The economic crisis has the country flailing.

That's not a controversial statement. Since early 2008 the federal government has been trying various, and expensive methods, of jump-starting the economy and propping up the housing market. Since December 2007 the Federal Reserve has created an alphabet soup of programs to stabilize the credit markets.

So far all of these attempts to stabilize the economy have had mixed results at best. Trillions of dollars have been spent and yet the economy is still crippled. Why?

The problem is that the people in charge are asking the wrong question. They are asking, "How do we get back to where we were before this crisis?" The question they should be asking is, "How did this happen?"

Unless we understand what happened and why, we will never be able to fix the economy.

If you listen to the news media today you would think the crisis started with the collapse of Lehman Brothers in September 2008. Obviously that isn't true since the recession started in December 2007.

The real start of the financial crisis was July 31, 2007, when Bear Stearns filed for Chapter 15 bankruptcy protection on its two major hedge funds (High-Grade Structured Credit Fund and High-Grade Structured Credit Enhanced Leveraged Fund). Both of these funds speculated heavily on mortgage-backed securities.

Of course the Bear Stearns hedge fund bankruptcy filing wasn't out of the blue - more than a month earlier Bear Stearns tried bailing out the funds. In fact the stress in the credit markets had been building since March of 2007 when New Century Financial went under.

However, the Bear Stearns crisis was different for a very basic reason - the assets of the funds would have to be liquidated because of the bankruptcy filing.

A sale would give banks, brokerages and investors the one thing they want to avoid: a real price on the bonds in the fund that could serve as a benchmark. The securities are known as collateralized debt obligations, which exceed $1 trillion and comprise the fastest-growing part of the bond market.

Because there is little trading in the securities, prices may not reflect the highest rate of mortgage delinquencies in 13 years. An auction that confirms concerns that CDOs are overvalued may spark a chain reaction of writedowns that causes billions of dollars in losses for everyone from hedge funds to pension funds to foreign banks....

"Nobody wants to look at the truth right now because the truth is pretty ugly," Castillo said. "Where people are willing to bid and where people have them marked are two different places."

The credit markets almost immediately froze up.

The market for mortgage bonds has become "very panicked and illiquid," CEO Michael Perry wrote in e-mail to employees yesterday..."Unlike past private secondary mortgage market disruptions, which have lasted a few weeks or so, our industry and IndyMac have to be prudent and assume that this present disruption, which appears broader and more serious, might take longer to correct itself," Perry wrote.

And that, in a nutshell, was the reason for the worldwide financial crisis - the mispricing of assets, mostly mortgage-backed securities, based on fictional financial models.

The reason for all this economic hardship wasn't because the government taxed too much or spent too much.

It wasn't because the Federal Reserve raised interest rates or contracted the money supply.

It wasn't because the American consumer stopped spending.

It was because the financial system knowingly overpriced a major financial asset class, and then leveraged itself against that asset class in the vain hope that the Day of Reckoning never came.

This simple fact is indisputable. So why don't we hear the politicians and financial media talk about it? Because the solution is perfectly clear and obvious - the financial asset class must be repriced to its real market value.

However, the obvious solution involves a lot of very rich, very powerful people losing a great deal of wealth. That's why every government stimulus package, every taxpayer bailout, every attempt at "solving" this economic crisis is really just an attempt at keeping the rich and powerful from having to realize their losses.

Of course that isn't what the politicians and financial media tells you. They work hard trying to convince the public that they are only acting in the voters' best interest.

However, the lies are so transparent that few are being fooled. Who really benefited from bailing out the Wall Street banks, especially now that those same banks have cut back on consumer and business credit? Who really benefited from the subsidies for the real estate market that hasn't slowed down the tsunami of foreclosures? Who really benefited from rolling back the mark-to-market accounting rules?

None of this is hard to figure out, yet all the populist talk is about executive bonuses and regulations. While those topics are worthy of discussion, we are missing the bigger picture. We are once again failing to ask the right question.

That question is, "Why did this major financial asset class get so dramatically overvalued?"

Bretton Woods II

Back in early 2005, Ben Bernanke gave a speech denouncing the Global Savings Glut. The speech was mostly BS because it blamed America's economic problems on foreigners reluctance to buy crap they didn't need.

However, there was a kernel of truth to Bernanke's premise. Asian nations were accumulating enormous quantities of dollar-based savings, and it was distorting global markets.

The reason why this was occurring can be traced directly back to the 1997 Asian Currency Crisis. When the 20% of the world's population was suddenly thrust into an economic depression, these nations turned to the U.S.-dominated IMF.

The IMF misdiagnosed the problem. They forced most of East Asia to devalue and then peg their currencies to the dollar. Suddenly manufacturers in East Asia had an unfair advantage over America's domestic producers. America suddenly couldn't compete in world trade.

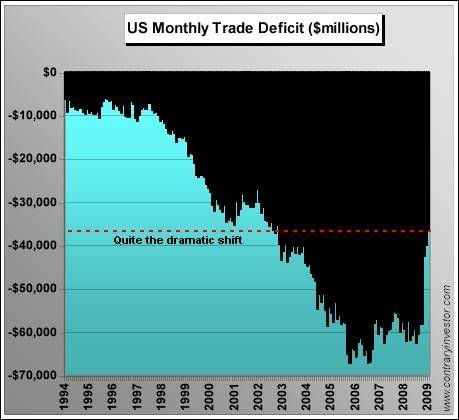

Manufacturing was outsourced to Asia and America's trade deficits exploded. In order to maintain the artificially low currency pegs, the Asian exporting nations had to recycle the massive flow of dollars flooding their economy from their trade surpluses. They did this by buying up America's growing debts.

This huge artificial demand for our debt kept interest rates artificially low, while the Asian nations built up huge currency reserves that kept them insured from having to turn to the IMF ever again.

These currency reserves, also known as savings, are what Federal Reserve Chief Ben Bernanke railed against.

When you look at it from the Asian perspective, Bernanke's comments are ironic. After all, where do you think all those dollar denominated savings come from? The only place those dollars could have been created was from the American banking system - specifically the Federal Reserve's domain. Bernanke was criticizing his own creation.

Historically a massive amount of monetary inflation like we've seen over the last decade to fund America's monstrous trade deficits has led to general price inflation. That didn't happen this time. Instead we saw asset prices grow dramatically while general prices remained tame (also known as The Great Moderation).

All sorts of theories were given for this phenomenon. Alan Greenspan told us it was because of phantom productivity numbers. Other attribute it to the opening up of former communist countries, or maybe it was just luck.

The real reason is much simpler and easy to understand. However, it is politically inconvenient to acknowledge.

What caused the bubble

The first thing we should do is to define the terminology.

For example, in 2005 and 2006 the rising stock market and real estate prices were called "asset appreciation" or "the wealth effect" or the "New Economy" or whatever.

Today we use a different term - a "bubble".

In fact, it all came down to easy credit that was the direct result of monetary inflation. Or to put it another way, the dollar was devalued, so all hard assets rose against it. The primary method of dollar devaluation was via the printing press.

When America printed excessive amounts of dollars to fund the Vietnam War, we ended up with general price inflation in the 1970's. This time we wound up with rising stock, bond and real estate prices.

The stock and real estate prices rose to extreme, bubble levels and finally burst in 2007 and 2008, nearly destroying the economy in the process. The bond bubble hasn't burst because of unprecedented intervention by the Federal Reserve.

The most obvious question you need to ask in order to answer this mystery is the one question that no politician or financial reporter will ever ask. If this was a criminal case (and it sort of is) like Watergate, the advice to give is "Follow the money."

Or to put it another way, "Who owns these assets? Who most benefited from the monetary inflation?"

The answer to these questions is the wealthy and powerful. The extreme upper class. The top 1%. They are the ones who created the bubbles that wrecked the economy. They are also the ones who got bailed out by the taxpayer. After all, when you literally own what made up the bubble, then you own the bubble.

You can see why no one in power wants to ask that question in public.

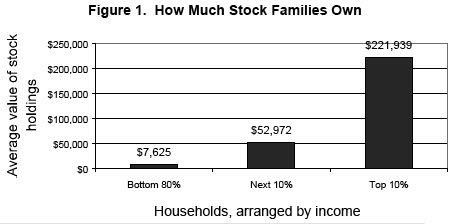

Let's face it, the $40,000 you have in your 401k is suckers money. The top 20% own 93% of all the financial wealth of this country, such as stocks, bonds, and real estate. And most of that 20% is concentrated in just the top 1%.

The richest 400 Americans own more than the bottom 150 million Americans. The top taxpayers pay the same percentage of their incomes in taxes as those making $50,000 to $75,000. The wages of the average working American haven't gone up since the early 1970's, but the levels of debt have more than tripled.

In 2007, the ratio of CEO pay to the average paycheck was 344 to one. Corporations, increasingly financial corporations, have created a wealth gap in this nation.

The Center on Budget and Policy Priorities reports that fully two-thirds of all income gains during the last economic expansion (2002 to 2007) flowed to the top 1% of the population. And that, in turn, is one of the chief reasons why the median income for ordinary Americans actually dropped by $2,197 per year since 2000.

By 2007 the top 50 hedge and private equity fund managers averaged $588 million in annual compensation each -- more than 19,000 times as much as the average U.S. worker. And by the way, the hedge fund managers paid a tax rate on their incomes of only 15% -- far lower than the rates paid by their secretaries.

On the flip side, rich or not, 1% of the population can only consume so much. Thus you didn't see much commodity and consumer inflation over the last 10+ years because the demand didn't increase proportionately, just asset inflation.

Which brings us to the next obvious question, "Why was so much of the monetary inflation funneled to the extreme upper class?"

The answer to this question I already mentioned earlier. The money that foreign central banks used to buy our debts and artificially hold down interest rates in this country came from our trade deficits.

But you didn't necessarily need to approach it from that direction. Just look at the biggest changes in economic policy over the last 15 years - free trade agreements.

Most of our free trade agreements over the last 15 years have been with 3rd world nations, with dramatic income stratification, that don't allow labor unions and/or strikes.

Is it really that surprising that our economy begins to resemble that of our trading partners?

A good example is NAFTA. Despite predictions that NAFTA would create 170,000 American jobs in just the first two years, Congress set up the NAFTA-TAA (Trade Adjustment Assistance) program for displaced workers. Between 1994 and the end of 2002, 525,094 specific U.S. workers were certified for assitance under this program. Because the program only applied to certain industries, only a small fraction of the total job losses were covered by this program.

What's more, NAFTA job losses are skewed towards high-paying jobs.

Since 1979, the real wage structure of our economy has moved significantly downward, as increasingly more workers have slipped into lower income brackets. NAFTA contributes to this trend: while only 21% of jobs in the 1989 economy were in the high-wage bracket, 23% of the jobs eliminated by NAFTA trade fall in that category. In contrast, the low-wage bracket represented 36% of 1989 jobs but only 32% of NAFTA casualties.

And it wasn't just the wages of Americans that fell. The wages of manufacturing workers in Mexico have done nothing but go down in relative terms. In 1993, Mexican hourly compensation costs for production workers in manufacturing were 14.5% of those for their counterparts in the United States. By 2001 they had fallen to 11.5% of U.S. costs.

This shouldn't surprise anyone. David Ricardo, legendary economist and free-trade proponent, explained how this dynamic worked nearly two centuries ago.

"If instead of growing our own corn... we discover a new market from which we can supply ourselves... at a cheaper price, wages will fall and profits rise. The fall in the price of agricultural produce reduces the wages, not only of the laborer employed in cultivating the soil, but also of all those employed in commerce or manufacture."

- David Ricardo, Des principes de l'economie politique et de l'impot, 1835

So you see, your wages are supposed to fall with free trade globalization.

Free trade means the freedom of movement for capital. However, the laws against the free movement of labor remain. Thus, when it comes to free trade, those who control capital will always have the advantage.

So what does this all mean? It means that the reason for the economic crisis was the asset bubble that preceded it. The "wealth effect" was a lie.

The reason for the asset bubble was monetary inflation that got directed almost entirely to the wealthy. They naturally used it to become wealthier, which means stocks, bonds, and real estate. The trickle-down theory is a lie.

The reason why the monetary inflation was directed to the wealthy is because free trade agreements which gutted the income of the working class and left the nation suffering from economic disparity. The promises made by free trade proponents was a lie.

In essence, the economic crisis that we are suffering from, and will continue to suffer from, was caused by too much concentration of wealth in the upper class. The country will continue to suffer from these bubble and bust cycles until either the nation addresses the income disparity, or the rest of the world stops offering to buy our debt.

Comments

trickle down is trickle up

It is a glorified redistribution of wealth. To the super rich and they also plain gave away American jobs via wage arbitrage to foreign nations too.

They double squeezed the middle class, outsourced their jobs, gave them to other nations, still act like middle class income won't cause the entire U.S. economy to implode, won't deal with outsourcing....at all and the corporate lobbyists are hard at work to increase this.

While we have people who should be financially secure, ready for retirement, between all of the age discrimination, layoffs, dot con bubble, housing bubble and wage squeeze basically do not have any retirement (oops, forget the raid on retirement generally through the 401k fake out rip off swap), and even worse are now facing massive age discrimination to get more income, which they desperately need.

Great post midtowng.

Wow!

Midtowng, you, hit it out the park. Policy people have been focusing way too much to OUR detriment on "how do we get back to where we were". Instead, saying wait - here is an opportunity to change/restructure our economy.

The problem is a serious ideological problem: those who created this mess are still setting policy. So naturally the thinking is let's get back to status quo. Hence, all the policies to re-inflate the bubble particularly housing.

I still think we have a serious insolvency problem that we are ignoring. The approach has been overwhelming liquidity but nothing has been done to address insolvency. I guess that is part of the same tired thinking that got us into this mess.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

We can't go back

Slight correction: they want to get to back to what they perceive as the status quo.

It's a large distinction. What they think is the status quo is 2005-2007. The problem is that 2005-2007 was an outlier. It was a bubble economy that wasn't based around anything sustainable.

What is actually the status quo is something before 1997. Probably pre-1994. But those in power, especially those on Wall Street, don't want to go back to that.

So our politicians, at the bidding of the wealthy and powerful, are trying to recreate something that can't be recreated. They are wasting time and resources.

Not just trade agreements

but an entire economic model. Including tax rates:

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

The brew is even more toxic than that

Because the one thing that is needed, given every fact you stated, is a media willing and able to expose all this.

The media is the third rail of all this. Possibly never before in our history have we needed a media that MUST uncover the dirtiest trick played on the people in American history.

And yet at this time, for reasons having nothing at all to do with the financial crisis, the media will not investigate or explain any of this, because at this exact time when we need them the most, the President of the United States is not a President to them, but a Holy Being.

Any serious expose on this could make Obama look bad, even though this crisis was decades in the making. Obama didn't cause it, and Obama didn't even start the bailouts, but he doubled and tripled down on them.

Obama is the embodiment of decades of liberal dreams. Had he been of another era, say 1964, then he could have come in and had all the government expansion he could think of ahead of him as semi-virgin territory. But he came in at this time, in this crisis, and proceeded to triple down on the biggest reverse bank robbery in world history.

So this puts us in rinky-dink dictatorship land. Where the situation on the ground for the people just gets worse and worse, while State Run Media keeps drumbeating how things are getting better and better.

The liberals got their dream President. But the timing is a nightmare for the nation. For rarely in our history have we been at a time when we could least afford that office to be occupied by a Holy being.

State run media?

Hardly. Corporate run all the way. It's in the interest of corporations to say all is good. Funny thing corporations used the concept of 'free markets' to pull off the biggest heist in U.S. history. It was successful, through astro-turfing, to get people speak out against their interests.

Obama is FAR from perfect but GOP would be a disaster and in fact so far not much different than GWB (except much more intelligent). Just saying.

Corporations own everything. IF its state run its corporate owned. We are fast becoming a corporatist society. MNC control everything and do what they want.

Funny, though, right-wing neo-liberal policies f*ck up the economy over past 20 yrs. and then expect it to be fixed in less than 12.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

Would love to read a review

Would love to read a review of the UK economy as well. From where I sit it looks as dreadful as ever. Surprisingly, we are still in recession after so many efforts. I just hope it doesn't get worse than this.

Red Alert: Security Breach!

We the sheeple are NOT suppose to be privy to this kind of information!

Although, you hit the nail on the head with this one!

WELL DONE.

The Reform of Monetary Policy

There is a relatively quick fix. It is an unpopular fix and will require a courageous leader to apply it. We are talking about the representation of debt and wealth as recorded in electronic ledger accounts of creditors and debtors. These representations are entered by a mouse click. The U.S. has global public and private debt of about $60 trillion. These holders of U.S. Treasury securities can be paid off with a mouse click.

Monetizing the global debt of the U.S. would not be inflationary if the Congress, i.e., the Government did it. The Government would buy back its own bonds and take them out of circulation. Government securities are already included in M3. They would just be turned into cash, leaving the overall money supply unchanged. However, under the Federal Reserve's monetization scheme the bonds are not taken out of circulation, although they could be. They become the basis for fractional reserve lending which is highly inflationary.

When monetization is complete the Federal Government then, without the burden of debt service payments, funds all and any program deemed necessary for the nation's welfare through the Treasury, not the Federal Reserve. The Government can print new dollars to do this rather than rely on Federal Reserve Notes and securities, i.e., interest bearing debt instruments.

For a complete discussion: www.webofdebt.com

How Would That Work?

If the Fed just stopped purchases, the Treasury would still have the same budget and the same borrowing needs. Interest rates might go up a bit.

Frank T.

Frank T.