That's how Marc Faber described the market for treasuries today.

Why would he say this? To answer that you have to look at two different factors - supply and demand. For the demand side, you should look at today's Treasury International Capital (TIC) report.

Net foreign purchases of long-term securities were negative $43.0 billion.

...

Foreign holdings of Treasury bills decreased $15.4 billion.Monthly net TIC flows were negative $148.9 billion. Of this, net foreign private flows were negative $158.1 billion, and net foreign official flows were $9.2 billion.

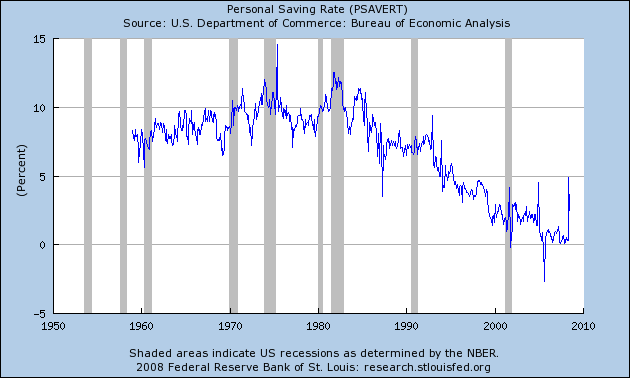

To put this into context, America's savings rate is barely above zero. We need massive amounts of the world's savings to fund our lifestyle - an estimated $2 Billion a day, 365 days a year.

Therefore, the TIC flows need to be a positive $30 Billion a month just so America can continue to tread water. Negative numbers are something that cause all sorts of problems. And negative numbers are what we've been getting on a regular basis recently.

| Aug-08 | Sep-08 | Oct-08 | Nov-08 | Dec-08 | Jan-09 |

|---|---|---|---|---|---|

| -5.5 | 30.0 | -36.6 | -56.0 | 22.4 | -18.8 |

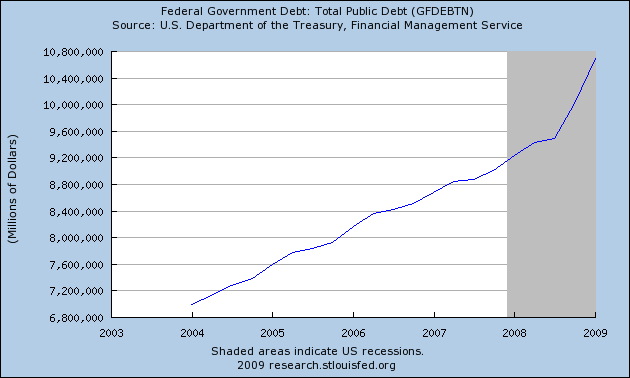

On the other side of the equation is supply - which is something we have no shortage of.

His budget plan projects a federal deficit of $1.75 trillion for 2009, or 12.3% of the gross domestic product, a level not seen since 1942 as the U.S. plunged into World War II.

All that deficit spending requires someone to buy that debt (in the form of treasury bonds). This tsunami of debt issuance is creating distortions in the bond market.

For instance, premiums on newly-issued treasuries over off-the-run securities have tripled. This is a reflection of increased risk. The credit default swap (insurance against the risk of default on debt payments) on treasuries has increased seven-fold over a year ago.

That increased risk was reflected by the statements of the Chinese Premier just last week.

“We have lent a huge amount of money to the United States,” Wen said at a press briefing in Beijing today after the annual meeting of the legislature. “Of course we are concerned about the safety of our assets. To be honest, I am a little bit worried. I request the U.S. to maintain its good credit, to honor its promises and to guarantee the safety of China’s assets.”

...

“China is worried that the U.S. may solve its problems with the fiscal deficit and banks by printing money, which will stoke inflation,” said Zhao Qingming, a Beijing-based analyst at China Construction Bank Corp., the country’s second-biggest lender.

Printing money (aka creating money out of thin air) is exactly what has the bond market concerned right now. In fact the Federal Reserves' January statement hinted at just that.

"The Committee also is prepared to purchase longer-term Treasury securities if evolving circumstances indicate that such transactions would be particularly effective in improving conditions in private credit markets."

Quantitative Easing: refers to the creation of a pre-determined quantity of new money 'out of thin air' through open market operations by a central bank as the start of a process to increase the money supply.

The term 'quantitative easing' is an innocuous term that hides the real damage it can inflict. If you want to see what quantitative easing can do, I will refer you to Zimbabwe, where the domestic currency no longer exists after the inflation rate hit 231 million percent.

So how common is quantitative easing in the world? The Bank of England just began its own process of creating money out of thin air last week. It was the first time in the 315-year history of the bank that it had done this in peace time.

The very next day the Swiss National Bank announced its plans to crank up the printing presses. I am not aware of any time in history that Switzerland has resorted to this.

The Bank of Japan is already preparing to create money out of thin air.

It's a worldwide currency race to the bottom and the Fed is unlikely to be left behind. Which brings us back to Marc Faber.

"Yields have already backed up pretty substantially and I tell you, I think the US government bond market is a disaster waiting to happen for the simple reason that the requirements of the government to cover its fiscal deficit will be very, very high," Faber said."The Federal Reserve will have to buy Treasurys, otherwise yields will go up substantially," he said, adding that as their reserves were dwindling, foreign investors were likely to scale down their purchases.

But there will be a time when the Federal Reserve will have to increase interest rates to fight inflation, and it will be reluctant to do so because the cost of servicing government debt will rise substantially.

"So we'll go into high inflation rates one day," Faber said.

You can't have massive deficit spending without someone buying the debt. Foreigners are becoming wary of buying that debt as unprecedented amounts of it get issued. Thus we are getting a squeeze - less demand for our debt just as the supply goes through the roof.

That leaves only the Fed, which can create money without limit.

There is no free lunch in economics. Supply and demand is still the iron-clad rule. If you create money out of thin air without increasing the goods that they will buy, then it devalues the money currently in existence.

If we keep going down this road we are going to have economic problems that will rival the Great Depression.

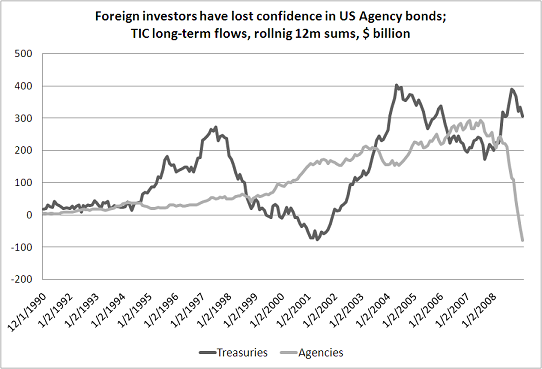

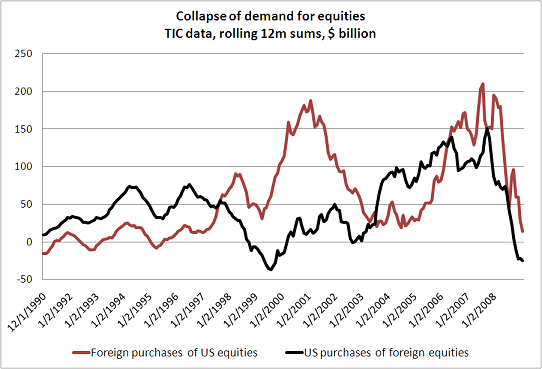

[update: a few more graphs of the TIC data]

Comments

Sure, if you want to get ...

all technical with facts, figures, stats and squiggly lines. Now you're just showing off. ;o)

What timing though, huh?

It has always been about class warfare.

raise hell

and facts, figures, raw data along with a "is this friggin' unbelievable you sacks of corrupt pieces of shit" is always useful! ;)

Populism with a Σ

put another way

This article explains it well.

Bear in mind that a big part of the capital inflows ...

... in the 4th quarter were US investors pulling out of hedge funds, who had part of their money overseas, so they had to sell overseas securities, and use the foreign currency to buy US dollars to liquidate the assets.

Once you know that was a big part of the flow, its kind of obvious that (1) a lot of that money will end up in US Treasury Securities as a flight to security and (2) it is not an ongoing process but a one-off shift.

Unfunded Pension Liabilities

There's $67 trillion of unfunded pension liabilities just with respect to Social Security, accoring to the Congressional Budget Office. This does not include unfunded liabilities on behalf of States and their Employee Retirement systems. There's basically a black hole here that no one can really address at the moment. China is very concerned.

Quant Easing: Central Banks Do Nuclear Option

I just found a fairly in depth article on seeking Alpha which has a host of graphs, analysis on how Central banks are "printing money" around the globe, per country.

He is also talking about the "race to the bottom" on currency evaluations around the globe.