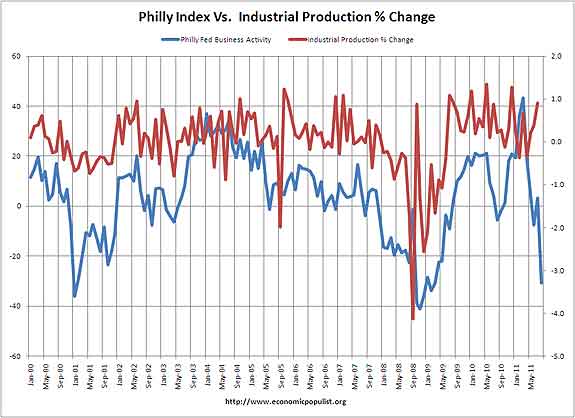

The Philly Fed Survey current business activity index plunged -30.7% for August. The below graph is the Philadelphia Fed Current Business Activity Index against Industrial Production, the national manufacturing and output indicator, released by the Fed. Without running correlations over time, it appears the Philadelphia Fed's regional index does closely match the percent change in Industrial production. The Federal Reserve's August data will be released in September.

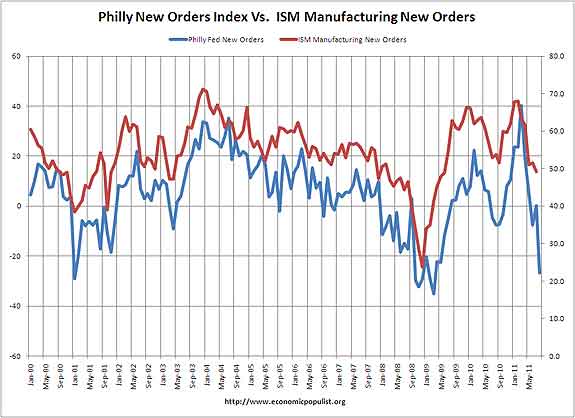

What about the ISM Manufacturing Survey? The regional Philly Fed New Orders diffusion index also seems to be highly correlated to the national ISM new orders index, graphed below. The August ISM manufacturing release is September 1st.

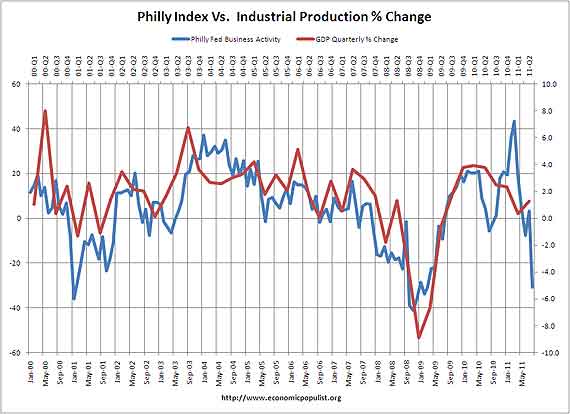

Finally, does the Philadelphia Federal Reserve regional index match changes to GDP growth? The below graph shows the Philly regional index isn't as closely correlated to GDP in comparison to the national industrial production index changes and the ISM manufacturing new order index, but GDP quarterly percentage growth (annualized) is still fairly close. Graph below. Q2 covers April, May & June and is the last GDP estimate available.

Seems traders were right to plunge the Dow -419.63 on news of this regional data release, from examining the above graphs.

All of the Philly Fed indices showed declines. From the report:

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from a slightly positive reading of 3.2 in July to -30.7 in August. The index is now at its lowest level since March 2009 (see Chart). The demand for manufactured goods, as measured by the current new orders index, paralleled the decline in the general activity index, falling 27 points. The current shipments index fell 18 points and recorded its first negative reading since September of last year. Suggesting weakening activity, indexes for inventories, unfilled orders, and delivery times were all in negative territory this month.

Firms’ responses suggest a deterioration in the labor market compared with July. The current employment index fell 14 points, recording its first negative reading in 12 months. About 18 percent of the firms reported an increase in employment, but 23 percent reported a decrease. The percentage of firms reporting a shorter workweek (28 percent) was greater than the percentage reporting a longer one (14 percent). The workweek index fell 9 points.

The Philadelphia Federal Reserve Business Outlook survey is conducted monthly on manufacturers in the 3rd Federal Reserve district only. We have seen some regional economic indicators and surveys in the past plunge, with little effect on the national economic data, so the above implies the 3rd district does mirror more closely the national data than other regional surveys.

The Philly Fed also has a series of future, or 6 months out questions and indices. The Philly Fed says they also dipped but are still above 50, or positive.

Rule 48 'regulation'?

A global downward economic trend appears to be clear, as EP has predicted for the U.S. as a result of willy-nilly congressional budget cuts and other asinine legislation or lack of legislation, plus effects of corporate outsourcing.

Financial commentators seem to have two theories that together cover all possibilities: if nothing happens, that means the news was discounted by the market, or, if something happens, that means the market "reacted." It's much better for brokers when the market "reacts" ... the oftener and more sharply the better.

Yesterday, it was all 'reaction', as the market put on its dunce hat and bragged about its lack of prescience. It was, commentators opined, delayed reaction to regulatory action (such as subpoenas) and to threats of new regulatory methods (Merkozy). Then, almost as an afterthought, commentators noted reaction to economic fundamentals -- where fundamentals such as business activity indexes are themselves influenced by business and investor reaction to such things as the S&P downgrade of US Treasury notes. (Of course, it's speculative about reaction affecting business activity, but there are apolitical sources like Random Lengths expressing such opinions.)

A big idea for many commentators -- who are, for the most part, on the payrolls of MNCs -- is that it's all the fault of regulatory efforts. See, e.g., current Breakout interview of Jon Najarian (Yahoo! Finance)

What I wonder about is corporate 'regulatory' action not subject to governmental regulation -- namely NYSE's Rule 48. Could invoking Rule 48 have telegraphed a message that assured a somewhat precipitous decline at the open yesterday (Thursday, 18 August 2011)?

After all, what are people or computers going to do when the open today is suddenly under what they thought was the floor yesterday? Buy? ... Yeah, maybe, if the news on fundamentals happened to be approximately good, but then Rule 48 would not have been invoked. Besides, why buy at the open when a decline has been telegraphed in advance by the very wise powers-that-be? (Of course, invoking Rule 48 is based on somebody's interpretation of recent futures trading.)

powers-that-be? (Of course, invoking Rule 48 is based on somebody's interpretation of recent futures trading.)

It doesn't have to be a major shift in the floor to have a tremendous psychological effect. It's like an earthquake. Even a small sudden lowering of the floor in your office on the 34th floor or of the street level outside can cause major traffic jams and overflow crowds at downtown pubs. It can also get you results if you can place winning bets on it happening.

This kind of 'regulatory' action had better have some fundamentals underpinning it, considering that it opens opportunities for brokers as to volume plus possible insider connections plus whatever is collaterally happening on the other side of the planet, between New York's close today and New York's open tomorrow.

plus whatever is collaterally happening on the other side of the planet, between New York's close today and New York's open tomorrow.

Rule 48 is presented as the NYSE's contribution to the cause of global stability. Supposedly, Rule 48 "smooths" the open. Hmmmm. Really?

From the point of view of the economy, the only thing that we would like to see now in financial markets is stability. Many investors could be open to looking to feed on a bottom, but they are fearful of "catching a falling knife". Of course, none fear a blade of gold ... except that if you catch that knife on the way up, you're likely to hold on to it for dear life, like Gollum and the Ring ... which could mean that you risk losing out on investments that produce dividends over the long term.

Goldbugs cannot quite suppress the idea that gold delivers no dividends. There's this almost legendary idea about people who bought AT&T in 1935 and lived off the dividends for many good years thereafter, ultimately raking in fortunes when AT&T was split up.

Of course, back in the 1930s, the regulation-monster FDR made it illegal to own gold, which put a real crimp into the gold market. (You didn't have to be a 'leftist' back then to praise FDR for that restriction on gold.) Also, back then, U.S. investors weren't crazy about investing in 'emerging markets' like China. Plus, there were (shudder!) tariff barriers!

FDR made it illegal to own gold, which put a real crimp into the gold market. (You didn't have to be a 'leftist' back then to praise FDR for that restriction on gold.) Also, back then, U.S. investors weren't crazy about investing in 'emerging markets' like China. Plus, there were (shudder!) tariff barriers!

Rule 48 + Global Markets again down 3%+ in a day

First, it's a very good idea to explain what you are talking about. Rule 48 is a method to smooth the market open with stops.

On the markets, I saw a commentary on CNN international which says it all, this is "like" 2008 because politicians never solved the original problems plus sovereign nations simply took on the banks liabilities (bail outs).

Yes, we have scum trying to claim reductions in social safety nets (the call them entitlements to mask the fact they are going to screw over most of America), is the thing to do.

Completely false. But is this 2008 redux? I don't know. I certainly think a market crash to this degree and global, almost pushes a recession to happen.

When markets crash, corporations slash and burn their workforce and all sorts of other things happen which cause the real economy to contract.

So, bottom line, in terms of more recession, it's looking bad at the moment. I hate covering markets because it changes too fast and this is a print, not TV.

But probably a weekly summary is in order. I stick by that $2100 gold high.

Ahem. The stock market crash

Ahem. The stock market crash is also impacting the forex trade, if you know what I mean. the rest as they say, will be history soon! :-|

Bounded rationality

Robert Oak:

As for '2008 redux', I don't see any great advantage for our understanding in that characterization, although of course we should keep all history in mind always.

About that governments have failed and are failing to institute necessary controls on global capital flows? NO DOUBT! This has been noted by European economists for at least two decades now. Part of the 2011 story is that some factions of 'Wall Street' (in an international form) may be waging a 'scorched earth' defense in a war with regulators. We can't say that all of 'Wall Street' is involved because Warren Buffet leads a substantial part of 'Wall Street'.

Gold

I have previously, and continue now, neither to confirm nor to deny your estimate or "target" (to use goldbug terminology) of $2100 per Troy ounce by EOY 2011. I did raise the question 'Gold fever breaking?', and there was some cooling off. I considered that important because anytime that there are margins made available and there appears to be an irreversible (monotonic) trend line, we're risking courting a bubble, IMO. Of course, gold has turned around to continue its ascent heavenward, as I have noted in my earlier blog (above) or as stated so eloquently by 'Forex Tutorial' -- who was kind enough to take a moment away from a very busy day filling orders at Forex .

.

Any discussion of the global gold market here at EP, I presume, concerns the price of gold as the primary indicator of the global liquidity crisis. There was a point recently, as the budget show was closing in Washington (with whatever insider trading effects we will never know) and an ounce of platinum fetched more than an ounce of gold, that the irrationality of the gold market was exposed, resulting in a correction, a momentary breaking of the gold fever. See, Thousands of circuit breakers!

On 12 August 2011 -- in a comment titled 'CME raised Gold margins by 22%' -- I described conditions such that your reply was 'Ah, implies it's a real bubble'. Of course, when platinum goes over gold, that's a "real bubble," and some professional goldbugs at that time were advising their followers to sell bullion in favor of taking bullish positions in gold miners (equity shares).

This is a time that many investors who normally would not be goldbugs turn to gold simply because of uncertainty (see, Fear, Greed and Uncertainty on what I call the "uncertainty industry") In such a time, I don't pretend to know if the global gold market is a "real bubble" or not. The way I prefer to state the situation is that the price of gold is the primary indicator of the global liquidity crisis, although there are important questions as to diminishing resources and increasing production expense.

Obviously, there are bubble-like aspects, but in the nature of financial bubbles, solid proof that it is a "real" bubble can only be retrospective -- when the bubble bursts in a crash. I doubt very much whether there will be such a gold crash in 2011. I would describe the current gold market in terms of bounded rationality.

Rule 48 is also describable in terms of bounded rationality.

About your link to Matt Phillips "Cliff Notes version" of Rule 48, here's my 2¢ --

(1) What is the operational meaning of Phillips' part (a) -- stating the precondition necessary for "a qualified Exchange officer" to "declare an extreme market volatility condition" for the purpose of invoking Rule 48 before the opening after a more-or-less normal closing -- a close that was about as "fair and orderly" as things get these days? The answer in the context of 18 August 2011 is that "a qualified Exchange officer" made a finding based on futures markets (not necessarily limited to NYSE) that "extremely high market volatility is likely to have a Floor-wide [involving many Market Makers or categories] impact on the ability of [Market Makers, i.e., certain specialized brokers on the Floor] "to arrange for the fair and orderly opening following any, (including relatively normal) "closing of trading at the Exchange." Operationally, futures trading between market closing and market opening can be the basis for an anticipatory invoking of Rule 48 at the next opening, in a less-than-fully-transparent process.

(2) According to Phillips' part (b), as applied to the case of 18 August 2011, Rule 48 suspends at the opening all normally "applicable requirements to make pre-opening indications in a security (Rules 15 and 123D(1))." What happens operationally as described at Phillips' part (b)? The answer can be seen in a hypothetical example: Widget Maker X ('WMX') closed at a low of $10.50 (down from a high in March of $11.25) and then it opens with a discontinuity at $9.95. Anyone, including computers, who has decided that $10.00 (or $10.10 or $10.25) was their floor immediately sells. The price falls. Others, seeing that this discontinuous jump downward has occurred will jump on the bandwagon ASAP. The price falls further. If there is any kind of bad economic and/or politico-economic news and if fear is dominating the market ... well, it's obvious, isn't it?

I cannot say for sure that invoking Rule 48 did not have adequate justification in fundamentals reflected in futures trading noticed by "a qualified Exchange officer." However, I can say that Rule 48 opens up all kinds of opportunities for brokers -- especially if there is insider advance information available to some but not others and especially when it's far from impossible to make anticipatory moves (computer managed) in markets open while New York is closed.

I am not convinced of the rationale that Rule 48 works for the good of all by "smoothing" at the open. I may even suggest that such theorizing verges on the area of untested "economic fiction" that should not be tolerated at EP. At the least, we should not accept without questioning the official explanation of what Rule 48 does, why it is invoked in a particular case, the wisdom of invoking it in a particular case, and so forth.

Market as cause or effect of fundamentals.

Yes, of course. It's the Chinese puzzle, isn't it? The riddle wrapped in the enigma? Synergy? Synchronicity? Parasitism? Symbiosis? Stupidity? Greed? Conspiracy? Coincidence?

My answer is, "Ya sure! "

That's my 2¢ and I suppose, in the interest of full disclosure, I should say that I distrust brokers without exception. And brokers' licensed sales people? Don't get me started!

Philly Fed strong correlation to PMI

Since I just did up these graphs as an fast exercise, to see if there was a pattern by "eyeballing it". I went reading after I wrote this and posted some basic graphs and found the Philly Fed Business activity index has a historic 75% correlation to the ISM manufacturing PMI. That doesn't surprise me at all from the above exercise in comparing the ISM manufacturing new orders to the Philly Fed new orders index, especially considering the region the Philly Fed index covers in manufacturing.

I also found other research which showed the Chicago index as well as another index are correlated to predicting future economic growth, see SF Fed link.

As well as the real time business conditions index, also by the Philadelphia Fed.

Seems the CFNAI, or Chicago index, is also a good predictor of recessions, early predictor.

Previously, I ignored regional indicators, preferring more quantitative metrics, such as how much stuff has been sold, how many people have been hired and so on...

The above exercise in graphs has prompted me to cover these additional indexes in overviews and possibly do some regression analysis, correlations. ....stay tuned!

Excellent research

Which indicators work as predictors, leading correlation, etc.?

Excellent research questions. Good work! (And I think we do all realize that there's a lot of work involved.)

Mark Zandi, Moody's

He really does a pretty good job in forecasting, but he uses a lot of multipliers.

Some of these, due to globalization, and conditions not implemented, I have to wonder about in 2011.

That said, these graphs are not correlations. I have to run the numbers and frankly my Matlab skills don't translate to Excel so easily, but regardless I'll run some.

but putting up a matching time line and then two lines of data does not a ocrrelation EQ make.

I was just curious, I literally didn't know about all of this research correlating the two.

This 30.7 index point plunge is dramatic, even for a survey, but you can see it happened in 11/08 too. That's pretty damn bad.

Anyway, we're working on it. Gotta get that "formula" section of Excel humming it looks like.