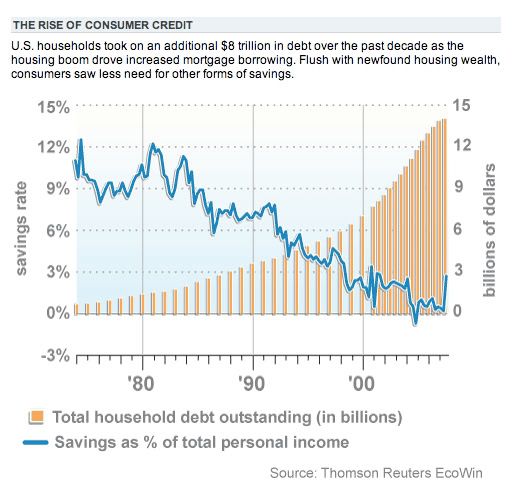

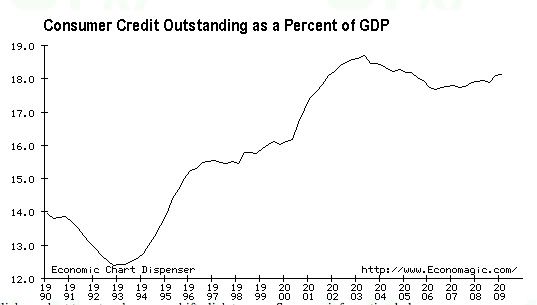

Economic growth in the U.S. since the mid- 90's has not been organic - it was synthesized with CREDIT.

From Reuters:U.S. consumers fall behind on loans at record pace

NEW YORK (Reuters) - Soaring U.S. unemployment and a shrinking economy drove delinquencies on credit card debt and home equity loans to all-time highs in the first quarter as a record number of cash-strapped consumers fell behind on their bills.

Delinquencies on the value of all card debt soared to a record 6.60 percent from 5.52 percent in the fourth quarter as more cardholders relied on plastic to meet day-to-day expenses, the American Bankers Association said.

*snip*

"The biggest driver is job losses," ABA Chief Economist James Chessen said in an interview. "When people lose their jobs or work fewer hours, it makes it that much harder to meet their obligations. Unfortunately, we're going to see higher job losses in the next year, and I expect elevated delinquencies."

How much consumer credit is at stake?

Also from Reuters Credit cards unkindest cut for U.S. consumers

Government intervention or not, banks will be cutting up America's credit cards at an unprecedented rate, with grave implications for the economy and company profits.

*snip*

The banks that provide the bulk of credit card funding generally want to cut back, pushed by their own woes, a conservative read of the economic situation and, potentially, regulatory changes that, while intended to ward off the excesses of the last bubble, will magnify the impact of its bursting.

Meredith Whitney, the Oppenheimer and Co analyst who has so far been ahead in identifying and explaining the weaknesses in the banking system, thinks over $2 trillion of credit lines, or 45 percent of lines available, will be pulled out from under American consumers in the next 18 months, a figure that puts the Fed's $200 billion for asset backed finance in its proper perspective.

"We are now entering a new era within the financial landscape that will be characterized by expanded forced consumer de-leveraging with a pronounced downshift in consumer spending," she wrote in a research note.

"We view the credit card as the second key source of consumer liquidity, the first being their jobs. Pulling credit at a time when job losses are increasing by over 50 percent year-on-year in most key states is a dangerous and unprecedented combination, in our view."

*********************************************************************************************************

More from Reuters: Poor cash forecasting could mean more bankruptcies

BOSTON (Reuters) - The brutal recession has made it increasingly difficult for corporate executives to forecast cash flow, a problem that could contribute to a surge in bankruptcies in the face of weak credit markets.

About 80 percent of the 1,000 largest global companies are unable to forecast cash flow over the next quarter within a 5 percent range of their actual performance, according to a study by Hackett Group Inc (HCKT.O) unit REL.

*snip*

Cash flow problems tend to wash across an industry, the study found. Lear's bankruptcy filing, for instance, followed those of Detroit automakers General Motors Corp (GMGMQ.PK) and Chrysler LLC, the most prominent victims of a sector-wide slump.

Companies that are trying to protect their own cash flow may begin to delay payments to their suppliers, which in turn can cause those suppliers to have trouble meeting their own financial obligations.

"As we get deeper into the recession, the weak get more and more stressed," said Janssen. "One man's policy of conserving cash causes ripples down the road."

If I were a bit more fatalistic, I would want to get this one right.

The central question here is: “But what actually happens when credit is destroyed at a faster rate than our central banks can print money?”

in recent months

the U.S. has gone from negative savings to something like 6.8% (sorry if this is inaccurate, it's around there) but the real question is how much of that is Seniors pocketing away their Stimulus rebate and so on?

For your average working person, no job, living on credit cards as credit cards jack up the rates!

A good point and increased savings would contribute

to a deflationary cycle, as savings would still be consumer $ pulled out of the economy.

This begs the common sense question of "where are the savings being parked?"

The Fed cutting interest rates is not encouragement for traditional savings. Most saw their 401's and IRA's decrease by up to 50% in 2008, leading me to believe most would not be motivated to pour more into these accounts.

So I looked into the methodology of the BEA

We have to put the savings rate in larger context

BEA link

However, I digress. Savings and credit/debt (as you pointed out) may operate in different spheres. One small sect with a disproportionately large amount of wealth may possibly be saving (perhaps seniors), while a larger sect is fueling their lifestyle or necessary spending (gas,groceries) with ever-dwindling credit.

The problem is that without real wage growth, the system is unsustainable. Participants in the overall economy have to earn enough to meet necessary demands without the credit bridge to contribute to real economic growth.