It's Friday Night! Party Time! Time to relax, put your feet up on the couch, lay back, and watch some detailed videos on economic policy!

It's Friday Night! Party Time! Time to relax, put your feet up on the couch, lay back, and watch some detailed videos on economic policy!

GM, along with Ford and Chrysler are now asking for $25 Billion dollars. We are hearing devastating reports of 3 million jobs lost, 4% decline in US GDP, in other words a tail spin cocktail for a bad economy, if GM or the US automakers were allowed to go into Chapter 11 bankruptcy.

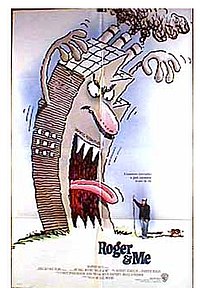

With the Auto Bail Out theme, I thought it appropriate to show Michael Moore's famous documentary Roger & Me.

Google video has the entire documentary online to watch. (click the link). Note, you can watch this full screen.

If you have not seen this it's a treat and if you have, notice some of the same similarities. Pets or Meat!

Recent comments