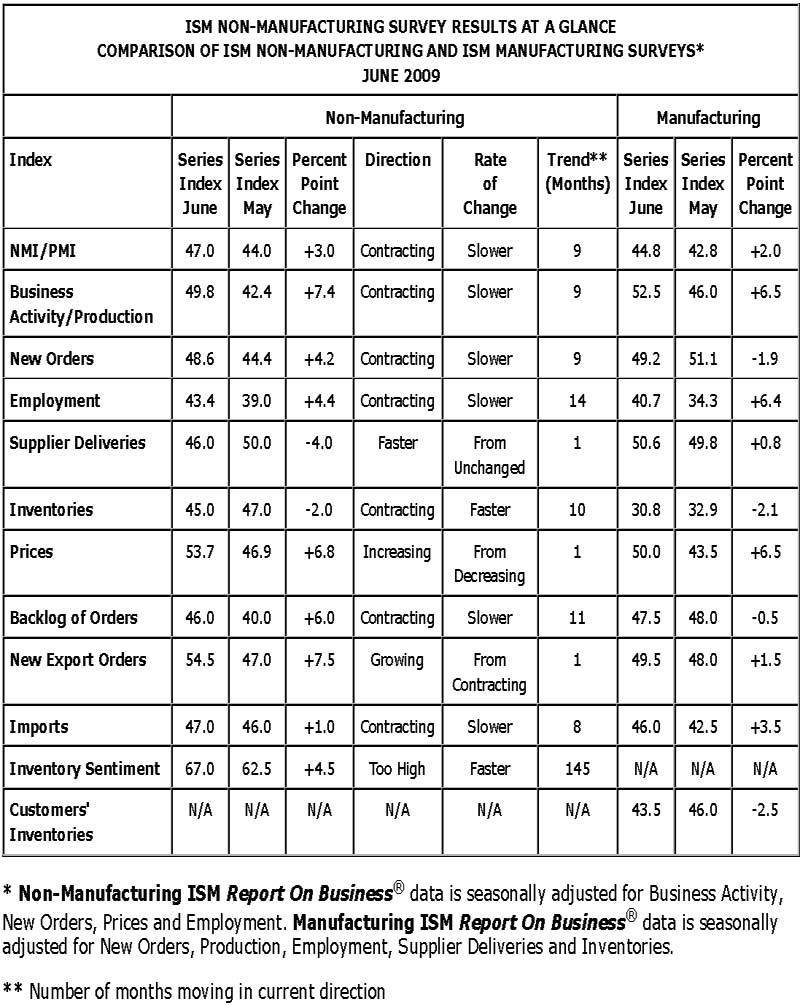

Increasingly we are seeing major financial reporting being in the spin zone. Here is what Bloomberg headlined on the ISM non-manufacturing index June 2009 report:

U.S. ISM Service Industries Index Increased to 47

U.S. service industries from retailers to homebuilders contracted last month at the slowest pace in nine months, as measures of new orders and employment improved.

The reality is the economy contracted for the 9th straight month. Bloomberg even goes so far as to claim this is stabilization:

The Institute for Supply Management’s index of non- manufacturing businesses, which make up almost 90 percent of the economy, rose to 47 -- higher than forecast -- from 44 in May, according to data from the Tempe, Arizona-based group.

Readings less than 50 signal contraction. The index’s third straight monthly improvement reflects signs of stabilization in housing and consumer spending. That combined with leaner inventories means companies may start expanding output again in coming months. Still, mounting job losses and stagnant wages are likely to restrain some purchases, limiting the impact of any recovery.

Uh, inventories are basically unchanged and prices are increasing. Not every index below 50 implies contraction, the indexes and meanings are unique to each category. For example, supply deliveries lower index means faster deliveries.

The only commodity in short supply is hand sanitizer.

Click Table to Enlarge and Zoom

For a demand-led contraction

Wouldn't this be as expected? Official indices below 50 & lots of inventory in the warehouses?

Though the rising prices kind of throws me for a loop- who exactly can afford these rising prices?

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

yes

The real issue is the message spin. Contraction is simply not "stabilize". Contraction is contraction period. Stabilize is no change.

Because the contraction is a slope instead of a cliff, they try to paint these indices as a recovery...well, it is not, the economy is still contracting by the ISM numbers.

The price increase I found odd considering there is a commodities glut (in so many words). I don't know the details of where that is coming from, maybe on an international wholesale scale and having to do with exchange rates as well. (or China buying everything in sight?)

CPI is down last I saw.

Business activity and new orders

at 49.8 and 49.6 are within rounding distance of 50. That's close enough to constitute stabilization to me.

The Long Hangover

Reuters:Finally, charting the recovery's course

Less consumer spending, more unemployment, more foreclosures, more contraction

I'm not fooled by the green shoots just yet.

It is - after all - a confidence game.

I agree with the Reuters report

The Reuters report does NOT see more contraction. It sees EXPANSION, with subdued (not "less") consumer spending, and continued job losses through the end of the year. I agree.

NDD, Please educate me

You have made it clear that you see the economy expanding.

How so? What is the driving force?

Private capital? Pensions? 401's? Government spending? Sovereign credit? Manufacturing?

Assets are declining.

Wages are declining.

Purchasing power is declining.

U.S. net worth has decreased to 2004 levels with a 26% increase in public debt in the same time frame.

Bernanke is printing money like there's no tomorrow while swallowing as many TBills as possible to avoid a bond dislocation.

Pensions are imploding.

Personal bankruptcies are at record rates.

Foreclosures continue to rise and now include CRE.

We have demand destruction. Volatility in commodities.

Those pesky derivatives have not been seriously addressed.

We have negative inflation a.k.a deflation.

So, please help me understand.

All I see is a massive transfer of wealth aided by our government.

A confidence game in which a few players that have not lost it all are pulling up a seat at the Black Jack table betting their remaining funds on a few select graphs and charts pointing to a better tomorrow.

let me come to NDD's defense here

NDD is analyzing the EIs and all of the indicators are moving in the direction where the region of convergence is "recovery".

I think the issue here is (and I've already commented) that just because some multinational corporation "recovers" that doesn't mean the U.S. middle class recovers.

It's just like the tech wipe out of the dot con bust. That sector "recovered" but...oopsy, they also offshore outsourced the jobs, just ignored the entire concept of age discrimination, thrashed their employees and demanded more imported workers.

Also, "profits" and even GDP (I'm going to write this stuff up in a post) in the day of globalization, doesn't mean what it used to....one can have a "recovery" yet the reality on the ground for most of America is still caca.

But, NDD is operating off of Macro Economics, indicators, predictors and other analysis....and it's good solid stuff.

So, I think the real argument here (between yellow weeds, green shoots) is what I'm drilling into lately.

Notice that I agree with both midtowng and NDD even though on the surface it appears they are coming up with opposite conclusions in analysis?

Yes, that's it

Unfortunately, it is perfectly possible for the economy as a whole to grow without meaningful participation by the middle/working classes. That's what we had from 2002-2008.

To answer yellow dog's question, it looks like manufacturing is getting ready to expand again. That's what both the ISM indices suggest (and it's well worth reading some of the comments by responders they cite in their reports). Basically they panicked and cut back too much late last year, and now are beginning to pick up again. Even new home sales are showing some signs of bottoming.

Since G and I are looking at different aspects of the economy, it is perfectly consistent to broadly agree with both of our analyses.

I'm not at all sure the economy grew between 2002-2008

In that I'm not sure that we should consider managers who do no manufacturing inside the United States, to be a part of the GDP.

There's a big hole in the definition of GDP that includes overseas manufacturing- if manufacturing was really expanding again domestically, we'd see an increase in the raw number of people employed, and we're not seeing that.

What aspect are you looking at that shows a true growth in the economy, as opposed to a growth in special interest parasitic salaries?

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Are EIs still worth anything in a global economy?

Robert, I do appreciate what NDD has done in the past, but I think we really need to redefine our economic language in this arena.

NO RECOVERY WITHOUT LOWERING UNEMPLOYMENT should be the new definition.

The real argument here isn't between yellow weeds and green shoots- it's between true economic expansion and nuclear wipe out of the American middle class.

And anybody who thinks we can have both, is just fooling themselves, because *there are no other consumers left in the world*.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

EIs are important, critical

and watch out, NDD has been right repeatedly when others were dead wrong. Completely analytical, so I suggest trying to understand his data and analysis first. but yes I'm working on some things on some EIs w.r.t. globalization and not capturing data accurately.

I agree that they are important

But we might be watching the wrong ones for this situation. *Everybody* preaching recovery in the past 10 years has been wrong when it comes to middle class wages.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

in comparison with?

2008? 2007? 2000? Seriously, before the great financial meltdown this country has already been in decline for sometime. I don't think it recovered from the 2001 recession frankly.

I'll remain agnostic on EIs myself but what I would like to see more of on EP is precisely why we can have diverging realities to the extent we do with EIs versus life on main street.

To me, something is clearly wrong when one can have EIs which show a growth in GDP yet more people fall into poverty, have no retirement, etc. as in something is wrong with the metrics themselves.

I also think overall there is not enough focus on unemployment and this is why all are claiming the economy is recovering. I don't think one can call anything a recovery with a > 10% unemployment rate, regardless of it being a "lagging" indicator. I also think that a "jobless recovery" is quite a myth, i.e. that's not a recovery and something else is going on long term.

I already have one topic I found that I am working on writing about with all of the above.

So, to sum, I do not disagree with you (not by a long shot, except this minor thing on stable vs. contraction with the ISM) or midtowng or Reuters, etc. but I do believe we are not looking enough at the actual metrics themselves.

I mean one cannot call something a recovery while wading through homeless people out their front door.

hmmm

New orders down from, @ 51.1 in May 2009 in manufacturing.

Question is, since they break up manufacturing and non are they claiming manufacturing is only 10% of the US economy?

Manufacturing was close to 50 3 months ago as well. Then the entire NMI was above 50 in J-J-A, 2008.

pdf with graphs of various indexes.

I don't see how you get stabilize from keyword contract. What I see is "cliff of death has stopped for now" but that is ignoring jobs, which is still following the pied piper, then because they separate out manufacturing it looks slightly better than it really is.