The Manufacturers' Shipments, Inventories, and Orders report shows factory new orders declined by -1.5% for June. That's after May new orders decreased by -1.2%. Durable goods new orders by themselves plunged by -3.9% for June after an May -2.9% decrease. That ain't good folks. Transportation new orders plunged by -10.5% as nondefense aircraft and parts dropped by -58.8%. The year to date in comparison to the same time period in 2015, new orders are down -2.6% while just durable goods new orders have had no year to date change. Inventories continue to be down as well, not a good sign. The Census manufacturing statistical release is called Factory Orders by the press and covers both durable and non-durable manufacturing orders, shipments and inventories.

While transportation equipment new orders plunged by -10.5% , motor vehicles bodies & parts new orders increased by 3.2%. Volatile aircraft new orders decreased -58.8% in nondefense and declined in defense aircraft new orders by -6.7%. Ships and boats new orders increased by 6.7%. There are other categories of transportation equipment not listed in the report, so don't blame it all on volatile aircraft, although the increase in autos & parts is a saving grace.

Core capital goods new orders increased by 0.4%. The previous month showed a -0.6% decrease and April showed a -0.9% decline. Core capital goods are capital or business investment goods and excludes defense and aircraft. This is all pretty weak, although a positive increase in the midst of such declines is another silver lining.

Nondurable goods new orders increased by 1.0%. Manufactured durable goods new orders, decreased -3.9%, shown below.

Shipments overall increased 0.7% for June. Durable goods shipments increased 0.4%. Nondurable goods shipments increased 0.1%. Core capital goods shipments decreased by -0.2%. Core capital goods shipments go into the GDP calculation. Below is a graph of core capital goods shipments.

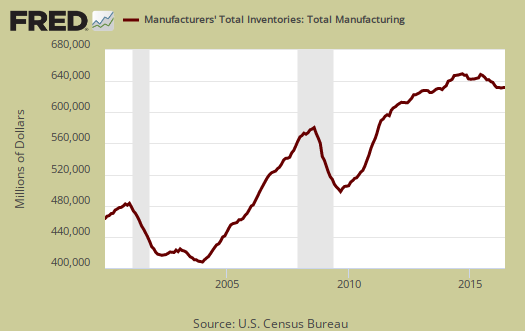

Inventories for manufacturing overall were down slightly by -0.1%, the same decline for May and April. Durable goods is much worse, with a -0.3% decline and have dropped 11 of the past 12 months. Core capital goods inventories increased 0.1%. Nondurable goods inventories increased 0.2%, but are down -3.8% for the same time a year ago. For the same time this year, overall manufacturing inventories have declined by -3.7%. Durable goods inventories have dropped by -3.7% also for the year.

The inventory to shipments ratio was 1.35, whereas May was 1.36. When ratios increase it can imply economic sluggishness.

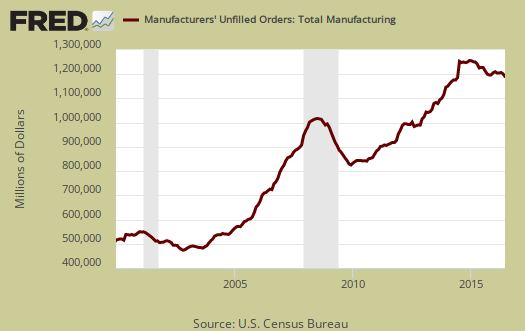

Unfilled Orders decreased by -0.8% and the unfilled orders to shipments ratios were from 6.89 in May to 6.81. Durable goods unfilled orders also declined by -0.8%. Core capital goods unfilled orders declined by -0.2%. Motor vehicles unfilled orders had no change. This is also pretty damn bad news as production activity is clearly more than keeping up with orders, although the supply chain speed might be implicated.

Generally speaking this report shows some serious manufacturing malaise. This with disappointing Q2 GDP sure show a very sluggish economy and one wonders why so many believe otherwise.

Part of this report goes into calculating GDP. The BEA takes this report, called M3, and uses the shipments values to calculate investment in private equipment, investment in software. Manufacturing inventories also goes into the changes in private inventories GDP calculation. At the bottom of this post is a little more information to estimate part of the GDP investment component.

The St. Louis Federal Reserve FRED graphing system has added individual NAICS data series from this report. If you're looking for a graph of some particular NAICS category, such as light trucks, autos & parts, or machinery, it might be found on FRED. Most news outlets source the Commerce Department, while technically correct, also makes it impossible for you, our beloved detailed reader, to find the actual statistical report and data which you might be focused in on. There is much more detail in the statistical tables published by the Census website for manufacturing statistics.

Recent comments