The Durable Goods, advance report shows new orders increased by 3.3% for April 2013. Wall Street soars, yet the gains are on volatile aircraft new orders. Aircraft and parts new orders from the non-defense sector increased 18.1% and jumped 53.3% from the defense sector. Excluding all transportation, new orders rose 1.3%. Core capital goods new orders increased 1.2%.

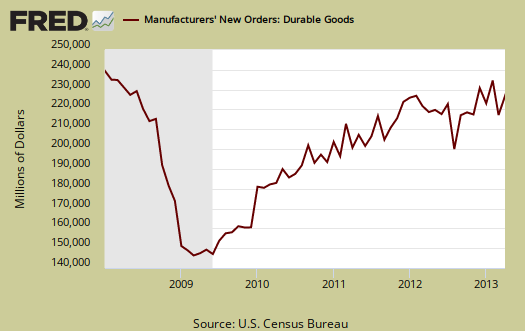

Below is a graph of all transportation equipment new orders.

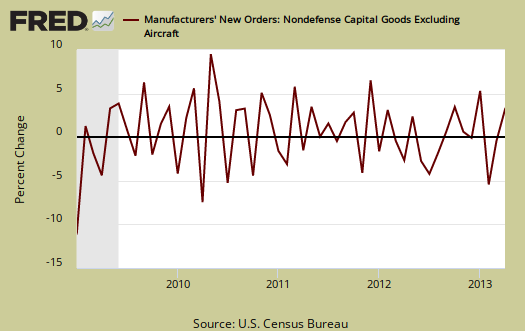

Core capital goods new orders increased 1.2% for April, which is a much better indicator overall for economic activity. Machinery increased 1.9% in new orders after two months of declines. Computers also bounced back with a 3.6% increase in new orders after poor showing for the previous two months. Core capital goods is an investment gauge for the bet the private sector is placing on America's future economic growth and excludes aircraft & parts and defense capital goods. Capital goods are things like machinery for factories, measurement equipment, truck fleets, computers and so on. Capital goods are basically the investment types of products one needs to run a business. and often big ticket items. A decline in new orders indicates businesses are not reinvesting in themselves.

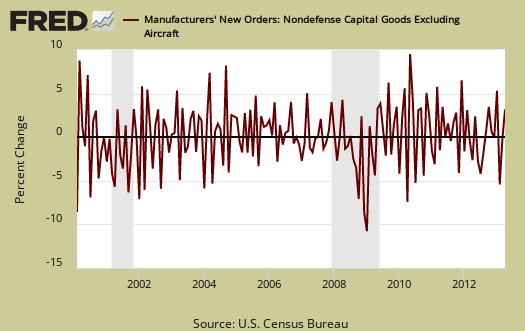

To put the monthly percentage change in perspective, below is the graph of core capital goods new orders, monthly percentage change going back to 2000. Looks like noise right? That's why one advance report does not an economy make.

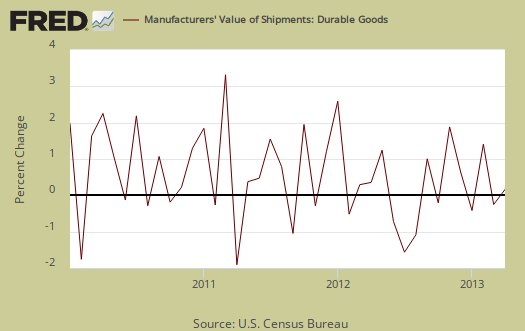

Shipments overall declined -0.6% from March and bear in mind new orders are not necessarily shipped the next month an order is made. Below is the monthly shipments percent change for all durable goods shipments.

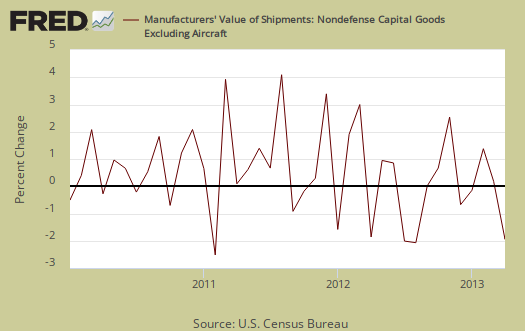

Shipments in core capital goods decreased -1.5% as computers and related products shipments sank by -5.6% and machinery shipments declined by -1.3%.

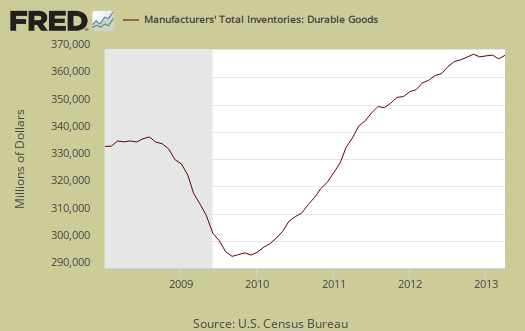

Inventories, which also contributes to GDP, increased 0.4% for April after decreasing -0.1% in March. Excluding transportation inventories declined -0.1%

Core Capital Goods inventories had no change after March's -0.3% drop. Graphed below are total durable goods inventories.

Core shipments contributes to the investment component of GDP. Producer's Durable Equipment (PDE) is part of the GDP investment metric, the I in GDP or nonresidential fixed investment. It is not all, but part of the total investment categories for GDP, usually contributing about 50% to the total investment metric (except recently where inventories have been the dominant factor). Producer's Durable Equipment (PDE) is about 75%, or 3/4th of the durable goods core capital goods shipments, in real dollars, used as an approximation. Below is the national accounts description of PDE:

Nonresidential PDE consists of private business purchases on capital account of new machinery, equipment such as furniture, and vehicles (except for personal-use portions of equipment purchased for both business and personal use, which are included in PCE), dealers' margins on sales of used equipment, and net purchases of used equipment from government agencies, from persons, and from the rest of the world.

The below graph might give a feel for what kind of investment component we might see on PDE for Q1 2013 GDP. This is the monthly percentage change of nominal values, not real, not adjusted for inflation, for core capital goods shipments. We can see Q2 isn't getting off to a great start.

While April is the 1st month of Q2 and thus it is too early to estimate what kind of investment component to expect in economic growth, this report is not the blow out Wall Street is claiming. More it appears to be a bounce back from last month's plunge. There is nothing in this month report to indicate the economy will have magical strong growth as being claimed by some in the financial press.

What is a durable good? It's stuff manufactured that's supposed to last at least 3 years. Here are our durable goods, related overviews, only some graphs revised. The durable goods advance report is often revised when the full factory orders statistics are released.

reason posted durable goods

The press had this economic report front paged for three days, as if it's incredible. It simply is not. Additionally, this is the advance report, almost always revised with the full factory orders comes out about 10 days from this release.

In spite of not being able to get the raw data update for the graphs, it is important to point out the details.

Why the financial press grabs some reports and tries to make them seem better than what they are is a very good question. We think it has to do with market hype.