In an article several months ago in the UK's Telegraph, the sovereign credit default swap market made the news. Until now, not that much was made of the sovereign CDSes; in fact, many didn't even realize the existence, and contagion, of such a market.

In an older Bloomberg article (Oct. 29), Bloomberg reporters' Abigail Moses and Shannon D. Harrington made the following observation:

"The financial crisis exacerbated by credit derivatives is costing so much to fix that speculators are now using those same instruments to bet on governments as the price tag for bailing out banks approaches $3 trillion."

......

"Credit-default swaps trade over-the-counter, leaving each party exposed to the risk the other won't fulfill the terms of the contract. The International Swaps and Derivatives Association, the industry group that has been setting the rules and acting as a self-regulator of the market, cited estimates that there were as much as $400 billion of contracts tied to Lehman Brothers Holdings Inc., even though the company only had $162.8 billion of debt, according to Bank of America Corp. analysts."

Theresa Einhorn, a derivatives attorney with Haynes and Boone, LLP, provides us with a concise definition of the CDS along with an even more concise manner they pumped up debt and risk with regard to the Lehman Brothers' meltdown awhile back.

A credit default swap protects the buyer against the loss of principal on a bond (or loan) in case of default by the borrower/issuer. The protection buyer pays a premium, either an upfront payment or a periodic payment, over the life of the contract. If, during the term of the contract, a “credit event” occurs (events such as dissolution, bankruptcy, failure to pay, obligation acceleration; and in some CDS transactions, debt restructuring), then the contract is settled and terminated. The settlement can be physical (i.e. delivery of debt obligations) or cash. In a cash settlement, the protection seller pays the protection buyer an amount equal to par value of such obligation minus the market value of the reference obligation. In either case, the settlement amount is intended to compensate the protection buyer for the loss that it would have incurred if it had owned the notional amount of the reference entity’s debt.

And here is an excellent explanation of the CDS involvement with compounding debt and risk:

The amplification of losses resulting from “naked” CDS contracts was illustrated by the numbers in the Lehman Brothers bankruptcy case. Lehman defaulted on debt in the approximate amount of $600 billion; in addition, according to market estimates, there were CDS contracts of about $400 billion to $500 billion in which Lehman was the reference entity. Market estimates suggest that only about $150 billion of the CDS contracts actually hedged underlying debt. The remaining $250 billion to $300 billion of CDS contracts were not hedging underlying debt. The losses on these CDS contracts were in addition to the $600 billion of actual debt. Thus, the CDS contracts amplified the losses by up to 50%.

In an interesting aside, there have been a slew of finance articles, notably Matt Taibbi's in the Rolling Stone and a number in Vanity Fair which would suggest that the run on Lehman Brothers was orchestrated by Goldman Sachs, JP Morgan Chase and Deutsche Bank.

Ellen Brown, banking history expert and well known for her Web of Debt online publication, suspects the principal actors might have been the Bank of England along with other European banks. (Personally, I'm leaning towards GS, JPM and DB. - JW)

And bringing us up-to-date on European sovereign CDS activity is Bloomberg's Kate Haywood:

June 4 (Bloomberg) -- Credit-default swaps on sovereign bonds surged to a record on speculation Europe’s debt crisis is worsening after Hungary said it’s in a “very grave situation” because a previous government lied about the economy.

The cost of insuring against losses on Hungarian sovereign debt rose 63 basis points to 371, according to CMA DataVision at 3:30 p.m. in London, after earlier reaching 416 basis points. Swaps on France, Austria, Belgium and Germany also rose, sending the Markit iTraxx SovX Western Europe Index of contracts on 15 governments as high as a record 174.4 basis points.

......

Swaps on Spanish government debt were up 22 basis points at 278, after earlier reaching a record 295.5, according to CMA. Contracts on Portugal were 26 basis points wider at 364.8, while Ireland was up 32 basis points at 292, and Italy climbed 30 basis points to an all-time high of 264, before retreating to 253. Contracts on Greece were 57 basis points higher at 783, down from 798 earlier.

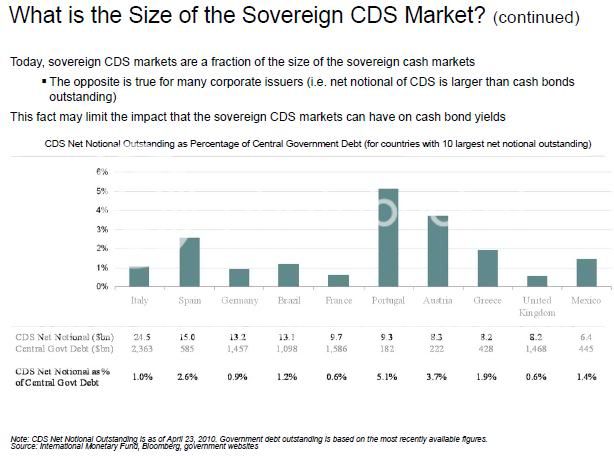

And what, pray tell, is the size of the sovereign CDS market?

Please note the graphs below, courtesy of the US Treasury’s Office of Debt Management, pp. 25 and 27.

Goldman Sachs --- JP Morgan Chase --- Morgan Stanley --- Deutsche Bank --- UBS --- BIS --- ECB --- Federal Reserve --- Credit Suisse ---

Goldman Sachs --- JP Morgan Chase --- Morgan Stanley --- Deutsche Bank --- UBS --- BIS --- ECB --- Federal Reserve --- Credit Suisse ---

And an excellent article by Nelson Schwartz and Eric Dash in the New York Times further elaborates what is going on in Greece with regard to sovereign credit default swap activity.

Bets by some of the same banks that helped Greece shroud its mounting debts may actually now be pushing the nation closer to the brink of financial ruin.

Echoing the kind of trades that nearly toppled the American International Group, the increasingly popular insurance against the risk of a Greek default is making it harder for Athens to raise the money it needs to pay its bills, according to traders and money managers.

As Greece’s financial condition has worsened, undermining the euro, the role of Goldman Sachs and other major banks in masking the true extent of the country’s problems has drawn criticism from European leaders. But even before that issue became apparent, a little-known company backed by Goldman, JP Morgan Chase and about a dozen other banks had created an index that enabled market players to bet on whether Greece and other European nations would go bust.

Last September, the company, the Markit Group of London, introduced the iTraxx SovX Western Europe index, which is based on such swaps and let traders gamble on Greece shortly before the crisis. Such derivatives have assumed an outsize role in Europe’s debt crisis, as traders focus on their daily gyrations.

Of course, there are many who would claim the intent of this article to be incorrect. That the purchase of naked credit default swaps ("naked" meaning the purchasers have no underlying ownership of bonds or other instruments involved, i.e., no "skin in the game") is a perfectly innocent and harmless activity.

But then what other reason could there be for such a purchase, as the naked swap buyer isn't hedging against the original bonds?

There is an obvious pattern we've observed: the investment bank coordinates the underwriting of bonds for a variety of reasons (public-private partnerships, for instance, which also acts to hide debt as an offshore Special Purpose Vehicle would normally be utilized), then various credit derivatives are generated on said bonds (debt), culminating with credit default swaps purchased against those bonds.

From an International Monetary Fund paper titled, Public-Private Partnerships, p. 10, it is noted how the debt is conveniently hidden or masked:

With a typical securitization operation, the government would sell a financial asset—its claim on future project revenue—to an SPV. The SPV would then sell securities backed by this asset to private investors, and use the proceeds to pay the government, which in turn would use them to finance the PPP. Interest and amortization would be paid by the SPV to investors from the government’s share of project revenue. Since investors’ claim is against the SPV, government involvement in the PPP appears limited. However, the government is in effect financing the PPP, although recording sale proceeds received from the SPV as revenue masks this fact.

Then either a "credit event" triggers payouts on those CDSes, from a variety of reasons, frequently the shorting of a company's stock when it involves a private entity -- or insider suggestions of hidden sovereign debt, in the case of a government -- or those swaps may be offered to the bond holders as profit-producing hedges (by the original swap purchasers) when the valuation of said bonds is questioned. There are a number variations on this, many subtle and elegant, but all usually profit-producing.

And an excellent listing from the US Treasury's Office of Debt Management:

Goldman Sachs --- JP Morgan Chase --- Morgan Stanley --- Deutsche Bank --- UBS --- BIS --- ECB --- Federal Reserve --- Credit Suisse ---

Goldman Sachs --- JP Morgan Chase --- Morgan Stanley --- Deutsche Bank --- UBS --- BIS --- ECB --- Federal Reserve --- Credit Suisse ---

Felix Salmon, although a fan of the sovereign CDS, does have some interesting comments from his financial blog:

That said, I was invited to a media lunch hosted by Loomis Sayles today, and I took the opportunity to ask David Rolley, their international fixed-income guru, whether CDS had been or could be used for nefarious purposes. And he unhesitatingly said yes, on both counts, saying that Brazil, for one, has paid as much as $1 billion in extra funding costs thanks to hedge fund types who use CDS to drive up the country’s bond spreads ahead of new issuance.

Mr. Salmon goes on to state that the hedge fund fellows aren’t out to destroy Brazil, simply to wrest as much profit as possible.

To that I would add, the robber isn’t always out to murder their robbery victim, simply to wrest as much profit (stolen goods) as possible.

(Please note the similarity of intent! ! !)

Chris Whalen, professional risk analyst and a well known contributor to various popular financial journals, and an editor of The Institutional Risk Analyst has written some interesting stuff on the credit default swap instrument.

During a trip to Reykjavik last year, when I gave a talk entitled “Credit Default Swaps and Other Acts of Satan” to several hundred cheering Icelanders, some of the discussion I had the previous week with several senior actuaries from several large insurers came into focus.

Specifically, I was troubled by the dichotomy of several clients of mine who use CDS for volatility trading, often against completely unrelated assets – for example, long cash exposure on Brazilian banks but short via CDS against sovereign Brazil -- while the people in the insurance industry were pricing the same contract against what they believed was a long-term, through-the-cycle default risk.

In other words, the former group was pricing the CDS off short-run volatility (i.e. bond yields) while the latter were at least trying to formulate an opinion between the probability of default of the underlying reference obligation. The valuation and VaR numbers generated for the same contracts by these two groups of users were very different and, as we can see in the marketplace, this difference is not trivial. For my client, the long cash Brazil banks/short Brazil sovereign via CDS, worked perfectly, but not all players are so lucky.

Losses caused by mispriced CDS contracts nearly caused the bankruptcy of several bond insurers during 2008, including MBIA (NYSE:MBI). In the wake of its near-death experience, MBI has split itself into two new companies and has publicly foresworn the use of CDS in hedging its credit exposures in future. Indeed, it seems likely that once MBI collapses the “bad bank” of legacy CDS exposure, it will return to the higher margin world of public bond insurance – assuming that public sector issuers wish to use insurance.

The experience with MBI initially caused the State of New York to propose a draconian regulation of CDS that would have compelled entities writing protection to regulated insurers to demonstrate the ability to pay on the contact – a funding requirement that would drive most dealers out of the default insurance market and leave what remained to the chronically overcapitalized, hold-to-maturity world of insurers.

Then we have American International Group, which was the recipient of a vast public bailout last year financed by the Federal Reserve Bank of New York, apparently for the benefit of Goldman Sachs and AIG’s other CDs counterparties, come in large part from the writing of CDS contracts on complex structured assets that AIG did not understand. AIG's sin was thinking it could buy low-risk growth through CDS, but even veteran CEO Hank Greenberg failed to understand the true risk of insuring high beta credit losses.

The sad part is that in chasing growth by taking risks with CDS, Greenberg and AIG were entering a relatively low-margin business compared with the mid-double digit risk adjusted returns found in traditional, low-beta insurance. The trouble is that the real economy does not grow very fast compared to the open-ended growth of derivatives. And it is to create the illusory, notional “growth” via derivatives that is the real point of the OTC model. But that said, not all of the losses at AIG came from CDS and I suspect we shall hear more about that this week.

At this blog site of Jule Treneer (The Faster Times) there is mention of the French Finance Minister, Christine Lagarde, warning off speculators --- but for very valid reasons, me thinks!

Though to be fair to Ms. Lagarde, harboring suspicions about recent action in the sovereign credit default swaps (C.D.S.) market hardly means you’re paranoid. Sovereign C.D.S are derivative contracts that work like an insurance policy against government debt default, though some investors use them simply to speculate on the likelihood of default. (Critics argue this is a bit like wagering on whether your neighbor’s house will burn down, but like everything else, it’s not that simple.) Sovereign CDS are not traded on any exchange. And this lack of transparency has got critics wondering whether they’re susceptible to manipulation. Recently, Barclays Capital looked into the question of whether sovereign CDS are a good tool for measuring investor sentiment, or merely a way for speculators to sow fear of default, as European policy makers have complained. Their report, “Are Sovereign CDS the Canary in the Coalmine, or the Cat Among the Kittens?” concluded that the small size of the sovereign CDS market made it less predictive than the underlying market for government debt it’s meant to insure.

But then again, small markets are easier to manipulate. Enter the conspiracy theory: on Wednesday, Jean Quatremer, who reports on the Brussels beat for the French daily Liberation, broke the story that Goldman Sachs and the hedge fund run by John Paulson are behind the attacks against Greece and the euro…

The most shocking aspect of this affair is without doubt the role played by Goldman Sachs, which, while at the same time advising the Greek government, has also taken secret positions against Greece and the euro.

And this coming in the same week that it was reported in Der Spiegel and the New York Times that, back in 2002, Goldman helped the Greek government conceal some of its debts from the European Union through a series of complex derivative transactions. The sole purpose of these transactions would appear to be to sidestep EU reporting requirements and paint a misleading picture of Greek finances. That news drew a lot of ire. Even the normally circumspect German Chancellor Angela Merkel lashed out, saying, “It’s a scandal if it turned out that the same banks that brought us to the brink of the abyss helped fake the [Greek] statistics.”

But potentially more damning is the assertion made by Mr. Quatremer, that Goldman Sachs has been taking advantage of its advisory role, and profiting at the expense of Greece.

… on 25th of January, Greece managed to place 8 billion Euros in 5-year paper, even though the original intention had been to issue only 3 billion: demand had reached 25 billion Euros! Goldman Sachs was certainly among the syndicate that placed this Greek paper. Up to that point, nothing out of the ordinary… After this spectacular success, everyone thought that the markets had calmed down… But then starting Wednesday [Jan. 27th] another storm hit. An article from the Financial Times… had just confirmed news to the effect that China had refused to buy 23 billion Euros of Greek debt, a “private placement” engineered by . . . Goldman Sachs. What was this about? When a government fears that it won’t be able to place its debt, it asks a bank directly to place it on its behalf with one or several investors. It’s a sign of panic. And the fact that Beijing was said to have declined the offer was downright disturbing. In short, two reasons for the markets to flee Greece. [Athens] denied this, but the markets nevertheless increased the risk premium they assigned Greece, boosting [Goldman's] profits.

Of course, Goldman Sachs is a huge bank, with a massive derivatives business that entails managing tremendously complex and often offsetting positions. But if the story’s true, Goldman’s actions have been ethically dubious at best. And in the eyes of the European public, it all must seem downright nefarious. Politicians respond to the public mood, and regulators in Europe don’t need much more motivation to start clamping down on financial market shenanigans. Already the new EU Internal Market Commissioner, Michel Barnier, has stated his intention to regulate the sovereign CDS market. But that’s just the tip of the iceberg. As he recently told Le Figaro, “No market, no actor, no product and no territory can go without relevant regulation and efficient supervision.” So, look out, markets: here come the regulators.

But for Goldman, at least in Europe, the tarnish on their image may be more worrisome. Goldman Sachs was already a lightning rod for conspiracy theory. Now this Greek episode may burn that image into Europe’s retina. As the French magazine Marianne recently put it, “How do you never lose? If you’re Goldman Sachs, you play from both sides of the table.” I can think of another group of people who profit no matter if their clients win or lose: arms dealers…

Mon Dieu!

Conspiracies at statistically-improbable yet perfectly profitable Goldman Sachs? Perish the thought, oh-ye-critics-of-high-frequency-trading-and-market-manipulation! ! ! !

For anyone wishing to refresh their memories on Goldman Sachs, please review the outstanding site at freerisk.org.

An IMF working paper ( Anticipating Credit Events Using Credit Default Swaps, with an Application to Sovereign Debt Crises, p. 14), published back in 2003, by Jorge A. Chan-Lau, establishes that there is indeed spillover between one country’s credit event – from default - causing negative effects on other countries’ sovereign creditworthiness related to CDS activity on sovereign bonds.

Goldman Sachs --- JP Morgan Chase --- Morgan Stanley --- Deutsche Bank --- UBS --- BIS --- ECB --- Federal Reserve --- Credit Suisse ---

US Treasury XXX

(or, Naked Came the Swaps)

From the Minutes of the Meeting of the Treasury Borrowing Advisory Committee Of the Securities Industry and Financial Markets Association, this past May 4th:

The presenting member identified 5 drivers of sovereign CDS spreads, with the predominant factor being macro-economic fundamentals on the underlying sovereign. Sovereign CDS spreads are an indicator of default risk and other macro factors such as current account and fiscal balances, debt-to-GDP, and stability and credibility of government policies. Market sentiment and risk tolerance are also drivers of CDS prices. CDS spreads also widen as counterparty risk increases, a feature that would be mitigated if this market moved from an OTC market to an exchange with centralized clearing. There is currency risk embedded in sovereign CDS as well. Finally, basis trading between the cash and CDS market can also impact CDS prices, but there are not many investors currently putting on basis trades.

The member noted that there appears to be no evidence that CDS movements are driving borrowing costs for sovereigns. Instead, CDS spreads appear to move alongside cash market spreads. Some members questioned this conclusion. (Emphasis mine – JW)

The presenter then highlighted some benefits of sovereign CDS including the use of CDS as a risk management tool for a wide variety of market participants. CDS additionally provide a low cost means of gaining or reducing exposure to a particular sovereign or index. The product also allows market participants to short sovereign markets more efficiently than is possible in the corresponding cash market. CDS spreads also serve a signaling effect by improving the price discovery process and alerting participants to perceived risks. Typically movements in CDS lead changes in credit ratings.

So at this meeting within the US Treasury, they are attempting to push the idea that there is fundamentally nothing wrong with naked swaps.

This should be truly shocking to anyone with a functioning brain. These are supposed to be experts in their fields, yet they appear either highly inexpert, or abjectly dishonest on this matter.

And the recommendations from this meeting (page 39):

Goldman Sachs --- JP Morgan Chase --- Morgan Stanley --- Deutsche Bank --- UBS --- BIS --- ECB --- Federal Reserve --- Credit Suisse ---

Goldman Sachs --- JP Morgan Chase --- Morgan Stanley --- Deutsche Bank --- UBS --- BIS --- ECB --- Federal Reserve --- Credit Suisse ---

Please note the top few lines warning against banning naked credit default swaps. The US Treasury is pro a financial instrument many learned individuals consider fraudulent, while the European Parliament is clearly against it.

When one cashes in multiples times on the same loss --- that inherently destabilizes everything --- it is the essence of the pyramid scheme.

Fraud is fraud --- all claims to the contrary!

Of course, it doesn’t hurt to familiarize oneself with the members of the Treasury Borrowing Advisory Committee.

Please note that some members, even though now with other organizations, are usually connected in some manner or other with Goldman Sachs, e.g., Irene Tse who, though with Duquesne, was a government bonds trader with GS, in New York and Europe, for a number of years.

And, from that excellent freerisk.org site again:

Former GSer leads debt issuance at the US Treasury

Karthik Ramanathan, who has overseen the issuance of more than $8 trillion in U.S. debt over the past year, plans to leave the Treasury Department at the end of March.

Mr. Ramanathan has run the Treasury's office of debt management at a time of severe borrowing needs necessitated by the government's attempts to combat the financial crisis and economic downturn. Under his watch, the national debt has grown by nearly $4 trillion...

...Since joining the Treasury in 2006 from Goldman Sachs Group Inc., Mr. Ramanathan has kept a low profile, largely working behind the scenes to make sure the Treasury's debt auctions go off without a hitch.

Goldman Sachs --- JP Morgan Chase --- Morgan Stanley --- Deutsche Bank --- UBS --- BIS --- ECB --- Federal Reserve --- Credit Suisse ---

Regulatory Kaptur

(Or, ”Let’s Play Wall Street Bailout”)

Below is an outstanding speech before congress by Rep. Marcy Kaptur of Ohio. Her delivery is both flawless and highly enlightening and is a most excellent account of a criminal conspiracy (today referred to both officially and eumphemistically as "regulatory capture").

And from Bloomberg we hear:

Goldman Sachs --- JP Morgan Chase --- Morgan Stanley --- Deutsche Bank --- UBS --- BIS --- ECB --- Federal Reserve --- Credit Suisse ---

References

Hudson, Michael. Euro-Bankers to Greece: The Wealth Won't Pay Their Taxes, So Labor Must Do So. May 11, 2010. New Economic Perspectives.

http://neweconomicperspectives.blogspot.com/2010/05/euro-bankers-to-gree...

Minutes of the Meeting of the Treasury Borrowing Advisory Committee Of the Securities Industry and Financial Markets Association, May 4, 2010.

http://www.ustreas.gov/press/releases/tg681.htm

U.S. Department of the Treasury, Office of Debt Management, May 4, 2010. Presentation to the Treasury Borrowing Advisory Committee.

http://www.ustreas.gov/offices/domestic-finance/debt-management/quarterl...

Meta:

- bloomberg

- imf

- new york times

- goldman sachs

- AIG

- Lehman Brothers

- CDS

- Marcy Kaptur

- Ireland

- US Treasury

- greece

- Iceland

- Euro

- Deutsche Bank

- Markit Group

- spain

- Telegraph

- Abigail Moses

- Angela Merkel

- Brazil

- Chris Whalen

- Christine Lagarde

- Credit event

- DataVision

- David Rolley

- Der Spiegel

- Ellen Brown

- Eric Dash

- European Parliament

- Federal Reserve Bank of New York

- Felix Salmon

- France

- Haynes and Boone

- LLP

- Hungary

- International Monetary Fund

- International Swaps and Derivatives Association

- Irene Tse

- iTraxx SovX

- Jean Quatremer

- Jorge A. Chan-Lau

- Jule Treneer

- Karthik Ramanathan

- Kate Haywood

- Liberation

- Loomis Sayles

- Marianne

- Matt Taibbi

- Naked CDS

- Naked swaps

- Nelson Schwartz

- Office of Debt Management

- Rolling Stone

- Securities Industry and Financial Markets Association

- Shannon D. Harrington

- sovereign CDS

- Special Purpose Vehicle

- The Institutional Risk Analyst

- Theresa Einhorn

Comments

meta data

fine, fine post but I think you're going a little nuts with the metadata tags. ;)

Yup!

I have to agree with you this time --- but I cribbed from a bunch of people and experts this time, so I had to give them credit, after all....

Did they even bring Dorgan's amendment to a vote??

He was on this and had an amendment to ban naked CDS, which of course was ignored. I know it was defeated but I don't think it even came up for a vote. It's no wonder Dorgan is retiring. How many times has he put forth great legislation, amendments, really knows what makes sense in finance to be ignored. I can hardly wait until Harry Reid is defeated, in spite of the psycho who will be in his place. Dorgan should have been Senate majority leader, now he will be gone.

Anywho, I'm monitoring the financial reform bill but I frankly expect it to be even more watered down than it is and it does not have a naked CDS ban.

It's just disgusting, banksters gamble putting the entire globe to the brink of financial ruin, keep their executive compensation and even more disgusting, are managing to keep the entire Ponzi scheme intact.

Nope, never got to the vote!

Nope, you're right, Dorgan's amendment never made it to the vote!

And I have absolute suspicious about Lincoln's (Arkansas) supposed derivatives regulation amendment --- I'm almost certain that was one of those false-front deals whereby she told the powers-that-be she was proposing it for her own election self-promotion.

Just like Senator Cantwell and Senator Feingold's recent vote against this so-called finacial regulation reform: Sen. Feingold's vote rings true -- it is absolutely consistent with his voting record!

Cantwell's vote against it DOESN'T RING AT ALL -- her record is completely inconsistent with her vote against it!

Just like Dorgan's amendment -- the closest thing to a public option on that Health Insurance Reform -- to come out of the Senate: Both Washington senators (Murray and Cantwell) voted against it -- completely consistent with their Bush-dog dem voting records!

Dorgan was one of the last, few hopes left in the Senate (along with Feingold, and possibly Sanders and what's-his-face from Minnesota, Al?? -- and in the House it's only Kucinich, DeFazio, Kaptur??).

truly

we'll see, bear in mind Lincoln still has to be in the general. But Cantwell was a surprise, she's so Microsoft representative.

We'll see. I wonder where Jon Tester, Jim Webb are, they are supposedly Populist. Then Jeff Merkley might be looking like a surprise, we'll see. I've seen him focus on the trivial, but he seems to be trying, esp. with the Volcker rule, it's clear he tried like hell to maneuver.

A Greek citizen's reply to Bloomberg

Almost a year ago, on 14/02/10 NY Times published the article titled “Wall St. Helped to Mask Debt Fueling Europe’s Crisis” and since then lots have been written and said about Greece and it's debt crisis.

But in many cases we were reading only parts of this story.

Today, i would like to inform you about an open discussion link, sent to Bloomberg, as a response to the lawsuit against ECB.

(http://www.facebook.com/?ref=logo#!/topic.php?uid=174452975917433&topic=356)

This letter was followed by a similar open discussion link, adressed to Greece's Prime Minister, Mr George Papandreou.

(http://www.facebook.com/?ref=logo#!/topic.php?uid=174452975917433&topic=360)

Both were written with the hope to initiate an informational campaign, a global conversation about what is really going on in this country and in Europe today.