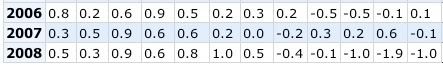

Here is a screen shot of the monthly readings of CPI for the last 3 years:

I include this because if you keep in mind what has been happening with Oil prices over that same time, a pretty decent picture of what is likely to happen to prices in 2009 takes shape. Remember that from August 2006 through January 2007, Oil prices decreased over 35% from $80 to under $55. Then Oil took off on a tear, hitting $147.50 in July 2008, before collapsing to under $35 by the end of the year. Oil prices are seasonal, rising in the first half of the year, and dropping in the later part of the year, and this is reflected in the "seasonal adjustment" of consumer prices.

Last year we were just beginning a recession, induced by imploding home prices and financier losses, together with an Oil shock. I knew, based on past Oil shock-induced recessions, that after an initial surge, the recession would kill enough demand to bring inflation back down. And that did happen. In Spades.

This year we have a deepening recession, with frantic monetary and fiscal measures being undertaken to avoid a catastrophic meltdown. So what will happen to prices in 2009? I see two scenarios.

First of all, Oil is not going to have nearly the dramatic swings it had last year. And it isn't going to $0. A seasonal advance may happen, but nothing like last year. That means the inflation numbers for early 2009 will be much less than those of early 2008. Similarly, a dramatic collapse in inflation later in the year is only going to happen if we are in economic apocalypse territory.

The two scenarios are Optimistic vs. Pessimistic. In the Optimistic scenario, the fiscal and monetary stimuli, together with intelligent new political leadership in Washington, halt the meltdown perhaps by mid-year, and wage reductions remain the exception. In the Pessimistic scenario, the stimuli fail, and wage reductions spread, leading to a wage-price deflationary spiral.

In the Optimistic scenario, monthly inflation remains positive, but perhaps at 1/3 to 1/2 the level of last year. By the end of June, first half 2009 inflation will be in the 1.4%-2.2% range. Year over year, however, as the 2008 numbers are replaced, DEflation will be realized, falling to (-2.0%) - (-2.7%) range. In the later part of the year, there may be some negative monthly readings, but nothing like 2008. By the end of the year, the two will balance out, and 2009 will end with a mild ~ +1.0%- +2.0% Inflation.

In the Pessimistic scenario, monthly inflation remains near 0%-1% in the first half, and is firmly negative, though less than 2008 in the second half. By mid-year, YoY DEflation will be somewhere in the (-3%) - (-4.5%) range. The second-half reading will be firmly deflationary, but probably still not as bad a 2008's. 2009 will end with (-1.0%) - (-3.0%) DEflation.

So, choosing between the two scenarios, what do I think? At every fork in the road over the last couple of years, the downturn has spread to the next "compartment", just like the sinking Titanic. Unfortunately, I suspect that will continue at least during the first half of this year, so I am leaning towards the Pessimistic scenario. At the moment, I continue to hope that ultimately the stimuli, aided and abetted by new hopeful leadership in Washington, will mean that the more Optimistic numbers will be those we will see in the second half, giving us an annual rate of price change in 2009 of almost exactly 0.0%.

Comments

The Stimulus

One of us (I guess the one who points it out is the writer ;)) needs to write up the possibility for effectiveness of current stimulus legislation for only with that could I see a potential pull out of the wage-deflation nose dive you're trying to estimate.

BruceMF has already gotten the transportation/infrastructure aspects and it looks pathetic!.