On its current economic trajectory the United States runs the risk of seeing millions of workers unemployed or underemployed for many years. As a society, we should find that outcome unacceptable. - Federal Reserve Chair Ben Bernanke

We sure do find that unacceptable!. The above quote is from a speech where surprise, surprise, Federal Reserve Chair Ben Bernanke came out swinging, called cash on emerging economies for keeping their currency evaluations artificially low.

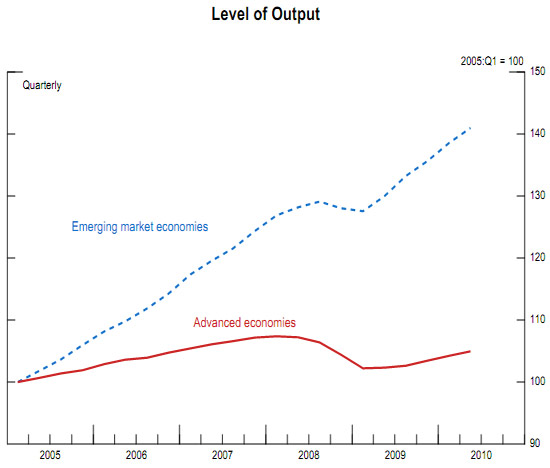

Bernanke referred to the two speed economies, ours and other high cost of living nations, slow as a dog, and nations like China, which are on fire. Below is a graph, taken from Bernanke's presentation, on what the real global imbalance problem is. We're languishing, emerging economies are booming.

From Bernanke's speech:

Since the recovery began, economic growth in the emerging market economies has far outstripped growth in the advanced economies.

Since the beginning of 2005, real output has risen more than 70 percent in China and about 55 percent in India.

Bernanke notes that it's not just U.S. monetary policy that is flooding emerging economies with foreign capital, it's also their artificially low exchange rates on their currencies:

An important driver of the rapid capital inflows to some emerging markets is incomplete adjustment of exchange rates in those economies, which leads investors to anticipate additional returns arising from expected exchange rate appreciation.

He then goes onto to describe why the Chinese (and others) now hold so much of our debt. In a nutshell, these nations are committing currency manipulation

Why have officials in many emerging markets leaned against appreciation of their currencies toward levels more consistent with market fundamentals? The principal answer is that currency undervaluation on the part of some countries has been part of a long-term export-led strategy for growth and development. This strategy, which allows a country's producers to operate at a greater scale and to produce a more diverse set of products than domestic demand alone might sustain, has been viewed as promoting economic growth and, more broadly, as making an important contribution to the development of a number of countries. However, increasingly over time, the strategy of currency undervaluation has demonstrated important drawbacks, both for the world system and for the countries using that strategy.

Here's the money shot:

Currency undervaluation by surplus countries is inhibiting needed international adjustment and creating spillover effects that would not exist if exchange rates better reflected market fundamentals.

Then Bernanke lists a host of vague policy prescriptions to bring about a global economic balance but he warns again on currency manipulation:

So long as exchange rate adjustment is incomplete and global growth prospects are markedly uneven, the problem of excessively strong capital inflows to emerging markets may persist.

This post has pulled quotes out of context in order to get to the meat of the speech. Please consider reading the speech in it's entirety.

Below is a video of the actual speech. (Why do we need to go all the way to India to see the actual speech instead of various analysts chattering about what was said?)