if they could. Second, Keith Hall doesn't specifically say these prime-aged workers who dropped out of the labor force had also filed a disability claim, or that they received a disability award. Just that they exited the labor force, and supposedly gave "disability" as a reason for exiting the labor force. But even that is highly questionable, and sounds pretty far-fetched. Where is the data to support his preposterous claim???

Since he previously mentions "20 years" when referencing the decline in the labor force, we will compare the decline for 25-54 years and those 55 and older. Below is for the participation rates of prime-age workers and older workers (for 20 years) from June 1993 to June 2003. Again, we see that Boomers aren't driving down the labor force participation rate.

So when Keith Hall mentions the labor force participation rate, he's correct in that, the majority who left were prime-age workers, but then he mangles the statistics by claiming the reason was because the vast majority (90%) of those 25-to-54 years old left to go on disability. That is totally and unequivocally false, and very concerning, especially when this comes from the new head of the Congressional Budget Office. How can we be expected to trust him when it comes to other budget matters?

But it's not those who are filing for, and receiving, disability claims that are driving the LFPR that much either — especially when compared to wannabe new entrants into the labor market, such as 3 million high school grads every year (not to mention college grads and those that drop out of school).

According to the NCES, a research arm of the U.S. Education Department (in the time frame Keith Hall refers to), the U.S. had approximately 21 million high school graduates (for classes 2007, 2008, 2009, 2010, 2011, 2012 and 2013. We had a record 3.4 million high school graduates in 2013 alone. Remember: We had a net gain of only 1,968,516 (for all ages) on disability over that 6-year period that Keith Hall refers to — and we had over 11 million more not in the labor force. The Bureau of Labor Statistics reported that only 48.8 percent of the 3.2 million youth who graduated from high school (as of 2012) were "in the labor force".

Oh...and about one million working Americans have been retiring every year on Social Security. Of all the Americans who retired on Social Security since 2000 (when the labor force participation rate had peaked for all age groups combined, as shown in the graph below) to the end of 2013 — of those, 6,365,927 were Baby Boomers (the first one retired early at age 62 in 2008). But yet, Keith Hall claims that most of the drop in the labor force since the Great Recession is attributed to prime-age workers going on disability (as he is quoted further below in this post).

Keith Hall claims: "In fact, overall the number of Americans removed from the labor force because of a reported disability is at a record 14 million — up from about 11 million just six years ago."

THIS IS TOTALLY WRONG. Even if one included, not just disabled workers, but also included spouses and children of disabled workers, and also added disabled widows (which would really fall under survivor benefits), it would still only be total 8,953,979 as of June 2007 — which then rose to 11,210,384 by June 2013 — for a net gain of 2,256,405 over those 6 years.

To get to 14 million, Keith Hall was probably doing what the NPR previously did, and used SSI statistics — and then added those to SSDI statistics — that's how NPR also showed 14 million on disability. But if Keith Hall doesn't know the difference, as I've explained it here, then how can he head the CBO? Clearly, qualifications must not matter if arithmetic and/or a knowledge of these two different government programs is a job requirement (How much are the taxpayers paying him? Compensation for the CBO director in 2009 was $162,900 a year. The average for a disabled worker is a mere $13,984 — so who's really on the government dole?)

Then Keith Hall goes on to say: "For those who were in their working prime in 2007 and remain there today, there was a 1.7 million increase in those taking SSDI. This one program alone accounts for three-quarters of the disability exits and therefore, for most of the decline in labor force participation by the prime working-age population."

Again, this is total BS. Remember, we only had a net gain of 1.9 million (for all age groups combined) during the time frame he refers to, so how can there be 1.7 million in their prime age? And according to Social Security, most of those on disability are over 55 years old (at 65 and over, they covert to regular retirement benefits). There are currently 3,497,673 in payment status for disability in the age bracket from 25 to 53 (the prime years) — and there are 5,423,007 in the age bracket of 54 to 65 (older folks). Clearly, it's mostly older workers, not prime-age workers, who are going on disability. What is Keith Hall's real agenda? Or did the head of a major government accounting department make a simple mathematical mistake?

So, if it's not Boomers that is mostly driving down the labor force participation rate, and even though it's mostly older workers who are retiring or going on disability, then it most definitely has to be "a lack of jobs" that is the primary reason for a declining labor force. So why would Keith Hall claim otherwise? (Note: But it would be very helpful if I can find the ages of those who were actually awarded SSDI claims only from June 2009 to June 2013 --- for further debunking Keith Hall. Maybe a reader can provide one.)

It's also worth noting, that historically, both disability "claims" (applications) and actual disability "awards" are way down — both in terms as percentages and numerically in the rise from previous year-to-dates. But for some reason, the GOP has targeted disability as one of their very first acts with their new Congress in 2015 (those who are the least able to fend for themselves), and now they have Keith Hall to help them.

Keith Hall also opines: "Although it was never meant to be an unemployment insurance program, both the applications and acceptances into the program follow the unemployment rate." That is total bullshit. There, I finally said it (because it's true).

Keith Hall also probably thinks that unemployment benefits cause unemployment — and that cutting unemployment benefits creates jobs too, even though currently only 2.5 million unemployed Americans receive jobless benefits out of the 9 million who are currently counted as unemployed. He, like others in the GOP, believe that ending these benefits for 2.5 million people will magically create 2.5 million net new jobs — and lower the number of people unemployed from 9 million to to 6.5 million — and raise the labor force participation rate up a notch too. (Now, if only we could get all those lazy scoundrels off the government dole!)

It should also be noted that when Keith Hall wrote that op-ed for the libertarian think tank Mercatus Center (when making his wild claims), he was previously the head of the Bureau of Labor Statistics — so he should have known better (unless, he was only a figure head — like he may be now.)

How can the CBO ever again be considered "non-partisan" (and not just another tool for the GOP) with someone like Keith Hall as the new boss? Hint: It can't.

Below: The full text to Keith Hall's op-ed, followed by links to the Social Security Administration for all the numbers quoted in this post.

Social Security Disability Insurance's Effect on Labor Force Participation (by Keith Hall Jul 25, 2014)

The labor force participation rate for the prime working-age population — those between 25 and 54 years old — has been declining in the U.S. since 1997. One of the big reasons is a rise in the disability rate, which hit a record 5.2 percent in 2013. Since the start of the Great Recession, the withdrawal rate due to disability has accelerated. In fact, 90 percent of the labor force decline for those who were in their prime working ages for the entire six-year span was from disability. Most of this — three quarters — was from those receiving Social Security Disability Insurance (SSDI) benefits.

In 2007, 83 percent of the prime working-age population was in the labor force and accounted for over two-thirds of our total labor force. Today, after six years of recession and weak recovery, labor force participation by this group has plummeted. Nearly five million out of the 125 million of them dropped out of the labor force. But why? How much of this is due to retirement? What else contributed to this decline?

For those who aged out of their prime working years — those now between 55 and 60 years old — about 2.4 million dropped out of the labor force. As you might expect, most (about 70 percent) moved into retirement. The rest exited the labor force due to disability. An underappreciated aspect of baby boomer retirements is the fact that they have not reduced their participation as much as prior generations. In fact, for those aged 55 and above, the participation rate was below 30 percent just 20 years ago — yet for the past five years, it has been higher than 40 percent.

For those who remain in their prime working years — now between 31 and 54 years old — the story is different. As with the older workers, the decline in participation has been significant — over 2.5 million have dropped out of the labor force. But while some moved into retirement, a shocking nine out of 10 individuals of the younger group report that they exited the labor force due to a disability.

In fact, overall the number of Americans removed from the labor force because of a reported disability is at a record 14 million — up from about 11 million just six years ago. What appears to have enabled so many of the prime working age population to exit the labor force has been a single program: SSDI. For those who were in their working prime in 2007 and remain there today, there was a 1.7 million increase in those taking SSDI. This one program alone accounts for three-quarters of the disability exits and therefore, for most of the decline in labor force participation by the prime working-age population.

The SSDI program is the largest federal insurance program for lost income from a disability. To qualify, someone must have a minimum work history and a physical or mental condition that prevents them from engaging in any "substantial gainful activity" for at least 12 months. Use of the program has grown significantly — generally over 4 percent per year. Although it was never meant to be an unemployment insurance program, both the applications and acceptances into the program follow the unemployment rate.

Many have expressed concerns over the sustainability of the growth in spending on SSDI, and the Social Security Administration projects the program to be insolvent in just two years. One aspect of this is concern over whether the incentives of the program are encouraging people with disabilities to substitute SSDI benefits for labor market participation. If this is happening, more may be at stake than viability of the program. It may be undermining one of the important purposes of the Americans with Disabilities Act that tries to make sure people with disabilities access the same employment opportunities and benefits as everyone else.

SSA and other Sources

http://www.ssa.gov/oact/STATS/dibStat.html

http://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/

http://www.ssa.gov/oact/ProgData/benefits/da_age201412.html

http://www.ssa.gov/oact/STATS/index.html

http://www.ssa.gov/oact/ProgData/byage.html

http://www.ssa.gov/oact/STATS/table6c7.html

http://www.ssa.gov/oact/ProgData/icp.html

http://www.economicpopulist.org/content/report-disability-claims-and-awards-declined

http://www.economicpopulist.org/content/last-word-social-security-disability

http://www.ssa.gov/policy/docs/statcomps/di_asr/2013/sect01.html

http://www.ssa.gov/policy/docs/statcomps/di_asr/

Recent comments