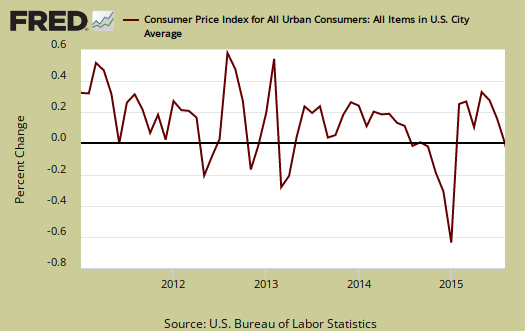

The Consumer Price Index decreased by -0.1% for August on energy price declines Gasoline alone dropped -4.1% for the month. Inflation without food or energy prices considered increased 0.1% for the month. From a year ago overall CPI has increased 0.2%, which is very low, yet without energy and food considered, prices have increased 1.8%. While 1.8% is below the Fed's 2.0% inflation target, it might very well be high enough to justify a rate increase from the Fed. We'll see tomorrow. CPI measures inflation, or price increases.

The flat yearly overall inflation is shown in the below graph, again driven by low energy prices.

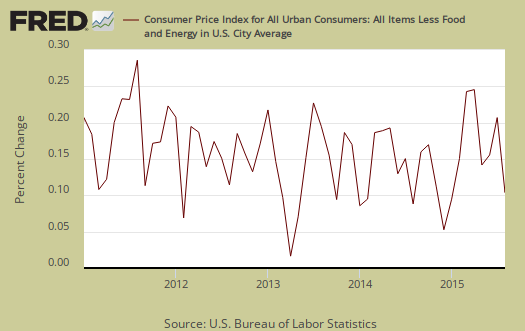

Core inflation, or CPI with all food and energy items removed from the index, has increased 1.8% for the last year. This is no change for the last two months. Core CPI is one of the Federal Reserve inflation watch numbers and 2.0% per year is their target rate. The Fed watches other inflation figures as well as GDP and employment statistics on deciding when to raise rates. Graphed below is the core inflation change from a year ago. For the past decade the annualized inflation rate has been 1.9%.

Core CPI's monthly percentage change is graphed below. This month core inflation increased 0.1%, as shelter increased 0.2%. Used cars and truck prices dropped -0.4% and are down -1.5% for the year.

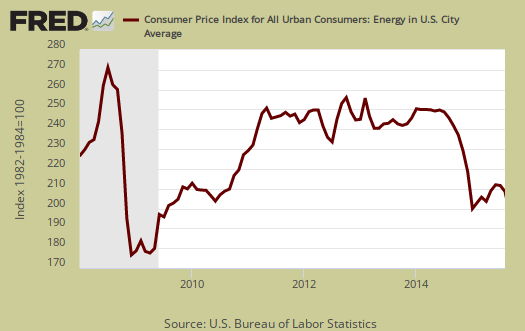

The energy index is down -15.0% from a year ago. The BLS separates out all energy costs and puts them together into one index. For the year, gasoline has declined -23.3%, while Fuel oil has dropped -34.6%. Fuel oil dropped -8.1% for the month. Graphed below is the overall CPI energy index.

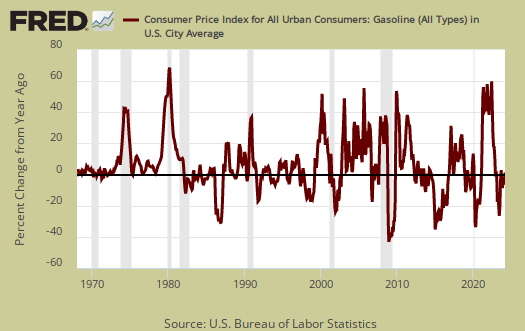

Graphed below is the CPI gasoline index only, which shows gas prices seemingly never ending wild ride.

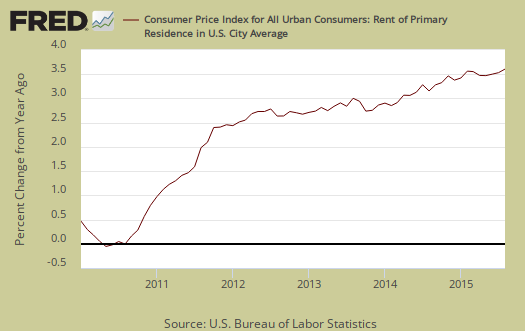

Core inflation's components include shelter, transportation, medical care and anything that is not food or energy. The shelter index is comprised of rent, the equivalent cost of owning a home, hotels and motels. Shelter increased 0.2% and is up 3.1% for the year. Rent just keeps increasing and this month rent jumped by 0.3% and is up 3.6% for the year. Graphed below is the rent price index.

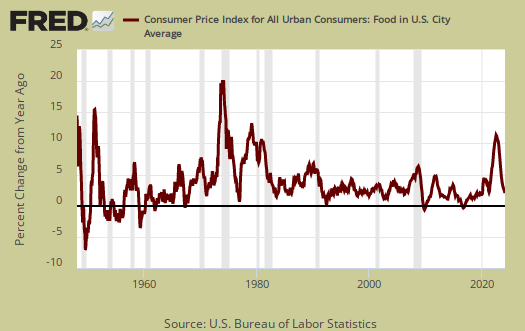

Food prices increased 0.2% for the month, the same increase as July. Food and beverages have now increased 1.6% from a year ago. Groceries, (called food at home by BLS), increased 0.3% for the month, and are up 0.8% for the year. Eating out, or food away from home increased 0.2% for the month and is up 2.7% for the year.

Graphed below are groceries, otherwise known as the food at home index.

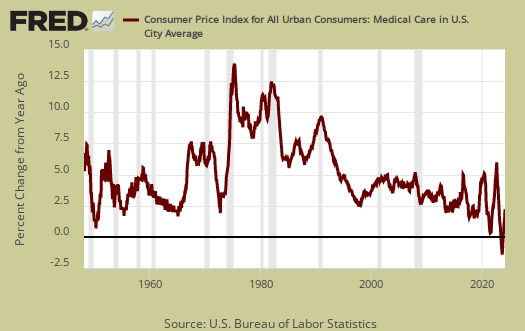

Medical care services had no change and has increased 2.2% for the year. Graphed below is the overall medical care index change of 2.5% from a year ago.

Below is a graph of the medical commodities index, which is mostly prescription drug prices. Medical commodities increased 0.3% for the month and is up 3.4% for the past year.

Real hourly earnings increased by 0.5% for all employees. Real means wages adjusted for inflation and since CPI decreased -0.1% and wages increased 0.3%. For the year real hourly earnings have increased 2.0%, still barely staying ahead of the inflation game. The average real hourly wage is now $10.55. Weekly real earnings increased 0.7% for the month. Real weekly earnings now stand at $364.86.

CPI details

The DOL/BLS does take yearly surveys on where the money goes in the monthly budget, but as one can see, food and energy are significant amounts of the monthly finances. Run away costs in these two areas can break the bank, so can food. Additionally CPI uses substitution, so if flour goes through the roof, somehow we're all just fine with oats and prices didn't really overall increase much. Here is the BLS CPI site, where one can find much more details, information on calculation methods and error margins.

Other CPI report overviews, unrevised, although most graphs are updated, are here. If you're wondering why the graphs display different figures from the text, the graphs calculate percentages from the index and do not round. The actual data from the BLS report does round to one decimal place. In other words, 0.05% is rounded to 0.1%.

Recent comments