The Baby Hoax: Reporters Repeat False Narrative Over Child Deportations

Authored by Jonathan Turley,

For years, the mainstream media has been criticized for open political bias, including repeating false narratives and claims.

There is little evidence that that will change despite falling revenues and audiences.

That was evident this week as leading journalists continued to raise a dubious claim about the Trump Administration deporting children, including cancer patients.

The media has been promulgating a false claim that children as young as four are being deported.

The Administration immediately stated that the decision rested with the mothers on whether they would take the children or leave them in the United States with family.

Many of the same figures accused of promulgating false stories quickly picked up the spin from the Washington Post.

On NBC’s Meet the Press, Kristen Welker pursued the narrative with Secretary of State Marco Rubio:

KRISTEN WELKER: Let’s talk now about some new reporting that came in overnight. I want just to go through it with you and for our audience. Three U.S. citizen children have been deported with their mothers. Now this is according to The Washington Post. The family’s lawyer says one of them is a 4-year-old with Stage 4 cancer, deported without medication or ability to contact doctors. The family’s lawyers are also saying their clients were denied communication with family and legal representatives before being deported, and it’s raising concerns about the issue of due process. That it’s being violated. So let me ask you, is everyone on U.S. soil, citizens and non-citizens, entitled to due process?

MARCO RUBIO: Yes, of course. But let me tell you, it looks- in immigration standing, the laws are very specific. If you are in the country unlawfully, you have no right to be here and you must be removed. That’s what the law says. Somehow over the last 20 years, we’ve completely lost this notion that somehow- or completely adopted this idea that yes, we have immigration laws but once you come into our country illegally it triggers all kinds of rights that can keep you here indefinitely. That’s why we were being flooded at the border, and we’ve ended that. And that’s why you don’t- you see a historically low number of people not just trying to cross our border, trying to cross the border into Panama, all the way down in the Darien Gap. I mean- i it’s been a huge help for those countries as well. On the headline- that’s a misleading headline. Okay? Three U.S. Citizens, ages 4, 7 and 2 were not deported. Their mothers who were illegally in this country were deported. The children went with their mothers. Those children are U.S. citizens- they can come back into the United States- there’s- their father or someone here who wants to assume them. But ultimately who was deported was the mother- their mothers who were here illegally. The children just went with their mothers. But it wasn’t like- you guys make it sound like ICA agents kicked down the door and grabbed the 2 year-old and threw them on an airplane. That’s misleading. That’s just not true.

That would ordinarily leave a journalist looking at their shoes in embarrassment, but Welker decided to double down and add the claim that children are being denied “due process”:

WELKER: Just to be clear, because I do want to get to the overhaul at the State Department. Is it the U.S. policy to deport children, even U.S. citizens, with their families- and I hear what you’re saying- without due process? Just to be very clear there.

RUBIO: Well- no, no, no. No, no. Again, if someone is in this country unlawfully, illegally, that person gets deported. If that person is with a 2-year-old child or has a 2-year-old child and says “I want to take my child with you- with me,” well then you have two choices. You can say yes, of course, you can take your child whether they’re a citizen or not because it’s your child or you can say yes, you can go, but your child must stay behind. And then your headlines would read, “U.S. holding hostage 2-year old, 4-year-old, 7-year-old, while mother deported.”

There is a great deal of litigation working through the courts on the level of due process required for deportations. The public overwhelmingly supports the deportation of unlawful immigrants and elected Trump based on his pledge to carry out such deportations. Unlawful immigrants often spend years in this country despite orders of deportation or removal. The level of review depends on their status. If they have previously entered unlawfully, they are subject to expedited removal.

The critical point, however, is that the children are not being deported.

If they were born in this country, they are still treated as U.S. citizens (though the Administration is challenging birthright citizenship in the courts).

Having a child in the United States does not make parents immune from removal or afford them special legal status over other deportees.

Over at CBS, Margaret Brennan (who was criticized for her “fact checks” in the presidential debate) also jumped on the narrative in interviewing Border Czar Tom Homan on Face the Nation:

MARGARET BRENNAN: On Friday, there were three American citizen children, born here, who were deported along with their mothers from Louisiana down to Honduras. And according to advocates, one of them is a 4-year-old child with Stage Four cancer. A rare form of metastatic cancer who was sent back to Honduras without getting to talk to a doctor and without medication. I understand this child’s mother entered this country illegally. But isn’t there some basis for compassionate consideration here that should have allowed for more consultation or treatment?

TOM HOMAN: Well, it certainly is discretionary. I’m not aware of this specific case. But no U.S. citizen child was deported. Deported means you gotta be ordered — reported by the immigration judge. We don’t deport U.S. citizens.

BRENNAN: The mother was deported along with the children.

HOMAN: These children- Children aren’t deported. The mother chose to take the children with her. When you enter the country illegally and you know you are here illegally and you choose to have a U.S. citizen child, that’s on you. That’s not on this administration. If you choose to put your family in that position, that’s on them. But having a U.S. citizen child, after you enter this country illegally, is not a “get out of jail free” card. It doesn’t make you immune from our laws. If that’s the message we send to the entire world, women are going to keep putting themselves at risk and come to this country. We send a message: you can enter the country illegally, that’s okay, you can have due process at great taxpayer expense, get ordered to move, that’s OK. Don’t leave, but have a U.S. citizen child and you are immune from removal? That’s not the way it works.

BRENNAN: So you don’t think there should be compassionate consideration for a 4-year-old child undergoing treatment for cancer?

HOMAN: I didn’t say that. I said ICE officers do have discretion-

BRENNAN: That was the question.

HOMAN: ICE officers do have discretion. I’m not familiar with the specific case. I don’t know what facts surround this case. I was just made aware of this when you mentioned it this morning. I was not aware of that case.

Brennan correctly noted that a court recently found a lack of due process in a child’s case. However, Holman had a reasonable response in citing the mother’s election in this one case to leave with her child.

BRENNAN: On Friday, a federal judge who was appointed by President Trump said a 2-year-old American citizen child had been sent to Honduras with the mother. But the judge said, quote: “there was no meaningful process.” So again, this is another similar situation and dynamic. Shouldn’t there be special care when the deportation cases involve small American-born children?

HOMAN: First of all, I disagree with the judge. There was due process. That female had due process at great taxpayer expense and was ordered by an immigration judge after those hearings. So she had due process. Again, this is Parenting 101. And you can decide to take that child with you or you can decide to leave the child here with a relative or another spouse. Having a child doesn’t make you immune from our laws of the country. American families get separated every day by law enforcement- thousands of times a day. When a parent gets put in jail, the child can’t go with them. If you are an illegal alien and you come to this country and you decide to have a U.S. citizen child, that’s on you. You put yourself in that position.

BRENNAN: Well, when it came to this particular case, you just pointed out that they could have made arrangements. The father tried, actually, to make arrangements as we understand it through our reporting. But he and the mother who were separated, since she was in detention after showing up for her appointment, was only allowed a very brief phone call. The father tried to petition to get the child handed over to an American citizen relative. So the mother had to make this decision and took the child with her. It just seems like there could be some more time frame here around due process allowed. That’s what the judge is saying, is saying- there should have been more of a process here.

HOMAN: There was due process. The 2-year-old baby- the two year old baby was left with the mother because the mother signed a document requesting her 2-year-old baby go with her. That’s the parent’s decision. I don’t think the judge knows the specifics of this case. The 2-year-old went with the mom. The mom signed a paper saying, “I want my 2-year-old to go with me.” That’s a parent’s decision. It’s not a government decision, it’s a parent’s decision.

BRENNAN: The father wrote a note. Anyhow, we have to leave it there, Director. Thank you for your time today. We’ll be right back.

It is important to note that these are two very different cases that were blended into the coverage.

In the second case, the government insists that there was no prior arrangement for the child to be left with the family and that the mother made this decision.

ICE should endeavor to accommodate such requests and there should always be an inquiry into allegations that these women were prevented from making arrangements for their children to remain in the country. However, there will also be practical limits in addressing those issues in the midst of a removal.

If Homan is correct, the mother was in the system long before the actual removal. The father “sending a note” at the end of that process is worth looking into, but it is hardly surprising that the removal proceeded with the mother’s consent.

The same narrative was playing over at ABC as Martha Raddatz had this exchange with former DoJ spokesperson Sarah Isgur:

MARTHA RADDATZ: Sarah, I want to turn here to some information that has been in The Washington Post about deportations of very young children who are American citizens. A 2-year-old, a 4-year-old, a 7-year-old sent back to Honduras. Is that legal?

SARAH ISGUR: This is something our immigration system deals with nearly every day. U.S. citizen children have to make that decision with their parents of whether they’re going to stay. The parent has the decision. We do not allow illegal alien parents to stay just because they have custody over U.S. citizen children, and at least one of these cases with the 2-year-old, the mother was the one who made the decision to take her daughter with her. The father is the one saying he wanted the daughter to stay here. Often times, it’s going to look more like a custody dispute than an immigration question.

Again, as Isgur correctly points out, this is the election of the parents who are being removed.

Critics have pushed back on these interviews, noting how the media seemed only marginally interested in thousands of children lost in the system under the Biden Administration as millions poured over the border.

The coverage suggested that children were being thrown on planes to be dumped in some foreign land.

The Washington Post, which is cited for the story, has been repeatedly accused of pushing misleading or false narratives. There was a recent riot in the newsroom when owner Jeff Bezos demanded that the newspaper return to more balanced coverage.

The most telling condemnation came from Post columnist Philip Bump, who wrote “what the actual f**k.” Bump has been repeatedly accused of false claims and previously had a meltdown in an interview when confronted about past false claims. After I wrote a column about the litany of such false claims, the Post surprised many of us by stating that it stood by all of Bump’s reporting, including false columns on the Lafayette Park protests, Hunter Biden’s laptop, and other stories. That was long after other media debunked the claims, but the Post stood by the false reporting.

We have previously discussed the sharp change in culture at the Post, which became an outlet that pushed anti-free speech views and embraced advocacy journalism. The result was that many moderates and conservatives stopped reading the newspaper.

In my book on free speech, I discuss at length how the Post and the mainstream media have joined an alliance with the government and corporations in favor of censorship and blacklisting. I once regularly wrote for the Post and personally witnessed the sharp change in editorial priorities as editors delayed or killed columns with conservative or moderate viewpoints.

Last year, that culture was vividly on display when the newspaper offered no objection or even qualification after its reporter, Cleve Wootson Jr., appeared to call upon the White House to censor the interview of Elon Musk with former President Donald Trump. Under the guise of a question, Wootson told White House Press Secretary Karine Jean-Pierre “I think that misinformation on Twitter is not just a campaign issue…it’s an America issue.”

The baby hoax shows that little has (or likely will) changed. In the meantime, the public is moving on. New media is rising as mainstream media audiences shrink. Journalists and columnists are increasingly writing for each other as polling shows trust in the media is at an all-time low.

Robert Lewis, a British media executive who joined the Post, reportedly got into a “heated exchange” with a staffer. Lewis explained that, while reporters were protesting measures to expand readership, the very survival of the paper was now at stake:

“We are going to turn this thing around, but let’s not sugarcoat it. It needs turning around,” Lewis said. “We are losing large amounts of money. Your audience has halved in recent years. People are not reading your stuff. Right. I can’t sugarcoat it anymore.”

It simply does not matter. The media continues to vigorously saw on the branch upon which it is sitting.

Jonathan Turley is the Shapiro professor of public interest law at George Washington University and the author of “The Indispensable Right: Free Speech in an Age of Rage.”

Tyler Durden

Thu, 05/01/2025 - 10:25

Buchanan

Buchanan

Holt

Holt

Treasury Secretary Scott Bessent and Ukrainian Economy Minister Yulia Svyrydenko sign the deal. US Department of the Treasury/Reuters

Treasury Secretary Scott Bessent and Ukrainian Economy Minister Yulia Svyrydenko sign the deal. US Department of the Treasury/Reuters

Via Associated Press

Via Associated Press

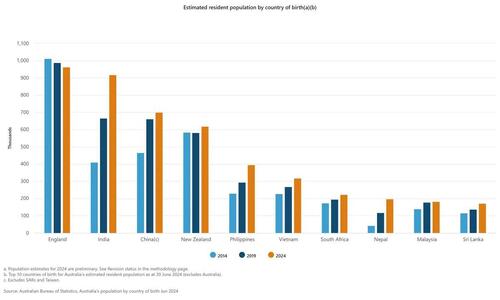

A young boy enjoys the Diwali light show put on by residents of Phantom Street, Nirimba Fields in western Sydney on Nov. 1, 2024. Brook Mitchell/Getty Images

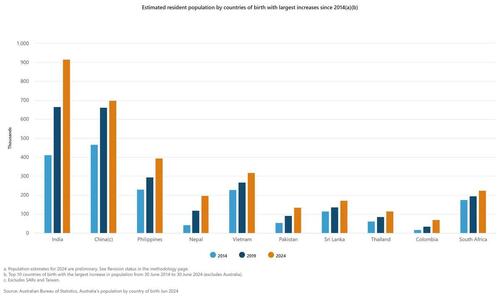

A young boy enjoys the Diwali light show put on by residents of Phantom Street, Nirimba Fields in western Sydney on Nov. 1, 2024. Brook Mitchell/Getty Images Data from the Australian Bureau of Statistics on the country's overseas-born population. ABS

Data from the Australian Bureau of Statistics on the country's overseas-born population. ABS

The U.S. Supreme Court building in Washington on Feb. 10, 2025. Madalina Vasiliu/The Epoch Times

The U.S. Supreme Court building in Washington on Feb. 10, 2025. Madalina Vasiliu/The Epoch Times

Illustration by The Epoch Times, Shutterstock

Illustration by The Epoch Times, Shutterstock A water delivery truck loads water for sale in Tijuana, Mexico, on March 24, 2025. On March 20, the United States announced it denied Mexico’s request for Colorado River water, pressuring the country to meet its obligation to deliver 1.3 million acre-feet of water to Texas under the 1944 Water Treaty. Guillermo Arias/AFP via Getty Images

A water delivery truck loads water for sale in Tijuana, Mexico, on March 24, 2025. On March 20, the United States announced it denied Mexico’s request for Colorado River water, pressuring the country to meet its obligation to deliver 1.3 million acre-feet of water to Texas under the 1944 Water Treaty. Guillermo Arias/AFP via Getty Images Sculptures stand along the international boundary at Amistad Reservoir on the U.S.–Mexico border near Ciudad Acuña, Mexico, on Feb. 21, 2017. Guillermo Arias/AFP via Getty Images

Sculptures stand along the international boundary at Amistad Reservoir on the U.S.–Mexico border near Ciudad Acuña, Mexico, on Feb. 21, 2017. Guillermo Arias/AFP via Getty Images

Recent comments