The Q2 2011 GDP report showed draconian revisions. Q1 2011 GDP was revised downward from 1.9% to 0.4%.

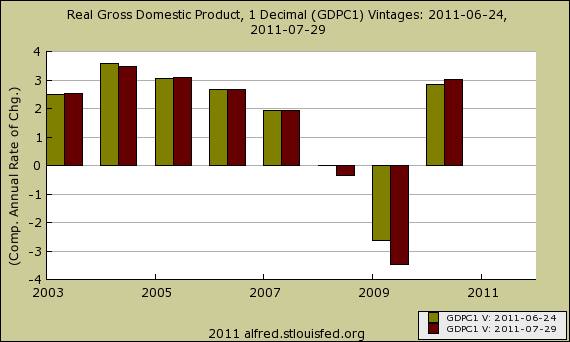

On an annual basis, 2008 GDP was revised from 0% to -0.3%. 2009 shows just how bad the economy became with a new annual -3.5% GDP, revised from -2.6%. 2010 was revised upward by just 0.1% to 3.0% for the year. Below are annual GDP revisions. This graph was generated from ALFRED, which allows you to compare historical economic data. The dark red bars are the revised numbers, compared against the previous GDP, in green.

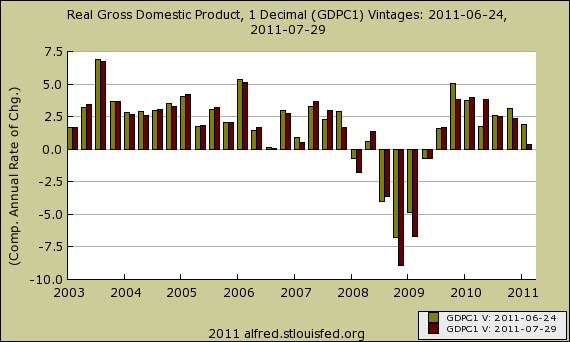

The worse revisions are in Q4 2008 and Q1 2009. Instead of a -6.8% quarterly annualized change for Q4 2008, it was –8.9%. Q1 2009 was revised to –6.7%, from -4.9%. Below are the quarterly GDP revisions. The BEA reports quarterly GDP as annualized.

For the period of contraction from the fourth quarter of 2007 to the second quarter of 2009, real GDP decreased at an average annual rate of 3.5 percent; in the previously published estimates, it had decreased 2.8 percent.

For the period of expansion from the second quarter of 2009 to the first quarter of 2011, real GDP increased at an average annual rate of 2.6 percent; in the previously published estimates, it had increased 2.8 percent.

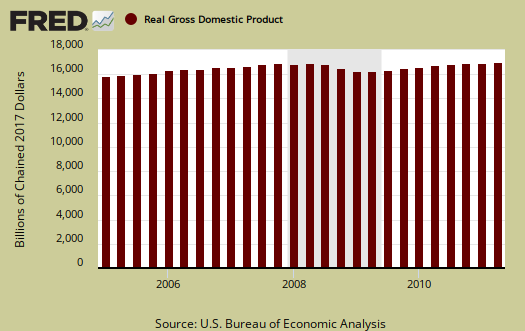

Revisions normally go back 3 years and are done in July, but there were additional revisions that went back all the way to 2003. The summary of where these revisions came from is here. Bottom line, real GDP, or in chained 2005 dollars, is less than before the recession. In other words, our economy has shrunk and not recovered.

It's quite the blood bath for current dollar GDP as well. 2010 GDP was 14.53 trillion after revisions. Yet that was a with a -133.9 billion downward revision. 2009 was revised down by -180 billion and 2008 was revised downward with -77.5 billion.

The most quoted definition of recession is two consecutive quarters of negative GDP. As we can see with these new revisions, officially the numbers do not go into the definition of a double dip, but assuredly we cannot say America is growing.

To take this in perspective, below is annual GDP, going back to the Great Depression. This graph includes the GDP revisions. Clearly these are the worse economic times since the Great Depression. Also, see that dramatic decline in 1937? That's when Congress tried to balance the budget and reduce deficit spending.

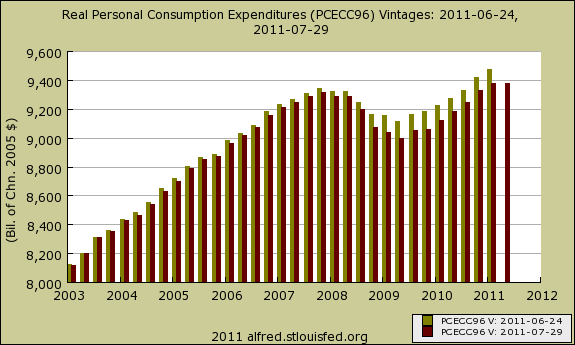

Personal Consumption Expenditures are 70.53% of total GDP. They also were reduced for the 2008-2009 period. A graph of PCE revisions is below. Again the revised numbers are represented by the dark red bars.

Gross private domestic investment was also revised downward, with 2009 being a -25% decline and 2008 revised to -10.2%.

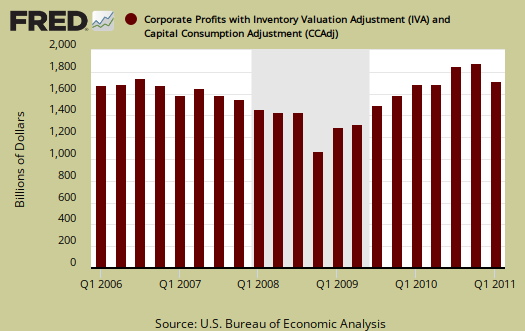

Here is something that should disgust you, considering the high unemployment and terrible economic growth. Corporate profits were revised upward.

Corporate profits from current production -- profits before tax with inventory valuation and capital consumption adjustments -- was revised down $14.4 billion, or 1.1 percent, for 2008; was revised up $104.0 billion, or 8.3 percent, for 2009; and was revised up $175.3 billion, or 10.8 percent, for 2010.

You maybe putting on your tin foil hat in response to such dramatic GDP revisions. Bear in mind a huge amount of input data goes into these national accounts. Also, there is usually missing data, so revisions going back three years is actually common.

More, the data is now starting to better reflect most Americans real economic experiences.

We simply can't affort the current power elite

They're to greedy. These are excellent charts. How about that GDP in 2008, shocking. Corporate profits went down. But as the people failed to come out of the recession/depression and the economy contracted, corporate profits rose above their previous high for the decade.

They're too clever by half. They gain short term but those profits will tank if there is a general collapse, a deliberate debt induced arrow in the side, or just stagnation/stagflation. They don't care, the CEOs and hedgers. They're making money now, they have more than they need. They think that they act with impunity.

We're teetering. If we fall, we know who to blame.

Excellent report.

Michael Collins

So How Bad Will Q2-Q4 Be?

What a mess.

I think I could use "What a mess" as a comment on a good 3/4 of what is posted here.

So many messes, so much at stake, yet we see so little being done, except for adding new messes.

What a mess.

Q2-Q4

Well, we've seen nothing to indicate the economy would turn around. We have "anti" policies in place to promote job creation.

I expect at max, GDP to be below 2.0% and possibly hovering around zero.

I think to go strongly (i.e. < -0.5%) negative, we need another event. Now that could happen, from a U.S. default to a major disaster to an implosion in Europe (financial)...

The situation is bleak, for we need some real policy changes from financial, tax incentives to hire Americans to invest, start, move production back to the U.S., we need infrastructure, way cheaper continuing and higher education and a host of other policies.

Instead we have conservative Republican Obama with crazy people waiting to take him down.

Notice this? Agendas that are corporate globalization agendas, will increase wealth redistribution, more poverty, income inequality are being advanced by Obama and many Democrats while the GOP now has an increasing fold of pure bat shit crazies in it.

That's just disastrous.

"tax incentives" or tariff?

"We need some real policy changes from financial, tax incentives to hire Americans to invest, start, move production back to the U.S., we need infrastructure, way cheaper continuing and higher education and a host of other policies." --- Robert Oak

Looking at "tax incentives to hire Americans to invest, start, move production back to the U.S." -- would not a 15% Across-the-Board Tariff (ABT), or some kind of equitably applied VAT if you prefer that term, accomplish much of the same objectives while increasing revenue for such expenses as federal support for education?

The problem with "tax incentives" is that they so often end up as tax loopholes. The end result is a system dependent on politically-inspired preferences that are counter-stabilizing and that, in the long run, inhibit the growth of a free enterprise economy.

across the board tariff, you do not want it and this is why

If you want to put an across the board tariff on China for currency manipulation, that might be a good idea but you don't want an across the board tariff and the reason is oil.

If you force oil prices through the roof, that would cause a deep recession. Oil price shocks literally are correlated to recessions and that would do 'er.

The two major causes of the trade deficit are China and oil. I overview this every month.

But you cannot do tariffs on oil, not with absolutely nothing in place to reduce foreign oil import dependencies, it would crash the economy for certain.

China, on the other hand, is where most of our manufacturing jobs have gone and they are committing all sorts of brazen trade violations, currency manipulation being just one.

There have been bills in Congress and it's amazing, they have almost all in Congress as co-sponsors yet magically are never brought to the floor for a vote.

Principle and expediency

Thank you for the only valid argument I have ever seen for your more targeted VAT approach rather than ABT at this time! In principle, I continue to advocate for ABT, but expediency sometimes overrides principle.

To give an example of how expediency may override principle, in principle I am opposed to government employee unions, but I must support them today on grounds of expediency.

So, okay, I am convinced that we need to send our Dutch Boy to stop this spouting hole labeled 'China', plugging it heroically with something larger than just his thumb ... but in the long run, we need a new dyke.

Argument for ABT

Promoting a 15% ABT is still a good rallying shout-out, because the people surely are capable of great support around the so-long-now forbidden word 'tariff'. Our corporate-govenment media, along with most of academia, have been suppressing even the thought of 'tariffs' for about 15 years now. Therefore, being as reactionary as the next guy, I use the word wherever and as often as I can.

The reason for an across-the-board tariff is to reconstruct a sane protectionist policy while avoiding preference systems, which are all essentially examples of political corruption. In other words, the reason for ABT is to reverse the situation where U.S. producers are effectively forced to subsidize foreign competition.

I am unconvinced that there are not ways to moderate the consequences of oil supply shock within an ABT system. Conversely, I am not sure that oil supply shock can be evaded by avoiding an ABT, nor am I convinced that the ABT approach can be ruled out as the best structural reform even considering, or perhaps especially considering, the problem of oil supply shock.

I don't think that targeting China will accomplish anything. Yes, China is tops on a list, but we should not confuse any one entry in the list with the list as a whole. Suppose, by way of analogy, that we stopped all the outsourcing to India. Would that stop outsourcing? The same corrupt influences that nurtured outsourcing to India would soon be nurturing outsourcing to Africa! So, if we drive Chinese money to move some jobs and the last stop before going on to the U.S. market into, say, Indonesia, would that constitute progress?

At some point, we (U.S.) need to announce that we are protecting ourselves against all comers, and, in the long run, that cannot be done as long as we perpetuate the politically motivated preference system that is the fundamental cause of our problems.

We need to recognize that our problems originated here in the U.S. with our delusional policies and habits of mind. Treating symptoms is often a necessary expediency, but recovery requires systemic treatment of underlying causes of the illness.

However, I do agree with your pragmatism. Everyone has some kind of economic ideology, but I am not so gone that I think that my ideology can be applied mechanically in real life, anymore than any other ideology. My ideology is just my adknowledgement of the springboard and guidelines for my 2¢ worth from time to time.

you are a broken record

Look, I've written many overviews as well as analysis on oil price increases being highly correlated to recessions.

It would be very nice if you paid attention to the economic statistics and adjust accordingly.

Pushing some agenda that doesn't fix the cause/effects/statistics, facts of economics is just as bad as these bat shit crazies going on air trying to claim that the current economic malaise is a result of budget deficits.

This site's motto is no economic fiction and that means you have to check your philosophy at the door and whip out your calculator and adjust.

The last thing you want to do right now is increase oil costs, PERIOD.

Okay, I already conceded the point!

"This site's motto is no economic fiction and that means you have to check your philosophy at the door and whip out your calculator and adjust."

Dude! Whiz!

I already conceded your point! I do nave a critical point of view as valid as anyone's, but I am no longer pushing agenda of imposing tariff on oil imports, as you see when reading my words. You have convinced me, although I suggest that there may be some other way of handling the problem within a framework that includes the dirty little word 'tariff'.

EP has already done the stats for me, showing that China's rake on imports at the border is about 20% and other countries similar. Mexico has a tariff on our goods (unless we allow destruction of U.S. independent truckers), Canada has a VAT. Meanwhile, our rake on imports is between 1% and 2%.

I'm just saying rather than what amounts to a trade war here and a trade war there, prosecuted by our feckless political leaders -- where we concede cases in WTO quasi-judicial fora -- why not erect a seawall, a dyke, against the entire incoming destructive tide?

In my final paragraph, I honor and credit your pragmatism and note that I am NOT pushing my economic philosophy as something to be mechanically applied to economic policy. No ideology should be so applied.

I understand that you do not want anything further reminding EP readers of the ABT option, at least nothing short of a well-researched and documented article, that's fine and I'll get to work on that, but please ... I'm not bat-shit crazy, not yet anyway.

This is why, a tariff in China might pass the WTO

The WTO might allow tariffs on China and that is because China currency manipulates. If they didn't, no.

But the point of any trade remedies is to improve the U.S. economy, create jobs and reduce the trade deficit...

so you cannot start, out of the gate, pushing for a policy that would actually cause the U.S. to enter another recession.

It's tricky and timing but first up is to worry about the cause and effects, not the WTO.

the WTO has a delay in hearing cases anyway. For example, by the time the WTO hears a China case...it doesn't matter. China already wiped out that U.S. sector and captured the market for themselves anyway.

By the time the case makes it to the WTO, those U.S. businesses are already out of business due to China's unfair dumping or tariffs or incentives or whatever they did which forms the WTO case against them.

Look, you don't need to "research" an ABT for obviously I am already aware of the argument and I'm saying it's just plain a bad idea for the obvious reasons.

You don't realize how dependent the U.S. economy is, U.S. manufacturing is, U.S. production is on oil.

What do you think turns on the factories and drives the shipping? Oil.

Generally black and white solutions for colored and dynamic problems is a real bad idea.

See, you're still a broken record, thinking "I just don't understand". Obviously I do and I'm saying it's plain a bad idea and wrong for the reasons I've already stated.

Okay, no more broken record

Your arguments are persuasive.

There is an argument, in WTO terms, for a 15% ABT (on all imports whatever the source) as long as Congress enacts carefully worded legislation like calling it "port-use fees" or whatever ... but you're right, oil is the controlling reality at this time and for the foreseeable future.

So, it's a very bad idea to mess with GATT, regardless of declining popularity of the WTO nationally and globally.

I'm not worried about the WTO paper tiger -- just another inefficient systemically-corrupt bureaucracy. We are all of us accustomed to dealing with inefficient unnecessary bureaucracies and grateful for any exceptions to that rule. Part of life. SNAFU.

more on double dip, Q2-Q4, GDP component % breakdown

One thing that was bad was June's durable goods, here

While the report is for June, new orders affect Q3 in terms of later shipments.

GDP is 71% personal consumption, 12.7% exports, imports subtracts off about 17%, investment is about 12.6% and government about 20%.

These components do vary quarter to quarter but personal consumption is always around 70%.

Durable goods report is manufacturing, so it's being produced, not consumed. That said, a drop in new orders isn't too good for further down the line.

Bottom line, even if GDP goes negative, the problem is corporations now routinely fire people the minute they see any negative anything, even when their profits soar.

I still do not expect anything like Q4 2008, Q1 2009. If it goes into a double dip, I expect it to be mild..

but how long does one have to have a lost decade, an economy not growing enough to create jobs, sustain it's population, before the NBER calls this a depression or something more significant beyond keyword recession.

In other words, this isn't looking too cyclical, as in a couple of quarters, to me.