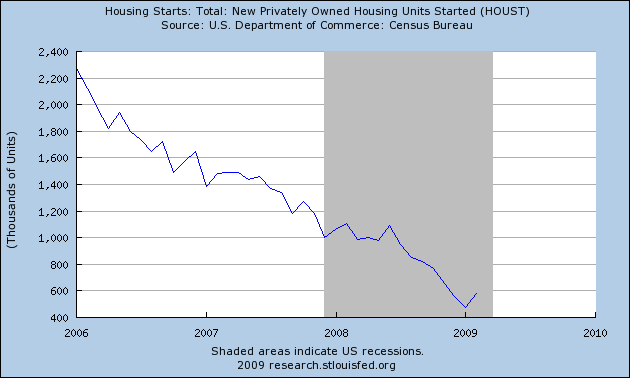

Today the Census Bureau reported on Housing permits and Housing starts.

New housing starts for February came in at a seasonally adjusted 583,000, up from a revised 477,000 in January.

This ~20% increase is by far the biggest increase in any month's data since the top of the housing market at the beginning of 2006.

Permits had a similar increase.

This data is more evidence that the Housing market is transitioning from Cliff-diving to rubble-bouncing. This is good news!

UPDATE: Almost all of the rest of the opinion in the econo-blogosphere is that this number is "just one month's data" or "just noise in a noisy series" or "don't get too excited" yadda yadda yadda blah blah blah.

Except with this data series (shown here from the January 2006 peak), you really only have two choices:

1. The decline of ~500,000 units a year will continue intact until we hit 0 by about the middle of next year, proceeding thereafter into the End Of Western Civilization.

Or

2. The housing crash transitions from guillotine to sandpaper (or cliff-diving to rubble-bouncing) phase sometime this year:

There simply is no other choice.

All things considered, an unexpected monthly increase of 22% strikes me as a good candidate for the beginning of that graphical transition.

Reporting the number this morning, Calculated risk says:

One month does not make a trend - However I do expect housing starts to bottom sometime in 2009.

Readers of my posts are not surprised.

Comments

At least one more leg down.

Low cost housing contributing to increase.

Housing is still too expensive in relation to incomes. With unemployment still cliff diving m-o-m foreclosures are set to continue higher.

One month does not a trend make.

It has always been about class warfare.

How many months till the trendline is broken?

Assuming you don't think there will be 0 housing starts in 2010.

Fortune teller I am not

So I will try to address your question this way.

We are now in what is historically the prime buying season for real estate. However with the record amount of inventory, shadow inventory, foreclosures, pre-foreclosures and short sales ... any new starts only exacerbates the problem.

Could we see a bump here in starts? Sure. Nothing is 100%. If builders aren't building they might as well be out of business. However builders are not competing against other builders in pricing ... they are competing against foreclosure pricing and with that I don't know how or why they are building.

It has always been about class warfare.

I suspect

That the popularity of "Extreme Home Makover" and "Habitat for Humanity" will keep housing starts from becoming truly 0.

But then again, those are charity cases, not for-profit sales.

-------------------------------------

Moral hazards would not exist in a system designed to eliminate fraud.

-------------------------------------

Maximum jobs, not maximum profits.

New Deal, you're such a party pooper!

Bringing some shocking positive statistics to light....jez, get with the Armageddon program! ;)

What's interesting is...

... there is a growing trickle of shocking, positive statistics -- suggesting (crossing fingers here) that we are getting quite late in the recession.

yeah well

I think one of my hopes is this macro economic recession is used to enact policy changes to stop the perpetual recession on working America, middle class.

I have to write a post on institutionalized age discrimination. We have so many people with zero retirement who now need to work until they drop, then on top of it, we have massive age discrimination in the work force.

I am not making this up, but literally high tech employers believe an Engineer, technical worker is "over the hill" at age 35. 35, I am not kidding.

So, that cuts careers short beyond belief, never mind the entire discrimination against anyone over the age of 45 in other sectors.

Anyway, that was my silver lining in Economic Armageddon, and I fear if the economy bounces back, the long slow dribble to death of the U.S. middle class, working America will just continue...nothing changes.

I am normally a very positive person but

this blip can be just a reflection of better weather conditions in Jan/Feb.

RebelCapitalist.com - Financial Information for the Rest of Us.