The National Bureau of Economic Research has declared an end of the Great Recession.

The committee determined that a trough in business activity occurred in the U.S. economy in June 2009. The trough marks the end of the recession that began in December 2007 and the beginning of an expansion. The recession lasted 18 months, which makes it the longest of any recession since World War II. Previously the longest postwar recessions were those of 1973-75 and 1981-82, both of which lasted 16 months.

So, it's all good then and we're back to normal? Not exactly.

In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity. Rather, the committee determined only that the recession ended and a recovery began in that month. A recession is a period of falling economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. The trough marks the end of the declining phase and the start of the rising phase of the business cycle. Economic activity is typically below normal in the early stages of an expansion, and it sometimes remains so well into the expansion.

So, in other words, the NBER are calling the end of the Great Recession, but leave widely open the possibility of a double dip recession.

The committee decided that any future downturn of the economy would be a new recession and not a continuation of the recession that began in December 2007. The basis for this decision was the length and strength of the recovery to date.

This seems odious. The reality is if a recession goes on 3 years, officially it is a depression. Did the NBER decide to double down over a couple of quarters of artificial GDP growth? Not exactly. The problem is the downturn was so severe, pretty much anything pulling out of that nosedive, in terms of economic cycles, looks positive. But as noted, the NBER is making a point to say just because the cycle turned in June 2009, don't not mean all is well and we have a true recovery in all senses of the term.

There is no doubt the trough did occur in June 2009. But does coming out of the Mariana Trench mean one's head is above water now? No.

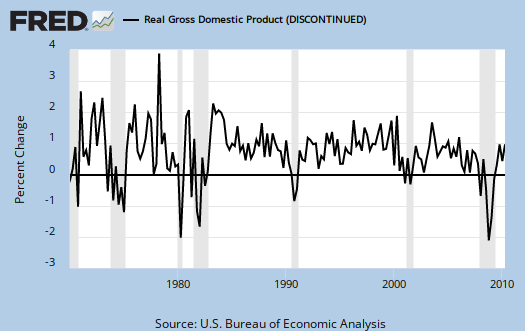

Below is a graph of the change in GDP with the recessions marked in gray from the Saint Louis Federal Reserve. Don't confuse cycle dating with the strength of the U.S. middle class or economic prosperity. They are not quite the same thing.

Recent comments