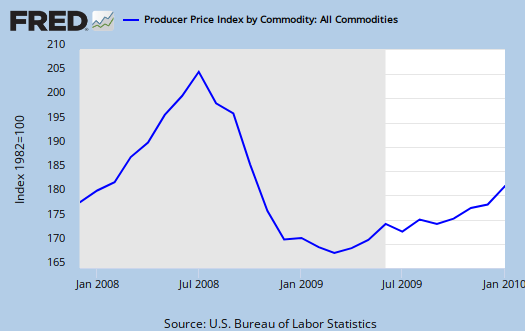

Ah, oil. The Producer Price Index for January 2010 is out and it appears energy inflation is rearing it's ugly head.

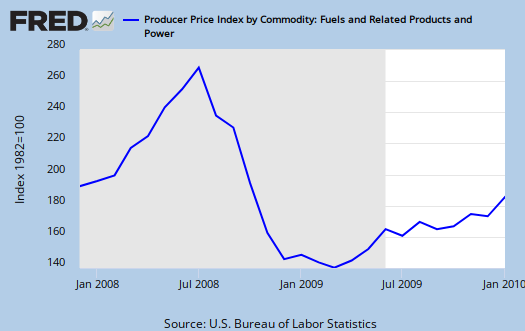

Wholesale Gas went up 11.5% in January and as I type, oil futures are barreling up again like a speculator's wet dream (what was that legislation in Congress again to stock oil and other critical commodities speculation?).

Home heating oil jumped 16.2%, wholesale, in one month.

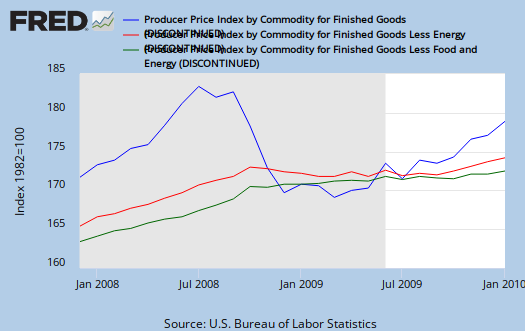

PPI is the selling price change of domestic producers and finished goods was up 1.4%, yet it looks like 72% of this finished goods monthly increase is all due to increasing energy prices!

The Producer Price Index for Finished Goods rose 1.4 percent in January, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. This increase followed a 0.4-percent advance in December and a 1.5-percent rise in November. In January, at the earlier stages of processing, prices received by manufacturers of intermediate goods climbed 1.7 percent, and the crude goods index jumped 9.6 percent. On an unadjusted basis, prices for finished goods moved up 4.6 percent for the 12 months ended January 2010, their third consecutive 12-month increase.

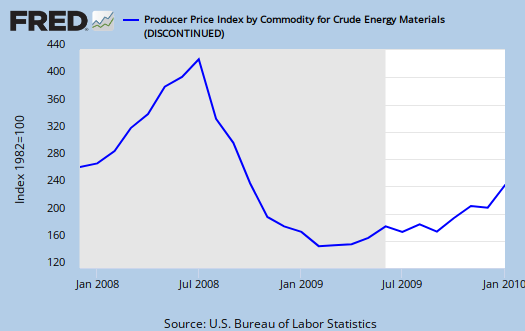

Crude goods, or things that are bought to make other things, such as crude oil, jumped 9.6% for January. Crude energy was up 16.8% and crude gas jumped a whopping 25.5%!

One thing to note from yesterday's Industrial Production and Capacity utilization is gas production decreased. The last thing the U.S. needs is yet another oil commodities, energy commodities bubble strangle hold on the economy like summer 2008.

Subject Meta:

Forum Categories:

| Attachment | Size |

|---|---|

| 238.95 KB |

Recent comments