Personal consumption expenditures (PCE) is usually the key metric for determining the ultimate trajectory of GDP each quarter. This key monthly release is detailed in the report on Personal Income and Outlays from the Bureau of Economic Analysis. This gives us the monthly data on our personal consumption expenditures (PCE) and the PCE price index, which is used to adjust that personal spending data for inflation to give us the relative change in the output of goods and services that our spending indicated. This report also gives us monthly personal income data, disposable personal income, which is income after taxes, and our monthly savings rate. However, because this report feeds in to GDP and other national accounts data, the changes reported for each of those metrics are not the current monthly change; rather, they're seasonally adjusted and at an annual rate. That means, in January’s case, that the report us what income and spending would be for a year if January's adjusted income and spending were extrapolated over an entire year. However, the percentage changes are computed monthly, and in this case of this month's report they give us the percentage change in each annual metric from December to January...

For example, when the opening line of the press release for this report tell us "Personal income increased $79.6 billion, or 0.5 percent, and disposable personal income (DPI) increased $63.5 billion, or 0.5 percent, in January", they mean that the annualized figure for personal income in January, $15,691.4 billion, was $79.6 billion, or a bit more than 0.5% greater than the annualized personal income figure of $15,611.8 billion for December; the actual change in personal income from December to January is not given. Similarly, annualized disposable personal income, which is income after taxes, rose by almost 0.5%, from an annual rate of an annual rate of $13,618.9 billion in December to an annual rate of $13,682.4 billion in January. Likewise, all the contributors to the increase in personal income, listed under "Compensation" in the press release, are also annualized amounts, all of which can be more clearly seen in the Full Release & Tables (PDF) for this release. So when the press release says, "Wages and salaries increased $48.1 billion in January, compared with an increase of $18.3 billion in December" that really means wages and salaries would increase by $48.1 billion over an entire year if January's seasonally adjusted increase in wages and salaries were extrapolated over that year, just as interest and dividend income rose at a $11.6 billion annual rate in January, and personal current transfer receipts, which happened to be the largest contributor to the December income increase, rose at a $10.6 billion annual rate in January. So you can see what's written in the press release is confusingly misleading, and often leads to media reports that parrot those lines the same way the BEA wrote them...

For the January personal consumption expenditures (PCE) that will be included in 1st quarter GDP, BEA reports that they increased by $63.0 billion, or 0.5%, which means the rate of personal consumption expenditures rose from $12,457.3 billion annually in December to $12,520.4 billion annually in January. In addition, the December PCE figure was revised up from the originally reported $12,448.3 billion annually. The current dollar increase in January spending was driven by a $46.7 billion annualized increase to an annualized $8,498.5 billion in spending for services and a $16.6 billion increase to $1,363.9 billion annualized in spending for durable goods. Current dollar outlays for non durable goods, on the other hand, decreased at a $0.3 billion annual rate to an annualized $2,657.9 billion…

However, before personal consumption expenditures are used in the GDP computation, they must first be adjusted for inflation to give us the real change in consumption, and hence the real change in goods and services that were produced for that consumption. That's done with the price index for personal consumption expenditures, which is included in Table 9 in the pdf for this report, which is a chained price index based on 2009 prices = 100. That index rose from 109.843 in December to 109.956 in January, giving us a month over month inflation rate of 0.103%, which BEA rounds to a 0.1% increase in reporting it. Applying that 0.1% inflation adjustment to the increase in January PCE means that real PCE was up 0.4032% in January, which the BEA reports as a 0.4% increase. Comparing the annualized January real PCE of 11,387.0 in chained 2009 dollars from Table 7 of this release to the annualized real PCE of 11,319.3 in chained dollars that was reported in table 3 of the 4th quarter GDP revision, we find that real PCE is already growing at a 2.41% annual rate so far in the 1st quarter, or at a pace that is already better than we saw for PCE growth in the entirety of the 4th quarter, such that the first quarter ended today, January PCE alone would add 1.66 percentage points to 1st quarter GDP.

With disposable personal income and personal consumption expenditures both up by 0.5%, there was little change in our personal savings for January from a month earlier. To arrive at the figures for savings, the BEA takes total personal outlays, or the sum of PCE, personal interest payments, and personal current transfer payments, which was at $12,977.3 billion annual rate in January, and subtracts that from disposable personal income, to show our personal savings growing at a $705.1 billion annual rate in January, down from the $709.2 billion that we would have ‘saved"’ over a year had December's savings been extrapolated for a year. This small decrease left the personal savings rate, or personal savings as a percentage of disposable personal income, at 5.2% in January, same as the savings rate as in December...

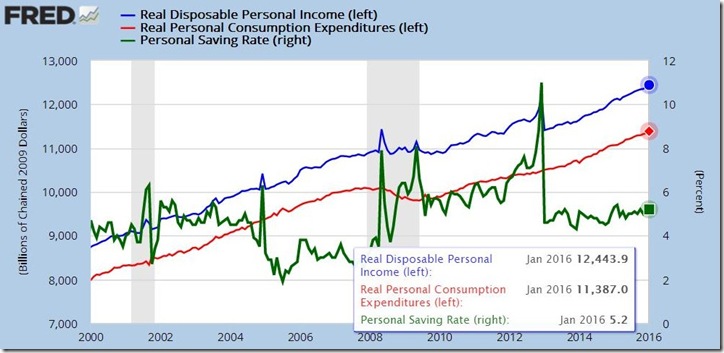

Our FRED graph for this report below shows monthly real disposable personal income in blue and real personal consumption expenditures in red since January 2000, with the annualized scale in chained 2009 dollars for both shown in the current data box and on the lower left; also shown on this same graph in green is the monthly personal savings rate over the same period, with the scale of savings as a percentage of disposable income on the right. The spike in income and savings at the end of 2012 was mostly the result of income manipulation before the year end fiscal cliff; the earlier spikes were as a result of the tax rebates enacted as a fiscal stimulus under George Bush….

NB: the above was adapted from my weekly macro synopsis at Marketwatch 666

Recent comments