On The Economic Populist you might have noticed the middle column. We try to list other sites and blogs who have exceptional insight and writing on what is happening in the U.S. economy.

Sometimes though, one cannot say it better but miss those who did.

Must Read #1

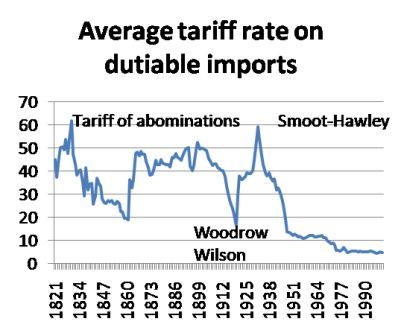

Paul Krugman hits it out the park to prove Reaganomics did not do this nation, especially the middle class, a lot of good. Read Reagan! Reagan! Reagan! I must also borrow Krugman's graph on the history of tariffs in the U.S.

Must Read #2

Financial Armageddon overviews the latest with the Commercial Real Estate collapse in A Tsunami of Red Ink. This is his response to Treasury Secretary Geithner's claim CRE isn't a threat to the economy or would cause a crisis resurgence.

Is he serious? All you have to do is spend about 15 minutes reading through just a few of the reports that were published recently and it quickly becomes apparent that a tsunami of red ink is forming in the sector, ready to come crashing down on the whole of the banking sector -- as well as the economy -- in the immediate period ahead.

Must Read #3

This New York Times article, Inside the Global Gold Frenzy is more just for fun. Think a bubble isn't brewing? Glossy, large pictures of shiny stuff, touching it, making it, selling your jewelry over it....yummy , this metal is precious! If you're a gold bug, the story will make you drool with the Midas touch.

For the real story on Gold, read Zero Hedge, Late Night Gold Breakout.

Must Read #4

U.S. Steelworkers President Leo Gerard writes on Stimulus money being used to create jobs....in China. In Hell no! We won't send our tax dollars to China

Taking candy from a baby: A consortium of Chinese and American companies goes to Washington and announces plans to build a $1.5 billion windmill farm in West Texas using $450 million in U.S. Stimulus funds, which will create 2,330 jobs - 2,000 of them in China.

The baby -- Washington -- doesn't cry or whine or spit in the consortium's face. That's what's really wrong with this story.

So accustomed to being bought and sold, Washington simply begins processing forms so it can hand over your tax dollars to create jobs in a turbine factory in the city of Shenyang, China at a subsidy of $193,133 each.

It's like these bureaucrats live in Wonderland. Or an America where the unemployment rate isn't 10.2 percent. Or where 40,000 American manufacturing facilities didn't disappear in the past decade. Or where banks didn't repossess nearly a quarter million American homes in the past three months.

We've got a message for Washington: Hell no! We're not giving tax dollars to China. What's wrong with these businesses and our government? It is the $787 billion American Recovery and Reinvestment Act of 2009. It's not the Chinese Recovery and Reinvestment Act.

Truly. This administration could care less that using U.S. taxpayer dollars to offshore outsource jobs has John Maynard Keynes rolling in his grave.

Must Read #5

Stress tests. Remember those? Determining the real health of the TARP banks? Considering the unemployment rate is way above the assumptions of the originals, we have financial bloggers writing on the latest lack of health of the TARP banks.

From Naked Capitalism, Quelle Surprise! Banks Overestimating Their Health and George Washington's Blog, More Stress Test Shenanigans.

Must Read #6

John S. Reed, who architected the repeal of Glass-Steagall banking regulation, apologized for it in a Bloomberg interview.

Lawmakers were wrong to repeal the Depression-era Glass- Steagall Act in 1999, Reed said. At the time, he supported overturn of the law, which required the separation of institutions that engaged in traditional customer banking services from those involved in capital markets.

He also said the big banks, which he helped create, should be broken up.

Congress’ overhaul of U.S. financial regulations should include ordering banks to hold more capital, ensuring executives’ compensation is aligned with long-term profitability and banning firms that take deposits from also engaging in equities and fixed-income trading, Reed said.

“I would compartmentalize the industry for the same reason you compartmentalize ships,” Reed said in the interview in his office on Park Avenue in New York. “If you have a leak, the leak doesn’t spread and sink the whole vessel. So generally speaking you’d have consumer banking separate from trading bonds and equity.”

He would know, he's one the main architects of this current systemic monster.

Happy reading*.

*Warning: Not recommended for those suffering from depression or on the verge of a breakdown.

Comments

Economist Brad DeLong Confirms Krugman on Reagan

How Much of it was Reagan's Fault?

I think these two posts are great because this is one hell of a myth, trickle upon economics "saved" the economy from stagflation.

I'd have to review but I believe Volcker saved the economy at that time. (with a whopping painful adjustment).