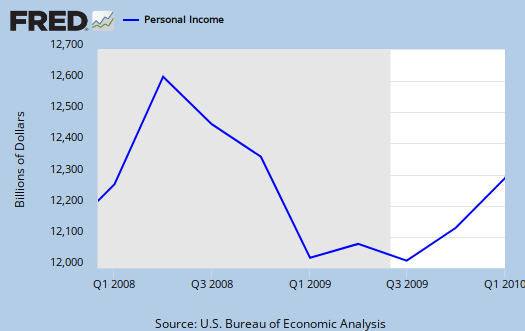

Out of this quarter's GDP report are some updates on personal income, disposable personal income, the personal savings rate and taxes.

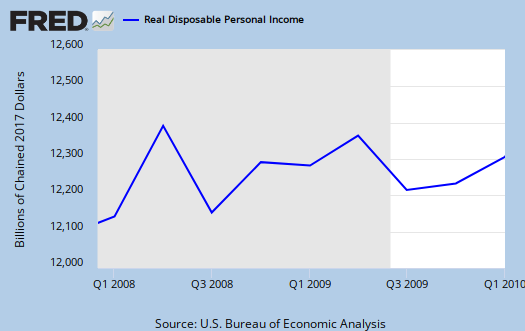

Recall real personal income means it has been adjusted for inflation. Below is this quarter's data along with graphs.

Current-dollar personal income increased $115.1 billion (3.9 percent) in the first quarter, compared with an increase of $92.5 billion (3.1 percent) in the fourth.

Personal current taxes increased $73.3 billion in the first quarter, in contrast to a decrease of $1.9 billion in the fourth.

Disposable personal income increased $41.7 billion (1.5 percent) in the first quarter, compared with an increase of $94.4 billion (3.5 percent) in the fourth. Real disposable personal income was unchanged in the first quarter, compared with an increase of 1.0 percent.

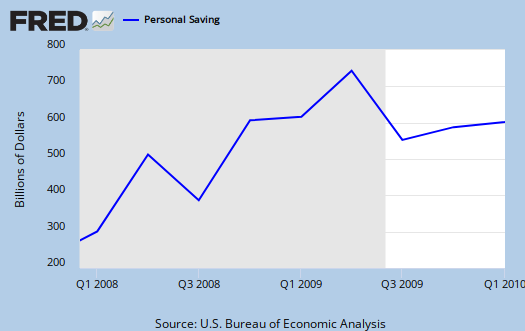

Personal outlays increased $130.4 billion (5.0 percent) in the first quarter, compared with an increase of $96.5 billion (3.7 percent) in the fourth.

Personal saving -- disposable personal income less personal outlays -- was $340.8 billion in the first quarter, compared with $429.3 billion in the fourth.

The personal saving rate -- saving as a percentage of disposable personal income -- was 3.1 percent in the first quarter, compared with 3.9 percent in the fourth.

So, one can see, as usual, the middle class ain't gettin' mo' money, more income, jobs and consumerism (PCE) was driven by a decline in savings. That's returning to the economy of before, but this time there is no home equity loan ATM.

Recent comments