Recently there has been several stories about 2000s being the Lost Decade of Jobs. No kidding. But what the stories fail to discuss is what are the reasons for the lack of job growth. Could it be because of economic policy? Heck, yeah - our current economic policy relies on wage suppression, cheap imports, more debt, abandonment of manufacturing sector (part of wage suppression strategy) and asset price inflation. But why don't we hear about this in the traditional media?

First, a Business Week article:

Second, from a New York Times Article:

Third, from the Washington Post:

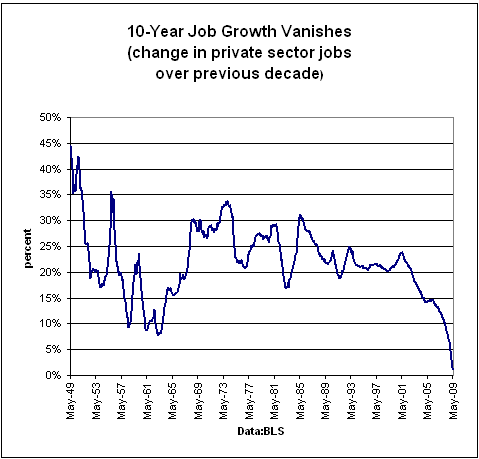

Last, the Chart of the Day:

All these graphs show the same thing two things: 1) number of private sector jobs and 2) disturbing downward trend in jobs by decade. What is missing is any discussion about why or how our current economic policies are failing us? Why? Because any changes to our economic policies will require upsetting the status quo and certain socio-economic groups or classes won't like that.

Cross Posted @ Rebel Capitalist

Comments

where did all the jobs go?

I think I'll revisit my favorite topic, global labor arbitrage in a post soon to try to find the lost jobs and where they are now. Of course the government won't track on those statistics!

;)

Is that a rhetorical question?

This is our current economic policy: wage growth means inflation so we must do whatever we can to suppress wage growth. So what do we do:

1) Unfettered globalization

2) Unfettered off shoring & out sourcing

2) Cheap imports to compensate for wage suppression

3) Destruction of unions.

4) Debt and asset price inflation replaces wage growth

But one big intended or unintended consequence was total abandonment of manufacturing sector.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

a rhetorical question that I intend on writing about later

I've been working on some site upgrades and some of it is code. (before I upgrade the site I need to finish this up and make sure it all actually works, THEN....I have to deal with the database itself, which is more modifications, I'm going to do it in "one shot" and will put up a blog post to that effect)....

But back to this question, it's not enough to say what we know.....but to try to prove what we know.

So, I plan on writing up some pieces on this topic later.

A duel to this topic, which will probably get a lot of denial is the importation of workers. Right now there are 1.5 million guest workers in the United States....

that's with a U6 of 17.3%. So, this does affect labor supply, sorry, that's the economic reality and I'm going to include in discussion. In terms of offshore outsourcing, I know India alone has 900,000 people employed...in just that sector, that doesn't include all of the job creation going on in other countries..by U.S. multinational corporations, instead of the United States. Krugman just did a rough cut estimate on jobs lost due to China. 1.4 million and that too was met with a huge denial...and from the left....anything that has to do with labor and jobs moving around the globe.....unfortunately it's some of the left who have their heads stuck in the statistical sand and wish to deny these results for some bizarre political agenda (which also happens to be MNC's political agenda too).

Anywho, there it is and I want to start looking at this, from the stats and theory because we've got a major job/multiple industry sectors hemorrhage going on here.

Another Picture of Job Loss.

Tom Iacono ran this graph the other day while discussing labor trends. What struck me when I looked at it was that we are currently at late 1950's levels of employment in goods producing industries. I don't know what the USA population was back then, but I would chance a guess of about 50% or less compared to today.

David Rockefeller's wet dream has come true.

Mess That Greenspan Made

Right, that's an interesting view on government jobs vs. private sector..

but I think it's important to site the author (unless you're using government generated graphs, which I use a lot of)

Tim got plain ripped off on his blog post, his graph lifted, not cited, no link by business insider.

I think that's pretty shitty to steal from some blogger to put on your front page and not even citing the graph.

Which is a reminder to all, if you're borrowing someone else's generated graph, always cite it with a link back.

Bloggers borrow from each other all of the time on graphs, but when it's something like the above, where they just literally ripped off the whole insight and front paged it, no citation, that's bad juju, unfair.

Right.

And John Carney at The Business Insider later corrected their graph with a hat tip to Iacono. He also emailed an apology to Tim (don't know where I got "Tom" from!).

good for them!

It's really easy to do so much is "shared" online.

Remind me will ya, I'm working on site upgrades (and this is going to be a real bitch, I will post/warn) on when I'm actually doing the code changes....

but to put in the "rules" on EP something to try to cite where materials originated from unless it's not easy to figure it out.