Representative George Miller is waging a lonely war against powerful enemies. He's trying to reform the 401(k) system, a system that most on Wall Street don't want reformed.

The key to Miller's plan is to force 401(k) providers to disclose their fees in plain English. If you don't think this is important, consider that those fees can eat up 75% of your potential retirement savings.

If you look at the system, basically what you have is working families making the conscious decision every month to try to save some money for retirement. Then along comes people managing those funds for them and they start dipping into those funds for fees that are really not in the best interest of those savers. So, you have elite financial managers getting rich off the back of middle-class working people. The last thing they really want is transparency.

"The 401(k) system today in the United States has been an acknowledged failure."

- Alicia Munnell, director of the Center for Retirement Research at Boston College's Carroll School of Management.

All these fees are a mystery to an overwhelming majority of Americans.

According to a poll sponsored by AARP, 83% of workers don't know how much they pay in such fees -- and most do not realize they pay any fees at all.

To assess the toll of such fees, consider the case of a 30-year-old worker with $25,000 in a 401(k) plan. If that account earns 7% and incurs fees of 0.5% a year, without another contribution, the total payout to that worker at age 65 would be $227,000. However, if that same account incurs fees of 1.5% a year, the extra 1% would shave off $64,000, or 28%, of the payout, which would be reduced to $163,000.

Of course fees of only 1.5% is an optimistic scenario. Of the nearly $3 Trillion in 401k funds in 2007, there were $89 Billion in fees. That comes out to about 3%, not 1.5%.

Here's a list of the most common fees:

a) Management fees

b) Administrative fees

c) Distribution fees (the top three usually averaging about 1% a year)

d) Sales loads (often averaging 1.4% a year)

e) Trading costs (averaging .5-1% in an actively managed fund)

f) Excess capital gains taxes when a portfolio is turned over

The U.S. Department of Labor lists seventeen distinct 401(k) fees, including ones for record keeping, legal services and toll-free telephone numbers. Many of them are not listed in the fine print.

John Bogle, founder of the Vanguard Group Inc., one of the largest mutual fund companies, said investors pay $600 billion a year in fees, an amount he called "staggering and unnecessary".

"The 401(k) system has to be fixed, and I don't know anybody who can fix it but the federal government."

- John Bogle

One of Miller's top proposals is to force providers to offer a low-fee index fund. The financial industry opposes this idea.

Even if Miller manages to push his reforms through - which is highly questionable at this point - the major problems of the 401(k) system will remain unaddressed.

The problems with 401(k)s

With any investment there is risk. The problem is that so few 401(k) investors understand the risks they are taking on.

For instance, 401(k) money is tax-deferred, not tax-free. Therefore, by putting money into a 401(k) and getting the tax break now, you are making a bet that taxes will not be significantly higher a couple decades from now when you retire.

Will taxes be significantly higher when you retire? Unless the federal government simply defaults on its Social Security and Medicare promises then taxes will have to be raised dramatically. You can bet the trillions of pre-tax money sloshing around in 401(k)s and traditional IRA's will be at the top of the hit list.

Another risk is the systemic risk of all of those Baby-Boomers expecting to use those stocks and bonds to fund their retirement. To put it another way, starting this year and increasing every year after that for almost two decades, the number of people who were buying stocks and bonds are increasingly going to be selling those stocks and bonds (the WSJ estimate $300 Billion a year, every year).

For those of us who are decades away from retirement, that means all our investments on Wall Street are going to be coming under increasing selling pressure. What kind of return on investment (ROI) can you really expect when the number of people only selling stocks and bonds increases by several million every single year? Some say that foreign investors will snatch up those stocks and bonds, but with almost all of the industrialized world (and China) aging at the same time the concept isn't realistic.

"The 401(k) will turn out to be the greatest systemic financial hoax ever perpetrated on an unsuspecting public."

- William Wollman, The Great 401(k) Hoax

At the end of April I was laid off from my job of 10 years.

I called up Fidelity and asked them to roll my 403(b) (the education institution version of a 401(k)) into an IRA. I was told that they couldn't do that until their employment records were updated, and those records wouldn't be updated until the "next payroll cycle".

That meant I couldn't make even this modest adjustment to my retirement savings for another month.

At the start of June I called up Fidelity again. Their records were now updated, but the money would have to be moved "manually" (whatever the Hell that means). The email sitting in my inbox said that it would take "7-10 business days".

At this point it suddenly occurred to me just how illiquid my 403(b) money really was. So I began looking into this problem and found out that my experience was rather mild in comparison to some.

Even with recent gains in stocks such as Monday's, the months of market turmoil have delivered a blow to some 401(k) participants: freezing their investments in certain plans. In some cases, individual investors can't withdraw money from certain retirement-plan options. In other cases, employers are having trouble getting rid of risky investments in 401(k) plans.

...

As of April 28, redemption requests that had yet to be honored totaled nearly $1.1 billion, or roughly 26% of the fund's net assets. Principal doesn't anticipate that it will make any distributions to investors who have requested redemptions until late 2009 or beyond, Ms. Hale said. Meanwhile, the fund continues to fall, declining 25% in the 12 months ending April 30.

An illiquid investment is inherently risky. The people in the article above have lost 25% of their retirement savings because of that illiquidity, a heavy price to pay.

What many people don't realize is that you are supposed to be compensated for that risk. If you were a professional investor you would get higher yields for having an investment you couldn't liquidate for 5-6 weeks (as was my experience).

Instead, the average 401(k) investor gets none of the extra compensation for the risk of having probably the most illiquid investments vehicles on the market next to real estate.

To put it another way - you are being played for a sucker.

The price of illiquidity

Earlier this year the Federal Reserve Board released a report about households borrowing from their 401(k)'s. You would think that the report would be critical of this borrowing because its potential of hurting retirement savings. You would be wrong.

More fundamentally, we find that many loan-eligible households carry relatively expensive consumer debt that could be more economically financed via 401(k) borrowing. In the aggregate, we estimate that such households could have saved as much as $5 billion in 2007 by shifting expensive consumer debt to 401(k) loans. This would translate into annual savings of about $275 per household—roughly 20 percent of their overall interest costs—with larger reductions for households that carry consumer debt at high interest rates or who hold larger 401(k) balances.

So why do households pay an extra $5 billion a year in high interest debt rather than tap their own savings? The answer is touched on later in the report.

...unlike checking accounts, 401(k) balances are generally illiquid.

Five billion dollars is no small amount, and this only applies on the losses due to households relying on high-interest debt. The more significant way you lose potential savings is by being cheated of compensation for the risk.

But how to measure it? To answer that let's look at how Wall Street views risk compensation.

One way of capturing the cost of illiquidity is through transactions costs, with less liquid assets bearing higher transactions costs (as a percent of asset value) than more liquid assets.

Most people are under the misconception that the only cost associated with a trading an asset is the brokerage transaction fee. In fact, the largest cost is "opportunity cost".

This cost can be measured by the bid-ask spread - the difference between what a buyer will pay and a seller will receive.

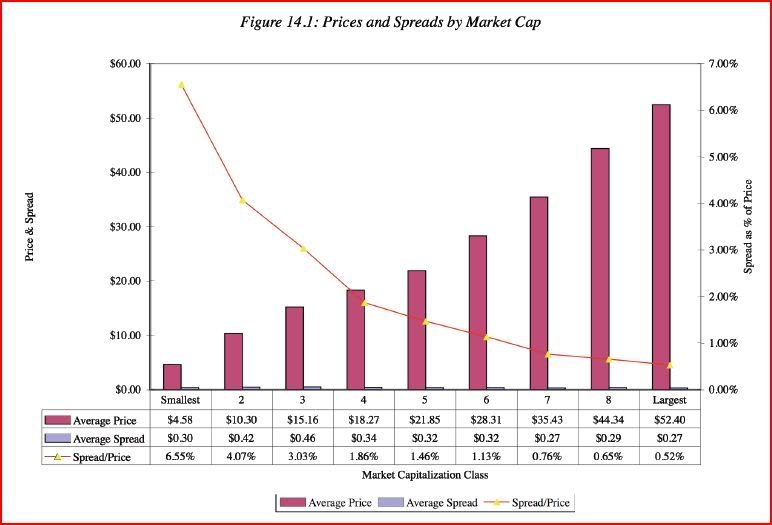

The bid-ask spread for treasury bonds, the largest and most liquid market on Earth is less than 0.1%. However, according to one study, small-cap, low-volume stocks the bid-ask spread can rise to as high as 6.55%, no small amount. Other studies have found the spread to be even greater.

To put this into perspective, an illiquid stock on Wall Street that may take several days to turn around requires risk compensation of over 6%. What about my 403(b) that took five weeks for me to liquidate? Shouldn't that garner me compensation of well over 6%?

Fidelity finally managed to move my 403(b) assets in four business days, but I had to wait four weeks for them to even start the process. Thus 84% of the illiquidity risk was carried by me. The average 401(k) investor is carrying an immense amount of risk with no compensation.

To put it another way, Wall Street brokers are offloading risk onto small 401(k) investors without compensating them for it. Since risk has a measurable price on Wall Street, you are directly subsidizing Wall Street by an amount that brokerage houses can actually put into their pockets for not having to hedge or buy insurance.

Not only is this this concept of 401(k) illiquidity not part of the reform proposals, most proposals would make it harder to liquidate your 401(k) after leaving your employer.

Comments

What we really need

Is a guaranteed version of the 401(k). One in which some form of insurance is taken out by the companies managing 401(k) accounts that makes sure they have a floor of 0% return, and cannot be allowed to go negative on their return, even if there's only $1 in the account.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Or create another type of account that has similar

characteristics to a fix rate annuity.

We are facing a serious crisis with retirement security.

The stock market is not the best place for retirement savings.

RebelCapitalist.com - Financial Information for the Rest of Us.

What we need is a national pension

Just cut the companies out of the mix altogether, except for taxes. That way our companies aren't unfairly burdened by legacy expenses and then can compete with foreign competitors on a level playing field.

Pensions are superior to 401(k)s because people who die young subsidize the people who live longer. Plus, they are run by professionals who don't get tricked as easily into paying extra fees.

On the personal side, the pensioner can plan his living standards based on a set scale, rather than trying to save enough, but not too much.

national pension

I hate to bring up a funny, but "lockbox" comes to mind.

I thought this was social security but we need something.

Not only is the 401k from traditional pensions a rob of retirement, so any have nothing in their 401ks. From emergencies to the stock market to bad companies to being laid off, etc....they are gone, gone, gone.

What do you think the cost of puts and calls will do to

your return? An FIA will give you access to the DOW/S&P/Bonds, etc. and you don't take negative years. Downside is you give up positive points.

I guess if someone doesn't like risk they can invest in zero-coupons. There is safety but I don't think people would like the returns on that safety.

A 401k doesn't give you that choice

Most 401(k) plans you have to invest in the limited number of mutual funds that your employer has in the plan; you don't have the choice of going with an FIA or zero-coupons.

The main problem with the 401(k) program is really how it is sold- as a retirement program when it is nothing more than the standard gambling-on-the-market-and-hope-the-house-doesn't-eat-you-alive Vegas retirement that most investment plans now are.

It is NOT a sufficient replacement for a defined benefit pension plan, social security, or even your run-of-the-mill charity annuity- but that's how it's being sold to the gullible workforce.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

That is correct I was only addressing safety

I got off topic.

A Scam from the get-go

Fundamentally, the 401(k) was recognized as a scam from its inception - a way to negate pensions, while increasing the assets of corporations and the stock market.

The Bush Administration had hoped to forestall the meltdown by privatizating social security and feeding those revenues into the stock market/Wall Street, but fortunately failed in that regard - granting we serfs (and soon-to-be serfs) a bit more time.

The 401(k) should always be recognized for what it is - paper entries bolstering the reported value of said corporations.

That's not all

Intentionally or not it's an assault on wages, it's an assault on domestic manufacturing, and it provides yet another market for finance. The pressure on delivering the quarterly bottom line ensures that costs are minimized, and one major cost is always labor. Others include meeting safety and environmental regulations, but if you offshore labor you've offshored these as well. So to ensure that we as participants in the 401k (or 403b) have enough to retire on, given that wages have decoupled from productivity and haven't even tracked inflation, we want maximum returns from the market, further putting pressure on wages.

It gets even better: savings accounts pay very little interest, nowhere near inflation. Money market accts and CDs pay better, but still lose money in real terms (or did until this year). The vast majority of wage earners who can put some money away are basically left with 401k's or other market based retirement account, or real estate to make up for hammered wages. The former puts pressure on their wages, the latter ... didn't work out so hot. The stock market is a useful investment device, both for investors and companies. But if we're to rely on it for a policy of retirement accounts we need far stronger rights for labor.

cash

I am really close to pulling all my money out of the market that wants to separate me from it. Seriously, True that money mkts and cd's lose money in real terms, but one must inflation-adjust the markets too and when you do, Dow 14000 doesn't look all that great. Imagine what that inflation adjustment would do to the current DOW 8600...

Quite frankly, the best thing I ever did financially is move to cash in 2007 and buy a bit of gold. Saved a bundle with the former move and the latter is about the only investment out there showing a profit (I bought AU @700/oz)

Cash is liquid and in today's world one needs to be able to change directions in the blink of an eye. Granted, I am in a good position with my home almost paid off and a sustainable cash flow... indeed, I would hate to be in the position where I HAD to depend on the markets.

Good luck with whatever choices you feel you need to make.

Good luck to all of us.

tangibles

Can't eat cash. But paying off your mortgage and planting a potato field instead of a front lawn might work.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

can't eat stocks either, huh?

I'm not sure what point you are making... stocks are better than cash because you can't eat cash?

No, tangibles beat everything

Because properly chosen tangibles (like land, seed, plants, livestock) can provide the things we need to live- and if you choose them right, you will be a "wealthy person"- or at least so claimed Crow to the Tualatin Ahntchuyuk Kalapuya.

It's a different form of wealth than we are used to- not being currency based- but there is much wisdom in the millennial old story of Crow.

If we scale it up- it means that every family should have the ability to make as much of what they need as possible. When the family is insufficient for this, then the community should have factories. All factories should be as physically close to the end consumer as possible, because you never know when war, bad trade deals, or natural disaster will prevent you from reaching foreign sources.

Only by keeping production close, can one truly have wealth.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

D'accord!

You speak the truth, sir.

Well

in a deflationary environment cash is king, so good for you for pulling out in time. But it still doesn't fix the problem of making investment in the stock market a de facto retirement savings policy. And it doesn't solve the wage/productivity issue.

agreed

I saved only myself and I was lucky. But let me be clear: when, in June of 2007, I moved mostly to cash and bought some gold coins (10 oz) I felt paranoid doing it... felt like I'd given in to the "crazy" crowd so often populated with survivalist types. But nothing else made sense either. My house, bought in 1999 for $110,000 had, by 2005, moved beyond half a million (in an area where the median income was probably never higher than $30,000) if measured by surrounding sales (I have no intention of selling). That bubble had to pop so I never heloc'd or hew'd. It seemed to me every one around was just crazy so I did something radical and moved myself as afar from the system (via cash) as I could. It was a good bet fortunately, yes, but I'm not bragging...

And no one is more concerned about jobs and wages than I... ask New Deal democrat, so we have no argument there. The Obama WH is skating on some thin ice economically and no amount of happy-talk will make their "recovery" bullshit come true absent jobs.

Cheers!

Read the writings of Teresa

Read the writings of Teresa Ghilarducci, including her testimony before Congress.

It is downright scary to think that there has been the proposal that 1/2 of out 401K residual upon our death go to the government - not to our heirs.

Yeah Teresa is scary

in her thought that the government deserves the money more than my kids.

You are going to see more and more Teres'a getting bold with their thoughts that government is the master.

What starts with an "F" and Ends with a "K"

401K

Saw this on Mother Jones. Thought it was quite appropriate