U.S. manufacturing expanded in November. The November 2011 ISM Manufacturing Survey increased +1.9 percentage points to 52.7% PMI. Below is the manufacturing composite index, PMI, on an upswing, similar to August 2009.

New Orders increased +4.3 percentage points, the 2nd month in a row for an increase, to +56.7%.

A New Orders Index above 52.1%, over time, is generally consistent with an increase in the Census Bureau's real series on manufacturing orders.

PMI is a composite index on manufacturing. Here's how the ISM defines PMI:

The PMI is a composite index based on the seasonally adjusted diffusion indexes for five of the indicators with equal weights: New Orders, Production, Employment, Supplier Deliveries and Inventories.

Below is the ISM table data, reprinted, for a quick view.

| Manufacturing at a Glance November 2011 | ||||||

|---|---|---|---|---|---|---|

| Index | November | October | % Point Chg. | Direction | Rate | Trend |

| PMI | 52.7 | 50.8 | +1.9 | Growing | Faster | 28 |

| New Orders | 56.7 | 52.4 | +4.3 | Growing | Faster | 2 |

| Production | 56.6 | 50.1 | +6.5 | Growing | Faster | 3 |

| Employment | 51.8 | 53.5 | -1.7 | Growing | Slower | 26 |

| Supplier Deliveries | 49.9 | 51.3 | -1.4 | Faster | From Slowing | 1 |

| Inventories | 48.3 | 46.7 | +1.6 | Contracting | Slower | 2 |

| Customers' Inventories | 50.0 | 43.5 | +6.5 | Unchanged | From Too Low | 1 |

| Prices | 45.0 | 41.0 | +4.0 | Decreasing | Slower | 2 |

| Backlog of Orders | 45.0 | 47.5 | -2.5 | Contracting | Faster | 6 |

| Exports | 52.0 | 50.0 | +2.0 | Growing | From Unchanged | 1 |

| Imports | 49.0 | 49.5 | -0.5 | Contracting | Faster | 2 |

| OVERALL ECONOMY | Growing | Faster | 30 | |||

| Manufacturing Sector | Growing | Faster | 28 | |||

Production, which is the current we're makin' stuff now meter, jumped +6.5 percentage points from last month to 56.6%. Production correlates to the Federal Reserve's industrial production, where the November statistics will be out mid-month.

Backlog of orders decreased -2.5 percentage points to 45.0%, which is still in contraction. Order backlogs are exactly what they sound like, how many new orders have delays in being filled.

Now we come to employment, otherwise known as where are the damn jobs? The manufacturing ISM employment index decreased -1.7 percentage points to 51.8%. The neutral point for hiring vs. firing is 50.1%. The great worker squeeze continues it seems.

Below are the BLS manufacturing non-farm payrolls (jobs) for the past decade on the left, in red (November's numbers are out tomorrow), graphed against the ISM manufacturing employment index on the right, in blue. The BLS number is simply raw manufacturing jobs tally, not taking into account population growth or overall sector shrinkage as well as time lag. One can eyeball a slight correlation in the middle of the decade, yet note the divergence this recovery, starting late 2008.

Inventories increased +1.6 percentage points to 48.3%, but are still in contraction.

An Inventories Index greater than 42.7 percent, over time, is generally consistent with expansion in the Bureau of Economic Analysis' (BEA) figures on overall manufacturing inventories (in chained 2000 dollars).

This is better news, than last months -5.3 inventory percentage point plunge. Changes in private inventories took off -1.55 percentage points from Q3 2.0% GDP.

U.S. manufacturing exports new orders increased +2.0 percentage points to 52.0%, which seems to be bucking the global trend. China's PMI dropped to a 3 year low in November and since China seems to be the globe's favorite place to offshore outsource jobs, this implies a global manufacturing slowdown. The U.K's PMI also dropped like a stone, also for the 2nd month in a row.

Imports decreased -0.5 percentage points to 49.0%, after last month's 5.0 percentage point plunge and is in contraction. Imports are materials manufacturers use to make their products.

Prices increased +4.0 percentage points to 45.0%. This is after last month's prices cliff dive of -15.0 percentage points and are still contracting. Prices are what manufacturers pay to make their products.

Here is the ISM growth and contraction sector ordered list:

Of the 18 manufacturing industries, eight are reporting growth in November, in the following order: Wood Products; Textile Mills; Petroleum & Coal Products; Primary Metals; Food, Beverage & Tobacco Products; Computer & Electronic Products; Apparel, Leather & Allied Products; and Paper Products. The nine industries reporting contraction in November — listed in order — are: Miscellaneous Manufacturing; Nonmetallic Mineral Products; Plastics & Rubber Products; Printing & Related Support Activities; Electrical Equipment, Appliances & Components; Chemical Products; Fabricated Metal Products; Transportation Equipment; and Machinery.

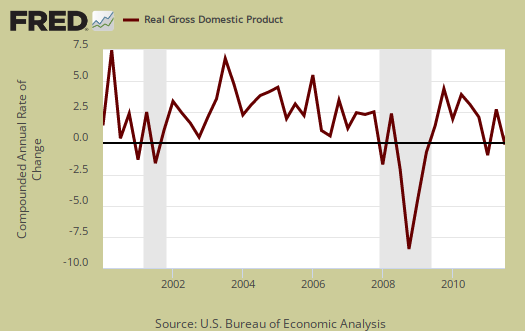

The ISM has a correlation formula to annualized GDP, but they are now noting the past correlation. Annualizing November's data, the ISM get a 3.6% 2011 annual GDP.

The ISM neutral point is 50. Above is growth, below is contraction, although the ISM is this report is noting some variance in the individual indexes. For example, A PMI above 42, over time, also indicates growth.

Last month PMI was 50.8%.

The ISM has much more data, tables and analysis on their website. For more graphs, see St. Louis Federal Reserve Fred database and graphing system.

Images (graphs) not showing on page

I'm voting for this blog, but something's going awry with graphs, here and maybe elsewhere at InstaPopulist articles. I am not seeing what I should be seeing. FireFox is giving me this message: "Waiting for research.stlouisfed.org"

they should be back now

Long story, but while these graphs are all my configurations, set up to match economic reports or show some value I'm interested in, they are actually hosted elsewhere. I have permission to set it up this way but if their server crashes because the graphs are hosted on their site, they will disappear for a minute. They almost never crash, can handle the traffic so this is a weird one. Seriously crashed, which I cannot do much about at the moment, but marking it in the "admin" book here.

Anytime you see "waiting on" on a site that means a server has crashed, many sites now days use multiple servers for content.

It's seriously crashed, I hope they aren't being dDoSed, these guys are economics geeks, not exactly Ben & Co.