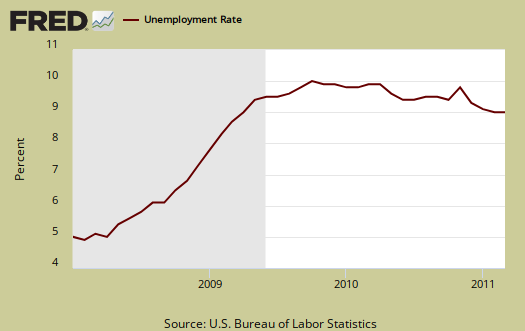

The March 2011 monthly unemployment figures show the official unemployment rate decreased to 8.8% and the total jobs gained were 216,000, with 28,800 of those jobs being private temporary. Total private jobs came in at +230,000 with government jobs dropping -14,000.

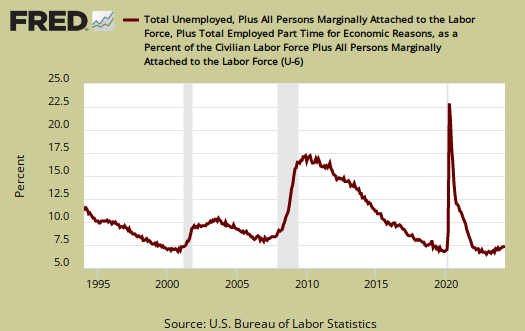

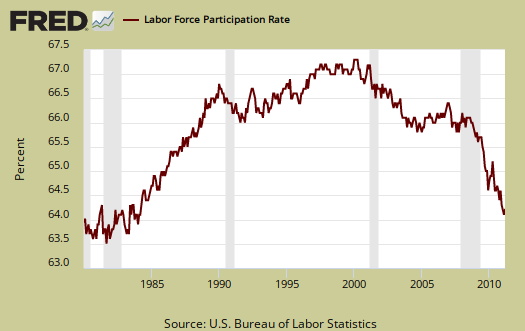

Those entering not in the labor force dropped by -11,000. The labor force participation rate was unchanged, 64.2%, the same as the previous two months. Those added to the civilian labor force was +160,000 and to the noncivilian population, +149,000. This is the lowest labor participation rate since March 1984. U6, or the broader unemployment measurement, dropped -0.2% to 15.7%.

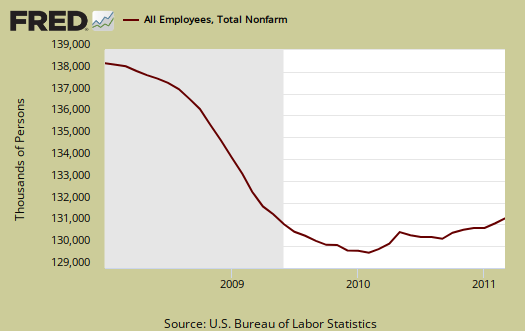

Below is the nonfarm payroll, the total number of jobs, seasonally adjusted. Since the start of the great recession, declared by the NBER to be December 2007, the United States has officially lost 7.245 million jobs. That does not take into account additional jobs needed to employ the United States increased population, but does include the jobs added over the over 3 year time period.

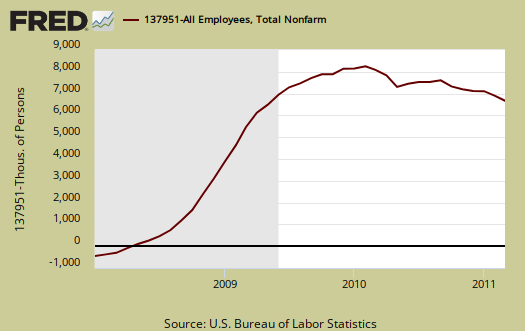

Below is a running tally of how many official jobs permanently lost since the official start of this past recession (recall the private NBER has declared the recession over!). This is a horrific tally and notice this isn't taking into account increased population growth, which implies the United States needs to create at least 10.5 million jobs to break even from December 2007.

We get a new graph of the alternative unemployment measurement, U-6, posted below. Here you can see the incredible increase in comparison to the beginning of this broader unemployment measurement.

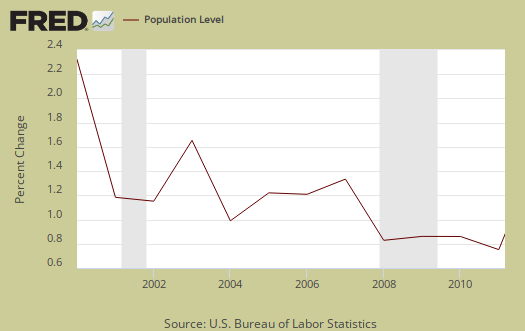

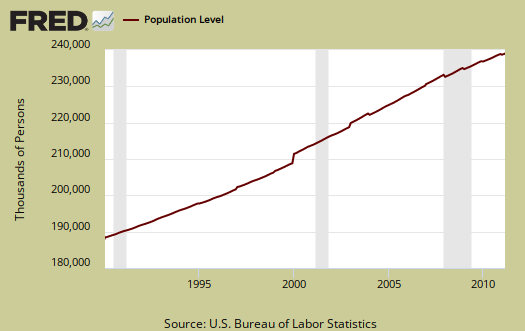

How can the unemployment rate decrease? Because there were 216,000 jobs plus noncivilian non-institutional population was only 149,000 this month, which is a monthly growth deceleration. Below is an annualized graph of civilian institutional population. We see a deceleration of population growth. It's from this category of people that potential workers come from.

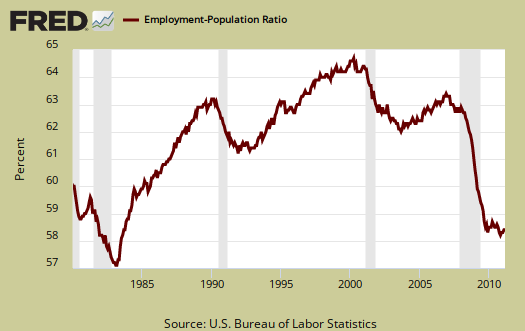

The population to employed ratio increased 0.1%. We finally had enough jobs created to go past the monthly increased of the civilian labor force, plus the estimates for non-institutional civilian population monthly growth have significantly reduced and non-institutional civilian population is the super set of potential workers.

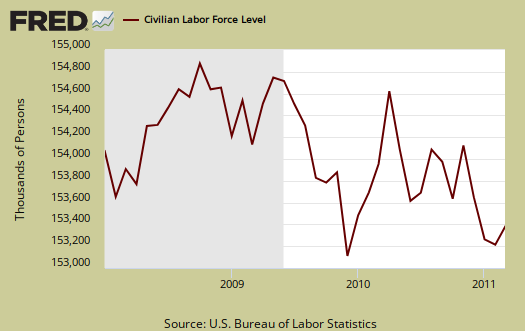

The civilian labor force increased by +160,000. Of those still in the civilian labor force, employed, increased by 291,000 in March, yet those unemployed dropped by -131,000. Those not in the labor force dropped by -11,000 in a month.

The civilian non-institutional population are those 16 years or older not locked up somewhere or not in the military or so sick and disabled they are in a nursing home and so on.

The increasingly low labor participation rate is now at 64.2%. If we go back to December 2007, the labor participation rate was 66%. The highest civilian labor participation rate was in January 2000, at 67.3%. What this means is there are almost 4.25 million people not be accounted for in the official unemployment rate who probably need a job and can't find one.

The employment to population ratio is now 58.5% which is 0.1% point above record lows. This isn't a structural change, such as all families decided to have a stay at home caretaker, or magically a host of people could retire early, this is people dropping out of the count.

These numbers are important because unemployment is a ratio, percentage or during a limited time period, the number of people actively looking for a job and counted. Many people are not counted in the official unemployment statistics, due to definitions, but obviously when one has more potential workers and less jobs, that metric doesn't bode well for America.

Below is the graph of the civilian non-institutional population, which is the largest super-set of the potential labor force, larger than the civilian workforce, due to those who are not looking for work, retired and so on being counted in this figure. This is why one must create jobs greater than the constant rate of jobs lost. There are more people to employ. Unemployment is a percentage, a ratio.

The BLS unemployment report counts foreign temporary guest workers as well as illegal immigrants in their U.S. labor force statistics.

One needs at least 175,000 and some estimate up to 375,000 permanent full time jobs, added each month just to keep pace with U.S. civilian workforce population growth. That's not general population, that's the group needing a job.

While this report now gives two months of solid job growth, bear in mind it's not enough. Don't let the press or the politicians trying to blind you into thinking America doesn't have a jobs crisis.

Hi Robert, I've been

Hi Robert,

I've been wondering how potentially fairly steep public layoffs might effect the employment picture this year and next. I've put a short piece out on this, would like your thoughts (either here or there) on this:

http://amovingworld.blogspot.com/2011/04/private-sector-job-growth-in-ma...

It will assuredly reverberate but how much?

What we can do is get the raw public sector job loss numbers for 2011, the estimate, or even the tally.

Then, what I can do, if this is of interest, is run some multipliers on the indirect effects.

The biggest factor, beyond home devaluations is tax revenues is income tax, so less people working, less revenues.

You know, you can join EP, request and author account and cross post, the rules on it are in the user guide.

Yes, I'd love to see anything

Yes, I'd love to see anything you'd like to do on this. In my piece I linked to what the Legislative Budget Board in TX has estimated for the coming two fiscal years--both direct layoffs and then follow-on effects that ripple through the state economy. They are scary numbers.

in the "more about March unemployment report

The BLS spelled out that local government has lost 416,000 jobs since 09/08.

here.

But projections for 2011/2012, if I can get a national tally, I can apply some multipliers.

Thanks for Beating Back the "Unjustifiable Optimism"

While things are better than two years ago, the unemployed are not out of the woods yet.

Actually I believe most of the long term unemployed are just about where they were two years ago, with fair-poor job prospects in most cases.

What they have in 2011 that they didn't in 2009 are continuing bills and no more unemployment. The last thing they need or the country needs is this happy talk about how things are turning the corner. The stock market has largely returned to where it was. Employment has not and God knows when it will.

Why are all our leaders looking for an excuse to do nothing? They know a majority of people can't hold out 2-3-4-5 years until they get a decent paying fulltime job. And yes, it will take 5 years and more for that to happen.

So what's the plan? Can they really not have a plan at all?

right, they did that last month too

I'm working on more details in a new post and I'm putting up, front and center the "official" unemployed count. Those reports of offshore outsourcing, bring in guest workers, refusing to hire anyone who actually needs a job, i.e. unemployed and all of the rest of it has not gone away with two months of better reports.

That said, these last two months of reports are better news!

Everytime....

we hope then more unnerving news comes along. The Gulf oil spill was months of national agony. Japan, Afghanistan, Iraq, Libya, the Mideast revolutions(good thing) and oil prices are skyrocketing. A new bottom for the housing market. I hope the economy can continue to create 200,000 jobs a month in the face of these headwinds. I'm leery that job creation will falter again this year.

With gas prices the Social Security tax cut has saved people some amount of pain. Sort of a one year fuel allowance. Guess it wasn't all bad. The wealthy class will take more then that from your SS Trust fund so don't feel guilty about it.

there is so much going on

I just don't have enough time to cover it all, but I'll still say, offshore outsourcing to China, India, bringing in foreigners, squeezing Americans from all ends, including financial support and entry/access into higher education, is the biggest problem we have.

Then, I agree, we have these major disasters, so major we're writing about them, even though EP is an economics site, these things do affect the U.S. at the economic level, plus it's so tough to get accurate information....

so, yeah, SS is under attack, workers are under attack, we have a Corporate lobbyist riddled government, including Obama, even worse on the GOP side and no end in site, if anything the corruption is 10 times worse than before the original "crisis".

Thank You for All You Do

"there is so much going on ... I just don't have enough time to cover it all,"

No, you don't. No one individual does.

But you manage to cover an amazing amount of ground here. Plus you respond to individual comments, including mine before I even registered, when I was just an "Anonymous Drive By."

My thanks to you (and the No. 2 around here, Michael Collins) for all the hard work you do.

In a world in which all the modern communications available cannot force the many willfully blind among us to see -- and admit to seeing -- what's plainly in front of them; at a time where educated people who know better will cover their eyes and allow themselves to be ignorant and mislead, this site is a godsend and an oasis.

I salute you, "Robert Oak", whoever and wherever you are.

"Why are all our leaders looking for an excuse to do nothing? "

That's a critical question to answer. I don't know why but I have a notion as to how they get away with it. Because of the barrier of money and media access, ideology can be vetted by those with the money and who own the media. As a result, we get candidates like Obama and McCain who BOTH interrupt their campaigns to come to DC and endorse the bailout, the object of great public ire. It can't hurt them because they're both in agreement. Who else could we vote for at that point? They'd never disagree because they were properly vetted by the money sources, those who had their fortunes riding the bailout.

Why doe they do nothing? Because the can and, imho, because that's their job. Other times their job is to do something. But in the case of action or inaction, their actions are not going to be in our interests, nor should we expect them to behave in that way.

The very best to you in the job quest!

Michael Collins

Report

Thanks for a great rundown of the employment report. The media always misses the message that 120,000 and more jobs each month need to be created to keep up with new entrants to the workforce.

If you count short term and

If you count short term and long term discouraged workers which haven't been counted since 1994 then unemployment in reality is really much higher.

Unemployment is still high in large areas of the US because the money printing stimulus packages from the FED went into funding the outsourcing of US jobs, factories, technology transfers overseas, military bases and intrastructure spending abroad, speculation into financial assets that is pushing up commodity prices and artificial consumption with debt. While Germany and Japan create new money to fund to production the US creates new money out of thin air to fund outsourcing.

I think other States and the FED could learn a lot from North Dakota. Currently the State has the lowest rate of unemployment, one of the highest State GDP growth rates, highest rate of job growth, stable housing market, low crime rates, lowest credit card default rates, and has a budget surplus. Yes North Dakota is rich in oil, but then again some other US States are also rich in oil and other natural resources but do not have an economy booming like North Dakota. What North Dakota does differently is that they have a State Bank that can credit to fund production and industry.

The Bank of North Dakota is an example of a model to follow. It places State tax funds into their own State bank that they can recycle to fund projects and industrial development within the State. Additionally they work with other private banks in the state, also hold deposits of other private banks and individuals. Instead of having to depend entirely on issuing state bonds, they can create credit to fund development within the State. The state of North Dakota has been successful at regularly maintaining low unemployment and budget surpluses with it's state bank because they encourage savings and can create credit to fund development. Also, the deposits with the Bank of North Dakota are not FDIC insured but insured by the State which prevents high over leverage on the Bank balance sheet because the State Bank knows it doesn't have a printing press that it can use to create unlimited amounts of new money. So money is not created to fund much speculation.

Oregon looking at North Dakota model

As I understand it, the idea for an Oregon State Bank modeled on the Bank of North Dakota is under serious discussion in the Oregon legislature, with support from members of both major parties. It started last year with a proposal from an alternative ("third") party called the Oregon Working Families Party. It's probably not getting any play in major media, I don't suppose, but the idea seems to be working its way around the interested public.

OregonLive blog discussion of the proposal

Oregon State Bank bill moves out of committee

According to e-mail received today from Steve Hughes of Oregonians for a State Bank, the bill has moved out of committee with a bi-partisan vote of 4-to-1. Thanks to popular input and grassroots activists, the idea moves forward in Oregon, despite what amounts to a news blackout by the mass of corporate media. Is the corporate media circus becoming as irrelevant to most as it has been to me for some years now? I think there's something to be said for plain old newspapers (like the family-owned Register-Guard of Eugene and surrounding area), and, like, Bloomberg, but tv news like FOX, CNN, ABC ... who cares?

Oregon effort for small business lending

Oregon is moving from the Oregon State Bank to a modification of the same idea, which they are calling the "Virtual State Bank."