Hurricane Gustav is currently eying oil producing rigs and the Lousiana Offshore Oil Port (LOOP) as it heads north across Cuba's Pinar del Rio province into the Gulf Mexico.

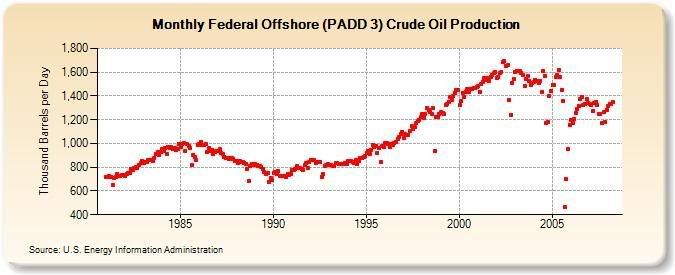

Over the past decade, oil from the Gulf Coast has become an increasing part of domestic production. (link to DOE production figures) Current figures show that oil rigs in the Gulf produced 1.35 mbd (million barrels daily) in April 2008.

South Louisiana is also home to the LOOP. The Loop is vitally important to the US oil supply handling about 1.2 mbd in oil imports and supplying over a third of the nation's refineries, it was left largely unscathed by Katrina in 2005.

Katrina's Impact

Hurricane Katrina was the most devastating event to occur on US soil within the lifetime of most of us here. Katrina left 1,836 confirmed dead (705 are still missing), and caused over $80 billion in economic damage. Ironically, New Orleans and the oil producing regions of South Louisiana dodged the bullet as the brunt of the storm bore east over coastal Mississippi.

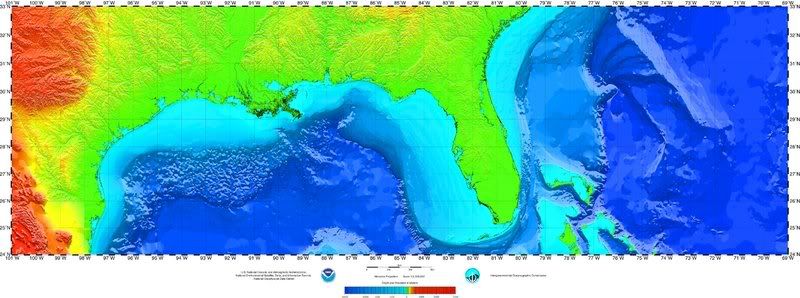

A quick look at the location of offshore oil rigs shows that while Katrina rammed home through a large group of rigs before making it's first landfall in Plaquemines and later in Mississipi, it spared a larger grouping of rigs further west.

The rightward turn also spared the LOOP, and after a short period oil imports through the port resumed. We are unlikely to be so lucky this time around for reasons I'll get to later.

What makes this all the more concerning is that we have the record of what Katrina did to the Gulf Oil industry in hindsight. production was halved from 0.217 mbd in Augst to 0.135 mbd the following month. All told, close to a million barrels a day disappeared from the market. To put this in context, that's a little under half what we imported from the Persian Gulf in June of this year.

The effect at the pump was even more dramatic. Retail gas prices jumped from an average of $2.23/gallon at the start of August to $3.04 a gallon shorty after the storm. That's a 32% hike in prices. A similar price hike today would take gas from an average of $3.66/gallon to around $4.83/gallon. And this price hike was tempered by the loan of European strategic oil reserves for US consumption. Spain, Portugal, and the UK all provided oil loans. All told these loans equaled 4.9 million barrels. In combination with 6 million barrels in loans from the US strategic oil reserve, this helped tame price increases. These loans have all been repayed, and at this time the reserve holds 727 million barrels.

While the impact of Katrina on the US oil supply was catastrophic, it did not cause significant damage to the LOOP. If Gustav follows the projected track, there is a strong possibility that it will damage the LOOP, limiting US imports for a significant period.

The LOOP

Oil tankers are large ships. While this sort of sounds like stating the obvious, it's important to remember that many modern oil tankers need at least 85 feet of water in order to not ground themselves. All of the offshore terminals and the LOOP are in at least 115 feet of water. The LOOP runs from onshore at Port Fouchon Louisiana, 18 miles into the Gulf of Mexico, where the offshore loading terminal sets.

As I noted earlier, the LOOP handles about 1.2 mbd in oil imports. Without the LOOP, those imports have to be rerouted. And with little excess refining capacity elsewhere in the country, the question becomes how to get oil from large tankers onto land. The LOOP serves a vital function and benefits from a distinct geographic location. No where else in the Gulf of Mexico does deep water come so close to land.

The loss of the LOOP for an extended period means that 13% of America's oil import and about a third of our refining capacity will go poof overnight. That's bound to have some impact on gas prices. And Gustav looks like it will have a much more devastating impact on the LOOP than Katrina did.

Gustav's Path

Current tracking models show show Gustav scoring a direct hit on Port Fouchon, bringing Class 4 winds in excess of 130 mph and waves up to 20 feet to bear on the offshore terminal.

Half of the computer models show the storm making a left hook after coming onshore heading towards western Louisiana and the Houston metro area. Two even show the storm popping back out over the Gulf of Mexico very close to Houston. This would be disastrous to the oil industry. Even a weak storm could have a significant impact on refiners along the Houston ship channel, and could cause further damage offshore.

The Oil Drum has a map up showing the location of rigs, refineries, and the LOOP and there likely status after the storm.

Blue means the rigs must be evacuated. Yellow that they are going to need to be checked before restarting. Red that they will require damage to be repaired before restarting production. Onshore it looks like 8 refineries are going to be knocked offline in by the storm. DOE figures put the refining capacity of these facilities at around 1.62 mbd. To put this in context, this is about 9% of total US refining capacity.

A left hook that took the storm back out into the Gulf would likely double that number, particularly if there was extensive damage in the Houston area. Current refinery statistics show that around 368,000 barrels a day of refining capacity is currently idled. This about 1.25 mbd a day of refining capacity is going to disappear, and if the storm takes that left hook anywhere between an eighth and a third of the nation's refining capacity could be taken offline for months. This would have the greatest impact in the PADD 3 area (Texas, Louisiana, Mississippi, Alabama, Arkansas, New Mexico), but the price increases would likely be national.

I recommend visiting The Oil Drum for information about the impact on the oil industry as this storm plays out.

Comments

Mac Jones

Not to mention the price increases driven by panic before the storm. :(

local prices

Can one buy oil futures 24/7 or is the US market only open during regular trading hours?

East Asian

markets are going to be open when the storm hits, and London will be open shortly after that.

just what we need

Wow, thanks middle. This is a very good analysis on the impact, which clearly the United States does not need right now. It will make landfall just in time for Tuesday to be a massive spike up (for they will be able to est. the damage by then) for Tues. market open. Expect a nightmare.

Didn't Rita go through those fields to the left? But that was a 2 not a 3.

And the unneeded burden

of increased gas prices is unlikely to do much as the second wave of mortgage resets hits this fall.

I think that Rita did go through the fields to the left, but I'm honestly much more worried about the LOOP. If it gets hit, that's going to knock a huge amount of oil off the market.

Remember that an effect like what we had with Katrina takes gas up to about $5 gallon.

Even if it's the same scale of damage, the price increase is likely to be higher, because the past three years have driven a lot of the prices elasticity out of the oil market.

Simply put, in 2005 there where a lot of people who rethought unneccesary trips to the big box in bfe when prices rose.

The demand that's left is things like people driving to work, things that they are going to do no matter what the price of gas is. Which means that the same shock has doesn't create demand destruction of the same order, so you ahve people bidding up the price of gas. $6/gallon gas seems at least plausible in this context.

And if there's permanent damage and it takes years not months like it took after Katrina to get back to the way things were before the storm, then we are in for a ride. I'm lucky, I can walk everyplace that I need to. (Work, groceries, etc.) I only need my car to get home from school, and that's less than 100 miles.

I deliberately choose live someplace I can walk because of the possibility of something like this happening.

High energy prices are here to stay

I've been saying for years that the suburbs and exurbs are doomed (not to mention being the biggest waste of capital and resources in American history). And that isn't just because I personally hate the suburbs.

It's because the suburbs and exurbs only work if energy is cheap.

A warming planet seems to be a very bad thing for Gulf oil production (as well as low-lying cities). I'm guessing that we are going to see this scenario played out every few years from now on.

on the burbs

I think I saw the same documentary you did on the death of the suburbs. They were built completely on an oil/highway/car economy, no doubt...but that said, in today's telecommunications world enabling distributed work centers to not force people to live in cities is possible.

Obviously, alternative energies and widespread deployment and adoption are critical but I don't see the answer to aggregating large populations in cities. This is due to quality of life issues to the distribution of energy and the local obtainment of energy. In other words, let's say every principality was tapping into their local alternative energy. In some areas that might be wind, others wave power, yet another might be biomass, regionally dependent. If alternative energies were tuned for what is practical in that locality, along with telecommunications enabling remote work.....the desired lifestyle of the burbs, which was to have some damn grass, some quiet and smaller communities, it is possible.

On a gas economy it is really stupid but so is demanding people go into some artificial cube, require them to be there 8-5, for many work types.

All Markets Closed Monday::Equit,:Commodity, Opt, Bond- U.S./CA

Unless you have an offshore broker, you cannot do commodity plays Monday. Tuesday, you can expect equities to go south,

except energy stocks. Commodities are an easy one.

Because oil prices will move up again, and stay higher for a while, XOM etc will move up. Options are the cheapest play.

That garbage aside, all of us will hurt this winter because of energy prices, just as with Katrina, if these models are correct.

Burton Leed

Pumping the SPR and Refining Capacity.

Leadership, if it existed, would at least threaten to pump the SPR. Last time it was a total fiasco because the brokers had no experience. But the SPR is a worthless system because the eye of the storm is going after refining capacity.

Government, in its wisdom, put the Reserve, and refining right where all the worst hurricanes hit - Lousiana Salt Domes and Louisiana/Texas Refineries.

Why not one refinery for the SPR? Or do we all know the answers to that one. Three years since Katrina, right?

Burton Leed

refineries

I'll give the real Republicans (versus the corporate agenda ones) some due on this....this is the best map I could find in the US of refineries. It sure seems that if one wants to have a domestic oil production supply they should be redistributing the supply chain so it's less vulnerable to natural disasters and regional issues (assuming they aren't causing man made environmental disasters!)

Good post

It looks like we are going to get another fall spike in oil prices, just like in 2005. The difference is that the economy is in much worse shape to handle it this time around.

oil just started trading

Immediate $3 dollar spike upon the open. Yea, Rah! Free markets!