It's the usual question that someone asks after getting hit over the head and mugged, or if they were in the immediate vicinity of an explosion.

For the American taxpayer, both of those things happened during these past two weeks.

So many unprecedented events took place in such a short period of time that it was hard to keep up. Lots of people said lots of scary things, but few stopped to break down the most important issues, which are: a) how did we get here, b) what exactly is being done, and c) what does it all mean.

I'm going to try to help with those question.

Congratulations! You now own the mortgage industry!

To tell the story of how we arrived at the bailout and virtual nationalization of Fannie Mae and Freddie Mac you have to go back to March 20, when the Bush Administration decided that it was going to use Fannie and Freddie's reserve capital to bail out the entire real estate sector. The capital reserves were supposed to help in the event of a catastrophic financial event, like the meltdown of the real estate market.

"Additional capital will enable the companies to help more homeowners and will strengthen the underlying fundamentals of the mortgage market."

- Treasury Secretary Paulson

Strike 1 for the bailout team.

Then the Bush Administration decided that all they needed was a "bazooka" (as Secretary Paulson called it) of bailout legislation to restore confidence in the massive mortgage giants. As it turned out the threat of nationalization crashed Fannie and Freddie stock, instead of bolstering it as the Bush Administration planned. Thus the $5 Trillion bailout became a necessity.

Which proves that neither the Bush Administration, nor the financial media, really understand the markets.

Strike 2 for the bailout team.

A week ago Fannie and Freddie got bailed out for a minimum of $200 Billion in taxpayer dollars. Most likely it is going to cost a lot more than that.

End of story, right? Wrong.

It turns out that the White House gang that can't shoot straight, in forcing Fannie and Freddie into default, and then nationalizing them, caused an even larger problem.

Congratulations! You now own the largest insurance company in the world!

Let me introduce you to the concept of credit default swaps.

Basically they are an insurance policy on debt (ie bonds) that a third party sells in case the debtor defaults on their obligations.

To give you a quick and dirty explanation, Fannie and Freddie handled the largest source of debt in the entire world (ie mortgages). That makes it also the source of the largest need for insurance (ie credit default swaps) on that debt in the world. And who is going to handle all that insurance? Why the largest insurance company in the world - AIG.

Which brings us to the problem of the Fannie and Freddie bailout.

The U.S. government's seizure of Fannie Mae and Freddie Mac has triggered more than $1 trillion of credit default swaps tied to the mortgage giants.

The International Swaps and Derivatives Association said in a memo on Monday that 13 major credit default swap dealers unanimously agreed that a credit event had occurred.

By nationalizing the mortgage giants we also triggered an event that caused $1.5 Trillion in credit default swaps to be paid out to their holders, and AIG was right in middle of that.

Strike 3 for the bailout team.

Within just a few days AIG was getting bailed out by the American taxpayer to the tune of $85 Billion.

Oh, one other thing about that AIG that didn't get much press: the Fed suspended a few rules that exist to protect shareholders. What does this mean?

The conglomerate financial firms are permitted at this point to use private individual brokerage account funds to relieve their own liquidity pressures. This represents unauthorized loans of your stock account assets. So next, if the conglomerate fails, your stock account is part of the bankruptcy process.

Congratulations! You're broke!

Not everyone got bailed out this week.

Lehman Brothers were allowed to fail, the largest bankruptcy in American history, thus moral hazard was reintroduced to the market place...well, sort of.

The Federal Reserve Bank of New York took the unusual step of providing some $87 billion in financing to units of bankrupt Lehman Brothers Holdings Inc to prevent disruption in trading markets as customers flee, according to a filing on Tuesday.

Oh, yeah. Did we forget to mention the $87 Billion that we loaned Lehman Brothers after they went broke? Why would we do something like that?

Despite the $87 Billion loan, Lehman still couldn't manage to pay its bills. It seems that Lehman Brothers still owed Freddie Mac a $1.2 Billion, due yesterday.

After the market closed Friday, the 12th bank of the year was taken over by the FDIC.

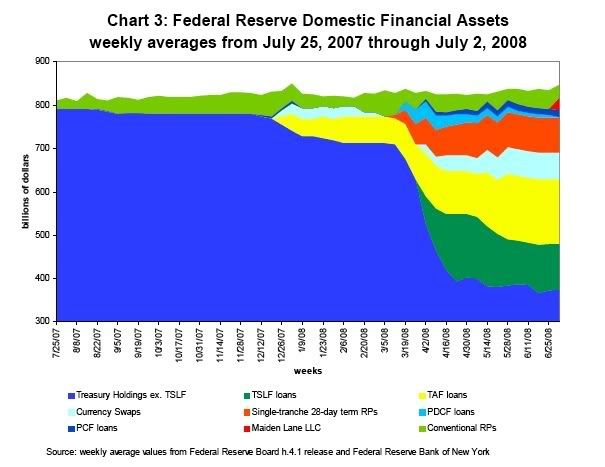

All year long the Federal Reserve has been swapping out the liquid treasury bonds in its portfolio for somewhat questionable mortgage-backed securities from investment banks. This week the Fed expanded this program to include largely worthless and illiquid securities from banks.

So why is this important? Because the Fed portfolio was largely already poisoned with illiquid assets and the treasury bonds were mostly depleted. Which brings up the problem of how the Fed can expand this program. The answer: more borrowing by the treasury.

The Treasury has added almost $300 billion in extra borrowing to offset the impact of central bank programs aimed at helping troubled financial markets and the economy, Karthik Ramanathan, director of the Treasury's debt management office, said in the text of a speech at a conference in New York.

What this means is that the Treasury is borrowing money from the Federal Reserve, at interest that the taxpayer is paying, that it doesn't need to borrow. To put it another way, the taxpayer is now subsidizing the Federal Reserve so it can bail out the Wall Street banks.

World markets roiled

Russia's stock market crashed this week. You didn't notice? In fact Russia completely suspended all trading for two days. Both the Russian government and the Chinese government are now actively buying equities in order to prop up their markets.

As the credit markets seized up, interbank lending rates (ie LIBOR) literally doubled overnight.

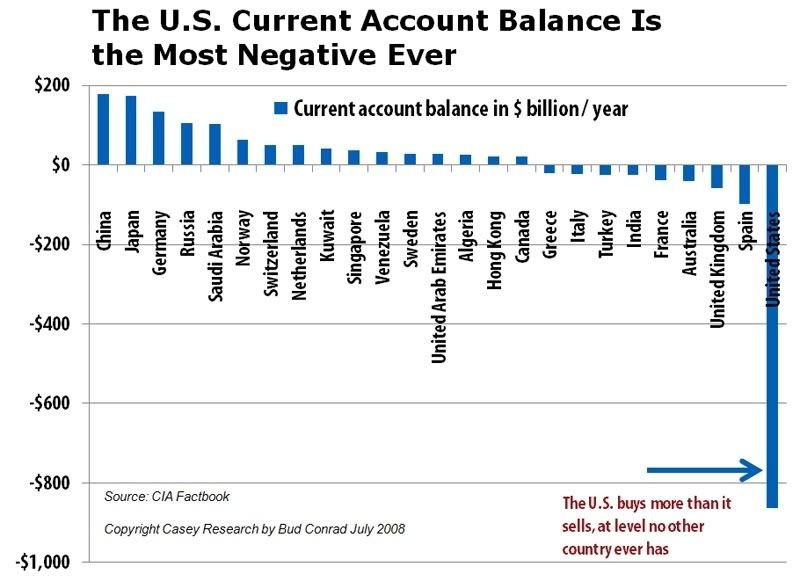

All this caused Mayor Bloomberg to ask, who is going to buy our debt? He's not the only one asking - China is too.

BEIJING (Reuters) - Threatened by a "financial tsunami," the world must consider building a financial order no longer dependent on the United States, a leading Chinese state newspaper said on Wednesday.

This nervousness at the increasing size of federal bailouts has caused our foreign creditors to demand higher interest rates on their loans due to the increasing chance of America going bankrupt. The market now judges our chances of going bankrupt at twice the levels of Austria, Finland and Sweden.

Is this what Bush means by Ownership Society?

Which brings us to the massive government bailout that Paulson proposed on Friday.

WASHINGTON - The Bush administration is asking Congress to let the government buy $700 billion in toxic mortgages in the largest financial bailout since the Great Depression, according to a draft of the plan obtained Saturday by The Associated Press.

This isn't just the largest bailout in American history, it's the largest in human history. It's a huge transfer of wealth from the working class to the investment class. Simple as that.

There is a winner in all this - foreign investors.

Further, since I assume the plan will apply to all mortgage debt, U.S. taxpayers will also be on the hook to bail out foreign institutions that loaded up on the financial sludge. However, once the government takes them off the hook, do not expect them to re-invest the windfall back into other U.S. dollar denominated assets. This get-out-of-jail free card will likely scare them straight. The global mass exodus from the U.S. dollar and Treasury debt is about to begin.

If this bailout happens, not only will it fail to rescue the financial economy (like all the bailouts that have happened so far), not only will it fail to rescue the real estate market (like all the bailouts that have happened so far), it will end up making things worse (like all the bailouts that have happened so far).

What's more, it will ensure that America's near future will end in bankruptcy and the destruction of the dollar.

It's time to stop trying to avoid the consequences of our actions by pushing out the costs onto our children and grandchildren. It's time to do the moral thing and accept the consequences for living beyond our means for years and years.

The alternative, as being pitched by the Bush Administration, will only make things worse for the working American family anyway. We need to tell Congress "no" to this bailout, and we need to do it this week. Any other option leads to an inflationary depression in America that will start with the next presidency.

Comments

I don't even know what to say.

My house, savings, 401K ??? Pension? Social Security? Lots of people are invested and not rich. They have lived conservatively and saved over long periods of time. Not everybody in the markets is rich. May they all rot in hell including the 59 million stupid effing American s that voted for Bush and gave him a second term. He can't get the hell out fast enough.

best timeline I've seen to date

Excellent research midtowng!

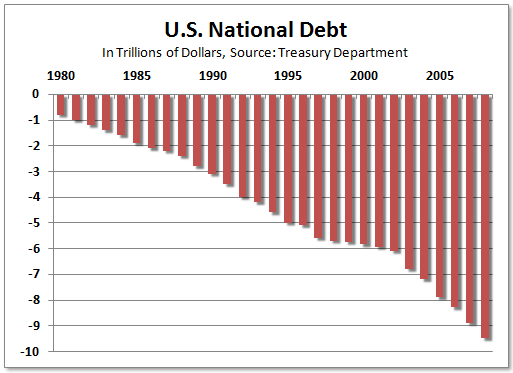

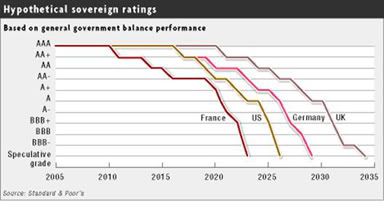

I have a question, on the change of the US defaulting on it's federal debt, that graph I see, when is the date of that assessment?

We're not even seeing the new deficit numbers or costs of this bailout being reported accurately.

You have $700B, I see $800B for this new plan and the previous tally ranges from $500B to $900B.

This is the ultimate question to me and one I have been asking for a week now. Are they going to bankrupt the United States and how do we alert people to this possibility if it is one?

Bankuptcy chart is two years old

The chart was made long before these massive bailouts started.

As for the Bailout of the Bailouts, I think the $700 Billion number will be about as accurate as the Bush Administration estimates for how much the Iraq War was going to cost us.

In the end the Federal Reserve is going to have to start monetizing debt from money printed out of thin air. I truly believe that.

2 years old!

I am really concerned the US is plain going to default!

Dr. Doom says that is not probable and the US has assuredly taken on higher deficit to GDP ratios in the past...

but this time, with all of these foreigners holding US debt I really am not so sure on this one.

Looks like we need to do digging into this possibility.

2 years old! Jesus we know it's way worse before they just started hanging gobs of money to wall street!

Figures.

http://www.openleft.com/frontPage.do

Obama is complicit

I tried to warn people he is in bed with these hedge fund managers, he put Robert Rubins clone, Jason Furman as his chief economic adviser and Goolsbee? Talk about out of reality in terms of cause and effect on current policy, I'm sorry but the guy thinks our trade deficit is no big deal seemingly.

Of course check out Senator Bernie Sanders speech nailing to the cross former Senator Phil Gramm as the primary cause of this disaster. Remember Gramm, America is a bunch of Whiners? Until he said that, he was McCain economic adviser, nuf said there! Unless McCain has an epiphany to realize he is dead wrong on economic policy to actually strengthen the US, this is a true choice of worse and worser.

And your list doesn't even include...

... the MOAB (Mother of All Bailouts) currently in front of Congress.

And it is not clear at all to me that even the MOAB is going to succeed. In fact, I hate to say this, but I suspect it won't. It just throws entire generations' worth of savings down the rathole.

Japan bailed out their banks twice

And it still didn't stop economic stagnation, a collapse of their real estate prices, and massive public debt.

Just look at our record for bailouts so far. They've only made things worse.

S&L bailout of 1989

Basically, when Congress created the program in 1989, it allocated $50 billion dollars. The Resolution Trust Corporation came back to Congress needing more money several times. Over 6 years, they eventually got $110 billion. Table 3 of the GAO report (from 1996) says the total cost was $160.1 Billion. Of that $160.1 Billion, only $28B was from the private sector. The rest was from the Taxpayer!

(http://www.gao.gov/archive/1996/ai96123.pdf )

One of the bs talking points is that they 'made money on this'. I think someone is spinning the fact that the RTC did not use all their money and had $17B left over. Somehow that gets spun into a profit.

CDSes

Now wait a second on these CDSes. If they had just let AIG, GSEs go directly into bankruptcy, can the 3rd party holders of CDSes start making calls on their asset because they are not part of that particular companies portfolio that just went into bankruptcy and liquidation?

Anyone know?

more on CDSes

Financial week has a few more details on these CDSes but as far as I can tell, bankruptcy also means these are still settled and cause major losses across other institutions that by themselves are not in trouble.

CDSes are $65 trillion so figuring how to evaporate this massive debt which they label profits and assets to me seems to be the real plan?

Really want to hear more info on this.

From the wording of the bailout bill

That virtually guarantees that the bailout will be far larger than $700 Billion.

Who says one needs guns to wage war?

This is just unbelievable. And it's a perfect weapon because most people don't understand numbers. They only understand guns.

Debt to GDP

2YrOld,

The ratio of FED debt to GDP is not what matters...it is TOTAL debt to GDP that matters. The reason that the dire predictions about the consequences of large deficits in the 80s never materialized was that debt in all other sectors was very low. Total US debt to GDP in the 80s was 150% to 200% of GDP.

Today, total debt to GDP is 350%!! The debt service has to come out of GDP. The US simply can not afford to expand debt. We are already stroking close to 25% of GDP on debt service. It does not matter which sector (Fed, State/Muni, Consumer, Corporate, Mortgage) the debt is in. We can not take on any more...period. In fact, all this is a symphtom of debt saturation. Debt saturation is the cause, and 'unclogging the channels of credit won't do anything' because there is no more capacity to support the debt service associated with credit growth.

End of story.

BrantW

Do you have any links to papers, graphs analysis on this?

I'm gravely concerned and so far few are focusing in on the possibility of a federal default. I've seen only one expert so far say it will not happen and that's Dr. Doom (Roubini), unlikely to happen but he said that before this latest bill.

Also, come and join us, to the right is a registration and a bunch of features become available to registered users. Sounds like this is one of your interests considering the comment.

very scary, but very sloppy

This is waaaay to sloppy and brief a summary to support analysis of the thinking.

You say that the government took Fannie and Freddie capital to their own purposes? And that the treat of takeover and not bankruptcy caused the fall of the stock value? And who bore the cost of those stock declines and for what amount?

There is nothing here at all that suggests an alternative, but even if there were, I'd suspect it would be sweet talked as much as the current "plan" is badmouthed.

Why did the rest of the market, which is NOT finacial, crash and then rise?

This "report" is far too speculative and shallow to be useful, except, yeah, it's scary, and really fun story if you like being scared.

uh

1. There are proposals in place, Clinton putting out a very specific one as alternatives.

2. this post is well cited with very detailed analysis if you bother to click on the links and read

3. I note you just are slamming the author and not adding to any analysis that would be constructive.

Too Bad

Color me stupid because I don't have a college education in accounting, business, economics,etc. I am just a guy who actually gets his hands and other anatomical parts dirty to pay my bills. So let me put it to you in my simple terms and solution. It doesn't hurt enough. The truth of the matter is these guys are trying to engineer a soft landing and have been for decades. Does anyone remember the Petro Dollars bailout, the S&L's, the junk bonds, the Mexican Peso, or the dot com's. To borrow a popular analogy they just put a different dress on the same pig and pigs, as another populist often says, GET SLAUGHTERED. Did anyone ever get fired, get prosecuted, go to jail or even get black balled for all the stupid schemes? I feel like I am watching a street hustler putting the pea under the walnut shells and shuffling.

This is my solution no one gets bailed out. May be if we all get hurt this nonsense will stop. This constant get rich fast, double figure quarterly growth or your a failure is not realistic. I mean if you want to look at something absurd look at the chairman of CSX whose in a proxy fight with a hedge fund. Let see them run it for a while and then compare results. But I do digress.

Back to the solution no one gets bailed out. First, no bailout for credit cards or car loans. Your stuck and you can't bk or repo them. You pay off the freakin' loan just like the rest of us and maybe next time you won't be so stupid with your money or credit.

Second, no bail out for commerical real estate. This is what you do for a living, supposedly and if your to ignorant or arrogant to structure the deal right then you deserve the same fate as any poor businessman, present company included, you lose.

Now for the home owners and the various institutions holding this paper. You gave and took bad loans on over valued properties with poor money management skills. Again you don't get to just walk away. Far to many of us, probably 90-95%, of the homebuyers, did it the right way and you shouldn't be allowed to break the rules for free.

All the shaky loans get reset as 30 year fixed, at a higher, 7-9%, interest, as ALL risky credit does. Again no bk, no walking away. You and the lending institutions are going to share the pain and suffering of this. I would change the amortization a little and allow a higher percentage of the payment be applied to the principle in the early years.

Now for the institutions that promoted and profited most from these transaction. The $700 Billion dollars is going to use as backup. You don't get dime one. There are literally thousand of college students studying law, economics, business administration, accounting, etc. They need internships and many have student loans. We form them into a task force and along with the FBI and any other enforcement agency we need. We set a good wage but not crazy, say $25-$30/hr., and we credit their time toward a pay off of the student loans.

Together they go through these companies top to bottom e-mails, memos, the books, everything and they get a good proctological exam. On top of that it is posted on publicly accessible website for anyone to review.

The management of these companies have to refund or work off all compensation except base salaries. As for the field guys, the guys in the trenches(????). If you were strictly commission you get a sufficient but not excessive salary. Say nothing more than $ 300,000/ annum.

Once the mess is really understood we can make some decisions. One is that you cannot walk away from this. People are going to feel the pain, including me, but hopefully after this there won't be a next time in my lifetime. We're going to do this somewhat like George Bailey did. Not how much do you want, but how do you need, to get by. And, we are going to charge you for this money and it is going to hurt.

All of these people need to pay a price. So you cannot quit, or work for someone else, or retire until this mess is cleaned up. If you drop dead on the job to bad. It happens all over America everyday.

There it is in basic outline. It needs a little work but not to much. Complexity creates wiggle room and we have seen how these weasels can wiggle.