Initial weekly unemployment claims decreased to 382,000 this week and last week was revised up to 395,250. The 4 week moving average dropped to 389,500, but is higher than the 4 week moving average from March 12th. Weekly unemployment claims seem to be hovering right above the job creation point of 375,000 per week now.

The magic number to show job creation is at minimum, below 400,000 initial unemployment claims per week and most Economists will quote 375,000. It seems a hover pattern is appearing, where initial claims are finally dropping, yet hovering above the job creation point and not fast enough.

From the jobless claims report:

In the week ending April 2, the advance figure for seasonally adjusted initial claims was 382,000, a decrease of 10,000 from the previous week's revised figure of 392,000. The 4-week moving average was 389,500, a decrease of 5,750 from the previous week's revised average of 395,250.

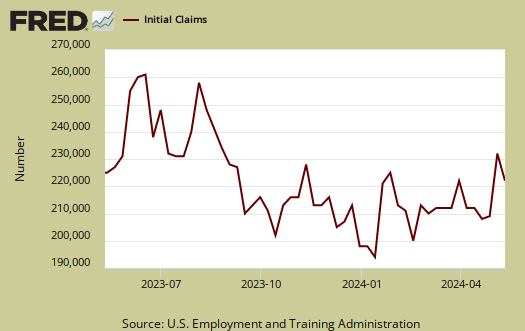

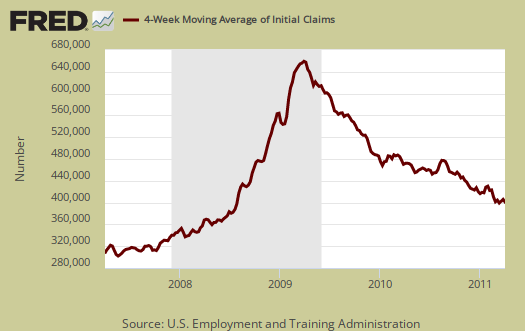

Below is the mathematical log of initial weekly unemployment claims, so one can get a better sense of the rise and fall of the numbers. A log helps remove some statistical noise, it's kind of an averaging. As we can see we have a step rise during the height of the recession, but then a leveling, not a similar decline....for a long period. Instead, we have this yo-yo bobblehead, over 400,000 every week on initial claims, never ending labor malaise for most of the time after the recession ended in July 2009. Now, notice the tail or the right of the graph, it appears a downward slope, a decline initial claims, started emerging in February.

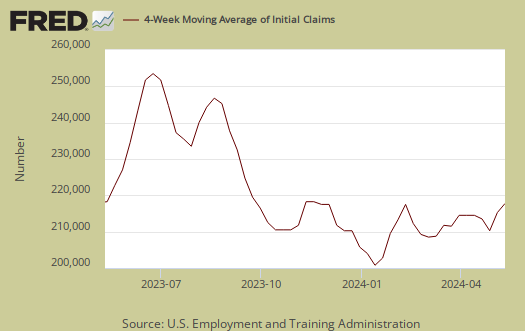

Below is the 4 week moving average, set to a logarithmic scale to remove even more statistical noise, for the last year. Here a trend is appearing that weekly initial unemployment claims are finally dropping. Again, we need the 4 week moving average to stay below 400,000 and keep dropping. Numerous economists say the number is 375,000 to show job growth. We see a strong decline, but remember the record highs. We need this number to keep dropping, steadily.

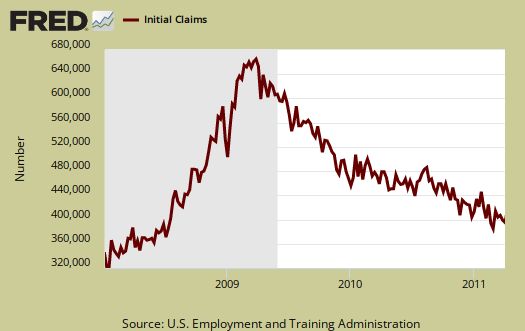

Below is the 4 week moving average, set to a log scale, from April 1st, 2007. This shows while the immediate change looks promising, we are nowhere near pre-recession initial weekly unemployment claims levels.

Continuing unemployment claims barely budged from last week.

The advance number for seasonally adjusted insured unemployment during the week ending March 26 was 3,723,000, a decrease of 9,000 from the preceding week's revised level of 3,732,000. The 4-week moving average was 3,745,750, a decrease of 24,000 from the preceding week's revised average of 3,769,750.

In the week ending March 19th, not seasonally adjusted, the raw number was 8,524,455 official people obtaining some sort of unemployment insurance benefit.

8 million

Robert:

Thanks for the analysis! Whether we interpret these numbers as promising or disappointing, there are still more than 8 million people receiving unemployment and many many more still seeking work! The debate about how to start creating jobs seems to always swing between market remedies and government subsidies, when we know the reality falls somewhere in between.

I encourage you and your readers to learn more about how folks in the nonprofit sector are bridging this divide in their approach to the issue of job creation. They are hopeful and relentless about on-the-ground efforts to create jobs but are also honestly frustrated with the tone of the current debate. We recently asked a bunch of leaders in the third sector to tell us what they think is missing from the debate and we got some pretty interesting answers. http://pndblog.typepad.com/pndblog/2011/04/philanthropy-andjob-creation....

I'd love to hear what you (and your readers) think is missing from the debate on job creation? What aren't we doing that we should be to bring unemployment numbers down?

Gabi

Gabriela Fitz

Co-Director

IssueLab

gabi@issuelab.org

http://www.issuelab.org

IssueLab: bringing nonprofit research into focus

Join us on Facebook: http://www.facebook.com/issuelab

Follow us on Twitter: @issuelab

We've said it many times on EP

Fundamentally it's "buy American and hire America". They need to quit this insanity of bad trade deals, offshore outsourcing jobs and yes, acting like illegal immigration doesn't lower wages (it does indeed!), also stop displacing professionals through foreign guest worker Visas.

We railed on the stimulus. Grants, tax incentives and even venture capital, it's all skewed towards moving to EEs (emerging economies) on some belief of cheap labor and better returns.

Just a case in point, what good is it to award a contract to an Indian offshore outsourcer in Ohio? They outsourced jobs and even when done locally by that Indian company, the reality is that company imported foreign guest workers instead of hiring local Ohioans.

Stuff like this goes on every day and this is assuredly not the situation in say Germany, which has a great export driven economy plus high wages, say Japan (who right at the moment is screwed due to disasters).

you need to tone down the links

I mean referencing a host of papers ignoring the reality that most of the funds for green jobs went straight to China, do not pass go, is a prime example of public relations sounding great juju with no hire American, buy America conditions.

No doubt G.E.'s "green job plant" is a PR response to the growing pressure to get G.E. out of the white house, but that does not negate the fact G.E. offshore outsources and labor arbitrages even their R&D engineers, severely. (and notice that fine engineering result over to Japan, Q.E.D.).

The AAM has the Buy American, Hire America conditions required in their infrastructure recommendations. As a result, one can trust their GDP multipliers much more than others. While the statistical measurement debate is raging on just how much labor arbitrage, globalization, outsourcing is skewing various economic metrics....it sure looks guaranteed they are being skewed at this point, from researching the latest research.

The China currency manipulation is very real and it's amazing how badly it affects the trade deficit. Do something about that, immediately and it has support on all sides of the political spectrum, except of course for U.S. multinationals, their lobbyists and their corresponding bought and paid for politicians, including the White House.

But you need to tone down the links. While we're fine for self promotion, there are limits here.

But hosting a group of 'white papers' without considering the source, one golden rule on EP, no economic fiction and that especially implies lobbyists' white papers, either side, any flavor of agenda. We'd no more allow budget fiction from the Heritage foundation any more than we allow biased mathematical equations, which happen to set a few variables to zero in order to claim some sort of fiction, or put some absurd, not on this planet conditions, from even the NBER.

If it doesn't hold water by the theory or the statistics, it's not something we wish to promote. Thanks.

economic fiction and buy america conditions

Robert - I apologize if my post seemed like self promotion. I am happy to drop the links in the future. I really just wanted to hear what you all think is missing from the current debate and wanted to provide some valuable context for that question. It's clear, from your comments at least, that what you think is missing is economic development that requires "buy american" conditions.

If you look closely at some of the examples of projects I link to, like those by Green for All and the Democracy Collective, these are green jobs projects that squarely focus on not just building jobs in the U.S. but building jobs in local communities that have long suffered joblessness. These are in many sense economic justice projects, not corporate PR.

On an editorial note, we do consider the source for every white paper that we host but we leave it up to our readers (whose intelligence we trust) to sort out which projects and approaches they support and which they have criticisms of. The fact, and this is far from economic fiction, is that nonprofits across the U.S. are working hard to build jobs here in the U.S. with mixed success. Evaluating and exploring their approaches is not lobbying, its looking for solutions to a real and urgent problem.

it is not "I think", or opinion

It is economic theory. On this site, we try to get specific. The Stimulus shows because they refused to have conditions of "Buy American, Hire America" on funds, especially "green job" funds went overseas, went to foreign corporations for workers in their home countries and purchases were made to foreign countries.

As a result, China, not the United States, is #1 for solar panels and recently a "green jobs" company, received large grants, U.S. taxpayer funds and then moved to China, completely and claimed "we need to compete"...

That's U.S. funds, enabling a start of a business and that business did not pay back a dime and instead, after they were started, set up, on Uncle Sam's dime, moved to China.

That's a direct hit, a direct loss of U.S. taxpayers funds flowing freely, to other nations.

You cannot have a GDP multiplier have strong stimulative effect by offshore outsourcing, jobs, production, capital goods, or insourcing workers (this means hiring foreign guest workers, importing workers, illegals).

So, another strong case for "fiction" is when a study either tries to manipulate economic equations, theory, statistics or ignores them completely.