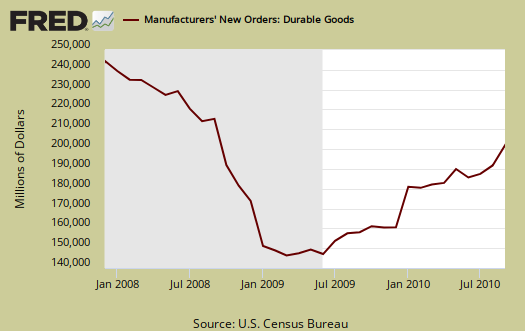

New Orders in Durable Goods increased 3.3% for September 2010. New orders has declined 2 of the past 4 months, with July showing a slight 0.7% increase. New orders in non-defense capital goods increased 8.6%. Core capital goods new orders fell -0.6%. August Durable Goods new orders was also revised up, to -1.0% with August core capital goods new orders revised up to 4.8% from 4.1%.

Aircraft & parts, non-defense, new orders ballooned up +105.0% and defense airplanes also jumped 30.0%. While other analysis seems to blow off aircraft, that's a $6.6 billion increase in one month of non-defense aircraft & parts new orders. Transportation new orders alone increased +15.7% in September. Autos (vehicles & parts) new orders down -0.4%. In the Advance Report on Durable Goods Manufacturers' Shipments, Inventories, and Orders:

Excluding transportation, new orders decreased 0.8%. Excluding defense, new orders increased 2.9%.

Core capital goods are a leading indicator of future economic growth. It's all of the stuff used to make other stuff, kind of an future investment in the business meter. Core capital goods excludes defense and all aircraft. New orders are down -0.6%. Shipments are up 0.4%. Two things to note, core capital goods has not recovered to 2007 levels but this month are some not so great numbers, masked by the incredible news on air-o-planes.

Inventories, which also contributes to GDP, were up +0.5% in August 2010 for manufactured durable goods with nondefense inventories up +0.6%, but excluding transportation, inventories increased +0.2%. Unfilled orders were up 1.0%.

Shipments, which contributes to the investment component of GDP, is down -0.4% in September and -1.4% in August, revised. Non-defense capital goods shipments decreased -0.7%, yet shipments in core capital goods rose 0.4% after August's 1.3%. There is a lot of confusion about precisely which shipment metric is a good approximation for the investment component of GDP. It is the total which gives a better feel. The reason? While core capital goods shipment is a good approximation for part of the investment GDP calculation, it sure isn't all.

Producer's Durable Equipment (PDE) is part of the GDP investment metric, the I in GDP or nonresidential fixed investment. It is not all, but part of the total investment categories for GDP, usually contributing about 50% to the total investment metric (except recently where inventories have been the dominant factor).

Producer's Durable Equipment (PDE) is about 75%, or 3/4th of the durable goods core capital goods shipments, used as an approximation. Therefore, we see some good news here with a 0.4% increase in core capital goods shipments, to guesstimate PDE, which is part of the GDP investment component. Yet 37.5% is not 100%. Airplanes and autos are also included in PDE. So, in other words, while core capital goods shipments are up, it's not all that goes into any PDE approximation and capital goods non-defense is down for the last two months.

While often Journalist guesstimates of GDP exclude aircraft, frankly it might be nicer if the BEA simply gave us all some open source software, more spreadsheets, less obscure PDFs so we can see the real methods as well as track on better GDP guestimates. After all, explaining to us what's going on with the economy is one of their jobs. The BEA does take off exports, bring in imports, remove intermediate goods for production & consumer, remove government purchases (for private investment) and also adjust for prices, on PDE. Whew! Now figure that as a multiplier ratio (left as an exercise for the reader ;)).

Seriously, this national account stuff is nasty wiccans on how they calculate national accounts from these monthly reports. Bottom line, point here is air-o-planes, transportation do count in the GDP investment metric. See BEA on National accounts for chasing down how they calculated PDE and GDP.

Here is last month's durable goods report, not revised.

Recent comments