Every once in a while in the world of economics an economic indicator will suddenly go crazy. One day the charts all look normal and easy to understand. The next day it suddenly launches into an entirely different world.

What a massive swing in the index means is always open to interpretation (a whole industry exists to analyze these movements), and no one is certain if they are correct until years afterward. Sometimes what it means is more obvious than the why, but the 'why' is ultimately more important.

The Quiet Oceans

The Baltic Dry Index dates back to 1744. To put it roughly, it is the price of moving raw materials by sea.

Whenever a major, worldwide economic index collapses by 98% in just a few months its time to sit up and take notice.

Peter Kerr-Dineen, chairman of Howe Robinson shipbrokers, said: "The scale of change in rate is utterly staggering – the market has come down from super-boom territory to pretty close to bust, effectively in two months."

The price of the daily rental of a Capesize bulk carrier has collapsed from $234,000 to $5,611. I'm no expert on shipping, but I bet that the cost of fuel, insurance, maintenance, and crew salaries on a ship that large is about $5,600 a day. If there is no profit from moving these ships, then goods will not move.

If the world's shipping lanes remain quiet then wheat doesn't make it to four mills and coal doesn't make it to power plants. Everything stops moving.

The reason for this epic collapse is the credit markets.

Cargos are sitting on docksides because the finance is not available to ship them, with the gravest implications for the future. "This is a nuclear bomb in the freight market, and in world trade," Mr Kerr-Dineen said. "Liquidity has to return because if there is insufficient money to provide standard finance, world trade will be sharply cut back and economic growth will implode."

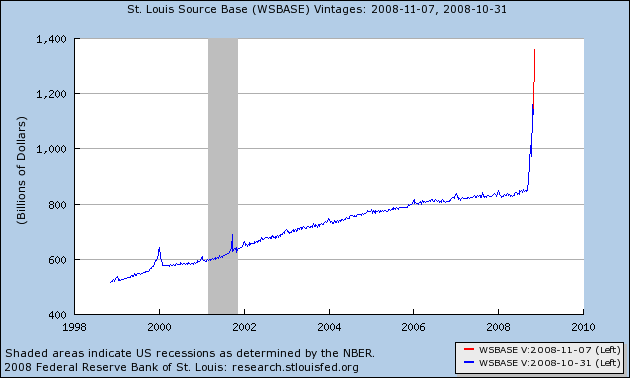

The Federal Reserve takes over the economy

It took just under 100 years, since its creation in 1913, for the Federal Reserve to accumulate about $800 Billion in assets.

It's taken just two months to nearly double it.

Notice where the line turns red. That's just the past week.

The Fed's monetary base is the most powerful money stock around. Because of fractional reserve banking, the Fed's monetary stock is leveraged many times over before it makes it to the consumer.

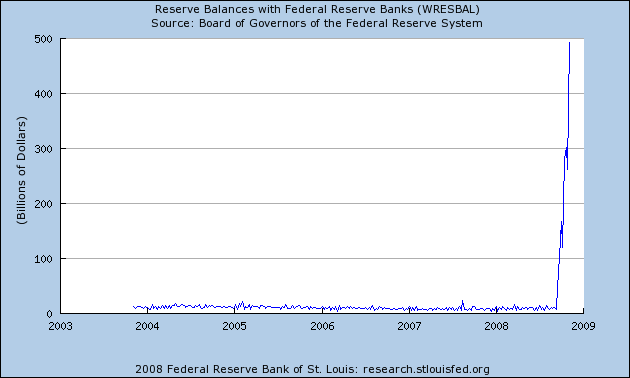

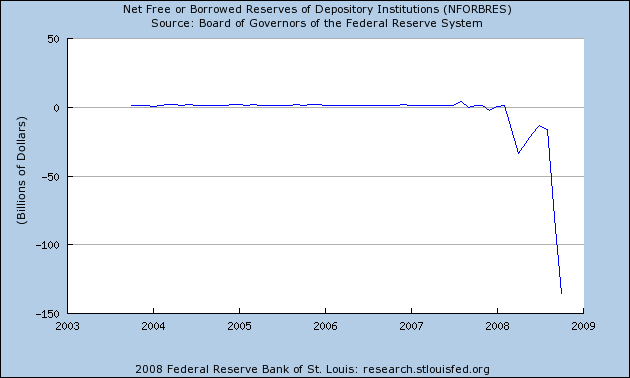

That's just the start. Take a look at two other charts from the Federal Reserve concerning their reserves.

I honestly don't understand exactly what is going on here (although I have a good idea), and I'm not alone. I've read lots of opinions, and they range from "unprecedented reaction to deflating asset prices" to "dangerous expansion of the Fed into the private market" to "setting up a hyperinflationary explosion once credit markets unfreeze". One or more of those opinions are likely true.

More importantly, the two charts are directly related.

The borrowed reserves chart indicate that commercial banks are relying in an unprecedented way on the Fed for credit because they can't get it from private sources.

It's the reserve balances chart that is the most interesting.

The Treasury has been issuing new debt (that the taxpayer must service the interest on) so the Fed can expand its balance sheet which it can leverage in order to lend more money to Wall Street banks. That is somewhat of a concern, but that isn't the real trouble.

The real trouble is that the Fed has started paying interest on capital that banks are required to keep in at the Federal Reserve. The idea is that this helps the banks stay afloat, but it is really a tax on the taxpayer because it reduces the amount of profit that the Fed returns to the Treasury each year. Another reason why the Fed is encouraging this is because it helps to hold down all the inflationary pressure that is being created from the Fed's balance sheet.

Congress approved this change before the credit crunch in 2006.

What this move has also done is that it has helped to dry up credit in the general economy. Banks now have a 100% safe place to store their capital and still earn interest that is greater than short-term Treasuries. In an environment where lenders don't trust borrowers, this is important.

A quick technical look

Any technical reading of economic charts will tell you that a parabolic spike is unsustainable. Eventually, and it doesn't take long, something will break, and the whole market will come crashing down. How long something like this can continue is unanswerable - we are in uncharted waters.

The problem here is that we aren't talking about orange juice or pork bellies. We are talking about the people who run the dollar. The currency that the world uses to trade goods with.

Which reminds me of the problem with shipping and their credit problems. Is there a connection? Probably.

The word "credit" is derived from the Latin word "trust". Ultimately if people don't trust dollar-based credit then they don't trust dollar-based debt, and the world runs on a debt-based currency.

Comments

GK Chesterton would say

That if you kept your natural resources at home, and ground that wheat yourself to bake into bread to sell to your neighbors, you wouldn't need to ship it halfway around the world.

This, of course, comes from the pre-Keynesian idea that England shall never starve, because it's surrounded by fish-bearing ocean.

It doesn't work if you've shipped all your millstones to China.

Sooner or later though, Distributionism (living within your means and putting your closest neighbors first in your capitalistic endeavors) may well take hold, but it's going to take a major collapse to do it.

I suspect we're on the brink of just such a collapse. Hope everybody has their 3 acres and a donkey ready.

-------------------------------------

Maximum jobs, not maximum profits.

It just isn't going to work today

What resource-poor nations like Pacific island nations? They will flat-out starve unless this gets fixed. I've seen the number that $6 Trillion in goods traveled by ocean last year. This means localized shortages of various things in every corner of the world.

This must get fixed and fixed soon. Otherwise we are talking about famines, economic collapses, and political and social upheaval on a global scale.

Well, following that pre-Keynesian theory

Those "resource poor" nations are actually pretty rich in the resources that actually count: food, water, shelter. They might have to get a bit creative like cannibalizing their cars to build deep-water energy transfer condensers, moving the bulk of their labor force back to fishing, etc but they'll survive, and be better off for not depending on regular shipments of the latest plastic toy from China.

Yes, $6 Trillion in goods traveled the ocean last year. But what we forget is that international trade is truly a LUXURY- that almost everyplace people are living today, people have lived for hundreds of thousands of years, save a few places like Antarctica.

-------------------------------------

Maximum jobs, not maximum profits.

no so in many cases

He's referring to areas that truly need food imports to survive and there are many like this around the globe. Trading cheap labor for wheat and rice scenarios.

Globalizing the food supply also has wiped out quite a bit of sustainable localized agriculture. This is what the farmers, from Mexico to South Korea are protesting about. (and they have lost, over and over). The Duha rounds of trade collapsed (thank God) over corporate globalized food supply in trade agreements.

Pacific Islands

Is what he referenced, not land-locked areas that need wheat and rice. Pacific Islands have OCEAN. Yes, it takes a lot more work per calorie to fish, but it's possible. Those cultures won't starve- they'll have a huge break in what they've been eating, and will have to get used to a much more traditional food supply, but they won't die of starvation.

Globalizing the food supply also has wiped out quite a bit of sustainable localized agriculture. This is what the farmers, from Mexico to South Korea are protesting about. (and they have lost, over and over). The Duha rounds of trade collapsed (thank God) over corporate globalized food supply in trade agreements.

This, is a completely different problem than that in the first message. Here in Oregon, there's this guy who for $290 will take you on a 4-day trip to teach you how to forage properly. There is some other costs (like your $6.50 shellfish license) but once you learn, you find food EVERYWHERE. His one-day trips are much more affordable at $25.

Just about anyplace that once had agriculture, has food supplies like this, no matter how unprofitable it suddenly became to grow monoculture crops like rice, wheat, and corn. Once again though, it's a major change from going to the grocery store to eating blackberry shoots (yes, there was a recent OPBS special on that guy, and that was one of the foods he recommended, apparently cane berry vines have a sweet edible core).

We're so used to our modern trade, modern agriculture, and modern conviences, we forget that the natural world actually has some pretty impressive stockpiles of food. It is not sustainable- but it's enough to get a population through the tough times and out the other side.

Oh, and for my birthday, this weekend we're going crabbing in Yaquina Bay. If it goes the normal way, my brother and I will go out crabbing, while grandpa takes the kids to the sand flats to dig clams. Nearly free food- just for the harvesting, and pretty good eats.

-------------------------------------

Maximum jobs, not maximum profits.

shellfish?

Watch out for the shellfish off the Oregon coast due to pollution, bacteria.

The crabs are aok, but be very careful on the clams.

Yeah, well Oregon is designed for survivalists but some of the Islands he's referring to have massive populations, not enough for sustaining "hunter and gather" behavior.

Yaquina is OK

the bacterial pollution that sometimes closes clamming is about 75 miles north of there, in the Cannon Beach/Seaside area where flat lands & overpopulation make for frightening floods.

On an Island- that just means you need to send the boats out further. Which could be hard with say, no oil?

-------------------------------------

Maximum jobs, not maximum profits.

I see your point

What about air freight? I looked at this Baltic index and it doesn't look like it's included.

They sure are not going to ship if they cannot even recover their costs, you're right and our lovely globalists have created this interdependent web without even understanding the parameters in the moderate extremes, never mind something like this.

Any small nation who cannot have a strong domestic, localized economy is in deep dodo from your stats.

Another thing that really bothers me, in mathematics, the minute one sees delta functions (which are all of these spikey things on these graphs, or large charges in no amount of time) that implies system instability. It's not a good thing usually.

The global financial system is a multivariate, multi-dimensional interaction and it's no wonder we have analysts saying massive deflation to hyper inflation, all with legitimate points to a degree and what I believe is going to happen is a standing tsunami wave of changing conditions...i.e. instability in the system.

Looks like we also need an "ode to Ron Paul" post on the Federal Reserve at this point (maybe more ode to William Greider).

Air freight

I've seen the number of 80% of all globalized trade moved by ships. Quick math tells me that $1.2 Trillion worth of goods traveled by air last year.

However, I don't have any numbers for what changed have happened to air freight in the last couple months.

you just wait

you think this is bad, wait until it gets to the point where food is now an issue! Hell...why even wait for that? You have two countries with over a billion people each right near each other, you also have a sea nearby that could provide them both with bountiful oil supply. Plus, just to add more to the situation, you have a former super power with decaying demographics but soon-to-be ample land for crops and such. I'm sorry, but I just see history sorta repeating itself.

It will get fixed...

...question is who will fix it?

The Bush admin is melting down before our very eyes. Look for a market plunge tomorrow in the wake of Paulsen's collapse in front of the camera today.

Obambi seems to be struggling also. The 'Agenda' section on his website was removed today.

Too much criticism...huh....

Some are saying his plans for healthcare, lacking any mandates, are DOA.

I'd be worried if we hadn't been putting up with this shit for the last 50 years of ReThuglican economic 'theory'. Eventually folks will wake the fuck up and then...

....look out.

And yes I do have 3 weeks food and water on hand.

Plus plenty of ammo.

ps. The 'folks' are actually pretty awake now Congress and Obambi just don't know it yet.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

collapse?

I covered Paulson in an instapopulist but did something else happen beyond in so many words telling the American people, with only $350B of the TARP left, that now they get to bail out, the very companies with their predatory credit cards and rewriting the bankruptcy bill to further screw and squeeze them to the point they are completely broke?