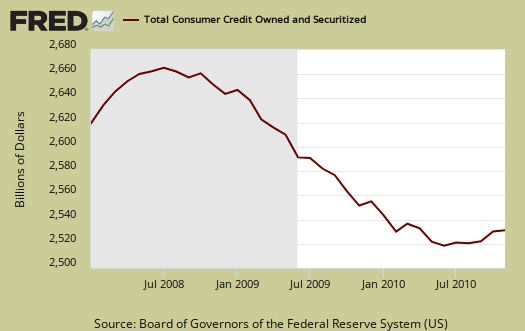

With all of the talk of increased lending, it's useful to look at the latest Federal Reserve's consumer credit report.

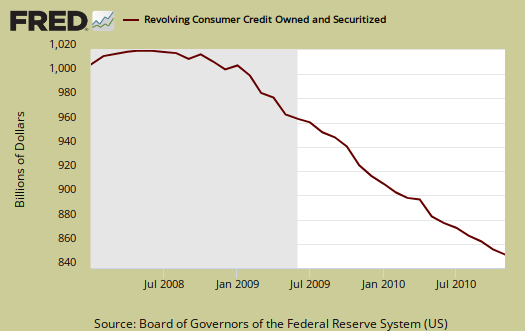

Consumer credit increased at an annual rate of 1-3/4 percent in October 2010. Revolving credit decreased at an annual rate of 8-1/2 percent, and nonrevolving credit increased at an annual rate of 6-3/4 percent.

Revolving credit are things like credit cards and non-revolving are things like auto loans and student loans.

This is a fairly dramatic drop in credit card debt, 8.5% in a month, at an annual rate. Charge offs are not included in this report.

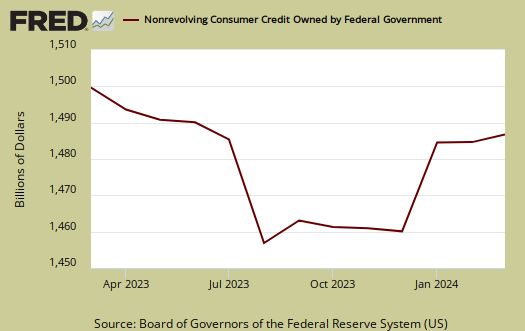

The majority of the increase was in student loans, as reported by the press. Great huh? There are no jobs and now the loans come due? It seems the Fed doesn't break down loan categories so you can just see the student loan increase. The closest is this, below, which is the Federal government non-revolving consumer loans including Sallie Mae. There are more student loans in total non-revolving credit.

looks like

It looks like Americans are finally waking up and understanding that spending outside of their means is not sustainable. I know many people that through unemployment, resorted to credit cards as a means to stay afloat financially and have basically ruined their credit. A lot of agencies out there are trying to capitalize on this through offering credit repair services, but the trust is you can do it on your own. First, stop charging more than 30% of your credit extension! Second, get your free, federally mandated credit reports through annualcreditreport.com and look for any incorrect information. Third, pay off your credit card every month! Follow these easy tips and you'll be well on your way toward repairing your credit!

Hi, I'm Ed. Nice to meatchew.