Red States Fight Growing Efforts To Give "Basic Income" Cash To Residents

By Kevin Hardy of Stateline

South Dakota state Sen. John Wiik likes to think of himself as a lookout of sorts — keeping an eye on new laws, programs and ideas brewing across the states.

“I don’t bring a ton of legislation,” said Wiik, a Republican. “The main thing I like to do is try and stay ahead of trends and try and prevent bad things from coming into our state.”

This session, that meant sponsoring successful legislation banning cities or counties from creating basic income programs, which provide direct, regular cash payments to low-income residents to help alleviate poverty.

While Wiik isn’t aware of any local governments publicly floating the idea in South Dakota, he describes such programs as “bureaucrats trying to hand out checks to make sure that your party registration matches whoever signed the checks for the rest of your life.”

The economic gut punch of the pandemic and related assistance efforts such as the expanded child tax credit popularized the idea of directly handing cash to people in need. Advocates say the programs can be administered more efficiently than traditional government assistance programs, and research suggests they increase not only financial stability but also mental and physical health.

Still, Wiik and other Republicans argue handing out no-strings-attached cash disincentivizes work — and having fewer workers available is especially worrisome in a state with the nation’s second-lowest unemployment rate.

South Dakota is among at least six states where GOP officials have looked to ban basic income programs.

The basic income concept has been around for decades, but a 2019 experiment in Stockton, California, set off a major expansion. There, 125 individuals received $500 per month with no strings attached for two years. Independent researchers found the program improved financial stability and health, but concluded that the pandemic dampened those effects.

GOP lawmakers like Wiik fear that even experimental programs could set a dangerous precedent.

“What did Ronald Reagan say, ‘The closest thing to eternal life on this planet is a government program’?” Wiik said. “So, if you get people addicted to just getting a check from the government, it’s going to be really hard to take that away.”

The debate over basic income programs is likely to intensify as blue state lawmakers seek to expand pilot programs. Minnesota, for example, could become the nation’s first to fund a statewide program. But elected officials in red states are working to thwart such efforts — not only by fighting statewide efforts but also by preventing local communities from starting their own basic income programs.

Democratic governors in Arizona and Wisconsin recently vetoed Republican legislation banning basic income programs.

Last week, Texas Attorney General Ken Paxton sued Harris County to block a pilot program that would provide $500 per month to 1,900 low-income people in the state’s largest county, home to Houston.

Paxton, a Republican, argued the program is illegal because it violates a state constitutional provision that says local governments cannot grant public money to individuals.

Harris County Attorney Christian Menefee, a Democrat, called Paxton’s move “nothing more than an attack on local government and an attempt to make headlines.”

Meanwhile, several blue states are pushing to expand these programs.

Washington state lawmakers debated a statewide basic income bill during this year’s short session. And Minnesota lawmakers are debating whether to spend $100 million to roll out one of the nation’s first statewide pilot programs.

“We’re definitely seeing that shift from pilot to policy,” said Sukhi Samra, the director of Mayors for a Guaranteed Income, which formed after the Stockton experiment.

So far, that organization has helped launch about 60 pilot programs across the country that will provide $250 million in unconditional aid, she said.

Despite pushback in some states, Samra said recent polling commissioned by the group shows broad support of basic income programs. And the programs have shown success in supplementing — not replacing — social safety net programs, she said.

The extra cash gives recipients freedom of choice. People can fix a flat tire, cover school supplies or celebrate a child’s birthday for the first time.

“There’s no social safety net program that allows you to do that.” she said. “ … This is an effective policy that helps our families, and this can radically change the way that we address poverty in this country.”

Basic Income ExperimentsThe proliferation of basic income projects has been closely studied by researchers.

Though many feared that free cash would dissuade people from working, that hasn’t been the case, said Sara Kimberlin, the executive director and senior research scholar at Stanford University’s Center on Poverty and Inequality.

Stanford’s Basic Income Lab has tracked more than 150 basic income pilots across the country. Generally, those offer $500 or $1,000 per month over a short period.

“There isn’t anywhere in the United States where you can live off of $500 a month,” she said. “At the same time, $500 a month really makes a tremendous difference for someone who is living really close to the edge.”

Kimberlin said the research on basic income programs has so far been promising, though it’s unclear how long the benefits may persist once programs conclude. Still, she said, plenty of research shows how critical economic stability in childhood is to stability in adulthood — something both the basic income programs and the pandemic-era child tax credit can address.

Over the past five years, basic income experiments have varied across the country.

Last year, California launched the nation’s first state-funded pilot programs targeting former foster youth.

In Colorado, the Denver Basic Income Project aimed to help homeless individuals. After early successes, the Denver City Council awarded funding late last year to extend that program, which provides up to $1,000 per month to hundreds of participants.

A 2021 pilot launched in Cambridge, Massachusetts, provided $500 a month over 18 months to 130 single caregivers. Research from the University of Pennsylvania found the Cambridge program increased employment, the ability to cover a $400 emergency expense, and food and housing security among participants.

Children in participating families were more likely to enroll in Advanced Placement courses, earned higher grades and had reduced absenteeism.

“It was really reaffirming to hear that when families are not stressed out, they are able to actually do much better,” said Geeta Pradhan, president of the Cambridge Community Foundation, which worked on the project.

Pradhan said basic income programs are part of a national trend in “trust-based philanthropy,” which empowers individuals rather than imposing top-down solutions to fight poverty.

“There is something that I think it does to people’s sense of empowerment, a sense of agency, the freedom that you feel,” she said. “I think that there’s some very important aspects of humanity that are built into these programs.”

While the pilot concluded, the Cambridge City Council committed $22 million in federal pandemic aid toward a second round of funding. Now, nearly 2,000 families earning at or below 250% of the federal poverty level are receiving $500 monthly payments, said Sumbul Siddiqui, a city council member.

Siddiqui, a Democrat, pushed for the original pilot when she was mayor during the pandemic. While she said the program has proven successful, it’s unclear whether the city can find a sustainable source of funding to keep it going long term.

States look to expand pilotsTomas Vargas Jr. was among the 125 people who benefited from the Stockton, California, basic income program that launched in 2019.

At the time, he heard plenty of criticism from people who said beneficiaries would blow their funds on drugs and alcohol or quit their jobs.

“Off of $500 a month, which amazed me,” said Vargas, who worked part time at UPS.

But he said the cash gave him breathing room. He had felt stuck at his job, but the extra money gave him the freedom to take time off to interview for better jobs.

Unlike other social service programs like food stamps, he didn’t have to worry about losing out if his income went up incrementally. The cash allowed him to be a better father, he said, as well as improved his confidence and mental health.

The experience prompted him to get into the nonprofit sector. Financially stable, he now works at Mayors for a Guaranteed Income.

“The person I was five years ago is not the person that I am now,” he said.

Washington state Sen. Claire Wilson, a Democrat, said basic income is a proactive way to disrupt the status quo maintained by other anti-poverty efforts.

“I have a belief that our systems in our country have never been put in place to get people out of them,” she said. “They kept people right where they are.”

Wilson chairs the Human Services Committee, which considered a basic income bill this session that would have created a pilot program to offer 7,500 people a monthly amount equivalent to the fair market rent for a two-bedroom apartment in their area.

The basic income bill didn’t progress during Washington’s short legislative session this year, but Wilson said lawmakers would reconsider the idea next year. While she champions the concept, she said there’s a lot of work to be done convincing skeptics.

In Minnesota, where lawmakers are considering a $100 million statewide basic income pilot program, some Republicans balked at the concept of free cash and its cost to taxpayers.

“Just the cost alone should be a concern,” Republican state Rep. Jon Koznick said during a committee meeting this month.

State Rep. Athena Hollins, a Democrat who sponsored the legislation, acknowledged the hefty request, but said backers would support a scaled-down version and “thought it was really important to get this conversation started.”

Much of the conversation in committee centered on local programs in cities such as Minneapolis and St. Paul. St. Paul Mayor Melvin Carter, a Democrat, told lawmakers the city’s 2020 pilot saw “groundbreaking” results.

After scraping by for years, some families were able to put money into savings for the first time, he said. Families experienced less anxiety and depression. And the pilot disproved the “disparaging tropes” from critics about people living in poverty, the mayor said.

Carter told lawmakers that the complex issue of economic insecurity demands statewide solutions.

“I am well aware that the policy we’re proposing today is a departure from what we’re all used to,” he said. “In fact, that’s one of my favorite things about it.”

Tyler Durden Tue, 04/16/2024 - 22:20

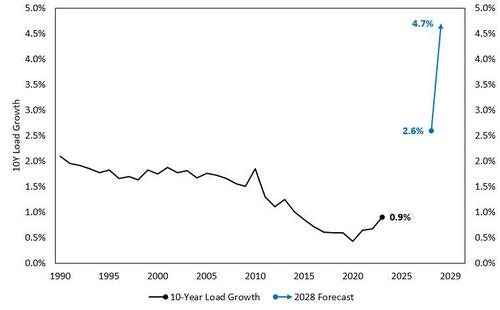

Source: NERC -

Source: NERC -

Via Reuters: Israel's military displays what they say is an Iranian ballistic missile which they retrieved from the Dead Sea after Iran's attack.

Via Reuters: Israel's military displays what they say is an Iranian ballistic missile which they retrieved from the Dead Sea after Iran's attack.

Federal law enforcement agents and officers keep watch as immigrants line up (R) to be transported from a makeshift camp between border walls between the U.S. and Mexico in San Diego, California, on May 13, 2023. (Mario Tama/Getty Images)

Federal law enforcement agents and officers keep watch as immigrants line up (R) to be transported from a makeshift camp between border walls between the U.S. and Mexico in San Diego, California, on May 13, 2023. (Mario Tama/Getty Images) Rep. Byron Donalds (R-Fla.) during an interview with NTD at the Conservative Political Action Conference (CPAC) at Gaylord National Resort Hotel And Convention Center in National Harbor, Md., on Feb. 22, 2024, in a still from video released by NTD. (NTD)

Rep. Byron Donalds (R-Fla.) during an interview with NTD at the Conservative Political Action Conference (CPAC) at Gaylord National Resort Hotel And Convention Center in National Harbor, Md., on Feb. 22, 2024, in a still from video released by NTD. (NTD)

U.S. Secretary of Homeland Security Alejandro Mayorkas at the U.S. Capitol, on April 10, 2024. (Samuel Corum/Getty Images)

U.S. Secretary of Homeland Security Alejandro Mayorkas at the U.S. Capitol, on April 10, 2024. (Samuel Corum/Getty Images) Senate Majority Leader Chuck Schumer (D-N.Y.) speaks to the press after the Democratic Party's weekly luncheon at the U.S. Capitol, on March 6, 2024. (Mandel Ngan/AFP via Getty Images)

Senate Majority Leader Chuck Schumer (D-N.Y.) speaks to the press after the Democratic Party's weekly luncheon at the U.S. Capitol, on March 6, 2024. (Mandel Ngan/AFP via Getty Images) Democratic House impeachment managers, led by Rep. Jamie Raskin (D-Md.), walk out of the Senate Chamber in the Capitol, on Feb. 13, 2021. (J. Scott Applewhite/AP Photo)

Democratic House impeachment managers, led by Rep. Jamie Raskin (D-Md.), walk out of the Senate Chamber in the Capitol, on Feb. 13, 2021. (J. Scott Applewhite/AP Photo) via EPA

via EPA

Recent comments