Michael Collins

You're headed for bankruptcy court tomorrow. It's been a long and difficult road. You and your husband both worked. You made decent money. Then your husband became ill. There was no sick leave because he worked for himself. His disability insurance had a six-month delay and only covered half of the lost income. That was all you could afford. (Image Wikimedia Commons)

His condition was critical and required medication three times a day at a monthly cost of $2500. Your company plan covered your husband but it didn't cover the medication because the insurance company termed it experimental. It was the sole option for the crippling illness according to the three specialists consulted.

Your husband contributed 40% of the family income. The loss was a big hit but you persevered. You couldn't sell the house, even if you wanted to. It was $150,000 upside down. There was no federal or bank program to relieve that burden. After four months of cashing in a modest 401(k), it became obvious that you couldn't make it. You needed relief and time for your husband to get well.

You consulted your accountant. On his advice, you decided to file for bankruptcy.

It was hard to find an attorney to take your case. The 0/congress/bills/109/s256/text">Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 made attorneys personally liable for any false claims by filers. That created a lot of extra work and a new risk for bankruptcy attorneys to serve a population that was, by definition, short of cash for legal fees.

When you did get an attorney, you found out that the new bankruptcy law of 2005 requires credit counseling within six months prior to filing (a provision of little value to you)

By the time you got your day in court, you were well overdue for debt relief

Here is what happened in bankruptcy court for the Chapter 13 filing.

The Bank Challenges Your Claim Alleging Fraud

The new bankruptcy law changes things for debtors. In the past, only "substantial abuse" by debtors led to an automatic dismissal of the case. The new law replaced a "a substantial abuse" with "an abuse" 0/congress/bills/109/s256/text">Section 102. In the past, only the U.S. Bankruptcy Trustee, an officer of the court, could charge fraud. Creditors now have that option (many of whom stand closurefraud.org/2010/09/29/foreclosure-fraud-cnbc-video-jpmorgan-chase-to-delay-foreclosures/">accused of fraud themselves).

When you got to court, you find out that your bank, MegaCorp, filed a charge of fraud claiming an understatement of your credit card debt. These charges are wrong but you lose a lot of sleep worrying about a violation that has a $250,000 fine and a nine-year prison term.

Before the favorable ruling from the court, you look at the U.S. Trustee Program web site for bankruptcy court.

It is obvious that the Department of Justice program is only interested in debtor fraud. There is no solicitation by the program for creditor fraud reports. Just debtors.

"Name and address of the person or business you are reporting.

"Identify the type of asset that was concealed and its estimated dollar value, or the amount of any unreported income, undervalued asset, or other omitted asset or claim." US Trustee Program

The Bank Leaves out Documentation Critical to Lawful Approval of their Claims against You

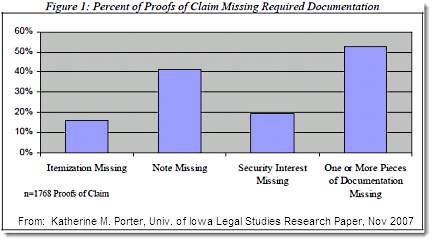

Kathleen M. Porter published a landmark study on bankruptcy court in 2007. Porter's research team reviewed 1700 bankruptcy rulings from federal courts across the country. Porter found that required documentation was missing in just over 50% of the cases from the extensive sample.

From, Misbehavior and Mistake in Bankruptcy Mortgage Claims, Katherine M. Porter, November 2007 p. 18

Professor Porter commented on this failure to comply with documentation requirements:

"Without documentation of the debt, the debtor and other creditors cannot verify the legitimacy or accuracy of claims, each of which cuts into the limited dollars available for distribution. Poor compliance with the claims rules effectively deflects creditors’ obligations onto cash-strapped bankrupt families, who must choose between the costs of filing an objection or the risks of overpayment." K.M. Porter, 2007 p. 36

Porter's research confirmed that only a minority of bankruptcy courts use incomplete documentation to disallow creditor claims. The failure to require proper documentation distorts over 50% of settlements. How can a bankruptcy judge set amounts owed, etc. without knowing the basis for such judgments?

The creditors with the special right to accuse you of fraud get away with filing flawed claims against you. Are their cases dismissed for errors? Hardly ever, according to the study.

You had no idea that the creditor clams were incomplete thus legally flawed. Neither the court nor your lawyer noticed.

There are Creditor Fees that You Don't Understand

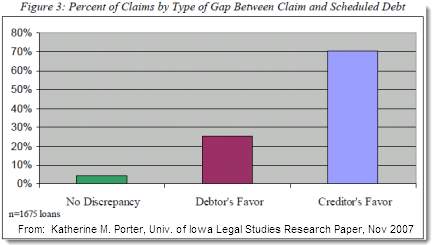

The paper chase of bankruptcy often times produces conflicting claims about amounts due. Debtors face tremendous pressure to readjust their entire lives to cope with impending financial doom. The graph below shows that creditors are much more likely to state claims in their favor than are debtors.

From, Misbehavior and Mistake in Bankruptcy Mortgage Claims, Katherine M. Porter, November 2007 p. 30

Debtors often listed more than they owed. Creditor usually listed more than they were due. Porter's extensive analysis suggested the following:

"Creditors' claims may themselves be bloated and overstate the accurate amount of the debt. Such problems could result from servicers’ practices of loading claims with default fees that are not disclosed to debtors, or because of mistaken calculations of the amount due in preparing the proof of claim; case law has documented both effects." K.M. Porter, 2007 p. 34

Once again, the debtors take the hit, the very people lacking the resources to challenge what they strongly suspect are creditor overstatements of debt.

You knew something was wrong but you didn't have the time or money to challenge your creditor's figures.

The Bank Claim is Approved

You suspect errors in the creditor claims but you can't prove that their figures are overstated. You do not know that your creditors are missing documentation, an error that should nullify their claims.

When debtors make a mistake, their case is subject to dismissal and they face severe penalties. When the courts receive and approve flawed, unlawful creditor filings in 50% of the cases, the court isn't even conducting a cursory review of essential documents. With any degree of diligence, most or all of the flawed creditor filings would be dismissed.

This proves, beyond any doubt, that in many cases, bankruptcy proceedings move forward without creditor adherence to clearly stated legal requirements.

The sole purpose of the court is to enforce the law. That simply doesn't happen for at least 50% of the cases judged.

Later, You Find Out that the Critical Documents were Missing and the Charges were Bogus

How could the bank prevail in this matter, you ask. The bank made a claim that they knew or should have known was false. The bank failed to present documents required from creditors, documents essential to judging the claim and making it conform with the law. The bank also included charges that were wrong and fees that were not warranted. Will the bank be charged with fraud? You want to challenge the ruling in favor of the bank but you're out of money. You now understand why most bankruptcy not contested

Bankruptcy Hell - Abandon hope all ye who enter here

There is no justice guaranteed for the weak, disadvantaged, poor, or dispossessed. Debtors filing bankruptcy operate on a limited budget and simply want the nightmare to end. They want to get on with their lives. They often lack the ability to make legal challenges. When their lawyers don't inform them of those challenges, they have no options.

In the 50% of the cases where critical documents were missing, their lawyers fail to make the challenge. Worse still, in those and other cases where creditor filings are obviously deficient and outside the law, the court misses the error.

Wouldn't it be better if bankruptcy court operated like, let's say, an automobile manufacturer. Honda issued a recall on airbags for 2001 and 2002 models.

"Honda has expanded a previously announced recall of certain 2001 and 2002 model-year vehicles to replace the driver's airbag inflator in an additional 378,758 vehicles in the U.S. … In total, Honda is aware of 12 incidents related to this issue as of February 2010." Honda February 9, 2010

Based on 12 incidents brought to their attention, Honda recalled every vehicle suspected, nearly 400,000.

At least seven federal courts have cited Katherine Porter's study Her study included over 1,700 cases., half of which had a defective part - missing documentation required by law to justify the bankruptcy. Compare 850 instances of a defective part with no corrective action to the twelve instances referenced by Honda that generated a universal recall of models for two consecutive years.

Perhaps, the federal bankruptcy courts should emulate the judgment and practices of Honda.

The failure of bankruptcy courts to apply the law equally and the refusal to go back and correct every error in judgment demonstrate that we are clearly not a nation of laws. We are a nation in which the front room of the law serves the back room of The Money Party.

END

This article may be reproduced entirely or in part with attribution of authorship and a link to this article.

Comments

all self-employed insurance will lead to bankruptcy here

No matter what premiums I would pay, what deductable, if a major illness, like Cancer happens, I'm screwed. The policy only covers 80% and a host of exclusions, so 80% of $1 million is I'm stuck with $200k...

that's the numbers game I see, so even with the best insurance one can find of the individual policies, you get sick, you're still screwed, or should I saw "I" in that story.

Health care reform offered nothing for the self employed

Other than, prolonged financial challenges and, too often, no insurance. Here's how it works

Health Care Reform - Abandoning the Self Employed

Michael Collins

Thanks for the link

Just checked out the article from back in January.

I like to call attention to the fact that all wages are subject to the Medicare Tax that mostly funds insurance for people who are not working or even looking for work, but is paid out of wages of working people. (Criticized by late Sen. Monynihan.)

In my working days, I was opposed to the Medicare Tax. I am still opposed to it. Lousy policy, unjustifiable.

Also, I like to call attention to factories that could have located in the U.S. have gone to Canada because of the medical insurance issue.

The only justification that I have heard for the inanities of the Affordable Health Care Act of 2010 is that it's a start on reform. I think that the President has on occasion spoken words to that effect. But, as the Act is implemented, it often looks like reform or progress by way of 'One step forward, two steps back'! It started with the insurance lobby, and it ends as legislation of, by and for the for-profit insurance industry.

Whatever happened to the proposal by Senator Leahy (Chair of Judiciary Committee) to repeal the anti-trust exemption that was enacted by Congress in 1945? Back in '45, the law was never intended as a long-term solution, but only as a stop-gap measure in response to a major SCOTUS case that had taken many years to 'ripen' and work through the circuits.

In February, 2010, the House - with the support of the White House - voted OVERWHELMINGLY to repeal the exemption.

Well, I am SOOO happy that we threw those b*st*rds out and retained the hopelessly divided and ineffectual Senate!

There's an example of what an intelligent and well-informed voting public can do!

2OLD4OKEYDOKE! Don't take our Medicare;)

It may not make sense but it sure covers a lot of health needs for those who lack the means, which is a good portion of the elderly. But we probably agree that there should be a single payer system for all citizens, funded through the government and (we may not agree on this) managed through the Medicare administration.

Look at the savings right out of the block: no insurance billing costs for providers; no insurance personnel inside hospitals and doctor's offices haggling with the run around from insurance companies all the time; limited review of doctor procedures (like Medicare); and, the big ones - elimination of the 15% insurance administrative fees to be replaced by Medicare's 3% and elimination of the 15%-20% profit that insurance soaks out of the self-employed and small businesses that can only buy from them. It would spur business and competitiveness. If you really want to make sense out of it, nationalize the useless drug companies that add zero value and slash prices. More medical schools and stop fooling ourselves that we can dictate ridiculously low doctor fees, that's insane.

Back to bankruptcy, I'm so sorry I posted this on the day of reckoning or whatever with the gone but not forgotten guy. I think bankruptcy court is an exemplar of the way our society runs - a fake representation of justice that's really just a pass through for the cash demands and citizen beat down by the financial institutions.

My point about Honda doing mass recalls and bankruptcy courts doing none was not trivial. The justice system is not about people or the application of the law. It's all about getting money from the masses and giving it to the perpetrators of the financial collapse.

Michael Collins

Injustice

In America, we do NOT have a system of justice, rather one of injustice, on all fronts. Consider how many innocent citizens we send to jails and our prison system each year. Consider how courts are run by those of the legal profession that take bribes.

Our judicial system is nothing more than a cruel joke played on those unlucky enough to fall prey to the power of money and influence.

Because you can do wrong, and get away with it, doesn't make it right

Pull your punches?

Another contributor here at EP who doesn't believe in pulling punches - but that's alright since they're legal and above the belt

since they're legal and above the belt

It's just that sometimes I feel like I'm getting punch-drunk here

Well, alrighty then...

Lawless Nation: The Executive Branch

Lawless Nation: Congress

"The Judiciary" is in production;)

Michael Collins

AMA Lobbyists And Medicare

This article may be of interest to you.

Health Care Budget Focuses on ‘Doc Fix’

The Medicare “doc fix” will cost more than $62 billion through 2013. The Obama budget offsets those costs over the next 10 years, leaving unaddressed the $315 billion that the physician payments would cost between 2014 and 2021. Over the next ten years, the Health and Human Services Department would:

reduce the threshold for taxing Medicaid providers in 2015 ($18.37 billion);

crack down on high prescribers and utilizers of prescription drugs in Medicaid through better tracking ($3.45 billion);

recover erroneous payments made to insurers participating in the Medicare Advantage program ($6.16 billion);

limit Medicaid reimbursement of durable medical equipment to Medicare rates ($6.4 billion);

speed generic biologics to market by limiting the exclusivity period for brand name manufacturers ($2.34 billion); and

prohibit brand and generic drug companies from delaying the availability of new generic drugs through so-called “pay for delay” deals ($8.79 billion).

http://www.thefiscaltimes.com/Articles/2011/02/14/Health-Care-Budget-Foc...

Also see : http://www.thefiscaltimes.com/Articles/2011/05/06/Medicare-Doc-Fix-Put-o...

Because you can do wrong, and get away with it, doesn't make it right

Companies and corporations

Companies and corporations are not leaving America because of insurance rates (which are paid for by employees and customers) that is a false narrative, the companies have fired millions of living wage earning Americans and taken those jobs overseas (mostly to a communist country) for profit, they have stabbed America in the back of money period.

Agreed on underlying motive, but ...

... what I wrote was that "factories that could have located in the U.S. have gone to Canada because of the medical insurance issue."

The point is that there is deadweight (especially in defined benefit retirement plans for retirees, although these plans are mostly no longer available under "tier system" contracts approved by union membership, often including voting retirees) with negative result for profit and prices because the U.S. medical insurance system has been set up on the basis of corporate responsibility. Of course, corporations where the first duty of every CEO and every member of the Board is to increase profits cannot be responsible for anything but their profitability -- and even that objective is compromised by corruption of corporate officers.

So, yes what multinational corporations do is for the objective of increasing profits (for someone somewhere), BUT we (the people) can at least look at a country like Canada and consider whether different ways of organizing payment for medical care might not be better economic policy.

The Affordable Health Care Act of 2010 is an attempt to make the old system of corporate cradle-to-grave job security work for everyone, whereas it pretty much doesn't work for anyone any more. Something else needs to be tried.

Start with repeal of the anti-trust exemption for the insurance industry. Passed overwhelmingly in the U.S. House in February 2010, blocked in the Senate and now ... forgotten ??? (Well, at least it has been forgotten by corporate news media!)

You don't have to wait 6 months to file

One correction - credit counseling is required to take place no more than 180 days before filing. It can be done the day before filing. I worked for an agency whose sole purpose was to get them through a counseling session and issue a certificate. It did not cost very much, either. The entire bankruptcy process under the 2005 law is designed to heap as much indignity as possible on the individual who has hit hard times. But they don't have to wait six months to file.

Indignity is the right term

(I added "wigtin" above)

The final indignity is the finding in Porter's very detailed and well constructed study - 50% of approved creditor filings are lacking in one of more pieces of legally required documentation. It seems easy for creditors to challenge a technical error on the part debtors but impossible for judges and bankruptcy attorneys to notice the most fundamental fact about creditor filings.

It is interesting to look at the Senators who voted for this: all Republicans plus about 14 Democrats including Carper and Biden (DE) and Reid (NV). It was so bad that Lieberman voted against it!

Michael Collins

"When you did get an

"When you did get an attorney, you found out that you had to wait an additional six months to file. The new bankruptcy law of 2005 requires credit counseling six months prior to filing."

This statement is incorrect.

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) provides that, with limited exceptions, people who plan to file for bankruptcy protection must get credit counseling from a government-approved organization WITHIN 180 days before they file. That means you can get credit counseling a day before you file -- or 180 days before you file.

BAPCPA did make filing for bankruptcy more difficult for debtors (especially for pro se debtors -- debtors without attorneys), but my experience with the bankruptcy court -- I was a law clerk for a bankruptcy judge for a few years -- does not paint such a dire picture for debtors. Bankruptcy judges, for the most part, are compassionate: There is a sincere sympathy for honest debtors (the vast majority of debtors) and a real urge to give them a fresh start.

Full employment for attorneys

Noto bene:

True story. It's part of what I call the omnibus Full Employment Act for Attorneys.

And that's peanuts compared to the omnibus Full Employment Act for Corporate Lobbyists and Political Apparatchiks!

You're right on "within"

That was left out and I corrected it. The GAO studied this and found that credit counseling has little impact on much of anything, thus is another delay tactic.

I have a hard time sympathizing with any bankruptcy judges, however. They should express their sympathy by discharging the 50% of creditor claims that are lacking in required documentation (but this is hardly ever done). Creditors have huge resources and there is no excuse for not having the legally required documents. Creditors can demand that a debtor filing be thrown out for simple "abuse." But the law requires the rejection of creditor claims for outright insufficient documentation. Why isn't this done by the sympathetic judges.

Michael Collins

six months!

Six months of credit counseling?! How much money does that cost? And it's just added to their pile of debt, assuming they can't pay for it, which they probably can't if they're seeking debt assistance!! Anyone able to graduate from junior high has the reading skills and intellectual capacity to utilize the internet to find the vast amount of resources out there to aid you through financial instability. I've been shaping up my credit score for the last six months or so by merely reading articles like this. Though it's not extremely well written, it's a jump start for those out there that feel the need to go further into debt to find a way out of it! It just doesn't make any sense! I think this country is seriously screwed unless theirs a mass awakening from the intellectual coma we've been beaten into. Take responsibility for yourselves, people. You'll find you're not as hopeless as every get-outta-debt scheme out there would have you believe!!

Hi, I'm Ed. Nice to meatchew.

Thank you Botocchio at Crooks & Liars!

Mike's Blog Roundup at Crooks and Liars

Michael Collins