If you are open minded enough to consider evidence that runs contrary to received wisdom and challenges your assumptions, read on, I hope you will find this thought-provoking.

Because there is some excellent evidence that, if "It's the Economy, Stupid", then there are some very powerful people who have operated some very powerful economic levers to the benefit of one certain Senator John McCain. And the cocaine they are injecting into the economy is going to hit full force by about election day.

Those very powerful people are the Open Market Committee of the Federal Reserve Bank, including Fed Chairman Ben Bernancke.

A year ago, blogger Cactus over at Angry Bear wrote a very controversial series in which she(?) demonstated that the Federal Reserve Bank used its tools -- primarily controlling short term interest rates (the Fed Funds rate in particular) and also the money supply (in the form of M2) -- in a very asymmetric way.

As she put it:

[The] factors the Fed has some control over (real M2 per capita, the Fed Funds rate) seem to always loosen up when an incumbent is running for office if that incumbent is from the same party as the Fed. These same factors tend to tighten up when an incumbent is running for office if that incumbent is from a different party from the Fed.

the fed funds rate, which the Federal Reserve controls directly, has similar very clear-cut behavior: when a “friend” is running for re-election, the fed funds rate is unusually low, and when an “enemy” is running for re-election, the fed funds rate is unusually high.

A cynic might conclude from this that the Fed helps its friends by making money cheap and easy to benefit its friends, yet tight and expensive to hurt its enemies.

See also this blog entry as well.

What reminded me of this was this morning's column by Prof. Krugman in which he said:

Let me offer an alternative suggestion: maybe his transformational campaign isn’t winning over working-class voters because transformation isn’t what they’re looking for.

From the beginning, I wondered what Mr. Obama’s ... talk of a new politics ... would mean to families troubled by lagging wages, insecure jobs and fear of losing health coverage. The answer, from Ohio and Pennsylvania, seems pretty clear: not much....Yes,... there are lots of policy proposals on the Obama campaign’s Web site. But addressing the real concerns of working Americans isn’t the campaign’s central theme.

This quote reminded me that I have recently diaried that Will the Recession be over by election day?; and that got me to thinking, if some working class voters are tempted to abandon Obama, there is a strong reason to suspect that the democratic response of "It's the Economy, Stupid!" will have ever less effect as election day approaches.

So, with that it mind, let's look: has the Federal Reserve Bank acted in accordance with Cactus' cynicism? Are they behaving exactly as if they want McCain to win, and will do everything in their power to help him out?

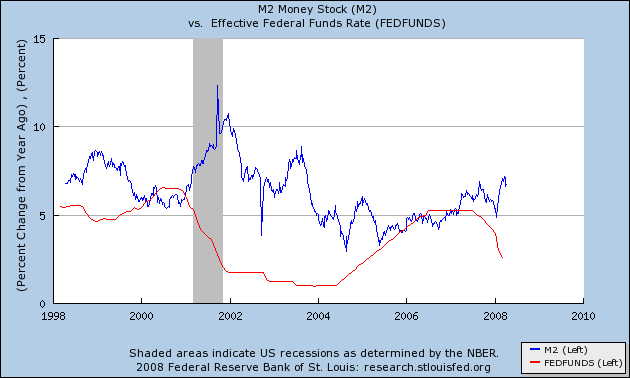

Below is a graph of M2 money supply (blue) and the Fed Funds rate (red) for the last ten years. To accelerate the economy, you would want to increase money supply (blue line going up) and decrease interest rates (red line going down). To put a drag on the eocnomy, you would do the reverse. And look what the graph shows:

Sure enough, in 2000 Republican Alan Greenspan drained money out of the economy and increased interest rates (hurting Democrat Gore), and in 2004 he added money, and kept interest rates at a praeternaturally low 1% until 6 months of election day (powerfully helping Bush). And in 2008, under Ben Bernancke, so far John McCain is the beneficiary of the exact same trends. (BTW, typically it takes interest rate hikes or cuts 6 - 12 months to be felt throughout the economy)

Another way of checking the same trend is to compare short term interest rates with long term interest rates. Generally, you want short term rates (on the left in the graphs below) to be lower than long term rates (on the right in the graphs below), and if both are under the inflation rate, so much the better. The left chart compares April 2000 (red)with April 2004 (black), the right one compares April 2000 (red) with now (black):

The red line at the top of both graphs is the interest rate curve Al Gore faced 8 years ago this week. Notice that short term rates are higher than long rates, and both are higher than the ~4% inflation rate of 2000 as well! Alan Greenspan was slamming on the brakes as Al Gore was running against George Bush. Contrarily, as shown by the black lines in both graphs, in 2004 and again now the Federal reserve has created a very friendly money and interest rate environment for the incumbent Presidential party -- the GOP.

That they may succeed in trying to make sure that the economy gets better rather than worse by election day is shown by this graph, which uses a mathematic formula based on interest rates to calculate the chances of recession:

That graph shows that over the next 12 months, the likelihood of recession recedes from the high point which is where it is right now.

Remember that 59 million people were willing to pull the lever for Bush in 2004. The economy doesn't have to be good, just improving enough relative to now for some people to relax and go running to 'daddy' McCain again.

Comments

It's the Economy Stupid

Will ring true for those voters in PA/OH/FL/MI and so on...

if the Democrat actually has policy positions which they want.

Just saying that one is going to put "environmental and labor standards" into trade agreements is just not enough to truly dramatically change direction or create a new trade strategy in the national interest.

That's the issue here with Obama, he is simply not talking about actual policy change that is what the people want. He describes the problems sure, but in terms of solutions, well, take health care for example, I think most people know that making sure every single person in the nation has health insurance is a key element for it to actually work.

And because of your sacrilege (which is one of the reasons The Economic Populist exists, so one can post and say sacrilege without getting some sort of cultist mob mentality attacking you and instead get some real consideration)....I'm going to talk about another thing that is going to hurt.

That's immigration. By electing McCain, they took this issue off because all three of them are doing the US Chamber of Commerce's bidding. That said, there are degrees, because the issue is actually complex. Hillary has recognized wage repression as a result, Obama has not. Even worse he calls people xenophobic and when they are having their jobs cut short, especially in construction, meatpacking and so on, that doesn't go over too well.

In other words, I think you're right, they are going to pump up the economy just enough so once again people vote on some perceived national figurehead but I lay the blame at the feet of the Democrats who also do Corporate lobbyists bidding and don't in a very concrete way put forth policy change in favor of what the majority of Americans want that would over ride some temporary illusion that the economy is ok by these sorts of manipulations.

I knew there was a reason I visit this site....

......this post shows it quite clearly.

No, no snark here. This what I call 'good stuff' and I will spread the word.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

Thank you very much!

n/t

Not Convinced of This Conspiracy Theory

Show me more years of data

Re more years of data

Go read cactus' blog entries on Angry Bear. I've linked to 3 of them. I believe there were 6 in all.

You don't need for there to be a conscious conspiracy. But cactus' data suggests there's much more than random chance.

Cactus' blogs were over a year ago. The Fed this year is behaving exactly as would be predicted by those blogs.