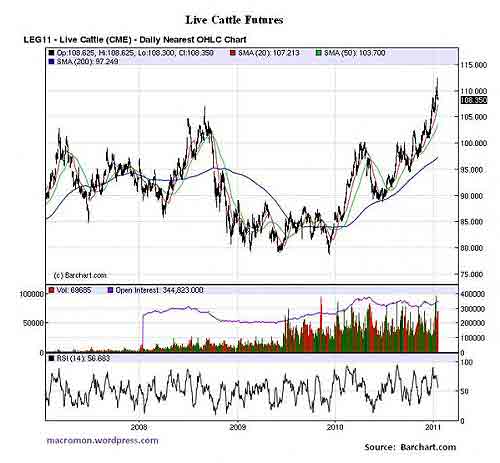

Cattle Futures are going through the roof and we have one very scary chart.

MacroMan points out that Live Cattle Futures have gone parabolic; Daniel Dicker blames speculative derivative traders and a lack of oversight as the cause. In other words, we never got any real financial reform laws.

It is clear now that we will instead be witness to the highest prices for commodities ever, fueled by the biggest influx of profit-driven trading and investment ever, unstanched even in the slightest by the hopes of financial regulation legislation.

The World Bank also warned on rising commodity prices being a threat to the global economy in 2011. Here we go!

A comment at Naked Capitalism on Iron is worth repeating:

Iron ore prices soar to record high – Iron ore prices have hit an all-time high as supply disruptions in India, the world’s third-largest exporter of the steel-making commodity.

...

Pakistan’s cement sector is likely to feel the heat of the soaring international prices of coal, going forward. Global coal prices continue to climb, already 34% up since June 2010.

Yeah, well, thank God there's no inflation, or we'd really be screwed. (snark)

Recent comments