On Monday of last week, the U.S. Energy Information Administration posted an article on their daily blog (Today in Energy) titled "United States remains largest producer of petroleum and natural gas hydrocarbons".. The article featured a graph of our production of gas and oil vis a vis that of Russia and Saudi Arabia and went on to tell the familiar story about how fracking made it possible for our output of gas and oil to pass that of Russia in 2012, and that, as the headline indicates, we're still on top. As the week progressed, copies of the graphic from that post started showing up on other sites around the web, some to highlight the "we're number one" aspect that it showed, some to disparage the Saudis, who by the looks of that graph, barely come close. So i thought it would be instructive to take a look at that graph, and see what it shows, and more importantly, what it doesn't show...

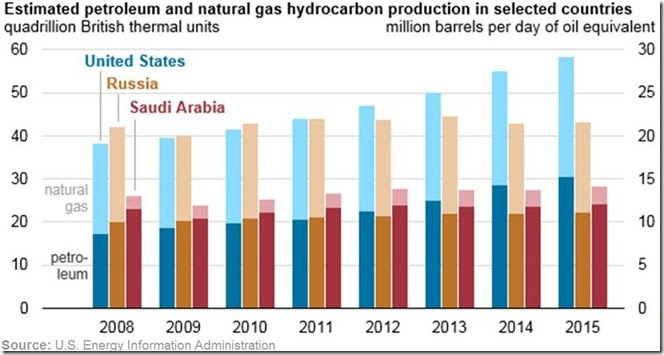

The above bar graph, from the EIA's Monday blog post, shows the annual oil & gas output for the US, Russia, & Saudi Arabia since 2008 in both quadrillion BTUs (scale on left margin) and in millions of barrels of oil equivalent (right margin). For each year, US output is represented by blue colors, Russian output is represented by brown and tan, and Saudi output is represented by brick red and pink, with the darker portion of each bar indicating crude oil output and the lighter shade representing natural gas output. Thus, even though Saudi output of natural gas is dwarfed by that of the US and Russia, we can still see by looking at the darker portions of those bars that they (in dark red) led the world in crude oil output up to 2013, when the graph shows the US (dark blue) overtook them...

Now, if you've been paying attention to the barrage of oil numbers we run through each week, you'll recall that the weekly EIA data on production of crude oil from US wells has shown that early this year our output of crude dropped below the 9 million barrel per day level, after being as high as 9.6 million barrels per day in mid-2015. But the graph above appears to indicate that our oil output topped 15 million barrels per day in 2015. Why the discrepancy? It's because the EIA includes a number of other hydrocarbon liquids in their broadest definition of oil, which thereby inflates our total "oil" output. If we check the weekly petroleum balance sheet (pdf) from the EIA, we see in the second section headed "Petroleum Supply" there are two subheadings, "Crude Oil Supply" and "Other Supply". Under "Other Supply", they include our weekly output of "Natural Gas Plant Liquids", "Renewable Fuels", which includes ethanol, and "Refinery Processing Gain". "Natural Gas Plant Liquids" are those hydrocarbons, primarily ethane, propane, butane, and isobutane, in natural gas that separate from the methane gas as liquids either in gathering or processing; they're valuable as a petrochemical feedstock but we can't refine gasoline from them. "Refinery Processing Gain" is the difference in barrels between the refinery crude input and product output that occurs because the products have a lower specific gravity than the crude oil processed.

So, looking at that weekly petroleum balance sheet (dynamic link, changes weekly) again to get an idea of the volume of this other supply, we see that year to date crude oil output for the first 5 months of 2015 averaged 9,327,000 barrels per day, while "other supply" averaged 5,172,000 barrels per day over the same period. That means crude oil was only averaging about 64% of our petroleum output during that part of 2015 (it's actually much less now), while natural gas liquids accounted for 21% and biofuels accounted for 7% of our so-called ‘petroleum’ output.

Now, from the output figures indicated above for the Russians and the Saudis, i can see that their "petroleum output" was accounted for in the same manner, so there's no deceit in that graph. But when most think about petroleum output, they're thinking of the dark colored viscous liquid as it comes out of the ground, not ethanol or the lighter liquids that condense during natural gas processing. For that kind of crude oil, US output averaged 9.4 million barrels per day in 2015; while the Saudis produced nearly 10.2 million barrels a day of crude at the same time, up from their 9.5 million in 2014, and while Russian output averaged over 10.2 million barrels per day in 2015. In fact, the Russians are now producing 10.49 million barrels of real crude per day as of their latest report, while US output has slipped below 8.8 million barrels per day. Even the EIA itself said that Russia is world's largest producer of crude oil and lease condensate on that same blog less than a year ago, in an analysis which didn't include US natural gas plant liquids or ethanol in the comparison. So when you see an article or hear someone say that the US has become the largest producer of oil, you know that they, or the source they're quoting, is including all those liquids we've just shown are included under 'other supply' by the EIA...

While we're comparing the world's top producers of fossil fuels, there's one more aspect of that comparison that we should bring up. You already know that the Saudis export most of what they produce. According to OPEC data, the Saudis export 7,153,000 barrels per days of crude oil and 2,202,000 barrels per day of refined products; that suggests they're exporting more than 90% of what they produce. The Russians are major exporters too; in 2014, Russia exported 4.7 million barrels per day of crude oil, almost 50% of their output, with 72% of that going to Europe and most of the rest to Asia. And just this week we learned that they even topped the Saudis as the top supplier to China, as Russian oil exports to China jumped 52.4% year over year to a record high in April. At the same time, Russian exports of natural gas are making their way to almost every country in Europe through a number of pipelines. According to the EIA, Russia exported 7.1 trillion cubic feet of gas in 2014, about one-third of their output, with Germany, Turkey, Italy, and Belarus accounting for more than half of that. In 2015, the state gas company Gazprom supplied 158.56 billion cubic meters of gas to European countries, with approximately 82% of the company’s exports going to western Europe. With the addition of the new Nord Stream-2 gas pipeline from Russia to Germany, Russian exports of gas have increased by 44% to Germany, by 42% to Italy, and by 73% to France since the beginning of this year....

So how about the US, who according to the EIA now produces more oil and gas than either Russia or the Saudis. Well, since we cover US oil imports every week, regular readers don’t have to be told that the US is still importing almost as much oil as it ever has. In February, the last full month we have confirmed data for, we imported 229,402,000 barrels of oil, the most in any February in 4 years, and only 18% below the record February 2006 imports of 279,530,000 barrels. But to be fair, we're also exporting refined products at the same time, so we should subtract those exports to find out what our net imports are. Conveniently, the EIA's weekly petroleum balance sheet (pdf) gives us that net figure, so we dont have to dig out each of the contributing data sets. On line 33 of that balance sheet, they give us a total for "Net Imports of Crude and Petroleum Products", which was at 5,946,000 barrels per day for the week ending May 20th.. For 2015 year to date, our net imports of oil & oil products were averaging 5,215,000 barrels per day. So despite the fact that our 2015 "oil production" of more than 15 million barrels a day was so much more than major exporters Russia and Saudi Arabia, we still found it necessary to import more than 5 million more barrels a day to meet our gluttonous needs.

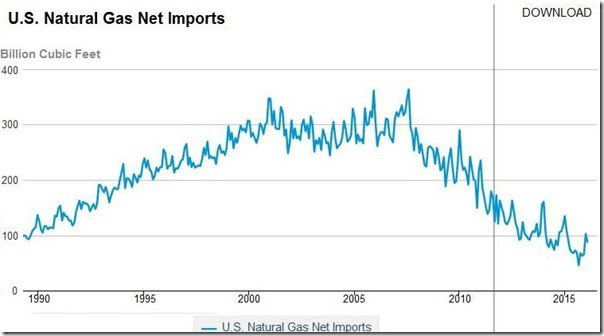

Well, how about natural gas? Surely, with the glut of gas we've seen in this part of the country, where prices for stranded natural gas fell to pennies per mmBTU this past winter, we must have such a surplus of gas that we wouldn't be importing that, too, right? Well, no. Even though you'll often run into those who'll say we're a gas exporter, we are also still a net importer of natural gas, despite being the top producer of gas by far globally, as the graph above indicates. While earlier this year the first LNG export tanker set sail for Europe, up until then the only LNG tankers we'd see were those that were unloading here, from LNG exporters such as Norway, Trinidad, and Yemen. The Natural Gas Imports and Exports Fourth Quarter Report for 2015 from the Dept of Energy, which incorporates annual figures for the year, indicates that our imports of natural gas totaled 2788.3 billion cubic feet in 2015, with 96.7% of that coming from Canada, while our exports of natural gas totaled 1771.9 billion cubic feet BCF, with nearly 60% of that going to Mexico, while almost 40% was exported back to Canada. For those interested in the details, that 163 page pdf actually shows the volume of our gas imports and exports by point of entry and point of exit, even including by truck. The point is that our imports of natural gas still exceed our exports, which can be seen in the EIA graph of our net imports below.

The above graph comes from the EIA's data series on our monthly net natural gas imports; in other words, our imports minus our exports, since 1990. Wwhile we can see that our net imports of natural gas are down considerably from the 300 billion cubic feet per month level we saw during the prefracking era in the early part of the last decade, we're still importing more than 100 billion cubic feet per month of natural gas that we export during the winter months. Despite the glut of natural gas that developed this year as a result of the warm winter, our net imports were still at the 103 billion cubic feet per month level in January and at 87 billion cubic feet level in February, the last month we have confirmed data for. Although the graph we posted to open this section gives our gas production in barrels of oil equivalents, the EIA gives our total production for 2015 at 27,096 billion cubic feet. The annual version of the above chart indicates our net imports for the year were 935 billion cubic feet, meaning we are still importing nearly 4% of the natural gas we use.

The Latest Oil Stats from the EIA

This week's oil data for the week ending May 20th indicated a rather large drop in our imports of crude oil, however, as it now includes a full week without imports from Alberta, where pipelines still remain shut off after the Fort McMurray wildfire roared through the oil sands camps. And although refining was off a bit from last week, the large 480,000 barrel per day fudge factor of last week was unnecessary, because the data showed the largest withdrawal of crude from storage in 7 weeks. Wednesday's reports from the Energy Information Administration showed that our imports of crude oil fell by 362,000 barrels per day, from an average of 7,677,000 barrels per day during the week ending May 13th to an average of 7,315,000 barrels per day during the week ending May 20th. However, that was still 9.2% more than the 6,696,000 barrels of oil per day we imported during the week ending May 22nd a year ago, and the EIA's weekly Petroleum Status Report (62 pp pdf) reports that the 4 week moving average of our oil imports remains at the 7.6 million barrel per day level, which was 10.9% more than our oil import rate of the same four-week period last year.

At the same time, this week's data showed that production of crude oil from US wells fell by 24,000 barrels per day, from an average of 8,791,000 barrels per day during the week ending May 13th to an average of 8,767,000 barrels per day during the week ending May 20th. That was 8.4% below the 9,566,000 barrels per day that we were producing during the third week of May last year, and 8.8% below the 9,610,000 barrel per day peak of our oil production that we saw during the week ending June 10th of last year. Our oil production has now been down 17 out of the last 18 weeks and has now dropped by 452,000 barrels per day since the first of the year.

As we mentioned earlier, refinery processing of crude oil also slipped somewhat this week, at a time of year refineries are usually ramping up, as US refineries used 16,279,000 barrels of oil per day during the week ending May 20th, 139,000 barrels per day less than the average of 16,371,000 barrels of oil per day barrels they processed during the week ending May 13th. The US refinery utilization rate fell to 89.7% of operable capacity last week, down from a 90.5% capacity utilization rate during the week ending May 13th, That's way below the 93.6% capacity utilization rate of the week ending May 22nd last year, when US refineries were using an average of 16,450,000 barrels of crude each day...

With less oil being refined, our refinery production of gasoline fell by 131,000 barrels per day, averaging 9,866,000 barrels per day during the week ending May 20th, down from the average 9,997,000 barrels of gasoline per day they produced during the week ending May 13th. That was 2.9% less than the 10,164,000 barrels of gasoline per day we were producing during the same week last year. At the same time, our refinery output of distillate fuels (diesel fuel and heat oil) also decreased, falling by 109,000 barrels per day to 4,661,000 barrels per day during week ending May 20th. That was 4.7% lower than our distillates production of 4,891,000 barrels per day during the same week of 2015...

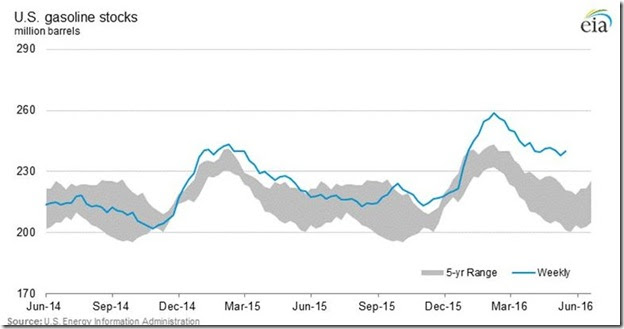

However, even with the drop in gasoline production, our gasoline inventories rose by 2,496,000 barrels to 240,111,000 barrels on May 20th, up from the 238,068,000 barrels of gasoline we had stored on May 13th. That was the largest increase in gasoline inventories since the 2nd week of February, and it came at a time of year when gasoline inventories are usually in decline. Factors contributing to that buildup of gasoline stocks included a 242,000 barrel per day increase in our imports of gasoline, which rose to 933,000 barrels per day, and a 239,000 barrel per day drop to 9,516,000 barrels per day in the amount of gasoline supplied to US markets, which last week was flirting with an all time high. So now our gasoline supplies are now 8.8% higher than the 220,627,000 barrels of gasoline that we had stored on May 20th last year, and still categorized as "well above the upper limit of the average range" for this time of year, which you can clearly see in the graph below, where normal supply levels for this time of year are indicated by the shaded area on the graph.

At the same time, our distillate fuel inventories fell by 1,284,000 barrels to end the week at 150,878,000 barrels, as diesel fuel was withdrawn from storage in all PADD districts except for the east coast. However, because distillate inventories were already bloated after a warmer than normal winter reduced heat oil consumption, our distillate inventories remained 17.1% higher than the 128,839,000 barrels of distillates we had stored at the same time last year, and thus they're also characterized as "well above the upper limit of the average range" for this time of year.

Finally, with the decrease in crude imports and with a fudge factor of just 17,000 barrels per day, we found it necessary to draw oil from our stocks of crude oil in storage, which fell by 4,226,000 barrels from last week to 537,068,000 barrels as of May 20th. Still, that was 12.0% higher than the 479,363,000 barrels of oil we had stored as of May 22nd, 2015, and 36.7% higher than the 392,954,000 barrels of oil we had stored on May 23rd of 2014. Though our supply of oil stored above ground (not counting what's in the government's Strategic Petroleum Reserve) is down by 6,236,000 barrels from the record high of 543,394,000 barrels set 3 weeks ago, our inventories are still up by 54,744,000 barrels since the beginning of the year.

(note: the above was excerpted from my weekly coverage at Focus on Fracking)

Comments

OIL

Thank you for some honesty

USA exports & imports about the same amount of refined product

so it should not be deducted from their oil imports - about 9 MBD

another reason it should not be deducted

a country imports 100 ton of iron ore and exports 80 ton of steel

does that mean they only imported 20 ton of iron ore?

what nonsense - nor is exported refined product the same as crude oil

America only produces 5 MBD conventional crude oil

100 barrels of crude oil into a refinery

107 out of refined product - crude & refined product are not the same

so adding 7% is fraudulent

also it doesn't BTU's

and please consider

you are making a cake - it requires 2 eggs whisked - that fluffs em 50%

have you just added 3 eggs? NO!

Neither should the 7% refinery gain be added - it is all part of their propaganda

Thanks again for an excellent article

I posted a segment on Google plus - G+

site name is

OIL WATCH Group

thank you

Gray