Futures Drop Ahead Of Macro Data, Earnings Deluge

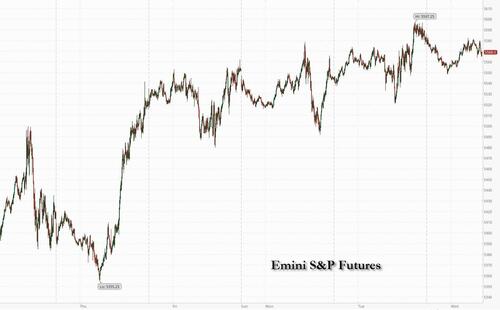

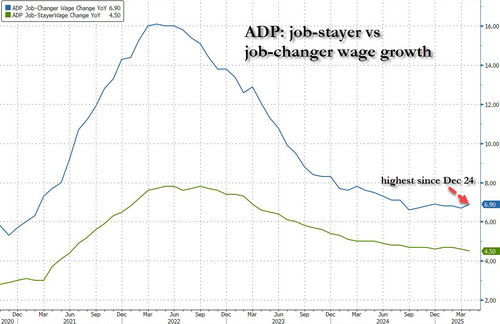

US equity futures slipped ahead of key GDP and PCE data. As of 8:00am, S&P 500 futures are down 0.3% while Nasdaq 100 contracts lose 0.5%, with Mag 7 names mostly lower (NVDA -1.4%, TSLA -1.1% and META -0.6%) as weak earnings weighed on risk sentiment after Super Micro plunged 16% ahead of Microsoft and Meta numbers later on Wednesday. Bond yields are lower by 1bps to 4.15% while the USD is higher. Overnight, China’s factory PMI slipped into the worst contraction since December 2023 (49 vs 49.7 cons) due to the negative impact of higher US tariffs, while Trump at a rally in Michigan renewed his criticism of Powell, noting he is "not really doing a good job" and that he knows more about interest rates. This morning, Euro Area flash CPI has been mixed, while Q1 GDP data was slightly firmer than expected at 1.2% YoY (vs 1.1% cons). Commodities are mixed: oil is 1.8% lower; previous metals are lower, while base metals are mostly higher. After yesterday’s close, earnings were modestly negative. Particularly, SBUX fell 6.7% on missed earnings amid margin pressure and top-line growth. BKNG commented that there is a moderation in inbound travel into the US, but so far the global leisure travel demand has been stable. Looking ahead today, we have ADP employment, Q1 GDP, PCE and employment cost index. There are no Fed speakers scheduled given blackout ahead of May's FOMC meeting.

In premarket trading the Mag7 stocks were mostly lower (Alphabet -0.1%, Amazon -0.6%, Apple -0.4%, Meta Platforms -0.9%, Microsoft +0.1%, Nvidia -2%, Tesla -1.3%). First Solar tumbled 12% after the maker of electricity-producing solar modules cut earnings guidance for this year due to tariffs imposed by the Trump administration. Norwegian Cruise Line dropped 7% after warning that cruise demand, which has long defied worrying travel trends, is beginning to weaken. Snap plunged 13% after the company declined to issue a sales forecast for the current period, saying it is navigating macroeconomic “headwinds” for its advertising business. Starbucks slumped 8% after weaker-than-expected results in the latest quarter amped up pressure for the company’s new management to deliver. Here are some other notable premarket movers:

- BridgeBio Pharma (BBIO) rallies 9% after the drugmaker reported sales of its recently approved heart drug, Attruby, that crushed expectations.

- Etsy (ETSY) rises 1% after the online marketplace for crafts reported revenue for the first quarter that beat the average analyst estimate.

- Freshworks Inc. (FRSH) climbs 9% after the software-as-a-service company boosted its profit and revenue outlook for the year.

- Garmin (GRMN) falls 6% after the maker of GPS-enabled products posted first-quarter results and provided a year forecast.

- Oddity Tech (ODD) jumps 17% after the direct-to-consumer beauty and wellness company boosted its net revenue guidance for the full year to a level above Wall Street expectations.

- Qorvo (QRVO) climbs 8% after the Apple supplier reported adjusted 4Q earnings that topped estimates.

- Regulus Therapeutics (RGLS) shares are halted after the company entered into an agreement to be acquired by Novartis AG.

- Seagate (STX) gains 7% after the computer hardware and storage company reported third-quarter earnings and revenue that beat the average analyst estimate

- Stride Inc. (LRN) climbs 3% after the online education company boosted its revenue forecast for the full year. Fiscal third-quarter revenue increased 18%.

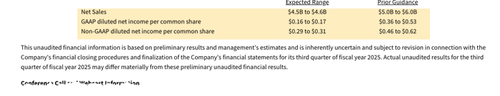

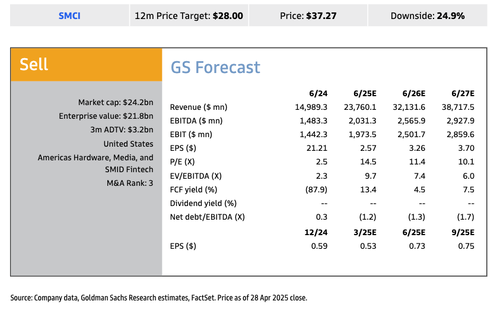

- Super Micro Computer (SMCI) tumbles 16% after giving preliminary results that fell well short of analysts’ estimates, a sign its comeback plan has been slow to gain traction.

- Tenable (TENB) plunges 17% after the cybersecurity company cut its full-year guidance, with analysts noting lower visibility ahead for the stock due to US federal spending uncertainties.

- Wabash National (WNC) falls 13% after the semi-trailer manufacturing company cut its revenue guidance for the full year.

Investors have been cautiously optimistic, with the Nasdaq 100 close to erasing all of its losses this month, after tariff U-turns and speculation the Federal Reserve will cut interest rates to prevent a recession.

“Perhaps we are past peak uncertainty,” Kim Crawford, global rates portfolio manager at JPMorgan Asset Management, told Bloomberg TV. “The administration has a more conciliatory tone on tariffs and to an extent as well, Fed independence.” Benchmark 10-year Treasuries steadied after six days of gains, with the yield at 4.16%. Gold dropped.

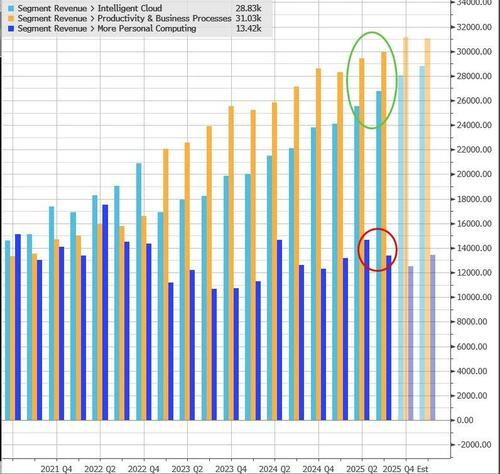

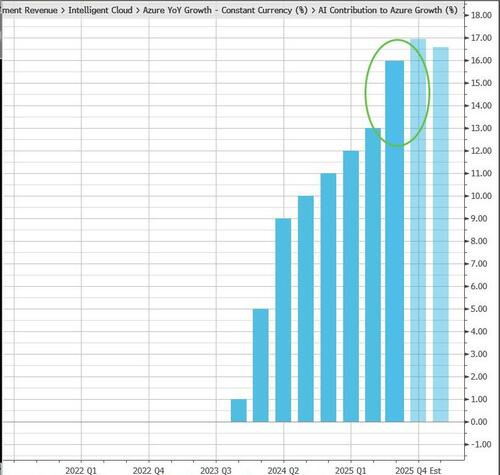

Four of the so-called Magnificent Seven — Microsoft, Apple Inc., Meta and Amazon.com Inc. — are reporting earnings this week. Analysts expect the group — which also includes Google-parent Alphabet Inc., Tesla Inc. and Nvidia Corp. — to deliver an average of 15% profit growth in 2025, a forecast that’s barely budged since the start of March despite the flareup in trade tensions.

“Even if you take out the tariff story outcome I think there is an issue for Big Tech and the market will probably start to refocus on that when we get this earnings season,” Christopher Wood, global head of equity strategy at Jefferies, told Bloomberg TV. “We still have the issue of the massive amount of capex being spent on Big Tech, they’re overspending on this AI story.”

Economic barometers of US economic health are also due with inflation and GDP data Wednesday that will give a snapshot of activity just before President Donald Trump unleashed country-specific levies on April 2. US real GDP growth likely cooled to a standstill in the first quarter amid disruptions from policy shifts, according to Bloomberg Economics.

Veteran emerging-markets investor Mark Mobius said he’s keeping 95% of his funds’ holdings in cash as he waits out the trade-related uncertainty. Hedge funds are reluctant to make major bets amid the turmoil, with the only significant shift in positioning in April being increased bets against US stocks, Bloomberg reported.

In the latest pivot in Trump’s trade strategy, the US president signed an executive order easing the impact of his auto tariffs, preventing duties on foreign-made vehicles from stacking on top of other levies and lessening charges on parts from overseas used to make vehicles in the US. The news supported sentiment toward European auto stocks Wednesday, with Mercedes-Benz Group AG and Stellantis NV rising even after withdrawing their outlooks for this year, citing the uncertainty of trade barriers.

In a rally celebrating his first 100 days in office, Trump defended his tariff policies as he marked his 100th day in office. He also renewed criticism of Fed Chair Powell, saying he is “not really doing a good job.”

In Europe, the Stoxx 600 rises for a seventh consecutive session, albeit only slightly, as disappointing earnings keep a lid on gains. Travel & leisure stocks are the worst performers. Energy and bank stocks also underperform with notable declines in TotalEnergies and Credit Agricole after their respective updates. Here are some of the biggest movers on Wednesday:

- Societe Generale shares advanced 5.7% after the French lender beat estimates as equities trading hit a record and it booked a gain on disposals.

- DSV shares rise as much as 11% after the Danish logistics firm gave a reassuring set of results, with analysts highlighting the synergies it set out from its DB Schenker deal.

- Schindler shares gain as much as 8.2% after the Swiss elevator and escalator maker reported impressive 1Q results with a dynamic order intake and no change in guidance despite US tariffs.

- Stellantis shares rise as much as 4.2% in Milan after the carmaker released a trading update which Bernstein said included some positives, with pricing ahead of expectations in all key regions.

- VW shares rise as much as 1.4% after the German carmaker reiterated its full-year guidance, a move JPMorgan called a positive signal.

- Deutsche Post shares rise as much as 4.1% after the delivery firm’s Ebit came in higher than expected in the first quarter, driven by its Express and Post & Parcel divisions and aided by cost-cutting.

- Aixtron shares climb as much as 14% after the German chip-tool company’s first-quarter results showed better-than-expected revenue, order levels and positive free cash flow, according to Warburg.

- Remy shares rise as much as 5.7% as analysts highlighted encouraging signs in the Cognac maker’s earnings, including an improvement in its US market as well as a better outlook for 2026.

- UMG climbs as much as 7.1% as subscription growth helps to deliver first-quarter results above expectations.

- Befesa shares rise as much as 13% after the German recycling company’s full-year earnings guidance surprised to the upside.

- AMS-Osram shares soar 17%, with ZKB analysts saying the Swiss chipmaker reported a good start to the year due to strong performance in its semiconductor business.

- Credit Agricole fell as much as 4.5% as higher-than-expected costs and a tax bill weighed on profit.

- TotalEnergies shares fall as much as 4.3% after the French energy company reported results that were in line with expectations, but also an increase in net debt.

- Mercedes shares drop as much as 2.8% after the carmaker said tariff volatility is too high to give a reliable outlook.

- Evolution shares drop as much as 18%. The gambling operator reported a miss on revenue and Ebitda in the first quarter, which management attributes to actions including ring-fencing regulated markets in Europe and countermeasures to cyberattacks in Asia.

Earlier in the session, Asian stocks rose, on track for a fourth-straight day of gains, as investors were encouraged by a continued rally on Wall Street and optimism over potential trade deals with the US. The MSCI Asia Pacific Index gained as much as 0.7%. Sony was among the biggest boosts after Bloomberg reported it is considering spinning off its semiconductor unit, while AIA climbed on strong quarterly results. The regional benchmark is poised to close April more than 2% higher, wiping out a steep intra-month loss sparked by US tariffs. The market has been looking toward various concessions from Washington as well as individual nations’ negotiations with the US. President Donald Trump on Tuesday signed an executive order easing the impact of his auto tariffs, while news emerged of discussions with South Korea and Australia. China’s manufacturing activity in April saw its worst contraction since December 2023, exposing early signs of weakness in Asia’s biggest economy from the trade war with the US. Shares of Chinese banks were among the biggest drags on equity benchmarks in Hong Kong and mainland China after weak earnings.

In FX, the Bloomberg Dollar Spot Index is little changed. The Aussie dollar outperforms rising 0.2% against the greenback after core inflation rose more than expected. AUD/USD rose as much as 0.5% to 0.6418 before paring the move; the nation’s core inflation in the first quarter beat estimates, damping expectations of rapid rate cuts. The pound and the yen were among the worst performers, down 0.3% and 0.4% against the dollar respectively.

In rates, treasuries mixed with the long-end outperforming where yields are down around 2bp on the day, supported by wider gains seen across the long-end of Germany and UK bonds after a flurry of European economic data. Ahead of today's quarterly refunding announcement, the 10-year US yield are down 1bps to 4.16%. US yields slightly cheaper across the front-end while richer in the long-end of the curve, flattening 2s10s and 5s30s spreads by 1.8bp and 2.5bp on the day; US 10-year yields trade down to around 4.16%, richer by 1bp on the day with bunds and gilts outperforming by 2bp and 2.5bp in the sector. European government bonds gain with little reaction shown to a flurry of economic data releases, including a beat for euro-area first quarter GDP. European government bonds rose; German yields were up to 4bps lower across the curve, with gilts mirroring that move; UK 10-year yield down 4bps to 4.40%

In commodities, oil prices decline, with WTI falling 1% to $59.80 a barrel. Spot gold falls $36 to around $3,280/oz. Bitcoin is steady near $94,800.

US economic calendar includes April ADP employment change (8:15am), 1Q advanced GDP (8:30am), April MNI Chicago PMI (9:45am), March personal income/spending, PCE price index, pending home sales (10am). Fed’s external communications blackout ahead of the May 7 FOMC meeting

Market Snapshot

- S&P 500 mini -0.1%

- Nasdaq 100 mini -0.2%

- Russell 2000 mini little changed

- Stoxx Europe 600 +0.2%

- DAX +0.5%, CAC 40 +0.4%

- 10-year Treasury yield -1 basis point at 4.16%

- VIX +0.3 points at 24.48

- Bloomberg Dollar Index little changed at 1222.44

- euro -0.1% at $1.1371

- WTI crude -1.3% at $59.63/barrel

Top Overnight News

- US President Trump said he achieved the 100 most successful days for a president in US history, while he noted a lot of auto jobs and companies are coming in and we're restoring the rule of law and ending the inflation nightmare. Trump renewed his criticism of Jerome Powell, saying the Fed chair’s “not really doing a good job.” He also championed his tariff regime at a rally that came just hours after he signed a pair of executive orders pulling back some of his auto levies.

- US Secretary of State Marco Rubio plans to speak with the foreign ministers of India and Pakistan in an attempt to calm tensions. BBG

- Trump continues to float fresh tax cut proposals while Republicans struggle to agree on ways to lower the cost of the reconciliation bill. Axios

- Top Trump advisor reportedly struggled to soothe investors in talks after market tumult in which Stephen Miran met with hedge funds and big asset managers after tariffs sparked Wall Street turmoil, according to FT.

- China’s factory PMI slipped into the worst contraction since December 2023, revealing early damage of US tariffs. Beijing has created a list of US-made products that would be exempted from its 125% tariffs. BBG

- Chinese sovereign investor CIC is selling about $1 billion of its private equity investment portfolio in the secondary market. The assets are held in a number of funds managed by eight U.S. fund managers, including Blackstone Inc and Carlyle Group. RTRS

- Huawei has started the delivery of its advanced AI chip “cluster” to Chinese clients who are increasing orders after being cut off from Nvidia’s semiconductors because of Washington’s export restrictions. FT

- Japan eco data falls short for Mar, including retail sales (-1.2% M/M vs. the Street -0.7%) and industrial production (-1.1% M/M vs. the Street -0.4%). BBG

- The euro-area economy grew 0.4% last quarter, more than expected, though is yet to feel the full force of US tariffs. The German and French economies returned to growth. BBG

A more detailed look at global markets courtesy of Newquawk

APAC stocks failed to sustain the positive handover from Wall St and traded mixed at month-end as the region digested a slew of data including disappointing Chinese official PMIs, while there was a muted reaction and very few surprises from US President Trump's speech to commemorate his first 100 days back in office. ASX 200 eked mild gains as strength in tech, healthcare and financials offset the losses in the utilities and commodity-related sectors but with the upside limited after firmer-than-expected CPI data saw money markets fully price out the chances of a larger 50bps RBA rate cut in May. Nikkei 225 was choppy with the upside contained following disappointing Industrial Production and Retail Sales, while the BoJ also kick-started its two-day policy meeting and there were some comments from a group representing major foreign automakers which noted that President Trump's latest tariff order for autos provides some relief but more must be done. Hang Seng and Shanghai Comp were indecisive after official Chinese Manufacturing and Non-Manufacturing PMIs disappointed although Caixin Manufacturing PMI topped forecasts, while the mainland heads into a five-day weekend owing to Labor Day holiday closures and participants also reflected on key earnings releases including disappointing results from China's Big 4 banks.

Top Asian News

- Chinese President Xi says China is to adjust economic plans based on global change; to promote transformation of traditional industries; says they are to stabilize markets and expectations Urges to address weak links in economy. Urges to achieve goals in all aspects. Says to understand impact of changes in international situation. Says China to optimize economic planning based on situations. Urges measures to stabilize employment. Says to promote transformation of traditional industries. Says China to adjust economic plan based on global change. Says China needs to adapt to changing situations.

- China NPC standing committee passed the private sector promotion law which will take effect from May 20th.

- Australian Treasurer Chalmers said the market expects more interest rate cuts after inflation figures and he doesn't see anything in the data as substantially altering market expectations.

European bourses (STOXX 600 +0.2%) opened mostly firmer and have traded tentatively within a tight range ahead of the day’s key risk events. European sectors hold a strong positive bias; Media (lifted by post-earning strength in UMG) and Telecoms takes the top spots, whilst Travel & Leisure and Basic Resources underperform. rnings include: Mercedes Benz (-0.8%) down Y/Y, high uncertainty noted; Volkswagen (U/C) miss, expects results at lower-end of guidance; UBS (+0.2%) beat; Stellantis (+1.5%) in-line, suspends guidance; Barclays (-0.3%) beat, upgrades NII guidance; GSK (+4%) beat; TotalEnergies (-3.2%) mixed, continue buybacks, confident in growth objective; ASM International (U/C) orders & margin beat; Air France (+1.6%) beat, confirms outlook; Iberdrola (-1.3%) mixed, expect strong performance ahead.

Top European News

- Germany's SPD has approved the coalition deal with the CDU/CSU, via Reuters citing sources. SPD's Klingbeil will be the Vice Chancellor and Finance Minister of the new German Government, according to German media.

FX

- DXY is currently building on Tuesday's gains in quiet trade. The two main drivers for price action were relief on the tariff front (autos) and soft US data (JOLTS and Consumer Confidence). Data will likely provide some impetus for the Greenback today with Q1 GDP/PCE and monthly PCE due on the docket. Q1 GDP may be seen as stale in some quarters given its precedes the announcement of US tariffs. DXY has ventured as high as 99.43 with Monday's peak at 99.83.

- EUR softer vs. the USD in what has been a busy morning of data which kicked off with steady French GDP, hot French inflation and in-line German GDP which saw the nation avoid a technical recession, but ultimately showed a Y/Y contraction. Thereafter, Eurozone GDP exceeded expectations (Q/Q 0.4% vs. Exp. 0.2%) but failed to have any sway on the EUR given that it doesn't capture the impact of Trump's tariffs (aside from some potential front-loading of orders).

- USD/JPY is higher after Japanese Industrial Production and Retail Sales disappointed overnight, prompting concerns over a negative outturn for Q1 GDP. Attention now turns to the BoJ, where the Bank is expected to keep rates steady. USD/JPY is north of Tuesday's high at 142.75 but is yet to approach the 143 mark.

- GBP is slightly softer vs. the USD and EUR with fresh macro drivers on the light side. Tier 2 data via the Lloyds Business Barometer and Nationwide House Index had little sway on GBP. On the trade front, the Guardian reports that US officials have split trade negotiations into three phases; the UK has reportedly been placed in either phase two or three. UK officials are also concerned that any EU-UK deal could make negotiations with the US more challenging.

- AUD is the marginal outperformer across the majors on account of firm inflation metrics overnight (Q/Q 0.9% vs. exp. 0.8%, Y/Y 2.4% vs. exp. 2.3%).

- PBoC set USD/CNY mid-point at 7.2014 vs exp. 7.2670 (Prev. 7.2029).

Fixed Income

- A relatively contained start to the session with USTs holding onto Tuesday’s spoils, firmer by a handful of ticks in a 112-03 to 112-09 band. Limited resistance in the near-term, nothing of particular note until 114-03+ from early April and thereafter 114-10. On the data front, the docket begins with ADP as a preview into Friday’s NFP. Thereafter, Q1 GDP, PCE and Employment Costs due. Afterwards, we get the monthly PCE figure.

- Bunds began the morning holding at the top-end of Tuesday’s 131.16-46 parameters, in-fitting with USTs. Then, after the European cash equity open, EGBs began to gradually pick up and despite being knocked briefly by marginally hotter German state CPI metrics than mainland consensus implies, Bunds are at a fresh 131.74 peak. EZ GDP metrics came in above expectations, but ultimately had little impact on the complex given the survey period does not include the implementation of Trump tariffs. German 2041 & 2044 outings were mixed, but ultimately had little impact on the complex.

- Gilts are outperforming, gapped higher by just over 10 ticks and then in-fitting with EGBs after the cash equity open began to extend higher and hit a 93.68 high for the session. Strength occurs despite a lack of fresh drivers in today’s session thus far aside from supply, an auction that came in strong with another b/c well clear of the 3x mark and a slim tail. Results sparked a modest bid in Gilts but one that occurred within existing 93.35-68 confines.

- UK sells GBP 4.5bln 4.375% 2028 Gilt: b/c 3.48x (prev. 3.27x), average yield 3.834% (prev. 4.263%) & tail 0.2bps (prev. 0.4bps).

- Germany sells EUR 1.143bln vs exp. EUR 1.5bln 2.60% 2041 and EUR 0.452bln vs exp. EUR 0.5bln 2.50% 2044 Bunds.

Commodities

- Crude is softer for the third session in a row following yesterday's slide which now sees WTI back under USD 60/bbl. Desks pin the downside to ongoing tariff risks alongside expectations of OPEC+ further opening the taps. Furthermore, the bearish Private Inventory report on Tuesday only adds to the downbeat mood. Brent July in a USD 62.17-63.34/bbl range.

- Precious metals are lower across the board amid a firmer dollar intraday and following US President Trump softening the Auto tariffs, which further unwinds some risk premium. Spot gold resides in a USD 3,280.28-3,328.16/oz range at the time of writing, within Monday's USD 3,268-3,353.20/oz range.

- Hefty losses across base metals against the backdrop of a firmer dollar coupled with a cautious risk tone. 3M LME copper is currently in a USD 9,206.17-9,436.60/t range at the time of writing.

- Equinor (EQNR NO) CEO says European gas storage is low, expect a tight market during refilling. Europe will need 200-300 extra LNG cargoes to refill storage this year.

- US Private inventory data (bbls): Crude +3.8mln (exp. +0.5mln), Distillate -2.5mln (exp. -1.7mln), Gasoline -3.1mln (exp. -1.2mln), Cushing +0.7mln.

- Chile's Codelco Chairman said April Copper production +22% Y/Y.

Geopolitics: Middle East

- "Israeli government statement: On Netanyahu's instructions, the army carried out a strike against a group that tried to attack the Druze in Sahnaya (Syria)", via Sky News Arabia.

- Iranian Foreign Minister Araqchi says US sanctions send a negative message during the nuclear talks; E3 will hold talks in Rome on Friday and with the US on Saturday.

- UK forces participated in a joint operation with US forces against a Houthi military target in Yemen, while the UK said the strike was conducted after dark when the likelihood of any civilians being in the area was reduced and all aircraft returned safely.

Geopoltiics: Ukraine

- Kremlin spokesperson says settlement should be reached with Ukraine, and not the US, via Tass "We are working very intensively with the US on Ukraine".

- US President Trump said he thinks Russian President Putin wants peace but he was not happy when he saw Putin shooting missiles, according to ABC News.

- White House Press Secretary said President Trump is confident the Ukraine minerals deal will be signed.

Geopolitics: Other

- Pakistan's Information Minister said they have credible evidence that India is planning "military aggression" against Pakistan within 24-36 hours.

- North Korea conducted the first test firing of a new warship, according to Yonhap. It was also reported that South Korean intelligence assessed that North Korea's combat capabilities have improved and that North Korea suffered 600 deaths during its dispatch of troops to Russia, while South Korean intelligence is monitoring a possible surprise summit between North Korea and the US.

US Event Calendar

- 7:00 am: Apr 25 MBA Mortgage Applications -4.2%, prior -12.7%

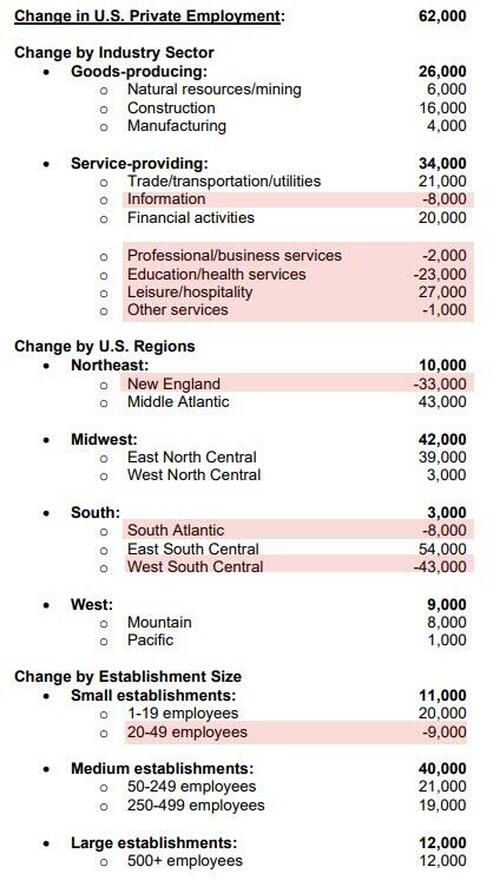

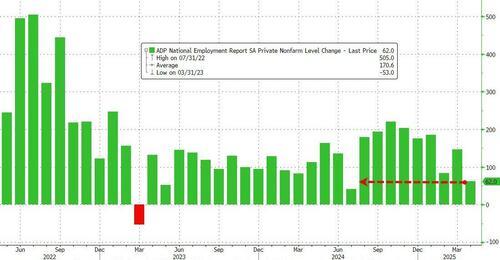

- 8:15 am: Apr ADP Employment Change, est. 115k, prior 155k

- 8:30 am: 1Q A GDP Annualized QoQ, est. -0.15%, prior 2.4%

- 8:30 am: 1Q A Personal Consumption, est. 1.16%, prior 4%

- 8:30 am: 1Q A GDP Price Index, est. 3.1%, prior 2.3%

- 8:30 am: 1Q A Core PCE Price Index QoQ, est. 3.1%, prior 2.6%

- 8:30 am: 1Q Employment Cost Index, est. 0.9%, prior 0.9%

- 9:45 am: Apr MNI Chicago PMI, est. 45.9, prior 47.6

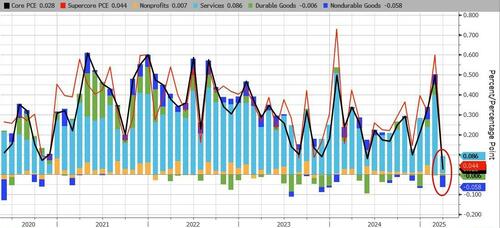

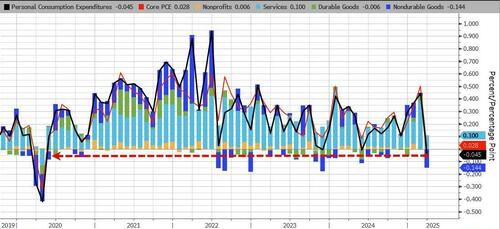

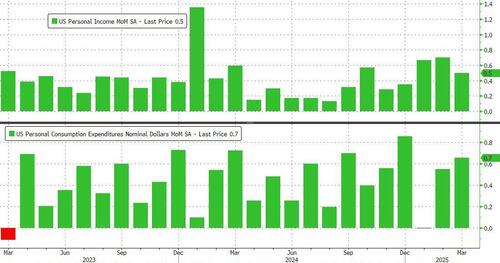

- 10:00 am: Mar Personal Income, est. 0.4%, prior 0.8%

- 10:00 am: Mar Personal Spending, est. 0.6%, prior 0.4%

- 10:00 am: Mar PCE Price Index MoM, est. 0%, prior 0.3%

- 10:00 am: Mar PCE Price Index YoY, est. 2.2%, prior 2.5%

- 10:00 am: Mar Core PCE Price Index MoM, est. 0.1%, prior 0.4%

- 10:00 am: Mar Core PCE Price Index YoY, est. 2.6%, prior 2.8%

- 10:00 am: Mar Pending Home Sales MoM, est. 1%, prior 2%

DB's Jim Reid concludes the overnight wrap

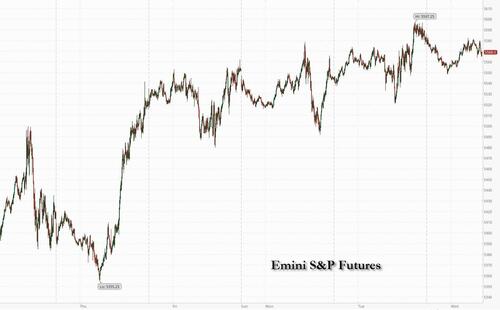

Welcome to the end of 100 days of Trump 2.0 with markets currently in a period of rare calm over this period. Indeed yesterday the S&P 500 (+0.58%) advanced for a 6th consecutive session and marking its best 6-day run (+7.81%) since March 2022. Interestingly, the latest gain means the index is now out of technical correction territory again, and now “only” stands -9.49% beneath its record high in mid-February and -1.94% below pre Liberation Day levels. This comes ahead of Microsoft and Meta’s earnings after the bell tonight and Amazon and Apple tomorrow. So these will go a long way towards dictating the sentiment of markets given we’re out of the most intense gravitation pull of Liberation Day now. It feels that in the last month or so AI has hardly been discussed as an investment theme after 2 years where it was the only game in town.

The main trigger for yesterday’s risk-on mood were headlines that Trump would announce some auto tariff relief ahead of tariffs on auto parts coming into force next weekend. The measures, signed later in day, prevent tariffs on autos and on steel and aluminium from stacking up on top of each other and provides partial rebates for domestic car makers on imported auto parts for the first two years. The President framed the move as giving companies “a little flexibility” at a rally yesterday evening, at which Trump also renewed his criticism of Fed Chair Powell, saying he's "not really doing a good job".

Those tariff headlines supported markets in spite of a weak batch of economic data. That included the Conference Board’s latest consumer confidence indicator, which fell to 86.0 in April (vs. 88.0 expected). Not only is that the weakest since May 2020 at the height of the pandemic, but the expectations component saw an even bigger slump to 54.4, marking its lowest since October 2011 when the post-GFC recovery was stalling and the Euro Crisis was escalating. In the meantime, the latest JOLTS report also showed job openings fell to a 6-month low in March of 7.192m (vs. 7.5m expected). Obviously that’s covering a period before Liberation Day, so markets weren’t too focused on that, but it still meant that the ratio of vacancies per unemployed individuals fell to 1.02, which is its lowest so far this cycle.

The read across for risk assets was probably limited by the fact that the Conference Board reading is still a survey and while the surveys have been consistently negative of late, hard data have been mostly holding up. So it didn’t lead to a major re-assessment about the growth outlook in the way that a negative jobs report might have done. On top of that, the details of the JOLTS report did include some more positive elements, as the quits rate of those voluntarily quitting their job hit an 8-month high of 2.1%. It also didn’t show an escalation in layoffs, as the layoffs and discharges rate fell back to a 9-month low of 1.0%. So it meant investors could still plausibly believe the narrative that a recession would be avoided, even if sentiment had taken a big hit.

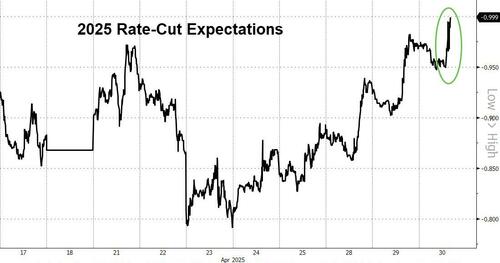

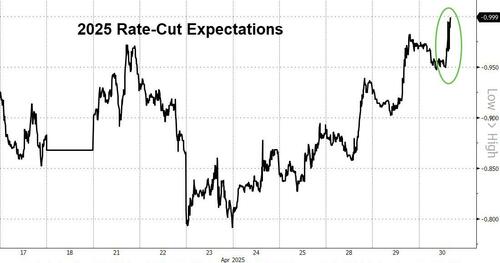

However, the more negative data immediately led investors to price in more Fed rate cuts this year. For instance, the amount of cuts priced by December moved up to 97bps, which is the highest since April 8, just before Trump announced the 90-day tariff extension. In turn, that led Treasury yields to fall across the curve, with the 2yr yield (-4.4bps) falling to 3.65%, its lowest level since October, whilst the 10yr yield (-3.6bps) fell to 4.17%.

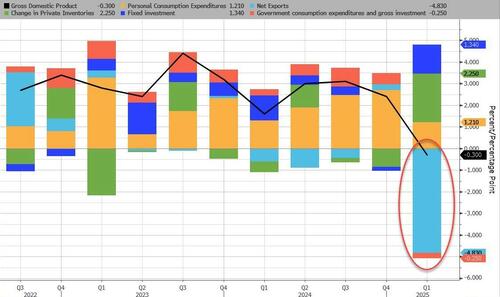

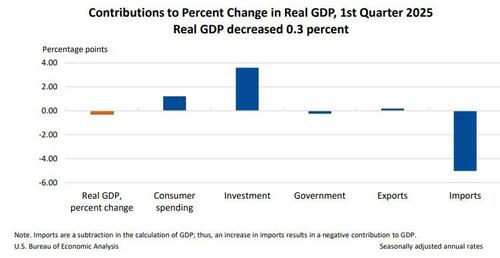

Looking forward, we’ll get a key piece of data today with the Q1 GDP release. Obviously that’s backward-looking and covers the period before Liberation Day, but it will give a strong indication of the extent to which people might have tried to import goods to get ahead of the tariffs. Indeed, yesterday we found that the goods trade deficit hit a record $162bn in March (vs. $145bn expected). So that led to a decent hit in GDP trackers, given that imports subtract from GDP growth. Indeed, the Atlanta Fed’s GDPNow estimate for Q1 is now at an annualised contraction of -2.7%, and their alternative model that adjusts for imports and exports of gold is still at a contractionary -1.5%. And our own US economists have updated their expectation to a real GDP to contraction of -0.9% in Q1 due to the surge in imports (see their note here). If today’s number does show a decline, that would be the first quarterly contraction since Q1 2022.

For now at least, equities continued their rally, with the S&P 500 (+0.58%) moving up to its highest level since Liberation Day, led by financials (+0.97%) and materials (+0.93%). Energy stocks (-0.37%) underperformed as Brent crude oil fell -2.44% to $64.25/bbl. Over in Europe, there was also a strong performance, with the STOXX 600 (+0.36%) posting a 6th consecutive gain as well, whilst the DAX (+0.69%) outperformed. The DAX has now entirely erased its losses since Liberation Day, leaving the index +0.16% above its level on April 2 and +12.64% YTD as opposed to -5.45% for the S&P 500. Meanwhile in the UK, the FTSE 100 (+0.55%) posted a 12th consecutive gain, which made it the longest run of gains since 2017.

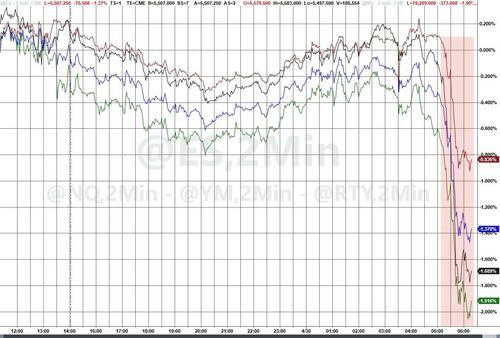

Overnight S&P 500 (-0.47%) and NASDAQ 100 (-0.64%) futures have fallen, not helped by a -17% after hours drop in Super Micro Computers after posting disappointing results. This is a company that was a darling of the AI world and peaked out at around 118 early in 2024 and will likely open in the low 30s today. The rest of Asia is largely consolidating with the S&P/ASX 200 (+0.24%), Nikkei (+0.17%) and Hang Seng (+0.22) seeing small gains but with mainland Chinese stocks broadly flat. Elsewhere, the KOSPI (-0.60%) is lagging behind its regional peers.

Coming back to China, the official manufacturing PMI contracted to 49.0 in April this morning, falling short of the expected 49.7 and significantly lower than the previous month's 50.5. This contraction is clearly being attributed to the escalating trade war with the US. The non-manufacturing PMI also disappointed, dropping to 50.4 in April, below the anticipated 50.6 and down from 50.8 in March. Consequently, China’s composite PMI decreased to 50.2 in April from 51.4 in March, barely remaining above the 50 expansion threshold.

Elsewhere, Australia's Q1 inflation edged up to +2.4% year-over-year (expected +2.3%), holding at a four-year low. The RBA's preferred trimmed mean inflation rate fell from a revised +3.3% to +2.9% in March (expected +2.8%). The data is likely to reinforce the central bank's cautious stance and dampen expectations for aggressive interest rate cuts in the near term. Against this background, the Australian dollar is holding on to its gains, strengthening +0.27% to trade at 0.6401 against the dollar. Meanwhile, yields on the 3yr policy sensitive government bonds are -0.7bps lower settling at 3.31% as we go to print.

Turning to back Germany, today is an important one in the process to forming a new government, as the vote of the SPD membership on the coalition treaty concludes. In light of this, our economists have put out a fresh note going through that vote (link here), as well as the fiscal timelines for the 2025 budget. Their view is that there is little event risk from the SPD vote, and that they don’t expect any additional fiscal support measures (beyond the coalition treaty) unless there are tangible signs of the trade shock materialising.

Finally in Europe, sovereign bonds put in a decent performance across the continent, with yields on 10yr bunds (-2.3bps), OATs (-1.9bps) and BTPs (-2.1bps) all falling back. That came as the European Commission’s latest economic sentiment indicator fell by more than expected in April, down to a 4-month low of 93.6 (vs. 94.5 expected). Separately, the ECB’s survey of consumer inflation expectations showed 1yr expectations up to +2.9%, the highest since April.

To the day ahead now, and US data releases include PCE inflation for March, Q1 GDP, the Q1 Employment Cost Index, and the ADP’s report of private payrolls for April. Meanwhile in Europe, we’ll get the flash CPI reading for April from Germany, France and Italy, along with German unemployment for April. From central banks, we’ll hear from the ECB’s Muller, Villeroy and Makhlouf. Finally, today’s earnings releases include Microsoft, Meta and Caterpillar.

Tyler Durden

Wed, 04/30/2025 - 08:17

Click hat... add to cart... check out... receive awesome hat...

Click hat... add to cart... check out... receive awesome hat...

Venezuelan illegal immigrants deported from the United States disembark from a Conviasa Airlines plane upon arrival at Simon Bolivar International Airport in Maiquetia, Venezuela, on March 24, 2025. Juan Barreto/AFP via Getty Images

Venezuelan illegal immigrants deported from the United States disembark from a Conviasa Airlines plane upon arrival at Simon Bolivar International Airport in Maiquetia, Venezuela, on March 24, 2025. Juan Barreto/AFP via Getty Images

Border Patrol agents wait for the arrival of Defense Secretary Pete Hegseth for a visit to the US-Mexico border in Sunland Park, New Mexico, on Feb. 3, 2025. AP Photo/Andres Leighton, File

Border Patrol agents wait for the arrival of Defense Secretary Pete Hegseth for a visit to the US-Mexico border in Sunland Park, New Mexico, on Feb. 3, 2025. AP Photo/Andres Leighton, File

Students walk between classes in front of College Hall on the campus of the University of Pennsylvania in Philadelphia on Sept. 25, 2017. Charles Mostoller/Reuters

Students walk between classes in front of College Hall on the campus of the University of Pennsylvania in Philadelphia on Sept. 25, 2017. Charles Mostoller/Reuters

via Flash90

via Flash90 New Africa/Shutterstock

New Africa/Shutterstock

Recent comments