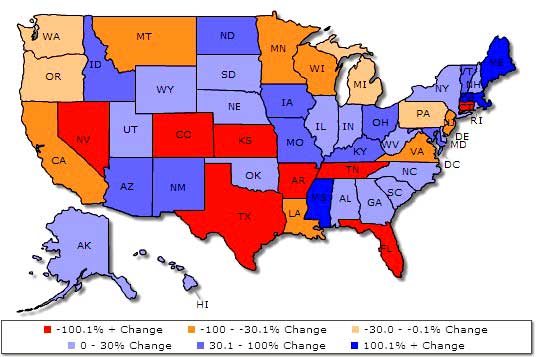

Every once in a while we see a piece of data which makes the hair on our heads stand on end. Such is the Census Foreign Trade graph of the month. Below are corn exports and their percent change a year from June 2012.

The more orange a state is, the more their exports declined. Texas corn exports declined a whopping -272.6%, Kansas dropped -160.9%. Arkansas is a real disaster, with a -445.2% drop in corn exports as of June 2012. What's worse is the June data only gives a 10% national drop in corn exports from a year ago. July gave much worse figures.

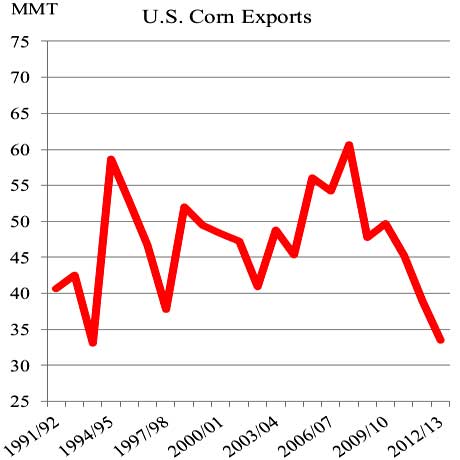

By July 2012, the United States corn export decline was the lowest in 19 years and had dropped 40% from a year ago according to the latest USDA statistics. The U.S. is the largest exporter of corn and corn is the largest export of course-grains. The below charts are from the USDA grain report.

In July 2012, corn exports according to Grain Inspections reached only 2.3 million tons, down more than 40 percent from a year ago.

Moreover, at the end of July, Corn Outstanding Sales for shipment during the current marketing year were also down 40 percent from last year at this time.

This is the worst drought since 1936 and prices are soaring. Corn prices have surged 62% just since July 15th.

Corn has jumped 62 percent since June 15 and soybeans gained 32 percent. Both reached records this month after July was the third warmest in 117 years across the seven major producing states and the past two months were the third driest since 1895, according to government data.

No surprise the drought effects are causing other commodities to skyrocket:

Commodities entered a bull market, gaining 21 percent from a June low, as grain prices surged after the most severe U.S. drought in half a century and as crude oil rallied amid increased tension in the Middle East.

The Standard & Poor’s GSCI Spot Index of 24 raw materials rose 0.9 percent to end at 675.55 yesterday in New York. The gauge has jumped from this year’s lowest close of 559 on June 21. A gain of more than 20 percent is the common definition of a bull market. Crude accounts for more than 50 percent of index.

Soybeans rose to a record yesterday, and corn soared 66 percent since mid-June. The U.S. Department of Agriculture has declared almost 1,600 counties in 32 states as natural-disaster areas after the drought seared millions of acres of cropland.

Cattle herds are now at a 40 year low as ranchers send them off to the slaughter houses rather than fatten 'em up with the usual toxic for cows anyway corn.

Beef output will slump to a nine-year low in 2013 after drought damaged pastures from Missouri to Montana, the U.S. Department of Agriculture estimates. The domestic herd is now the smallest since at least 1973, and retail prices reached a record last month, USDA data show. Cattle futures may rise 8.1 percent to an all-time high of $1.35 a pound in Chicago in the next 12 months, said Rich Nelson, the chief strategist at Allendale Inc. who has tracked the market for 15 years.

As a result, global food prices increased 6.2% in July. In spite of all this, the U.S. is still using corn for ethanol, up to 40% of the U.S. corn crop.

The ethanol requirements are aggravating the rise in food costs and spreading it to the price of gasoline, which is up almost 40 cents a gallon since the start of July.

Many are calling for ethanol mandates to be scrapped, blaming the EPA and calling ethanol requirements and clean air laws obscene and immoral. Yet, Reuters is reporting removing ethanol additives from gas isn't going to make a dent in prices:

The worst drought in half a century revived a fierce food versus fuel debate. Livestock and food producers and others are calling on President Barack Obama to abandon -- at least temporarily -- a government mandate that requires converting more than a third of the U.S. corn crop to ethanol. The president has three months to decide.

Experts say that even if he waives the Renewable Fuel Standard (RFS), that will not necessarily free up much corn for food and livestock feed. In fact, unless corn prices rise another $2 or oil prices fall sharply, it may not make a difference at all.

Even without the standard, a third of the U.S. gasoline supply must contain ethanol to meet unrelated clean air rules, mostly in California and on the East Coast. No other available substance can oxygenate gasoline as effectively, helping it burn more cleanly.

More importantly, ethanol is as much as $1 cheaper than other types of octane boosters like reformate, which refiners use to increase the efficiency of their fuel.

What a choice, corn or cancer and by the way neither will affect what you pay at the pump. These are incredible statistics, all pointing to soaring prices and inflation. Yet, the USDA did not revise their food price outlook. The 2012 annual overall food price increase is projected to be between 2.5% to 3.0%. Food inflation for 2013 is projected to be 3.0% to 4.0%. These figures are actually part of the Consumer Price Index. The USDA projections seem hard to believe, considering food price increases for 2011 were 3.7% in actuality. How can food inflation be projected to be lower than 2011 considering this is the worst drought since the Dust bowl and the heat records surpassed 1936?

This year's drought is actually big deal. It is an economic disaster. Already the crisis is being labeled the 3rd largest natural disaster in recent years.

Agricultural economists are now predicting a trickle-down effect that will have multi-year implications on all consumers, the depth of which has been unseen since the Dust Bowl era.

Experts believe this drought will be one of the most expensive natural disasters on record.

Chris Hurt, agricultural economist at Purdue University, said the economic impact of the 2012 drought looks to be on or near the same scale as the drought of 1988, which is estimated to have cost about $77.6 billion.

It was the second worst natural disaster since the National Oceanic and Atmospheric Administration began its database in 1980, and second in terms of cost only to Hurricane Katrina.

“It could be the second- or third-worst economic natural disaster since 1980,” Hurt wrote in an email. “It is a big deal.”

Just what the nation needed, another economic disaster and worse, seemingly it's not being acknowledged yet as one by government officials. This is also more good reason why more quantitative easing shouldn't happen. With soaring commodities prices caused by the drought, don't you think there will be an outright revolt in the heartland if the Federal Reserve causes commodities to soar even higher?

Comments

Revolutions happen overseas over such things

Soy, rice, wheat, and other commodities' prices are the stuff revolutions are built on overseas (e.g., French Revolution and wheat shortages). Food supplies and prices are the source of endless struggles globally. Even Iran knows screwing around with its massive subsidies that keep gasoline (not food directly ) dirt cheap causes major domestic unrest (besides the problems internally and externally it already has). People in places like the PRC, Cambodia, Vietnam, India, and Thailand aren't all kicking it in some new Ford plant and saving some cash, in fact, most of them are still scratching out a living. And given that many locals left farms to look for greater prosperity in cities, they are especially prone to higher prices because they can't grow their own food anymore. So when we face droughts and problems, they are going to be facing the same things and increasingly get agitated. Especially once a new middle class gets used to beef (outside India) and higher-end products and get those taken away, oh, people get pissed.

animal feed

corn is in Turkey, chicken animal feed as well, also similar to beef. Grass feed beef is way more healthy for us and the cattle, but drought kills everything, including grass.

Well, if the Fed does more quantitative easing I think there is going to be "end the Fed" movement come out even more powerful.

The Fed and Feds don't care about farmers or consumers

Through their repeated actions, it's clear that the Fed and the Federal Govt. aren't really too concerned about what small farmers (i.e., non-mega-corporate farmers) and consumers think. Those in power aren't going to end the Fed under any circumstances.

The Fed is owned and run by banksters - just look at its composition, and where its alumni work. Banksters lobby and run the White House, DOJ, Treasury, etc. They aren't giving up power, especially when they are set to win this election no matter who wins the exercise. Banksterdom central. There are supposed to be spots open to regular, non-bankster citizens according to the Fed rules so that unemployment and inflation are dealt with to the benefit of the majority of American citizens, but those spots are never filled by Joe Regular Citizen, it's pure banksters all around. Would Joe Regular really help foreign banks like DBank or Barclays through secret loans? Of course not, he would look out for his friends, neighbors, and fellow Americans. So he's excluded and you get megarich people like Dimon and others. Sure, I trust those people. . . to rob us and then blame us for the robbery.

CFTC, DOJ, state AGs, and county DAs with juridiction over victims, suspects, and funds didn't do anything when Corzine caught commingling and stealing $1.2 billion from farmers across the USA and then moved stolen money to Dimon's JP Morgan despite law after law and reg after reg prohibiting it. White House okay with theft since Corzine still raising money for White House, despite fact farmers growing food for us and world are decimated financially. Hey, it's only food, banksters and politicians need to get richer, just eat cake (but use bark to make it).

And consumers/food eaters, well, no one cares about them. Fed QE to infinity, endless ZIRP, Fed paying interest on Fed funds held at bankster banks, banksters borrowing from Fed at 0% but loaning out at loanshark rates (but using credit cards, so it's "legal"), etc. merely rewards banksters through massive inflation and savers losing out to speculators. And banksters love speculating on commodities, just like oil, metals, pork, soy, corn, etc. So, no one in power cares if small farmers or people desperate for jobs, or food, suffer more. It's all about the banksters - and they demand more $. What's eating bark compared to another house in Aspen? ASPEN! Come on, don't deny the banksters, politicians, or Fed officials. Let everyone else eat bark!

Anything against USD

Anything vs the USD is going to go in one direction excepting brief breaks when the CB need some lower inflation numbers for a quarter or so ..for political reasons. Look at the yen for example..

http://mlatrader.com/?p=64

All the same..

Where the Corn is Going

Sixty percent of all animal feed used by China is imported from the U.S. but somehow, we have no trade leverage with China. Without U.S. corn, China has very little meat, and very little complete protein. China also imports soy. It no longer matters about the Treasuries held by BOC when rampant world hunger is getting nearer at hand.

That same corn must transverse the port of New Orleans, which may bite the bullet of this hurricane, but not all of them

Burton Leed

One word--Ethanol

You are welcome.