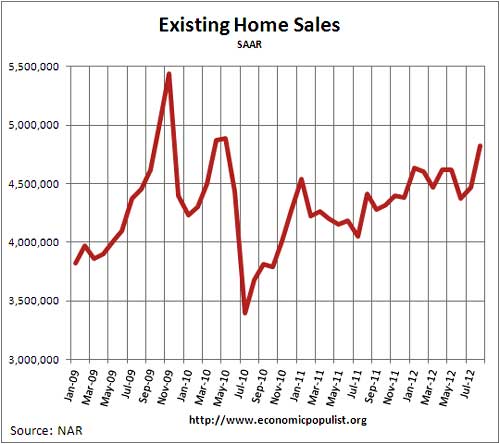

The NAR released their August 2012 Existing Home Sales. Existing home sales increased 7.8% from last month and inventories are down to a now tight 6.1 months of supply. Existing homes sales have increased 9.3% from a year ago. Volume was 4.82 million, annualized against July's 4.47 million annualized existing home sales. Existing home sales haven't been this strong since May 2010.

While inventory increased 2.9% or 2.47 million existing homes for sale, due to increased sales the monthly supply dropped 4.7% to just 6.1 months of supply. This is a 25.6% decrease from a year ago.

The national median existing home sales price, all types, is up, now at $187,400, a 9.5% increase from a year ago. It's clear foreclosures, REOs are being held off of the market. Below is the August breakdown by types of sales:

Distressed homes - foreclosures and short sales sold at deep discounts - accounted for 22 percent of August sales (12 percent were foreclosures and 10 percent were short sales), down from 24 percent in July and 31 percent in August 2011. Foreclosures sold for an average discount of 19 percent below market value in August, while short sales were discounted 13 percent.

According to NAR 32% of existing homes were on the market less than a month.

The median time on market was 70 days in August, consistent with 69 days in July but down 23.9 percent from 92 days in August 2011. Thirty-two percent of homes sold in August were on the market for less than a month, while 19 percent were on the market for six months or longer.

Yet all cash sales, implying investors are still snatching up homes, are still high.

First-time buyers accounted for 31 percent of purchasers in August, down from 34 percent in July; they were 32 percent in August 2011.

All-cash sales were unchanged at 27 percent of transactions in August; they were 29 percent in August 2011. Investors, who account for most cash sales, purchased 18 percent of homes in August, up from 16 percent in July; they were 22 percent in August 2011.

There were less foreclosures sold, which in part explains the increase in median price. The NAR claims one-third of homes sold were on the market less than a month.

Distressed homes – foreclosures and short sales sold at deep discounts – accounted for 24 percent of July sales (12 percent were foreclosures and 12 percent were short sales), down from 25 percent in June and 29 percent in July 2011.

Foreclosures sold for an average discount of 17 percent below market value in July, while short sales were discounted 15 percent.

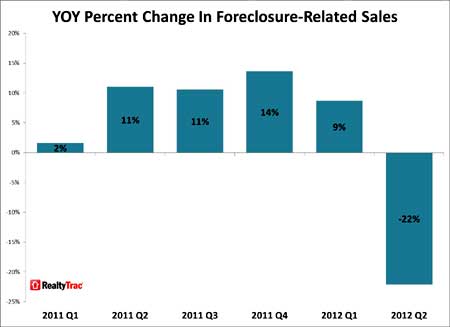

Realtytrac reports in Q2 2012 foreclosure supply on the market decreased.

Sales of homes that were in some stage of foreclosure or bank-owned (REO) accounted for 23 percent of all U.S. residential sales during the second quarter — up from 22 percent of all sales in the first quarter and up from 19 percent of all sales in the second quarter of 2011.

Although foreclosure-related sales as a percentage of total sales increased, the raw number of foreclosure-related sales in the second quarter (224,429) decreased 12 percent from the previous quarter and was down 22 percent from the second quarter of 2011 — the first annual decrease in foreclosure-related sales after five quarters of increases.

Yet contingent short sales, not part of existing home sales active listings, were up.

As a supplement to the report, RealtyTrac analyzed nationwide short sale transactions occurring on properties not yet in the foreclosure process and found that those increased 18 percent on a year-over-year basis for the period of January through May. These non-foreclosure short sales accounted for 14 percent of all sales during this time period, a bigger percentage than either pre-foreclosure sales or bank-owned sales.

Foreclosures in August were little changed, according to Realtytrac:

Foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 193,508 U.S. properties in August, an increase of 1 percent from July but down 15 percent from August 2011. The report also shows one in every 681 U.S. housing units with a foreclosure filing during the month.

According to Corelogic, for the 2nd quarter, homes with a mortgage in negative equity were 23.7%.

We couldn't find an update to the estimates of how many foreclosed properties, REOs were being held off the market. Last estimate given around July put this percentage at 85-90%. That said, some are pointing to localized shadow inventory being the problem and overall bank owned properties are down.

Last month's existing home sales overview is here, unrevised.

Recent comments