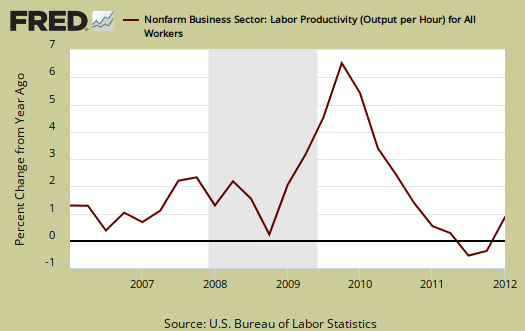

The Q1 2012 Productivity & Costs report was significantly revised and now shows Labor productivity decreased -0.9% from Q4 2011, annualized. Output increased +2.4% and hours worked increased +3.3%. While this might seem good news for workers, more hours for them, the statistics on wages below tell a different story. Graphed below is business, nonfarm labor productivity per quarter.

The basic equation for labor productivity is , where

is the total output of industry.

How does the DOL calculate labor productivity?

Labor productivity is calculated by dividing an index of real output by an index of the combined hours worked of all persons, including employees, proprietors, and unpaid family workers.

, or Labor, is measured in hours only. Both values are normalized to a base year, 2005. Business Output directly correlates to real GDP, minus the government, all of those nonprofits and our infamous, often illegal nannies and gardeners, and equivalent rent of owner occupied properties. The output, or

is about 75% of real GDP reported. Farms, if you can believe this, only subtract off about 1% from output totals. Labor productivity is reported annualized. The main productivity numbers above are all business, no farms. This does include the manufacturing sector.

From Q1 2011, or a year ago, annual productivity increased +0.4%, output +2.7% and hours +2.2%. Changes from a year ago show a little more worker squeeze for increased output than the annualized change between the last two quarters. Output only growing 2.7% shows an anemic economy as well.

BLS defines unit labor costs as the ratio of hourly compensation, , to labor productivity,

, or

. For more formula definitions see the BLS handbook. From the report is the relationship of the ratios:

BLS defines unit labor costs as the ratio of hourly compensation to labor productivity; increases in hourly compensation tend to increase unit labor costs and increases in output per hour tend to reduce them. Real hourly compensation is equal to hourly compensation divided by the consumer price series.

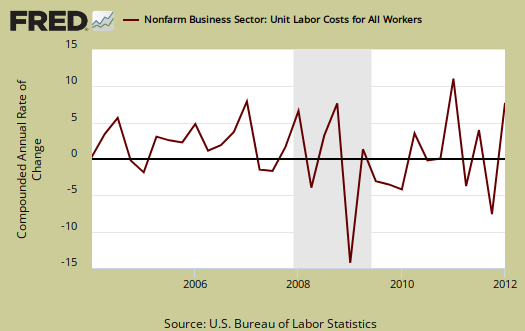

Graphed below are unit labor costs, compounded annual rate, percent change. Annualized unit labor costs increased +1.3% for Q1 2012, although from a year ago, Q1 2011, labor costs are are up only 0.9%. Increases in unit labor costs are due to mo' money, increased compensation for the same output. Increased productivity for the same $$ paid to workers would show lower unit labor costs.

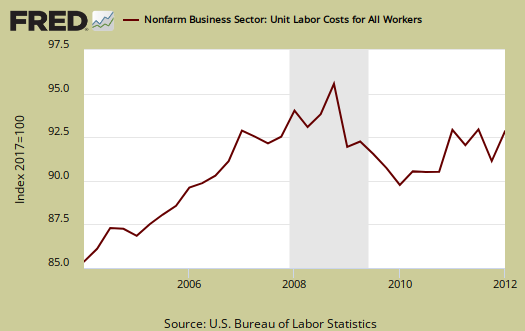

Graphed below are unit labor costs, indexed to 2005. Notice the decline starting in the Great Recession, that's right, workers became mega cheap. This Q1 2012 increase in unit labor costs is slightly better news for workers' pockets.

Real hourly compensation is wages adjusted for inflation. Real hourly compensation is equal to hourly compensation divided by the consumer price series, or .

Yet the consumer price series, , increased at a 2.5% annual rate for Q1, so in terms of real dollars, adjusted for inflation, we have an annualized -2.0% decline in real hourly compensation for Q1 2012, non-farm businesses, and a -1.5% decline in comparison to Q1 2011. This implies workers are being squeezed and squeezed, in spite of increased unit labor costs. Wages are not keeping up with inflation. Below are quarterly changes to hourly compensation, adjusted for consumer prices. You can see the rise and fall with deflation and inflation.

The BLS productivity statisticians use CPI-U-RS up to 2011 and then for the current quarter, re-adjust CPI-U, but indexed to 2005. First, the CPI-U-RS is a research measure. This consumer price series seems to flatten inflation, thus make the decline in U.S. wages less. The implicit price deflator, applied to nonfarm business productivity, is from the BEA.

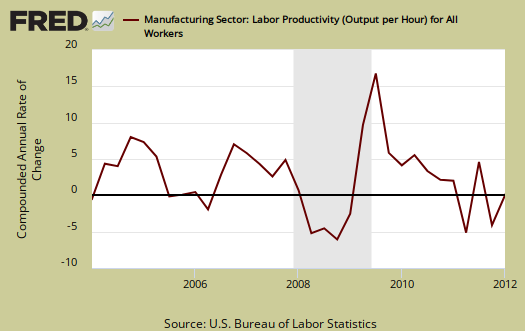

The BLS also reports separately on manufacturing productivity, but uses a different calculation method than the one for business productivity. So, don't think ya can subtract the below and get services productivity, the two ain't the same.

Manufacturing is sales, removing duplicates, adjusting for prices and output () is correlated to shipments and the industrial production. indexes. Hours are hours like above. Page 4 of the report has the manufacturing productivity measurement nitty gritty.

Manufacturing productivity increased, annualized, 5.2% in Q1 2012. Manufacturing output increased a whopping +10.0% while hours worked increased 4.6%. Since Q1 2011, productivity increased 2.3%, output increased 5.3% and hours rose 2.9%. This is the largest increase in hours over the past four quarters since 1997.

Manufacturing unit labor costs are down -4.9% for Q1 2012, at annual rates, which implies manufacturing labor busted their asses.

Real compensation (wages) in manufacturing decreased -2.4% for Q1 2012, even though compensation per hour, not adjusted for inflation, literally was 0.0%. Manufacturing workers are getting squeezed!

Since Q1 2011, real hourly compensation has dropped -3.4%, the largest decline in the history of the series!

Manufacturing wages are beyond not keeping up with inflation, the numbers look like plain labor arbitrage. Actually hours increased 4.6% from Q4 2011 to Q1 2012 and all of these quarterly change percentages are annualized.

Most the productivity gains for manufacturing were in durable goods and probably the result of auto makers. Durable good manufacturing productivity grew at 9.9 %, output increased an astounding 15.4% and hours increased 4.9%. Yet none of this translated to workers. Durable goods labor unit costs dropped -9.6% and real compensation declined -3.0%! It's unbelievable, actual hourly wages dropped -0.6%. That's straight hourly wages, being paid to durable goods manufacturing workers. All of these figures are the change from Q4 2011 and are presented as annualized rates.

What you see these days in productivity is not what it appears. The press will claim increased productivity is a great thing, and maybe that's true for corporate profits, but it's clearly not translating into wages and jobs for workers.

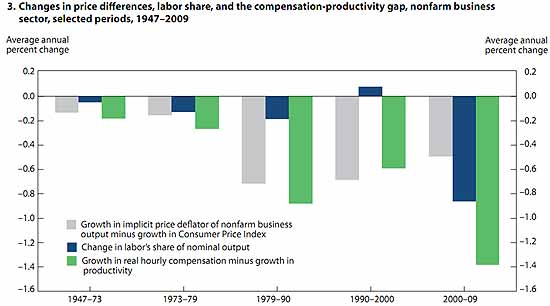

While leads me to this paper from the Monthly Labor Review, The compensation-productivity gap: a visual essay. Now these are the people who maintain the BLS productivity statistics. In the report, they go over their methods, calculations, which can make a huge difference in results. Bottom line they show since the 1970's, workers are getting less and less of the labor share or payout, less of a slice from the American pie called increased economic output. What they found was most of the productivity vs. how much you get in your pocket to spend gap before year 2000 could be attributed to a couple of different measures for inflation. After 2000, the gap is because workers are getting screwed. From the paper:

Labor share is a measure of how much of the economic pie goes to all workers. When labor share is constant or rising, workers benefit from economic growth. When labor share falls, the compensation–productivity gap widens. Concurrently, nonlabor costs—which include intermediate inputs into production and returns to investments, or profits—represent a greater share of output.

Their paper is loaded with graphs, but the above was reprinted for it shows clearly, since 2000, American workers are simply getting shafted while those making the profits are taking it to the bank.

This overview was revised from the originally reported Q1 2012 statistics.

Great Job

Boy you keep digging out the details behind the numbers.

Thanks for doing all this relentless work. I really appreciate it.

Thanks

Labor productivity, I won't mention names but there were so major press that just got the ratios upside down and what this means for U.S. workers. I just hope I'm translating from those dense government economic reports to real people enough.