By paul craig roberts

The free trade theory set out by David Ricardo at the beginning of the 19th century is merely a special case, not a general theory.

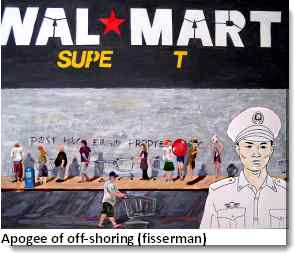

These are discouraging times, but once in a blue moon a bit of hope appears. I am pleased to report on the bit of hope delivered in March of 2011 by Michael Spence, a Nobel prize-winning economist, assisted by Sandile Hlatshwayo, a researcher at New York University. The two economists have taken a careful empirical look at jobs off-shoring and concluded that it has ruined the income and employment prospects for most Americans. (Image: fisserman)

To add to the amazement, their research report, "The Evolving Structure of the American Economy and the Employment Challenge,"was published by the very establishment Council on Foreign Relations.

For a decade I have warned that US corporations, pressed by Wall Street and large retailers such as Wal-Mart, to move offshore their production for US consumer markets, were simultaneously moving offshore US GDP, US tax base, US consumer income, and irreplaceable career opportunities for American citizens.

Recent comments