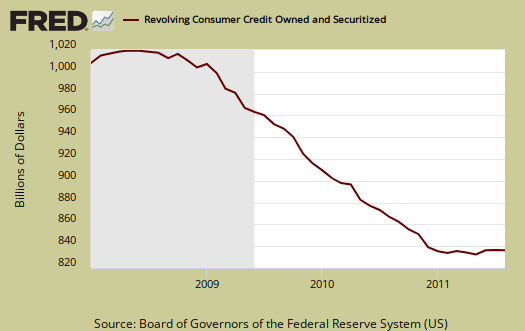

The Federal Reserve's consumer credit report for August 2011 shows a dramatic annualized decrease in consumer credit, -4.6%. Revolving credit decreased at an annual rate of -3.5%, and nonrevolving credit decreased at an annual rate of -5.25%.

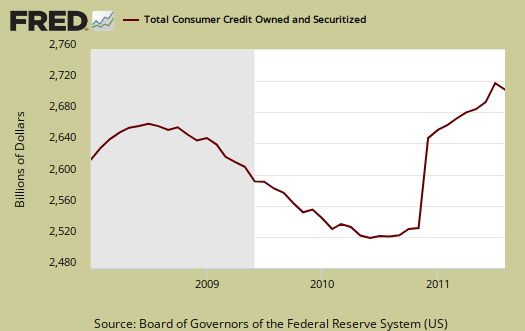

Overall consumer credit dropped $9.5 billion dollars to $2,444.9 billion. Revolving credit dropped $2.2 billion while non-revolving decreased $7.3 billion. Revolving credit are things like credit cards and non-revolving are things like auto loans and student loans.

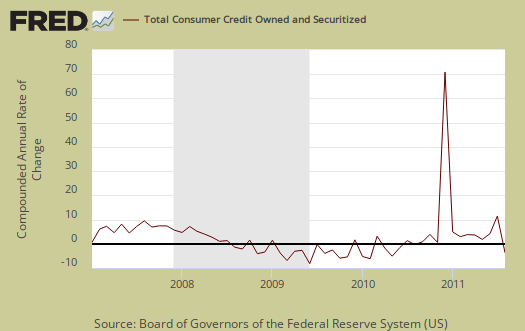

From the above graph we can see outstanding consumer credit drops correlate to recessions. This report does not include charge offs and earlier delinquencies for Q2, of April, May, June, increased. Below is total consumer credit.

This is the biggest drop since April 2010's -5.1% decline. The last monthly decrease was September 2010, and only -0.6%.

That said, the drop was in nonrevolving. Last month revolving credit declined -5.4%, annualized, yet nonrevolving jumped with a 11.3% increase in July. Below is non-revolving credit, seasonally adjusted, annualized percentage change.

What this means is people are using less credit, whether by choice or default. Yet it appears strange that all sorts of nonrevolving loans increased in July and then plunged in August. Looking at quarterly and annual data in the next statistical releases is probably in order.

Below is revolving credit, raw totals. Charge offs are not included in this report. These numbers are seasonally adjusted.

New car loan interest rates were 5.94%, personal loan, 10.82% and credit card interest rates were 13.08% for accounts charged interest, 12.28% credit card rates overall.

Recent comments