Michael Collins

Speculation reigns supreme in your nation's capital. Who is next in line after the bin Laden operation? The bipartisan coalition directing the war on terror forgot one important fact about the security of the United States of America. It doesn't matter who they kill overseas, the assault on almost all citizens continues unabated at home. No one is doing anything to stop it. Only the financial and political elite remain immune. (Image-WikiCommons)

According to the National Bureau of Economic Research, the national economic collapse (aka recession) ended June 2009. That's news to the 55% of the public that believe we're in either a recession or depression (April 2011).

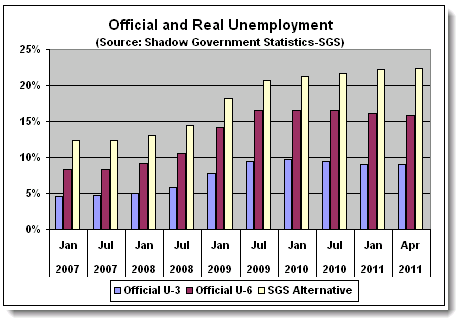

Official unemployment is around 9%. That excludes the marginally employed and under employed. Adding those two groups takes unemployment up to 15.9%. Add the long-term unemployed and the figure climbs to nearly 23%.

The total of all types of unemployment and underemployment reached Great Depression levels in 2009. (Link)

When you have 23% real unemployment/underemployment among those willing and able to work, you have budget deficits at every level of government. Businesses fail or slow down. Governments reduce or eliminate services. People lose their homes and health insurance. Credit ratings dive, making it more expensive or impossible to borrow for any reason, including emergencies. The unemployed contribute much less to the economy, which shrinks substantially, leading to more under or unemployment. There future darkens. All that's left is hope, a commodity of little use today.

If you're part of the financial elite in crowd, you don't need hope. You're about to get another big payday. Much lower taxes and relaxed regulation of foreign exchange derivatives are on the way.

More Corporate Welfare - Tax Breaks for Those with all the Breaks

Obama administration Treasury Secretary Timothy Geithner plans an overhaul of the corporate tax rate. His boss, the president approves, no doubt. Politico reports that Geithner's proposal will reduce corporate income tax from the current 35% to between 26% and 28%. This is a charade since few major corporations pay anywhere near the proposed 26%. ATT paid federal income tax of 2.7% last year. General Electric, with pretax profits of $10.3 billion, paid nothing and got a $1.1 billion tax benefit.

The administration's proposed corporate tax breaks are window dressing to obscure corporate tax breaks that reduce what corporations actually pay, around 17% a year according to one study. There will be no provision to rectify the difference between tax rates on domestic corporate income, 35%, and the 15% corporate tax for income gained overseas.

Will we see loopholes closed that keep most corporations from even coming close to paying the full amount of income tax?

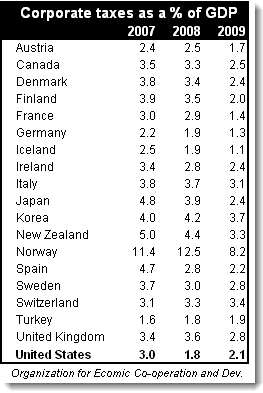

Count on hearing that US corporate tax rates are the highest in the world. This is simply untrue when you count the taxes actually collected. According to the Organisation for Economic Co-operation and Development (OECD), US corporate taxes accounted for 2.1% of the US gross domestic product (GDP-see graph) in 2009, highly favorable compared to the rest of the industrialized world.

To offset any lost tax revenues, Geithner's plan will end some key tax benefits for US manufacturing companies. We can assume that these manufacturing companies will cover the tax benefits for multinationals until the last manufacturing job leaves the United States.

In what appears to be high comedy, Politico reported that,

"Aides say Geithner will personally dive into the negotiations. House Speaker John Boehner also sees this as a ripe area for bipartisan cooperation."

This defies belief. Negotiations require differences. When it comes to corporate policy and subsidies, there is just one party position; that of the bipartisan coalition called The Money Party.

The Forth Horseman of the Looming Collapse - Derivatives Unleashed (again)

Secretary Geithner has been a very busy White House policy operative. While he's giving away the store on corporate taxes, he fails to remind us that Treasury wants to exempt certain currency derivatives - swaps and forwards - from the recently enacted Dodd-Frank financial industry reforms. Recall that the collapse of the Wall Street derivatives scheme, subprime mortgage backed securities, was largely responsible for kicking off the current economic decline.

Derivatives are risky financial instruments largely outlawed until 2000. The 1999 repeal of the Glass Steagall Act barring banks from risky investments and enactment of the Commodity Futures Modernization Act of 2000 changed all that. These bipartisan legislative efforts became the enabling acts for the reckless ride to ruin thanks to Wall Street and the big banks

What are President Barack Obama and Secretary Geithner up to?

Gary Gensler, Commissioner of the Commodity Futures Trading Commission (CFTC) has a clear picture of the Obama - Geithner scheme. Gensler sent a letter to the US Senate in August 2009 objecting to a proposal similar to the one Geithner just released. He said,

"Currency and interest rate swaps could be broken down into their component parts and then restructured to resemble a series of foreign exchange forwards or a foreign exchange swap to come within the scope of these foreign exchange exclusions and thereby avoid regulation." In other words, this proposal opens the door to wider currency speculation.

The exemption for foreign exchange currency swaps and forwards would enable Wall Street and the big banks to continue doing what they have done all along, engage in irresponsible and damaging currency speculation of the type that ruined the economy of Greece, for example.

Commissioner Gensler pointed out that, "these exclusions may have the unintended consequence of undermining the CFTC’s enforcement authority over retail foreign currency fraud." The use of "unintended consequence" is a generous appraisal for a move by Treasury that makes fraud easier. We can better judge Geithner's motives as self-evident from the predicted outcome.

Back to the Future

Gensler made another critical point regarding Geithner's 2009 proposal for over the counter derivatives trading, language that made it into the Dodd-Frank financial reform package:

"The Proposed OTC Act provides for mandatory clearing and exchange trading of standardized swaps. It creates an exception, however, from the mandatory clearing and trading requirements when one of the counterparties is not a swap dealer or major swap participant (and does not meet the eligibility requirements of any clearinghouse that clears the swaps)" Gary Gensler, Commissioner CTFC, August 2009.

The informed public is already suspicious of Wall Street's secrecy and market manipulation. The New York Times headline of December 10, 2010 shows the realty of the situation. This is happening under the Dodd-Frank financial reform legislation. What happens when Gensler's prediction of a separate, unregulated derivatives market operates without regulation as allowed by the financial reform? Another meltdown is in the works thanks to the legislation we were told would make sure that never happened again.

We live in an upside down world. The real threat to the United States is the ongoing economic decline, jobs that they tell us will never return, no new jobs and flat income since 2000, and financial schemes that make a tiny fraction even wealthier while the nation as a whole struggles and declines.

This article may be reproduced entirely or in part with attribution of authorship and a link to this article.

Comments

that is a great reference, so much for that "35%" tax rate!

The reality is only domestic business, those without teams of CPAs, tax attorneys and moving funds, now derivatives (reference to FX swaps), around the globe with creation of fictional holding companies to move patents and assets in various countries and tax havens more of their business than making things.

It is the self-employed, the LLC, the small corporations who are getting hammered, long with the middle class and working poor.

Great references Michael Collins!

saving Social Security by taxing Derivatives

$600 trillion derivatives market = opportunity to reduce National Debt by an additional 1/2 $ trillion yearly

A small 0.5% transfer fee on the $600 trillion Derivatives market would pay off the debt without cuts in Social Security, Medicare or Medicaid. It would raise $500 billion per year.

Reference: How to Pay Off the National Debt by Kainz available at Barnes and Noble or amazon.com

Jim Kainz - tax derivatives

Great idea and we've have many proposals on some sort of transaction tax on trades, generally, but putting a tax on derivatives, esp. those which create systemic risk, are the most "fictional", say CDS since they are not 1:1, i.e. the trader has no connection to the underlying asset would be great.

If you want to have your book reviewed, email me off line and get me a copy and I'll write it up as a post.

Sounds interesting and frankly, anything the MNCs or Wall Street doesn't like, which are usually sound proposals, gets suppressed for even public discourse.

transfer fee on Derivatives

How to Pay Off the National Debt

© 2010 James F. Kainz

Within Ten Years:

(1) Pay off $4 trillion of the national debt.

(2) Have consumers choosing electric/hybrid E85 passenger vehicles that get 100 miles per gallon of E85 fuel and 700 or more miles per gallon of gasoline.

(3) Be free of dependence on foreign sources of fuel.

Solutions

1. Begin to pay down the national debt by taxing derivatives. A 0.5% tax on the buyer and seller of each transaction would raise substantial revenue. There are over $600 trillion of derivatives in circulation currently, and the tax could pay off the existing $13 trillion national debt within the lifetime of most people alive today. This would avoid passing the debt on to future generations.

2. Initiate a 5% stake for the federal government in companies accepting Small Business Administration loans for new business start-ups. In addition to paying back the full amount of the loans, the businesses would grant a 5% ownership interest to the Small Business Administration (SBA) as compensation for providing the venture capital. The program is already a success at creating employment and tax revenues for the country. It should be significantly expanded, and retaining a piece of the new company would contribute to the social benefit of the operation.

3. Loss of freedom is a fair sanction for criminal behavior. Warehousing humans is a societal waste of resources. Prisoners should be offered the opportunity of doing community service while doing their time. It would be administered by prison personnel and selectively granted to some prisoners at the discretion of the authorities. Reduction of the cost of incarceration should be one of the objectives.

4. End the oil depletion allowance. It is an accounting lie. No out of pocket expenditure is incurred, and it constitutes a double charge off for tax purposes. Not only are true costs being deducted, a fictional phantom is engendered by legal definition. It was created during World War I to stimulate exploration at a time of national emergency—an emergency that no longer exists. Now it destructively diverts market resources to oil away from alternative energy sources, which are disadvantaged by this subsidy. Renewable energy does not enjoy a level playing field against this institutionalized bonus for petroleum because of the preferential tax treatment.

5. Federal budgets should be in surplus four years out of every five. The only exceptions should be for recession, war, or disaster. Deficit spending should be rare and only used when truly justified. This principle should not be enshrined as a constitutional amendment; but, rather, as a pledge to voters signed by candidates to elective federal public office.

6. American military troops based overseas should be reduced by 75% within five years to reduce expenses. Staffing fixed bases in Germany, Japan, and South Korea with tens of thousands of soldiers is an outmoded method of exercising power. Those expenditures could be better used for communications, mobility, new weapons systems, and readiness. Better to keep those forces within the United States, ensure that the money contributes to our economy, and make the troops available for use in potential conflicts.

7. Cheap transportation is essential to economic prosperity. The target for miles per gallon of gasoline on new cars sold in the United States should be raised from 25 in 2010 to a range approaching 700–1000 by 2020. This is achievable if consumers stop buying gasoline-only powered vehicles and buy electric/hybrid engines that utilize E85 for fuel. Most trips are shorter than forty miles and could be completed on battery power alone. For longer distances, the fuel would be mostly non-corn ethanol with a small percentage derived from oil. A forty-fold increase in miles per gallon of gasoline would reduce our dependence on oil, free us from foreign suppliers, and stimulate the economy simultaneously.

A New Quasi-Governmental Agency:

Federal Assets and Liabilities Board

(1) The purpose of the FALB is to pay off the national debt of the United States.

(2) It will be a private business for the public good.

(3) It will not be financed by or a part of the federal government.

(4) It will receive revenue from a 0.5% transaction fee assessed on all derivatives transactions executed within the United States.

(5) Salaries and expenses will be paid from a 2% cut of revenues Operations Fund. All the remainder 98% will be used to pay off the national debt.

(6) The Chair and Vice-Chair will be elected by voters in all states.

(7) Regional Presidents will be elected from geographical locales coterminous with the Federal Reserve Districts. All voters in those areas will be eligible to vote for their Regional President.

(8) A Venture Capital Committee will consist of the Chair, Vice-Chair, and three of the Regional Presidents in a rotating order. They will have monies available from the 2% Operations Fund. They will make loans to individuals and companies who apply for funding. These loans will require a repayment of 100% of the monies borrowed and the transfer of a 5% stake in the borrowing firm to the Federal Assets and Liabilities Board (FALB). No taxes will be paid by the FALB. Instead, 98% of the fees received from the transaction fee on derivatives will go directly toward paying off the national debt.

(9) The FALB will be directly responsible to the voters. Annual reports will detail transactions for the period and make activities transparent to the public.

(10) After ten years of operation, the charter of the FALB will be reviewed by the voters for renewal or dissolution.

Derivatives

One of the simplistic explanations of the Great Recession (Great Panic) that we just went through chalks up much of our trouble to sub-prime mortgages. Ben Bernanke was right about that. The sub-prime mortgage market was not big enough to sink the American economy. What Bernanke missed is that there were much larger dollar amounts of derivatives based on sub-prime mortgages in existence that could and did help trigger the meltdown.

The amount of derivatives in circulation now is over $600 trillion. To put that in perspective, the entire output of the U.S. economy in 2010 will be $14 trillion. That means the value of derivatives is over forty times the U.S. GDP.

Derivatives are financial instruments that derive their value from other events. Crop futures for farmers are one type. The value of the contract is derived from a future value of corn, for example. If a corn farmer wants to take out an insurance policy against a decline in corn prices, she can buy a "put" derivative based on the future price of corn. If the price of corn goes below her "strike" price, she will collect compensation based on how much below the strike price the market goes. If an airline wants to hedge against an increase in aviation fuel costs, it can buy a "call" derivative to offset the increase above the strike price.

Those are socially beneficial derivatives.

An example of evil derivatives would be slicing and dicing mortgage baskets of specific properties so that the buyer and seller have no insurable interest. They neither own the property nor the mortgage, but they can "bet" on whether a certain amount of the mortgages will default. That is why some critics referred to the Wall Street derivative marketplace after this crash as a "casino" for rich people.

Derivatives are a market where you can place a bet on an event that you have no stake in. I could place a bet on whether your house will burn down. I don't own your house; I don't have a loan against your house; I cannot buy a fire insurance policy on your house because there are laws against that since I have no insurable interest; but I could buy a derivative for a million dollars that your house will burn down. If your house burns down, I collect a million dollars as long as I have paid the ridiculously low premium! This manner of gamboling is unregulated.

That is why derivatives are more dangerous than all the other issues, such as globalization, sub-prime loans, or liar mortgages, that our recent meltdown has been blamed on.

Probably fewer than 5% of Americans have any concept of what derivatives are or that they are anywhere near as sizable, dollars-wise, as they are.

Many real problems contributed to the crisis. They deserve thoughtful discussion and attempts at resolution:

1. A person went from the insurance industry to a derivatives desk at a hedge fund. His annual compensation increased from $100,000 to $30,000,000 in 1 year. The sad part of the story is he did not even know what he was selling. He got a tiny commission, but his sales were in the billions of dollars.

2. Incentives to go into finance are misaligned with social values.

3. The middle class is vanishing. The gap between the lowest paid and the highest paid is widening to the point that it is destructive.

4. Interests of owners are divorced from the interests of their agents who work for them.

5. Values beyond dollars are not built into measurements such as the GDP, bonuses, damage to the environment externalities, and other metrics we use for decision making.

6. Political leaders are chosen by a faulty campaign funding process.

7. Measurements of risk are flawed, and rating agency compensation is based on a conflict of interest where the debt issuers pay for their own product ratings.

8. Damage to the whole economy (systemic risk) by certain big corporations is poorly understood or monitored. Nothing has been done to eliminate the concept of “too big to fail.”

Attention to these issues deserves public discussion and resolution. But having the financial wherewithal to deal with them (by eliminating the national debt) is the cornerstone to ensuring against a repeat of the disaster we have just found ourselves in.

Growth

It’s the Economy, Stupid

The way out of the Great Recession (Great Panic) is through growth.

The Great Depression was stalled by Keynesian economics, but the efforts were too slow, too timid, and too halting. It took the unbridled deficit spending of World War II to turn record high unemployment and underutilization of production capacity into the greatest engine of productivity the world has ever seen. The U.S. economy was a time bomb waiting to explode. We had a trained work force and facilities waiting to be put to use. The war gave our leaders the excuse we needed to deficit spend with gusto. Matching capacity to need was Herculean but doable. The danger of the military threat gave us just cause to engage in stimulus that would have never otherwise been adopted by political leaders for fear of a public outcry.

We again face large unemployment, inactive funds, and an underutilized capacity to produce. We have huge, unmet economic needs. It is a new time bomb ready to unleash a new round of economic prosperity—it’s about to explode; we just need the national unity to light the fire. What we lack is will—the will to turn our potential into reality.

The United States has been satisfied with long-term growth of 3–5%. That has been considered high. It should be twice that. And we can target that growth rate with an objective to keep inflation below 2%, or thereabouts. China has sustained that level of growth for decades. We should do no less. Many problems go away when we have sufficient resources to solve our long list of needs.

Central to making this happen is eliminating our national debt. As long as our financial resources are constricted, property values will be depressed, the stock market will languish, jobs will be scarce, the environment will suffer, and a whole host of issues will not be dealt with. If we have the money to spend on national prerogatives, we can put unemployed people to work. We can profitably invest billions of dollars of capital, which is sitting on the sidelines. And we can start making socially desirable progress in areas where we decide to set our priorities.

Money (not greed) is good. Money is the facilitator; money makes things happen; money makes half of the problems go away.

Supply-side economics got it half right: free markets are essential to prosperity. What Supply-side economics left out was regulation. Supply-side economics (and the Austrian School of economics) was too often married to deregulation—private enterprise was king, government was bad. The Arch of Success requires two columns of support: free markets and effective regulation.

Putting a driver in the backseat (free markets absent effective regulation) is what drove us into the ditch. The stimulus plans of our new administration have barely gotten us out of the ditch, and there are no considerations as to how to make our vehicle soar. What will make us soar is a thoughtful plan with numbers, time frames, and dollar amounts to put America back to work. That is the plan we seek to lay out in this Financial Telesis project. Idle workers and plants are a social waste.

Let us stop discussing lowering benefits for people on Social Security, restricting executive salaries, delaying retirement, and postponing environmental rescue.

Let us start talking about how to get rid of foreign oil dependence; remake our transportation system; finance new small businesses; and afford to keep our entitlements to dignified retirement, medical care, and education.

"Dow 30k by 2020" could become a platform for both political parties. Creating jobs, eliminating the national debt, eradicating our dependence on oil at the same time as reducing our dependence on foreign sources of energy supplies are priorities we can unite on together as a nation. The right will criticize this agenda as too liberal because it seeks to emphasize the role of government and break the back of Big Oil. The left will criticize it as too conservative because it emphasizes profits and free markets. I hope the political center will embrace it as a modicum of common sense, jobs and prosperity for all.

Our resources are great. Our needs are great. Is it really rocket science for Americans to figure out how to match the two? We have the talent. What we lack is political civility, which would allow us to cooperate on matters that benefit all, and the impetus to stop wrangling about what we disagree on. We need less controversy and more trusting cooperation on what will help everybody.

No wonder everybody is angry. The stock market went down over $5 trillion, depending on when you measure the losses. The value of real estate is down over $7 trillion. We have the highest unemployment since the Great Depression. We came very close to having even worse unemployment (we could have been looking at unemployment of 25% or higher instead of 10%). The median family standard of living has gone down. We consume more than we produce. Foreclosures and bankruptcies are sky-high.

When can we come together and decide we want to rewrite the prescription for progress intelligently planed?

The key is how we can pay off the national debt. Then we can begin the renewal process.

Demand-Side Economics

Keynes Got It Right

Aren't you tired of tightening your belt? I am.

If we want to light up the economy, we must change the national purpose. We need to identify what it is we want and where we are going to go.

Free market idolaters have convinced us that the national government has no role in setting the agenda. The government is not allowed to “pick winners and losers” in business.

The National Railway System was a conscious decision of the government under Lincoln. Similarly, the Interstate Highway System was a decision made by President Eisenhower. These transportation systems were built by private corporations. Fortunes were made by private individuals, but the vision came from the top of government. There is nothing unholy about politicians setting the national agenda.

Will individuals and corporations get rich? I hope so.

Free markets are necessary for prosperity. That is a truism. Even former Communist countries such as Russia and China have some form of free market economy now. It is stupid to think otherwise.

But constantly banging that free market drum and ignoring the role of the government in setting business priorities is equally stupid. We have let the notion of "tax cuts, tax cuts, and tax cuts," along with deregulation, lead us to the edge of the cliff. We have been to that place where two women with smiles on their faces are driving us over the edge of the Grand Canyon, high-fiving each other. It is the road to perdition.

“I want to earn a profit because of low taxes” is not a job creator. “I want to sell something because I will earn a profit” is a job creator. Demand for your product or service not low taxes is the reason to create jobs.

It is no accident that both of the examples of government driven priorities for growth I cited earlier (National Railroads and the Interstate Highway System) relate to transportation (we could also look at the national parks, the space program, or the abolition of slavery as top down choices, but those are not as instructive in terms of demonstrating economic engines that are game changers over time).

Our new agenda should be business choices that free us from oil dependence. Waiting for the free market to decide this is not good enough. And waiting fifty years is not acceptable. We need to do it in less than ten years. Is that crazy? I think not. But we must, as a society, get behind making it happen, or it won't.

General Motors is coming out with the Volt this year. That is a game changer. And, by the way, America owns a major interest in General Motors right now. Isn't that nice? There are, of course, other electric cars and hybrid cars on the market already, but the Volt seems to be of a different caliber.

Guess who buys the largest number of cars in the United States each year: The federal government. What if we set a national policy that at least 50% of new government vehicles are electric or hybrids? Would that create instant demand for alternative-fuel autos? Certainly. Do we need to do economic studies and endure bureaucratic red tape to make that decision? No; it is a choice at hand.

New car purchasers can influence the economy immediately by selecting electric/hybrid cars. A 30- to 40-fold improvement in petroleum per mile efficiency (over current levels) is on the market now, and many more models are scheduled for imminent introduction. By selecting electric or hybrid-powered passenger vehicles, an economic stimulus revolution is available that requires no deficit spending by the government!

Running on electric power only is practical for trips shorter than 40 miles and uses no oil. And if longer distances are required, using a fuel composed of 85% non-corn ethanol will magnify fuel efficiency by 7 times, as compared to gasoline. Corn-sourced ethanol is of negligible benefit because the energy returned on energy invested (EROEI) provides near zero improvement over gasoline. The energy used to produce it is roughly as much as the energy that it yields. Ethanol from other sources is more advantageous.

Some have advocated big trucks switching to natural gas from diesel for fuel. Is that something we can do now? Yes. We need to look at environmental degradation, however, before engaging in exploitation of additional natural gas sources willy-nilly. That is a genuine concern. But we already have plenty of capacity. We need the will to make the decision, and we can do that right away. Oh, and guess which country has a seemingly limitless supply of natural gas: the United States. These are domestic supplies, which will help us get off oil and reduce our dependence on foreign suppliers at the same time. What a concept.

The economic impact from these changes is immediate, long term, and pervasive. Fortunes will be made. New jobs will sprout. The return of a prosperous middle class can be achieved. Opportunities presented by kicking our addiction to foreign oil dependence are abundant. Oil companies may resist change. Energy companies will see a pot of gold within reach. It is up to our petroleum corporations to define themselves. Are they oil companies or energy companies? Let the free market decide.

"Dow 30K by 2020" could become a platform for both political parties. Rapid economic expansion is what we need. Creating jobs, eliminating the national debt, eradicating our dependence on oil at the same time as reducing our dependence on foreign sources of energy supplies are priorities we can unite on together as a nation. The right may criticize this agenda as too liberal because it seeks to emphasize the role of government and break the back of Big Oil. The left may criticize it as too conservative because it emphasizes profits and free markets. I hope the political center will embrace it as a modicum of common sense, jobs and prosperity for all.

Our resources are great. Our needs are great. Is it really rocket science for Americans to figure out how to match the two? We have the talent. What we lack is political civility, which would allow us to cooperate on matters that benefit all, and the impetus to stop wrangling about what we disagree on. We need less controversy and more trusting cooperation on what will help everybody.

Small Business: The Engine

The Small Business Administration is the only part of the federal government that makes money. It doesn't make money itself, but the guaranteed loans generate more income to the country in tax revenue than the dollar losses on the few business loans it makes that default. So the net operation is a winner.

It is very well known that the small business sector of the economy is the most productive job creator. The fact that the SBA is also profitable is less well known. The question remains: why, if it is the secret to solving a lot of our problems, don't we do more underwriting of start-ups?

The biggest source of finance for new businesses is private individuals. Add to that the banking industry, the SBA, Venture Capital companies, and charitable groups and there is a huge driver of business activity.

As the cheerleader for capitalism, however, we still make it awfully hard to get money to grow the economy. It is quite hard to get a loan from the SBA if you are not expanding an existing business. Venture capital firms are notoriously difficult to do business with unless you want to surrender the majority ownership (sometimes they are called the Vulture Capitalists). Plus, the transaction costs involved in obtaining start-up funds are excessive.

If we, as a society, wish to grow at a faster pace, we can make it easier to create start-up enterprises that have the business fundamentals and prospects for success. We know enough about what it takes to move this creative solution to rapid expansion. Prosperity is something Americans understand very well. Facilitating the pieces of the puzzle coming together is an area which we need to strengthen.

The current SBA program is very efficient. Why does the country take the risk in guaranteeing the loans, though, and then just walk away when the loans are paid back? Why do we not keep a residual, small piece of the ownership? There is a built-in prejudice against the government owning a part of a private business. We do it when the IRS takes over operations of a company that has not paid its taxes, but it is always limited to an exit strategy. As soon as we can sell it we do. We do it in a bankruptcy case in which a trustee operates the enterprise for a while—but, again, it is just as an exit strategy.

It would seem to make sense that when we make start-up loans to foster businesses we should be able to retain a small portion of ownership in consideration for taking on the original risk. Keep the transaction costs very small (unlike the Vultures), but claim an equity position for the agency that made the loan possible. The SBA or the FALB.

Real Estate

Most analysts attribute the onset of the Great Recession to the housing market. When Treasury Secretary Paulson and Fed Chair Bernanke went to congress to get $700 billion for the Troubled Asset Relief Program, the rationale was to buy up toxic mortgage assets. That didn't happen. And there was precious little explanation why. They underestimated how serious the crisis was by a large margin of error.

They only obtained authorization for $700 billion. The problem necessitated over $7 trillion (some estimate it was even higher than that). You can't correct an amputation wound with a Band-Aid. Therefore, they had to figure out what they could do to fix the problem with what money they had. Saving the "too big to fail" banks and two auto companies was what they settled on.

The "underwater mortgages" problem never went away. The federal government still does not have enough money to buy up the mortgages that are upside down or even make up the difference between market value and mortgage value. The banks are unwilling to engage in mitigations, which include lowering principal, because accounting rules would require them to take immediate losses on their books. Banks are willing to extend the terms of the loans and lower interest rates, but not deal directly with the fundamental problem of lower market value compared to mortgage value. The loss mandated if they write down the principal gives them good reason to avoid the necessary solution to underwater mortgages. The final resolution of the housing crisis, unfortunately, remains beyond the horizon. We have no plan on the table as to how to make it go away.

One solution would be to end the Great Recession by making the national debt anchor disappear and begin an era of rapid economic expansion. Property values would rebound somewhat if we could accomplish that. Rising property values would make the underwater mortgages problem diminish dramatically. It would still take too long by most peoples' judgment, but there is little else on the table for discussion.

Rapid inflation could be used, but I don't think many would subscribe to that—the dangers of runaway inflation are too well understood.

Letting housing prices crash is another alternative that would solve the problem in the long run. But few would want that solution either. In the long run we are all dead.

Selling off properties to the government is still possible, but undesirable. It’s the same story with setting up a "bad bank" to take on all the underwater loans.

In short, we have a lot of inadequate solutions to the housing problem other than making the economy sizzle through concerted action by the government. That is a viable panacea for real estate reinflation.

Some have suggested that the problem of declining property values posing a threat to the entire economy can be mitigated with put derivative provisions that would become part of standard mortgages. This would insure home buyers from suffering losses if the home prices decline below the strike price. For a modest premium, buyers and mortgage companies alike would be protected. It is a win-win-win proposition. The buyer, Mortgage Company, and public all come out ahead. Only the insurer on the put derivative policy loses. But because they will construct a profitable business model that includes adequate loss provisions it is presumed they will profit overall even though they have to pay off some losses.

Missed Opportunities

There is a vast wasteland of missed opportunity—work at home jobs.

Sources of workers:

1. Stay-at-home moms

2. Disabled people

3. Retired people

4. People below the age of fifteen

5. Prisoners

6. People with time to kill

Some suggested new and improved industries just to scratch the surface of the possibilities include:

1. Tutoring

2. Remote security camera monitoring

3. Test administration and scoring

4. Writing projects

5. Research

6. Companionship service for the elderly

7. Conflict mediation

8. Anything which can be done from a distance.

In the age of the Internet, it remains for some clever entrepreneurs to harness these assets to everyone’s advantage. There is gold in them-there hills.

Gold versus the Power Grid

The value of gold is meaningless; it has no intrinsic value. The power grid, on the other hand, represents a real and tangible threat to the American standard of living. Yet the price of gold appears in the news media frequently. The power grid is seldom mentioned.

The power grid is not well understood by the public. Many do not know what the grid is to begin with, and even more do not understand what a significant danger it is to our way of life. The electric power grid is the system of wires that distributes electricity across the country.

If you watch the stock market channel, they quote the price of gold constantly. Gold has been valued for thousands of years, all over the world and across cultures. Currently an ounce is priced over $1,000. Compare that to the annual income of people in some poor countries of $100–300 per year (e.g., Zimbabwe and the Congo). An ounce of "worthless" metal could support a person for up to ten years in those countries? Two pounds of "worthless" metal could support a person nicely for a year in the United States? That is nonsense.

The destruction of our way of life due to catastrophic failure of the power grid is a little-known fact. And there is a significant possibility of such an event happening. In August, 2003 Cleveland, Ohio experienced a heat wave that caused the power lines to sag into the trees below. The drooping wires caused an electrical short that brought down the eastern section of the grid which serves 50 million people in Canada and the United States and cost about $6 billion.

The disparity between attention paid to something of little consequence (gold) and something of major consequence (the power grid) is incredible. How do we know that the grid is more important than gold? Think about the impact on your daily life if you had to go without gold for three years. Private ownership of gold was actually outlawed in the United States for several decades without much change in everyday life. Now think about the impact on your daily life if you had to go without electricity for three years. Our lifestyle would be hardly recognizable.

The High Cost of Foreign Military Bases

The United States maintains tens of thousands of soldiers in Germany, Japan, and Korea even though conflicts with those countries ended decades ago. The cost to keep those troops abroad each year certainly exceeds $100 billion. That expense has a negative impact on our Current Accounts and the Balance of Trade Deficit. It lowers our standard of living in the United States.

During the Cold War, these deployments may have had a beneficial effect on our national security. A reexamination of the cost–benefit analysis of vast foreign bases has never been published by the military leadership of our country since the Cold War ended. It is hard to believe it makes sense now.

Just returning the troops to home bases would mean that the money they spend would add to our economy rather than add to the Balance of Payments Deficit. It would be a huge boost to domestic demand, which would mean sizeable increases in available jobs and American prosperity.

The foreign bases in Germany and Japan were of little use during the Korean, Vietnam, or Middle East wars. Likewise, they weren’t terribly useful for other military actions since the end of World War II. If we used forces from these bases for those military conflicts, they were replaced by others. The large force deployments there did not add to our ability to defend ourselves.

Our allies like the military bases in their countries for the most part. It means they do not have to provide for their own defense with their own forces. But it is a subsidy to our friends we can no longer afford if we are to fix our problems at home.

Remedy for the Great Recession

(1) Begin to pay off the national debt by taxing the buyers and sellers of derivatives. Paying off the debt should be earmarked for 98% of the proceeds, and the overhead should be limited to 2%.

(2) Bring the troops home from Germany, Japan, and Korea and station them in the United States.

(3) Make it federal government policy to buy 50% electric or hybrid cars for 3 years.

(4) End the oil depletion allowance for tax purposes.

(5) Allow the federal government to retain a 5% interest in companies to which it grants venture capital loans or loan guarantees—whether it is to the Small Business Administration (SBA) or the Federal Assets and Liabilities Board (FALB).

(6) Utilize prisoners as volunteers in community service activities that reduce the price of incarceration.

(7) Have candidates for federal office pledge to pass balanced budgets four years out of every five unless there is a recession, war, or disaster. They must be accountable to the voters.

(8) Establish the FALB to collect the transaction fee on derivatives and pay off the national debt, as well as provide start-up loans for new businesses.

(9) Create incentives for owners of big rig trucks to switch to natural gas from diesel fuel—especially when ordering new equipment.

(10) Take steps to make the national electric grid less susceptible to catastrophic failure. This should include aspects of smart grid technology for conservation purposes and to reduce our defense vulnerability.

(11) Reductions in the interest payments on the national debt should be directed to tax rate reductions which produce the highest bang for the buck in growing aggregate demand for the economy.

(12) Revise the method of financing elections to reduce influence peddling and corruption.

(13) Audit the efficiency of the current use of national assets—public lands, buildings, employees, organizations, vehicles, practices, and capabilities—to build the economy and create jobs.

(14) Reconsider entitlement programs.

(15) Revisit mortgage policy in light of upside down property values. This includes all agencies such as Fanny Mae, Freddie Mac, HUD, Veterans Benefits, and the FDIC.

(16) Audit the long-term effectiveness of regulatory agencies.

(17) Change standard mortgage agreements to provide an insurance provision derivative against declining home values.

(18) Foster methods which enable work at home enterprises for jobs and income possibilities to groups which are not part of the workforce such as retirees, minors, the disabled, and people with time to kill.

(19) New car buyers should select electric/hybrid models to diminish both our dependence on oil and our dependence on foreign energy.

We are at a turning point as a society which resembles where we were at the end of The Depression and before the start of World War II. We have excess capacity galore. Unemployment, Capital "sitting on the sidelines", and businesses operating below potential are everywhere. We seem to be waiting for a Pearl Harbor incident before we summon the courage to let loose the wealth generation machine within reach.

Let us not wait for a catastrophe like a foreign invasion to strike the match igniting rapid economic growth and increased wealth for everybody.

James F Kainz, MBA

President

Hermosa Strategic Planning Group, Inc.

819 Eighteenth St.

Hermosa Beach, California 90254-3109

520-494-9915 jamesfkainz@yahoo.com