Why Is Gold Rising Now, Where Is It Headed Tomorrow?

Authored by Matthew Piepenburg via VonGreyerz.gold,

Needless to say, we at VON GREYERZ spend a good deal of time thinking about, well… gold.

The Complex, the Simple, the Math and the History

Year after year, and week after week, there is always a new way to examine gold price moves and decipher the obvious and not-so obvious forces which flow behind, ahead, above and below its monetary and, yes, metallic, move through time.

Today, deep into the early decades of the 21st century, and well over 100 years since the not-so immaculate conception of the Fed in the early 20th century, we could (and have) spent pages and paragraphs on key turning points in the rigged to fail history of paper vs. metallic money.

At times, this effort can and has seemed intense and even complex, with all kinds of historical facts, mathematical comparisons and “big events.”

The turning points of gold’s relationship with fiat currencies, and its role in preserving wealth, for example, are known to an admitted minority—as only about 0.5% of global financial allocations include physical gold.

Gold’s Language

Yet the need, role and direction of gold is fairly blunt, at least for those with eyes to see and ears to hear.

History, for example, has some clear things to say about paper money.

And so does gold.

From the Bretton Woods promises of 1944 and Nixon’s open and subsequent welch on the same in 1971 to the 2001 outsourcing of the American dream to China under Clinton (and the WTO) or the recent weaponization of USD in Q1 of 2022, gold has been watching, acting and speaking to those who understand her language.

The Big Question: Why Is Gold Rising Now?

And this year, with gold reaching all-time-highs, piercing resistance lines and racing toward what the Wall Street fancy lads call “price discovery,” we are understandably getting a lot of interview requests, phone calls and even emails from friends otherwise silent for years and now suddenly asking the same thing:

“Why is gold rising now?”

The Wall Street side of my odd brain, like it or not, gets all excited by such questions.

Never at a loss for words, my pen and mouth rapidly seek to wax poetic on the many answers to why gold matters forever in general, and why it is rising in particular now.

Toward that end, the list of the fancy and not-so-fancy answers to this question in recent years, articles and interviews could look as simple (or as complex) as the following list of 7 key factors:

The Malignant Seven

-

Every debt crisis leads to a currency crisis—hence: Good for gold.

-

All paper currencies, as Voltaire quipped, eventually revert to their paper value of zero, and all debt-soaked nations, as von Mises, David Hume and even Ernest Hemingway warned, debase their currencies to retain power—hence: Good for gold.

-

Rising rates (and fiscal dominance) used to “fight inflation” are too expensive for even Uncle Sam’s wallet, thus he, like all debt-soaked nations, will debase his currency to pay his own IOUs—hence: Good for gold.

-

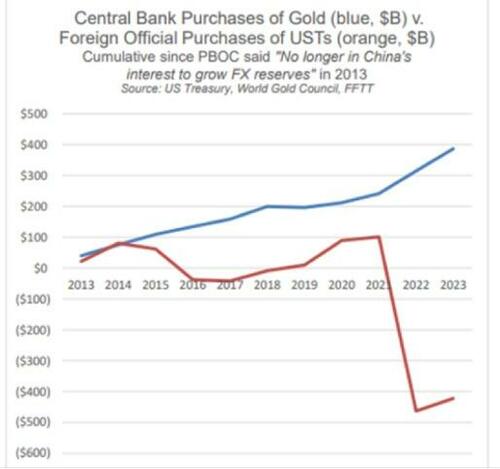

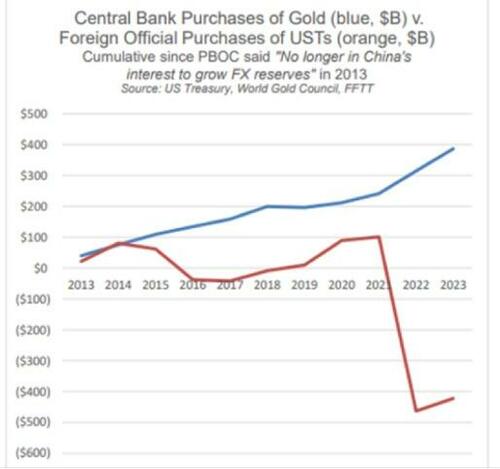

Global central banks are dumping unloved and untrusted USTs and stacking gold at undeniably important levels—hence: Good for gold.

-

After generations of importing US inflation and being the dog wagged by the tail of the USD, the BRICS+ nations, prompted by a weaponized Greenback, are now turning their tails slowly but surely away from the USD dog—hence: Good for gold.

-

The Gulf Cooperation Council oil powers, once seduced (circa 1973) into a Petrodollar arrangement by a high-yielding UST and globally revered USD, are now openly selling oil outside of the 2024 version of that far less-yielding UST and far less-trusted USD—hence: Good for gold.

-

That legalized price-fixing sham otherwise known as the COMEX employed in 1974 to keep a permanent boot to the neck of the gold price, is running out of the physical gold needed to, well…price fix gold—hence: Good for gold.

In short, each of these themes–from sovereign (and unprecedented) debt levels, historical debt lessons, the secrets of the rate markets, global central banks dumping USTs or the implications of changing oil markets to the OTC derivatives scam masquerading as capitalism–all DO explain why gold is rising now.

This list, of course, may be simple, but the forces, indicators, lingo, math and trends within each theme can be admittedly complex, as each theme is in fact worthy of its own text book rather than bullet point.

Indeed, currencies, markets, history, bonds, geopolitics, energy moves and derivative desks are complicated little creatures.

But despite all this complexity, study and deliberation, if you really want to address the question of “why is gold rising now?”—the answer is almost too simple for those of us who wish to appear, well… “complex.”

The Too-Simple Answer to the Big Question

In other words, the simple answer—the answer that cuts through all the fog, lingo and math of “sophisticated” financial markets–boils down to this:

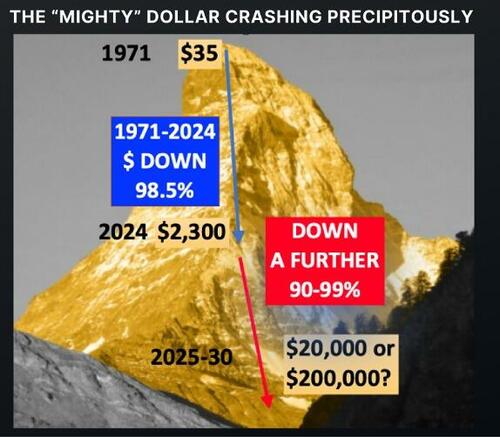

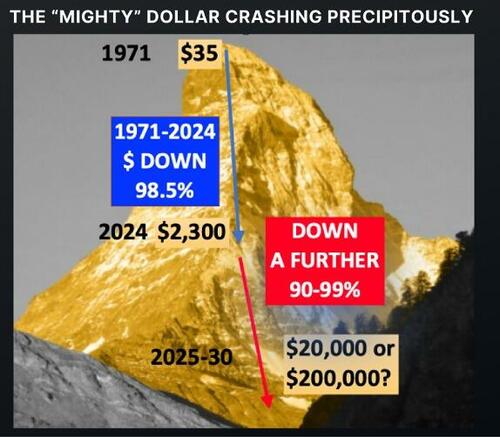

GOLD IS NOT RISING AT ALL. THE USD IS JUST GETTING WEAKER AND WEAKER.

At VON GREYERZ, we never measure gold’s value in dollars, yen, euros or any other fiat currency. We measure gold in ounces and grams.

Why?

Because history and math (as well as all the current and insane financial, geopolitical, and social events staring us straight in the eyes today) teach us not to trust a currency backed by man (or the “full faith in trust” of the UST or a Fed’s mouse-clicked currency), but instead to seek value in monetary metals created by nature.

Fake Money & Empty Promises

Once a currency loses a gold backing (nod to Nixon), it is nothing more than the empty promise of a government now free to print and spend without a chaperone to buy votes, market bubbles and even a Nobel Prize (i.e., what Hemingway called “temporary prosperity”) but then hand the bill and inflation to future generations (what Hemingway then called “permanent ruin”).

Gold Does Nothing

So yes, gold, as Buffet and others have quipped, “does nothing.” It just sits there and stares at you.

But while this yield-less pet rock sits there “doing nothing,” the currency by which you measure your wealth is in fact quite busy melting like an ice cube–one day, month and year at a time.

Here’s to Doing Nothing: Price vs. Value

Sometimes a picture can say a thousand words and make the most complex economic topics or themes, like “price vs. value” or “store of value,” make immediate sense.

Think, for example, about a 1-ounce bar of gold just doing nothing in say… 1920.

Well, if you had 250 of those do-nothing ounces in a shoe box in 1920, which was “priced” then at around $20 USD per ounce, you could afford the average US home, then priced at $5000.

Today, however, the average price of a US home is $500,000.

So, if your grandfather left you a shoebox with 5000 crumpled Dollars inside, it would not even pay for the landscaping needed for that same house today.

But if your grandfather had instead handed you a shoebox with those same 250 singe-ounce bars of gold (today “priced” at 2300/ounce), you could buy the same average home and the landscaper too—with a nice tip for the latter.

So, do you still think those little gold bars just stared back at you, doing nothing?

After all, the shoe box with the 5000 USDs inside was very busy doing one thing very well, namely: Losing its value like snow melting off a spring mountainside…

So, which shoebox would you want to measure your wealth?

The one measured in fiat dollars actively losing value? Or the one measured in gold ounces “doing nothing” but retaining its value?

Sometimes the complex really is that simple.

The Next Big Question: Where’s Gold Headed Tomorrow?

The pathway to answering such a question is just as clear as the one we just traveled.

The aforementioned “Malignant Seven” are each factors which we believe will continue to push the USD down and hence gold higher, because, and to repeat: It’s not that gold will get stronger, it’s just that all fiat currencies in general, and the weaponized, distrusted and over-indebted USD in particular, get weaker.

But for those still understandably and realistically convinced that despite its myriad and almost endless flaws, the US (and its Dollar) is still, for now at least, the best horse in the glue factory, a case can be made that measured relative to other currencies (i.e., the DXY), that the USD is supreme, and that when and as financial markets weaken, investors will flock to it like a lifeboat in a tempest.

Milkshake Theory?

Such a credible view is held by very smart folks like Brent Johnson, with whom I have discussed the USD at length.

Brent’s “milkshake theory” intelligently argues that powerful demand forces from the euro dollar, SWIFT and derivative markets, for example, create a massive, “straw-like” sucking sound for the “milky” USD, which demand will keep it strong, and send it stronger, in the seasons ahead.

He may in fact be right.

But I think differently.

Why?

Two primary reasons stick out.

No “Straw” for the UST

First, despite the undeniably powerful demand forces at play for the USD, demand for USTs is, and has been, tanking around the world since 2014. That is, foreigners don’t trust the US IOUs as much as they did before America became a debt trap.

Ever since foreign (central bank) interest in USTs began net-selling in 2014, and gold interest began net-buying in 2010, the only buyer of last resort for US public debt has been the US Fed, and the only tool the US Fed has to purchase that debt is a mouse-clicker (“money printer”) at the Eccles Building.

Unfortunately, creating money out of thin air is not a sustainable policy but a near-term fantasy. More importantly, such a policy is inherently, and by definition: Inflationary.

My US Realpolitik Theory…

The second, and perhaps more important reason the USD’s declining future is fairly easy to see (or argue), is this:

EVEN UNCLE SAM WANTS AND NEEDS A WEAKER DOLLAR.

Why?

Because the only way out of the biggest debt hole the US has ever seen is to inflate its way out of it by debasing the currency to “save” an otherwise rotten system.

We’ve argued this for years, and the facts supporting this historically-repeated pattern (and view) haven’t changed; they’ve just grown worse.

That is why it was easy to foresee that inflation would not be “transitory” despite all the useless commentary (and Fed-speak) arguing to the contrary.

That is also why it was easy to see that Powell’s “war on inflation” was a political ruse—an optics play.

Powell’s real aim was (and remains) inflationary via negative real rates (i.e., inflation higher than 10Y bond yields).

Thus, even while pursuing his “higher-for-longer” and anti-inflationary rate hikes, actual inflation, which Powell needed, was still ripping.

But he (and the BLS) was able get around this embarrassing CPI reality by simply lying about the actual inflation…

In other words: Classic DC fork-tonguing…

China is Not Turning Japanese

But in case you still need further proof that the US wants and needs a weaker USD to fake its way out of their self-created debt disaster via an increasingly diluted USD at YOUR expense, just consider what’s happening with China.

Unbeknownst to many, Yellen has been scurrying off to Asia to convince, cajole or even threaten China into accepting a weaker USD vs the CNY.

Why?

Because the prior, “stronger” 40-year version of the Dollar has rendered expensive US exports (and trade deficits) unable to compete with cheaper Chinese goods.

This floating currency game was a trick the US played on Japan when I was a kid—i.e., weaken the USD to fight the then-rising Sun of Japan’s then rising power.

But China ain’t Japan. It won’t float its currency in dollar terms.

So, what then can the US do to weaken the USD without upsetting China?

Does DC Finally Want Higher Gold Prices?

Well, as Luke Gromen once again makes beautifully clear, the easiest path forward for all parties concerned is to simply (and finally) let gold go much, much higher.

The surest and steadiest path to a weaker USD is higher gold.

Yellen’s Treasury Department could use its Exchange Stabilization Fund to buy/sell gold and other financial securities to control the USD without having to rely so much on the Fed’s now embarrassing money printer.

Gold is now a critical pivot point and tool for the US. If gold went, for example, to $4000 while CNY gold sits at 16,000, China’s central bank would have to re-rate higher in Dollar terms, pushing the CNY higher.

But such an arrangement won’t upset China, as it holds a lot more gold than the World Gold Council reports.

Rather than float the CNY in Dollar terms, China could instead float its CNY in GOLD terms.

In short: A veritable win-win for the China and the US, with gold now leading the way.

Or stated otherwise, you know it’s gonna be a gold tailwind, when both China and DC are seeking higher gold.

Based on the foregoing, do you still think gold does nothing?

Think harder.

Tyler Durden

Sat, 04/20/2024 - 11:40

Via Telegram

Via Telegram

Recent comments