I will be on the road this morning when the CPI is reported. I will check back in later and update after I have had a chance to look at the numbers and the release, but here are a few things to watch for: -- UPDATED with analysis!

Originally I was going to call our new form of rotten economic performance with heightened inflation, "Stagflation nouveau" but I don't think that quite catches the meaning I want to convey. I think "Scroogeflation" works better. What we have here is an inflation which is gradually, month after month, slowly eating away at middle and working class Americans' standard of living. It is the kind of inflation that Ebenezer Scrooge would welcome. Hence, "Scroogeflation". If you think of something better, let me know.

1. Seasonality. The media generally reports the "seasonally adjusted" number, and they focus on the monthly change. Ignore it. Focus on year-over-year comparisons, in which case the seasonal adjustment doesn't matter.

Just so you know, the inflation rate does have large seasonal variations (depending on things like driving, heating, Christmas sales, etc.). Here are the monthly averages for the past 10 years (rounded to the nearest 1/10th of a percent):

January +.4%

February +.5%

March +.6%

April +.4%

May +.2%

June +.2%

July +.1%

August +.2%

September +.3%

October +.1%

November -.1%

December -.2%

This caused a major brouhaha on the blogs last month because the "seasonal adjustment" wiped out increases in the price of oil.

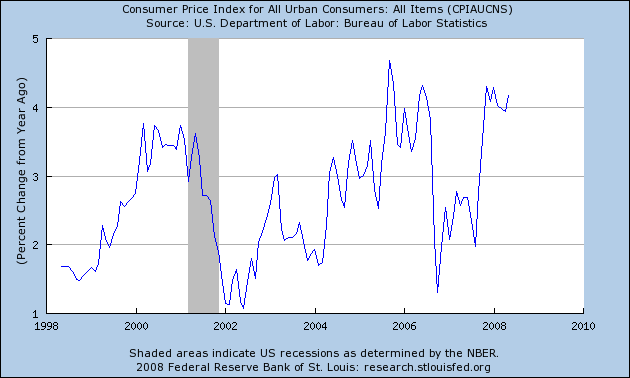

Focus on the yearly inflation rate: is it higher or lower than 4% (for those of you who prefer Shadow Stats, is it higher or lower than last month's SS number?). If the recession is deep enough, it will cause enough destruction of consumer demand to bring down the rate of overall inflation; if inflation surges again - because consumers are still spending - that suggests the recession is not deep (at least not yet).

UPDATE: Nonseasonally adjusted +.8%, seasonally adjusted to +.6% YoY 4.2%. This is a "hot" number confirming the impact of soaring energy prices in particular on consumers. And boy oh boy look at what happened with import prices as reported yesterday based primarily on oil imports:

The only good news here is that it would be very unusual for the overall inflation rate to spike higher from here, based on past oil spikes, at least until we are well into a recovery post-recession. Here's the updated graph of CPI from 2002-today's release:

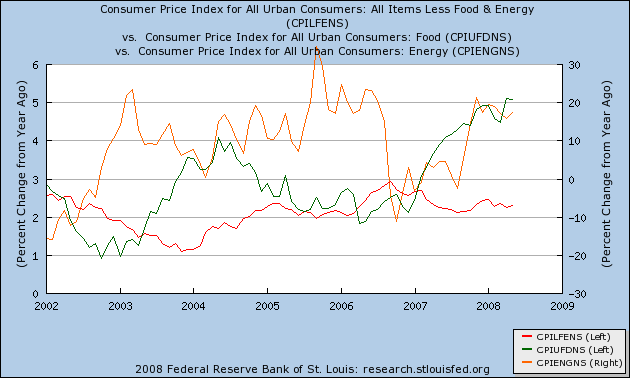

2. Has the inflation rate for food peaked? That normally happens first before energy.

UPDATE: Food inflation is not abating (see graph below). Not good news for the next few months.

3. I have come to believe that in this cycle non-food, non-energy prices (also called "core inflation") move contrary to oil prices -- thus, the bigger the increase in gas prices, the less consumers have to spend on other things, and the more retailers have to hold down the prices on those items. I'll be interested to see if this month's CPI continues to show that pattern.

UPDATE: This pattern is confirmed. Non-food, non-energy inflation (a/k/a "core" inflation) continues to abate. This is not such good news either, though, because it means that the prices of discretionary items are being held in tight check because prices for necessities: food, energy, health care, education, are increasing so rapidly. In the graph below, food inflation (green) and non-food, non-energy a/k/a core inflation (red) % increases are shown on the left scale, and energy inflation (orange) (% increases are shown in the right scale, which is the only way to keep them from taking up the enitre page!:

In summary, what today's inflation report shows is that household budgets continue to be eaten up more and more by spending on necessities, with less left over to spend on discretionary items. Here's a graph from a couple of weeks ago demonstrating the point:

Drip by drip by drip, Americans' standard of living declines ever so slowly every single month. Ebenezer Scrooge would be proud.

Comments

Scrooged

Very good analysis! I like to chat locally to people and that's generally what I hear. People are scrimping on things like meat, frozen foods, soda, pretty much anything they can find and they are running out of places to find at this point, in order to get the extra money to fill up their gas tanks.

With globalization forcing global labor arbitrage, downward pressure on wages and longer periods without any wages plus forced early retirement, I believe the US middle class is on the cliff as a whole.

I think we need to look at just how many have been pushed off the middle class cliff recently.