All sorts of warnings, hints and implications thereof are hitting the news on Europe. Watch out for your hair standing up on end. Here is a round up of the latest.

All sorts of warnings, hints and implications thereof are hitting the news on Europe. Watch out for your hair standing up on end. Here is a round up of the latest.

Pulling Old Currency Trading Gear Out of the Basement

The Wall Street Journal is reporting Inner Workings of Market Readied for Euro Breakup:

Companies that provide the plumbing for the $4 trillion-a-day foreign-exchange market are testing systems that could handle trading of previously shelved European currencies.

ICAP PLC, which operates the biggest system for enabling currency trades between banks, said Sunday that it is prepping electronic-trading systems for a possible exit by Greece from the euro zone and a return of the drachma, the country's previous currency.

CLS Bank International, whose platform enables banks to settle their currency trades, is running "stress tests" to prepare for a dissolution of the euro, people familiar with the matter said.

We noted earlier that the Federal Reserve had increased, on the 23rd, an other fund by $88 billion. This fund could be used for emergency foreign currency exchange intervention, among other purposes, such as the IMF.

IMF & ECB Offer Italy a $600 billion bail out

We kid you not. Credit Writedowns seems to be verifying the source in this post:

According to a media report, the International Monetary Fund (IMF) is preparing an assistance program with a capacity of up to 600 billion euros for heavily indebted Italy. Appropriate credit could be awarded for a period of twelve to 18 months in order to stabilize the financial situation of the country, reported the Italian newspaper "La Stampa " on Sunday, citing an IMF official. With interest rates between four and six percent, it would be much cheaper than current two-and five-year bonds with interest rates of more than seven percent.

Now Dow Jones is reporting the IMF $600 billion bailout isn't credible.

A report that the International Monetary Fund could offer Italy between EUR400 billion and EUR600 billion in financial support is not credible, people familiar with ongoing international discussions on the European debt crisis said Monday.

The report is "not credible," one of the people told Dow Jones Newswires.

"I think it is baseless," another source also told Dow Jones Newswires. "There has been no talk on something like that among (Group of Seven) authorities."

No surprise on any of these new events for there to be rumors, denials and then confirms. The situation is in constant flux.

The Eurozone Collapse is a Matter of Days

The Financial Times is reporting economic Armageddon with a twist. Disaster can be averted, but only if three major points of a deal are struck within days, a Euro bond, a fiscal union and some sort of ECB backstop, intervention in the current bond markets, also to provide short term liquidity.

Wolfgang Münchau:

If the European summit could reach a deal on December 9, its next scheduled meeting, the eurozone will survive. If not, it risks a violent collapse. Even then, there is still a risk of a long recession, possibly a depression. So even if the European Council was able to agree on such an improbably ambitious agenda, its leaders would have to continue to outdo themselves for months and years to come.

French Budget Minister Speaks

The French Budget Minister is claiming progress:

Valerie Pecresse said Sunday that France was working to change European Union treaties in a bid to further consolidate the euro zone.

What Happens if a Country Drops Out of the Eurozone?

Jared Bernstein has a simple explanation on what happens to the currency and debt:

What would happen if a country broke away? Well, the problem is all in the transition. Contracts between creditors (lenders) and debtors (borrowers), including everything from bonds to cheese deliveries, have to be renegotiated, and done so at the value the world decides to assign to the new currency, e.g., the ND ("new drachma"). And one can imagine that assignment will not be flattering to the dropout country.

Bank runs are a worry -- those holding euros in Greek banks will be assigned the new value in "NDs," and account holders will want to avoid that devaluation.

As weaker economies dropout, their currencies will fall relative to those of stronger ones, like the US dollar or the euro, as currency markets once again can vote on an individual country's currency, as opposed to that of a currency block. This could help them adjust through exports, but we're probably not talking about gentle devaluation here; we're talking systemic shock.

Basically, the transition is by definition a huge devaluation event. You leave the currency union because you can't achieve solvency within it, and once you're free, the world casts judgment by revaluing your currency in ways that reflect the conditions of your exit. Any support you enjoyed from being a weaker player of a stronger team vanishes.

European Financial Stability Facility

MarketWatch is reporting an agreement on the EFSF (European Financial Stability Facility) fund for leveraging:

Finance ministers from the euro zone are slated to meet Tuesday and expected to sign off on rules for borrowing against the European Financial Stability Facility (EFSF), as well as guidelines for intervening in the euro-zone bond markets and providing credit lines to governments, according to a Reuters report Sunday.

Such an agreement would mark a key milestone for the 440-billion-euro-strong ($586 billion) EFSF, after European leaders agreed to leverage the fund last month.

Tighter Economic Integration...for 17

Reuters is reporting France and Germany are moving towards tighter economic integration for countries who use the Euro:

Germany and France are exploring radical methods of securing deeper and more rapid fiscal integration among euro zone countries, aware that getting broad backing for the necessary treaty changes may not be possible, officials say.

Germany's original plan was to try to secure agreement among all 27 EU countries for a limited treaty change by the end of 2012, making it possible to impose much tighter budget controls over the 17 euro zone countries -- a way of shoring up the region's defences against the debt crisis.

The Eurozone countries include Italy, Spain and Greece and use the Euro as currency. This is different from the European Union.

Here Come the Credit Ratings Agencies (Again)

No surprise, now Moody's is threatening downgrades of EU member countries sovereign credit:

Moody's Investors Service warned on Monday the rapid escalation of the euro zone sovereign and banking crisis threatens the credit standing of all European government bond ratings.

The story is moving quickly to the point this article has been revised and updated.

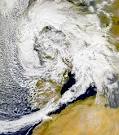

Bottom line, What's the answer to stop the Eurozone from becoming the Twilight Zone? Batten down the hatches and hold onto your hat, something is clearly brewing and it ain't long now before this storm comes ashore.

Comments

OECD just downgraded economic growth, blames Euro Crisis

I just scanned the growth rates, they all seem too high, no recessions, treading water. Bloomberg has more for now but significant they blame weaker economic growth on the European crisis.

Gee, how about offshore outsourcing everybody's jobs and letting Goldman Sachs, et. al run amok for years?

Missing news on French bank runs

It sure is a puzzlement. Anyway, where or when are the runs on French banks? Around the next corner?

It all makes sense, if we agree that the professors from Wharton have it figured right. If so, EU policy-makers -- including Merkel -- are destined to converge at the analysis and solutions envisioned by the Wharton professors. Their analysis/solution is that Greece takes the drachma road (good news for tourism there), Italy stays in the Euro zone, probably along with Spain. See, EP's FMN (11/26/2011).

Only radical goldbugs will be disappointed. They are waiting, with bated breath, for news of runs on French banks, due to collapse of Italian bonds into junk status ... but, (not to worry), the bank runs may be just around the corner!

See, CNBC's NetNet story by John Carney (23 November 2011), 'Has the Bank Run Begun in Europe?'

The thing is ... that was no more than a question raised ... and that was last Wednesday ... ancient history.

Today (28 November 2011), I can't find any evidence that the long-predicted bank runs have begun. However, given the right spin, there's still some good news for global goldbuggery. After all, even if the €600B are to be in the form of euro bonds, that's nonetheless a form of "printing" -- which is inflationary and so bolsters perception of imminent currency collapse. Just look at the Rupee! And even better -- I'm sure we'll be reminded any minute now -- the €600B is less than half of what is actually needed!

Meanwhile, here's today from the Bloomberg tape --

Euro is up -- and steadily rising against the USD.

Gold is up, but only moderately ... so far today.

U.S. 10-year is continuing up (effective interest down), although stabilizing.

NYSE looks strong, indexes up about 3%.

Crude oil is still under $100.

No news of 40,000,000 nervous Frenchmen forming long lines around major banks in Paris.

What's to worry? Go on a Buffett buying spree ... and don't forget to book your Christmas vacation in Greece as soon as the New Drachma drops out of sight through the trapdoor.

EFSF Europe "bail out" fund "not adequate"

Right now things are "all good" but I expect this to change. The latest is the emergency "bail out" fund isn't adequate and Greek got a $8 billion payment. This is all no surprise and now buzzes about the IMF are popping up (read U.S. bails out Europe)....

Seems the only way to find out what's really happening, as Europe loves to issue "solutions" that are really kicking the can down the road, is to check sovereign bond prices.

Bloomberg has good charts.

I'll update something, probably on whatever the next major event is. They have officially about 10 days (by most analysts), so we'll just keep tracking and updating.

What I'm surprised about is apathy of Americans in tracking on Europe. It's seriously going to tank the global economy. I don't think that's realized.

Ground Hog Day #1 ?

NYSE treading water today.

Euro up a little over yesterday.

Gold up, but only slightly (with silver actually down a tad).

U.S. 10-year continuing high (effective interest down), but mixed during the day.

Crude oil is still under $100, but perilously close at $99.30 (WTI).

Merkel still says 'Niemal!' to the euro bond deal.

NASDAQ reports Dow Jones online reports "Italian Bonds Sell, But At Record Yields"

Something seems to be stabilizing ... but what?

as far as I know

They believe a few things, #1 that the 17 Eurozone countries are going to issue some sort of "preferred" Euro bond to cover the debt and more integration, and they are "working on a solution".

but as far as I know little has changed beyond what I put up earlier, strong signs of the "end of the Euro".

Goodbye, Ground Hog Day!

As the Aussies say, "Stack me!" It sure didn't take long. I thought we might be hanging in 'Ground Hog Day' suspended animation for a week, but the engines of globalism have already pushed the world forward out of the muck of Euro mud ..... and into what?

Maybe into more Euro mud muck ... or maybe into the fabled New American Century, where the USD rules unchallenged once again?

Anyway, there was something a little different in the news today -- different enough that we seem to have plowed our way out of yesterday's 'Ground Hog Day' rut. But -- back in the world of plain old real economics -- we're still laboring in the same muddy fields as yesterday

See, Robert Oak's blog on latest world-saving move by the traditional tri-lateral leaders of global capital, Central Banks Make Swappin' Out Your Euro Cheaper.

truly, how many "bail outs" can we get here?

I'm still waiting for details to see if that little line in the H.4.1 report is for this purpose. I believe so, which makes us that read numbers, aware.

Of course the people suffer and Europe exploded today in demonstrations, some already planned.

More bail-outs?

I'm thinking that you're watching for signs of (yet another) MBS bail-out, per remarks this quarter from some of the FOMC. Your recent report reviewing ADP employment report (part about "Construction just came alive") would tend to make another MBS bail-out less defensible ... one would think.

Of course, if some Fed move would be something other than just more transfer of wealth to the big dogs ... it could even be a good thing, IMO. (But that's unlikely.)

From WSJ online story, noon today (Wednesday), Central Banks Take Coordinated Action --

Here come the eurobonds

It appears that the preconditions set out by Chancellor Merkel are being met, presumably clearing the way for the ECB to issue eurobonds in order to amortize Italian debt over a number of years going forward.

From BBC News story (1 December 2011), ECB's Drachi hints at robust action to help eurozone

Germany is carrying the rest

That's the huge problem, Germany is carrying many.

Sequel to 'Here come the Euro bonds'

€489B in three-year euro bonds now on markets

It looks like markets are still guessing ... what else do markets do? Something definitely looks better for Europe .... Probably not a roller coaster, just a see-saw. (But who knows what wonders flash-trading will perform?)

From Reuters (21 December 2011) --

From Bloomberg/Businessweek (21 December 2011) --

To my blurry eyes, what's happening looks like this -- scant action in Precious Metals. Holidays. Everything reduces to that the USD continues to look good, but no market rally appears to be building anywhere, despite some samo talk of a 'surge' or whatever (on light volume?)

Bottom line: Euro bonds have been quietly introduced and no one is panicking.